Bank Of England To Global Markets: 'You Have 3 Days To Sell All The Things'

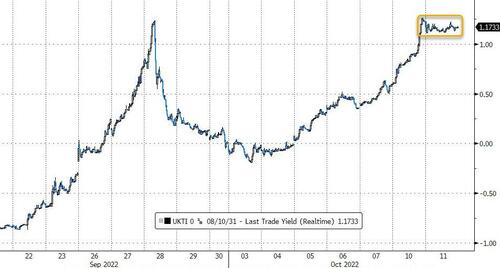

An interesting day that started with The BoE expanding its pension fund bailout, the IMF slashing global growth outlooks, and significant hawkishness from Mester refuting Brainard's comments yesterday.

Things were all holding together in an 'orderly' fashion however until BoE's Gov Andrew Bailey started speaking in Washington late in the day and went full "Leeroy Jenkins'...

After doubling-down on its pension fund bailout scheme, BoE's Bailey spoke in Washington this afternoon, initially warning that "market volatility went beyond bank stress tests" (which is scary), then reinforcing that there is a "serious risk to UK financial system stability," noting that the buying program is "temporary".

But the piece de resistance was his reminding the market that BoE will be out by the end of the week, adding a simple threat...

“My message to the funds involved and all the firms is you’ve got three days left now,” Bailey said at an event in Washington on Tuesday.

“You’ve got to get this done. The essence of financial stability, is that it (intervention) is temporary. It’s not prolonged.”

Or what Andy?

What does the BoE Governor expect global markets to do now? Knowing that this is a "serious risk to financial system stability" and more stressful than bank stress tests, what would you do with your investments?

Our tweet says it all...(Roughly translated: 'you have 3 days to sell everything')...

Was his teleprompter hacked? This is the dumbest possible thing you can say https://t.co/R9xIVOdDZP

— zerohedge (@zerohedge) October 11, 2022

The Bank of England doubled down on the booze at the pension fund bailout party this morning (adding inflation-linked debt to its purchases to stabilize the market after a record surge in yields on Monday)... but no one turned up as Gilts and Linkers both saw yields higher despite billions in buying promised...

Source: Bloomberg

The FT answers why UK investors aren't selling more bonds?

Traders say the reluctance of some investors to offload larger quantities of gilts is in part a consequence of the BoE’s approach to making purchases.

The central bank has only bought gilts at close to the prevailing market level and has rejected offers it deemed too expensive. Investors may get a slightly better price by selling their bonds to the central bank rather than on the open market, but the difference is measured in small fractions of a percentage point. In return, they have to face the uncertainty of whether the BoE will actually accept their offer to sell, or potentially leave the bank holding unwanted gilts in a market where the price may have moved against them in the meantime.

“Clients don’t like the uncertainty - they say ‘you take the risk and you can charge us for it’,” said a gilt trader at one big investment bank.

The BoE’s approach is in contrast to its QE programmes that followed the global financial crisis, the Brexit vote, and the Covid outbreak. Then, the central bank waded into markets to buy a pre-determined amount of bonds whatever the price, with the express intention of lowering yields.

This time, the BoE has said repeatedly it has no intention of seeking lower bond yields, a message investors have taken to heart.

“You sell the bond wherever the market is - there’s no buying force coming from the BoE,” the trader said.

“The way that the bank has structured this intervention is they can only buy assets if people put offers into them, but nobody is putting offers in,” said Craig Inches, head of rates and cash at Royal London Asset Management.

He said the pension funds would rather sell their riskier assets, including corporate bonds or property.

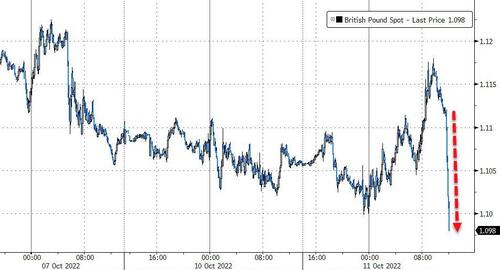

And so, after Bailey's late-day comments, the selling began...

Cable puked to 10-day lows back below 1.10 (UK bonds were closed obviously)...

