WTI Dips After Unexpectedly Large Crude Build

Oil prices eked out modest gains on Tuesday ahead of tomorrow's OPEC+ meeting. Oil-watchers are skeptical that OPEC+ will answer President Joe Biden’s call for more oil supplies when it meets on Wednesday, expecting the coalition to preserve its remaining capacity for another time.

“OPEC is unable or unwilling to swing as much as consuming nations would like,” said Tamas Varga, an analyst at brokers PVM Oil Associates Ltd. in London.

“While President Biden’s visit to Saudi Arabia produced no immediate oil deliverables, we believe that the kingdom will reciprocate by continuing to gradually increase output,” said Helima Croft, chief strategist at RBC Capital Markets LLC.

“A failure to add any more barrels to the market would undoubtedly be viewed as a major disappointment in Washington.”

The rollercoaster today seemed also driven higher by fears of WW3 and then lower as Pelosi never triggered WW3, then oil prices tumbled back as Fed speakers jawboned down any hope for a Fed Pivot anytime soon, once again raising growth fears.

“A global economic slowdown might be happening, but crude prices have come down too far given how tight the physical market remains,” Edward Moya, senior market analyst at Oanda said.

For now all eyes are back on inventories...

API

-

Crude +2.165mm (+467k exp)

-

Cushing +653k

-

Gasoline -204k

-

Distillates -351k

Analysts expected a modest build in crude stocks after last week's unexpectedly large draw, but were off with a significant build of 2.165mm barrels last week (gasoline and distillates saw small draws)...

Source: Bloomberg

WTI was hovering around $94.25 ahead of the API print and slipped lower after the data, back below $94...

US crude futures closed below its 200-day moving average for the first time this year on Monday. The level is considered by many to provide technical support and prices have since rebounded.

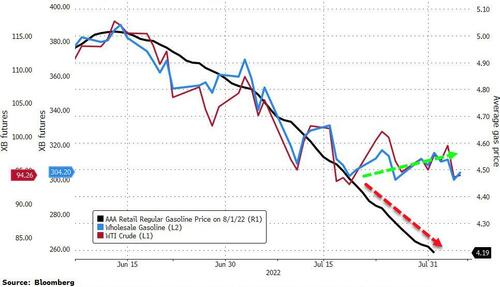

Finally, we note that while gas prices at the pump continue to slide, wholesale gasoline and crude prices are decoupling higher and they lead retail higher...

Source: Bloomberg

Not good news for President Biden.

https://ift.tt/msQcR6e

from ZeroHedge News https://ift.tt/msQcR6e

via IFTTT

0 comments

Post a Comment