Pivot Dreams Spark Panic Bid As Lehman-Suisse Forgotten

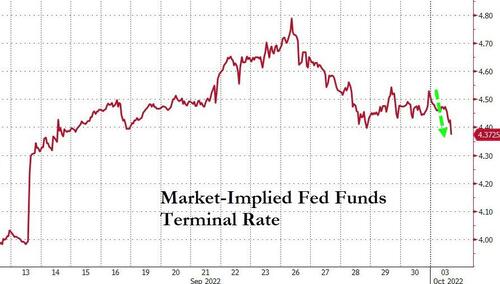

A weekend full of reports suggesting a Powell Pivot is close - but admittedly most suggesting considerable more downside pain is needed to force that through - combined with a weak PMI print (including a deflationary price impulse) prompted dovish shifts in market expectations for The Fed:

Rate-cut expectations for Q1 2023 are back...

Source: Bloomberg

And Terminal Rate expectations are falling fast (down 45bps from last week's highs)...

Source: Bloomberg

FedSpeak today offered absolutely no signs of a shift in tone from Barkin or Williams:

“Tighter monetary policy has begun to cool demand and reduce inflationary pressures, but our job is not yet done,” Williams said Monday in remarks prepared for a speech in Phoenix.

“It will take time, but I am fully confident we will return to a sustained period of price stability.”

“What if we are in a new era -- one in which we face inflationary headwinds?” Barkin said in his prepared remarks.

“History may be less of a precedent for appropriate policy.

“As a result, our efforts to stabilize inflation expectations could require periods where we tighten monetary policy more than has been our recent pattern,” Barkin said.

“You might think of this as leaning against the wind.”

The UN begged The Fed to stop pushing the global economy into recession (meddling?) as one could be forgiven for thinking politicians are starting to feel the pain:

"There's still time to step back from the edge of recession," UNCTAD Secretary-General Rebeca Grynspan said.

"We have the tools to calm inflation and support all vulnerable groups. But the current course of action is hurting the most vulnerable, especially in developing countries and risks tipping the world into a global recession."

But, the 'pivot' trade spread like syphilis through European porn stars to every asset class with the dollar down while stocks, bonds, commodities, precious metals, and crypto all bid.

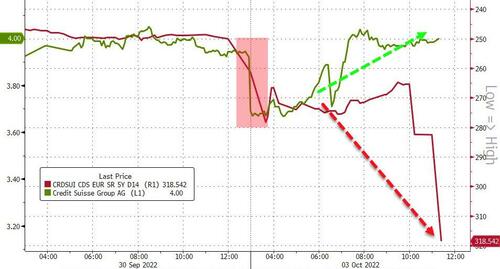

However, before we get on to that excitement, Credit Suisse stole all the headlines from a systemic risk perspective and while CS stock price bounced back from an ugly pre-open, its CDS kept pushing to new record wides intraday...

Source: Bloomberg

No obvious knock on effect in other market stress signals (FRA/OIS did not worsen today) as everything else was bid and shurugged off CS credit risk.

Futures were lower overnight but lifted into the open and then exploded higher as cash started trading...

This was close to the S&P's best since the peak of the COVID crash rebound.

Was a rally ever in doubt...

Kolanovic turned bearish. Bottom https://t.co/bXVFOHDoRS

— zerohedge (@zerohedge) September 30, 2022

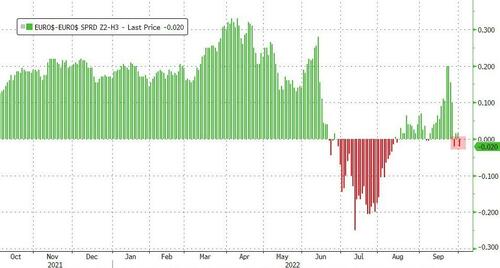

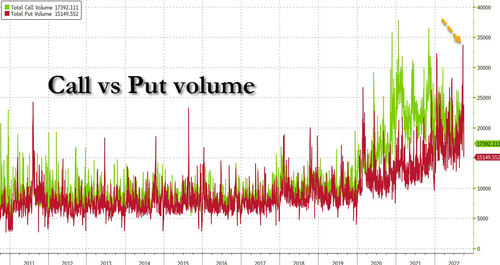

This was not a classic 'short squeeze' (yet)...

