Catrusstrophe & Consumer Prices Clobber Bonds, Bullion, & Big-Tech

UK u-turns, soaring CPI, short-squeezes, endless FedSpeak, and Putin pontifications... what a week...

Amid the chaotic headlines from the UK (and the apparent end of BoE's pension fund bailout), cable ended the week marginally stronger (though dumping today)...

Source: Bloomberg

...but gilt yields were notably higher after an ugly selloff today into the UK close (30 Gilt yields rose 60bps from their lows today)...

Source: Bloomberg

We suspect nothing is solved across the pond.

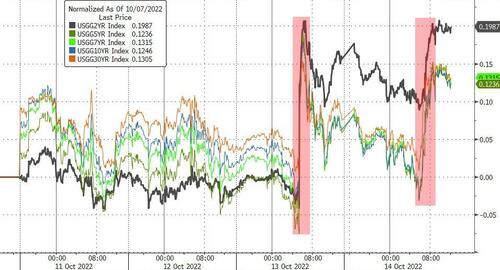

In the US, Treasury yields are all higher on the (shortened) week with the short-end underperforming (2Y yields closed the week above 4.5%)...

Source: Bloomberg

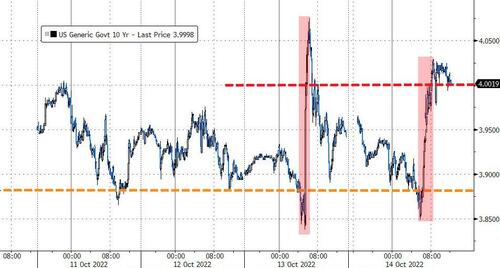

10Y Yields rose back above 4.00% again today and stalled there...

Source: Bloomberg

30Y Yields tagged 4.00% yesterday briefly and tried today but were unable...

Source: Bloomberg

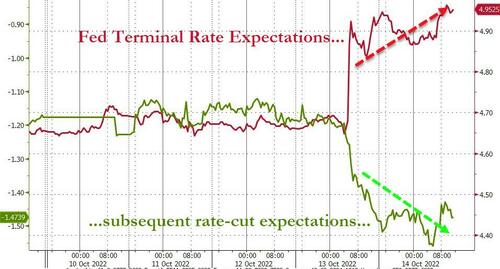

At the short-end, the market's expectation for The Fed's terminal rate (hawkishly) surged to 4.96% (in March 2023). At the same time, market expectations of post-recession rate-cuts also surged (but dovishly)...

Source: Bloomberg

While stocks bounced back yesterday after the CPI print, the hawkish shift in rate expectations continued today and stocks started to catch down to that reality today...

Source: Bloomberg

US equity markets were just as chaotic as bonds after yesterday's CPI puke and panic-buying squeeze which led to today's reality check lower. A late-day dump meant the Nasdaq ended the day down over 3.0% after being up 1.5% pre-market...

On the week, only The Dow managed to close green with Nasdaq dumping all of yesterday's gains and then some, closing down over 3%...

One bright spot is that today's lows were above yesterday's CPI-spike-down lows.

The S&P seemed to find support around 3600...

On the week, Staples & Healthcare outperformed while Discretionary and Tech were the laggards

Source: Bloomberg

Wells Fargo and JPMorgan outperformed today after earnings beats while Morgan Stanley missed and dumped almost 5%...

Source: Bloomberg

The dollar rallied for a second straight week, albeit with some crazy volatility...

Source: Bloomberg

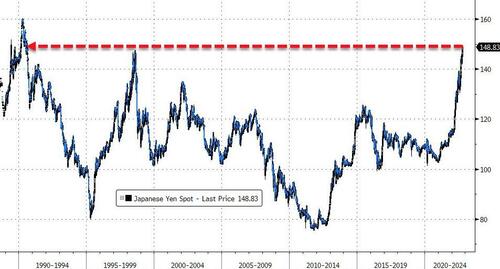

JPY was a shitshow this week (down 8 days in a row and down 9 weeks in a row), crashing to its weakest against the dollar since 1990 (almost at the Maginot Line of 150)...

Source: Bloomberg

Despite yesterday's surge higher, cryptos ended the week lower (with Bitcoin the prettiest horse in the glue factory, holding above $19k)....

Source: Bloomberg

Gold suffered its worst week since July (after 2 weeks of gains), unable to hold its bounce back above $1700...

Silver was slammed over 9% lower on the week, its worst week since Sept 2020...

A big reversal in the recent trend of silver outperforming gold...

After last week's surge higher, oil prices tumbled this week with WTI unable to hold $90 (falling further today after an unexpected jump in the rig count)...

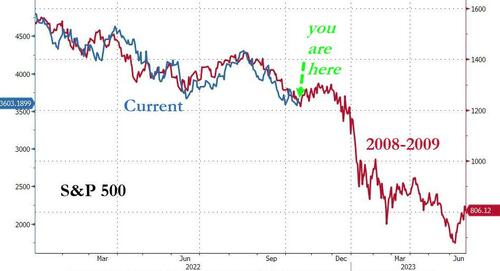

Finally, the 2008/9 analog continues to play out...

So is a bounce into the FOMC meeting set?

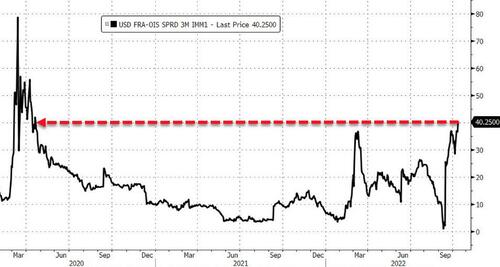

However, the market's real fear gauge is surging higher... (FRA-OIS is an indicator of interbank funding stress)

Something's going wrong in the market's pipes.

Simply put, if the FRA-OIS spikes another 10-15 points, the Fed will have no choice but to emerge from its paralysis and reassure markets that the financial system isn't about to experience another paralysis.

https://ift.tt/YbgGOdJ

from ZeroHedge News https://ift.tt/YbgGOdJ

via IFTTT

0 comments

Post a Comment