Source: Bloomberg

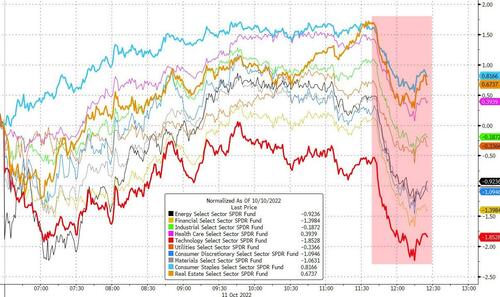

US equity markets plunged to the lows of the day after Bailey's comments. The Dow managed to scramble back into the green but the S&P and Nasdaq were down (the latter worst of the majors on the day)...

Nasdaq and S&P are down for the 5th straight day with Nasdaq at its lowest level since July 2020.

All sectors were hit on Bailey's comments, with Tech the worst performer and Staples and Real Estate leading on the day...

Source: Bloomberg

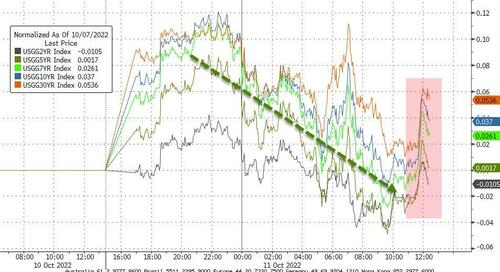

US Treasury yields were lower on the day (and mixed from Friday's close with the curve steeper as the short-end outperformed), reversing yesterday's increases (futures-based) shortly after Europe closed today. Yields spiked higher after Bailey's comments...

Source: Bloomberg

Notably 10Y Yields once again stalled perfectly at 4.00%...

Source: Bloomberg

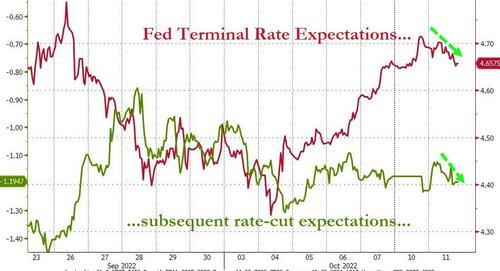

Hawkish comments from Fed's Mester who warned "at this point the larger risks come from tightening too little and allowing very high inflation to persist and become embedded in the economy." However, STIRs shifted very modestly dovish today...

Source: Bloomberg

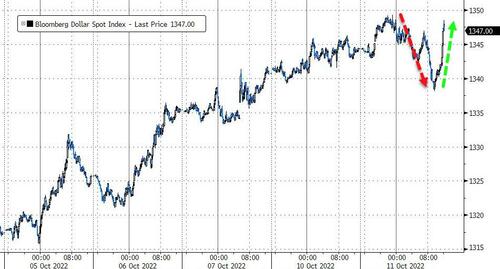

The USDollar was down quite hard today after 4 straight days higher before Bailey's comments sent the greenback soaring...

Source: Bloomberg

The Swiss Franc bounced higher after touching parity against the dollar once again today...

Source: Bloomberg

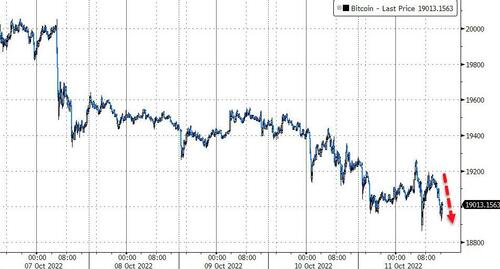

Bitcoin tumbled after Bailey's comments, back below $19k...

Source: Bloomberg

Oil prices extended losses after Bailey's comments...

Gold puked hard after testing up towards $1700 intraday...

Finally, we note that Cathie Wood's ARKK is on the verge of taking out COVID lockdown lows as its analog to the DotCom boom and bust completes...

Source: Bloomberg

"This was coming because it has always been this way before," 'Big Short' Michael Burry tweeted Monday, adding "how anyone over the age of 40 did not see it coming is a riddle. The answer is Greed."

https://ift.tt/PUfBQ4u

from ZeroHedge News https://ift.tt/PUfBQ4u

via IFTTT

0 comments

Post a Comment