Source: Bloomberg

As all of last week's Put delta was vaporized today...

Source: Bloomberg

And there was one big loser today in equity-land (TSLA), as it missed expectations for deliveries...

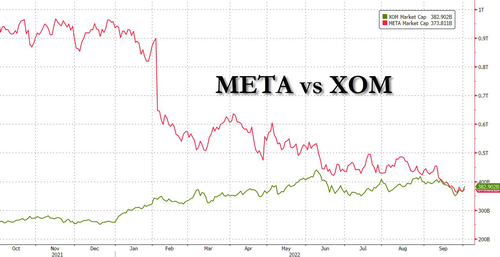

Exxon's big surge today took its market back above that of Meta...

Source: Bloomberg

Treasuries were also aggressively bid with yields in the belly of the curve dropping over 30bps at the trough today. The long-end underperformed but it was still a huge day for bonds...

Source: Bloomberg

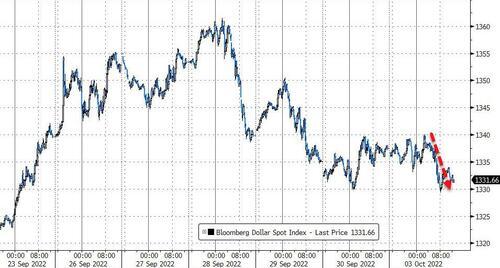

The dollar lost some ground today, hitting a 7 day low...

Source: Bloomberg

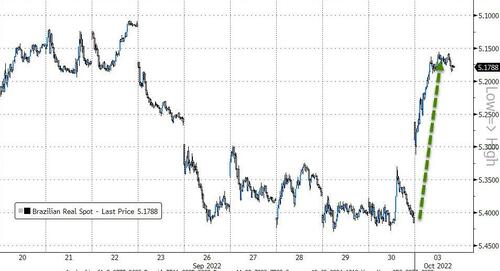

The Brazilian Real surged after Bolsanaro's better than expected performance over the weekend...

Source: Bloomberg

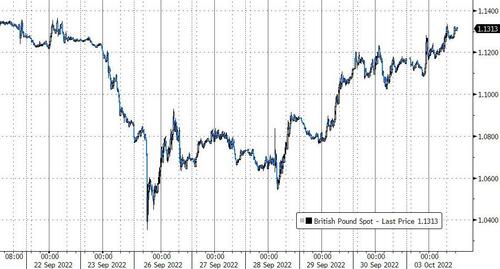

Cable also rallied, erasing all of last week's chaotic losses, after Truss folded on her tax cut for the rich...

Source: Bloomberg

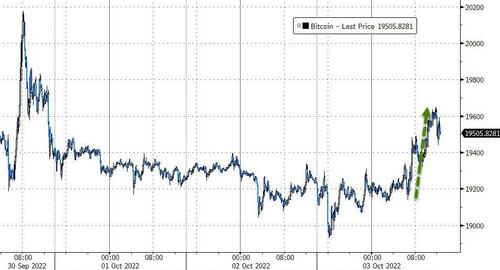

Bitcoin rallied on the day, testing back above $19500...

Source: Bloomberg

Silver soared almost 9% today...

Gold gained over 2%, with futures back above $1700...

Silver drastically outperformed Gold, sending the ratio of the two back to 5-month lows (from 95x at the end of August to 82x today)...

Source: Bloomberg

Oil soared today as dovish hopes combined with chatter that OPEC+ will slash production dramatically this week. WTI surged back above $80...

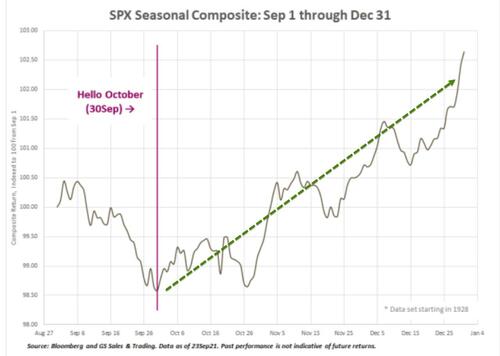

Finally, if you're buying this dip in stocks, seasonals are in your favor...

Payrolls on Friday... do you feel lucky, punk?

https://ift.tt/8CkIfzQ

from ZeroHedge News https://ift.tt/8CkIfzQ

via IFTTT

0 comments

Post a Comment