Mexico's Oil Hedging Program Begins, Expected To Protect Against 2023 Downside

Mexico has started hedging its 2023 oil production in the world's most secretive and largest oil hedge, Bloomberg reported, citing people familiar with the matter.

The source told Bloomberg that the Mexican government is hedging for the downside in crude oil markets. The hedge covers production (between 200 million and 300 million barrels) in the first half of 2023 and would shield any losses if crude tumbles below $75 a barrel.

As one of the most secretive hedging transactions typically costs around $1 billion, the sources provided no information on hedging products Mexico is using. Though the source said trading desks via oil majors are executing the hedge. Usually, Mexico has bought put options from Goldman Sachs, JPMorgan & Chase Co., and Citigroup Inc., but in recent years, oil majors have increasingly done the hedging.

For some years, Mexico has scored big on its oil hedge. In 2020, the hedge earned $2.38 billion when crude prices crashed and $6 billion in 2015.

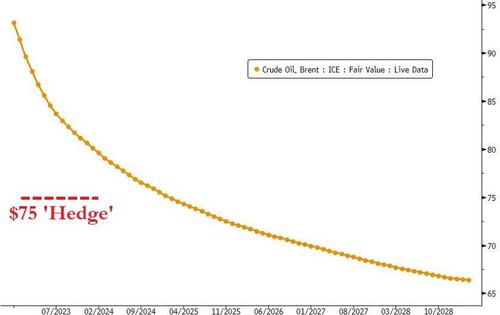

The $75-a-barrel level would mean Brent prices would need to fall 20% from current levels of $93.

Future and forward contracts point to increasing downside risks in crude markets through next year.

A souring macroeconomic outlook could drive crude prices down next year, according to a note via RBC Capital Markets, which warned about the rising global recession risks.

RBC's Michael Tran said there's a 15% chance that a significant slowdown in economic growth could result in Brent prices falling 37% from the $94 handle down to the $60 level.

Macroeconomic drivers include "stickier than expected inflation wreaking havoc on consumer demand, to China's reluctance to pivot from consumption hindering COVID policies, to a Fed overreach by moving fast and breaking things," Tran said.

"Such macro threats are realized and lead to a recession-like backdrop where correlations between risk asset classes move sharply together as investors seek safe havens," he added.

If Tran's bear case is correct, this would mean Mexico is well hedged for the coming crude plunge. He also noted a bull case scenario where prices could jump 25% to $115-$120 as Russia continues to reduce crude supply to Europe.

Meanwhile, OPEC Plus, the coalition of oil-producing nations led by Saudi Arabia and Russia, slashed production by 2 million barrels per day last week due to fears of a global economic downturn. OPEC+ has also warned of limited spare production capacity.

In any case, Mexico is preparing for the downside.

https://ift.tt/GRwiJst

from ZeroHedge News https://ift.tt/GRwiJst

via IFTTT

0 comments

Post a Comment