Goldman Prime Finds Hedge Funds Massively Piling Into Energy Stock Shorts

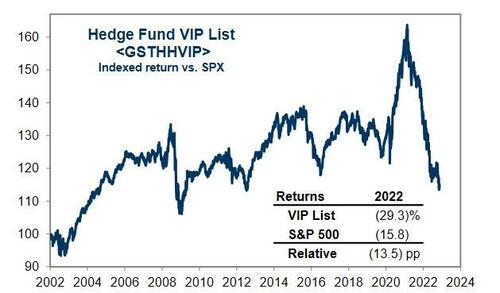

Last week, when we recapped Goldman's quarterly hedge fund monitor report which is the most detailed breakdown of hedge fund activity in the prior quarter, we pointed out something remarkable: while the hedge fund VIP list of most popular long positions continued to dramatically underperform (i.e., suck( as the "hedge fund hotel" model works very badly during times of broader market drawdowns...

... what was far more interesting was the list of Very Important Short Positions, or VISP, where at the very top was none other than Exxon - our favorite long since the summer of 2020 when it dropped to the $30s - which has doubled this year (and quadrupled since it was kicked out of the Dow Jones). As we said last week, "judging by how much short covering XOM still faces, not to mention how much more buying lies in stock as hedge funds rotate from being short to going long energy, Exxon may very well double again from here."

It very well may be eventually... but not before hedge funds double down on their worst trade of 2022 which has been to massively short the best performing sector in the S&P500 this year.

You see, so ingrained is the mean-reversion Pavlovian response among the hedge fund community that it continues to double down on tech longs - hoping that any minute now they will soar higher just because - while doubling down on such formerly hated names as energy stocks, nevermind the massive underperformance that the average hedge fund has suffered YTD.

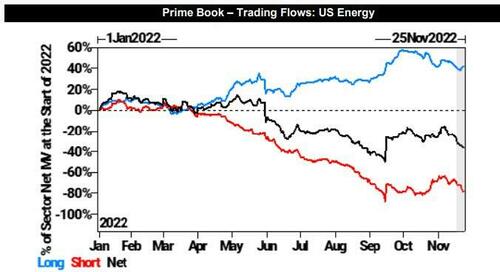

And sure enough according to Goldman Prime's latest report, energy was the top shorted sector (notionally) on the bank's Prime book last week with short sales outpacing long buys 6 to 1! Yes, during the previous week when many energy names hit fresh all time highs, instead of cutting losing tech longs, hedge funds were sextupling down on their energy shorts, and as GS Prime further adds, "US Energy stocks have been net sold 7 of the past 8 trading sessions, and last week’s notional net selling was the largest in over 5 months."

It gets better: the US Energy Long/Short ratio has steadily fallen to 1.83 from its YTD peak of 2.38 in January. The Long/Short ratio is currently in only the 2nd percentile vs. the past year!

Amid all the shorting, the US Energy Over/Underweight vs. the S&P decreased week-over-week to -0.69% underweight, which is in the 32nd percentile vs. the past year and in the 65th percentile vs. the past five years. Yes: despite the historic outperformance of energy, hedge funds remain stubbornly, stupidly short the sector even as it continues to grind ever higher.

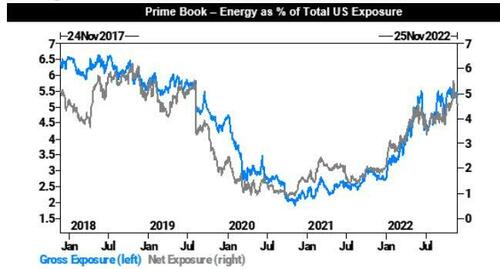

Finally, Goldman prime observes that over the last week, US Energy as a % of Total US Net Exposure decreased to 4.57%, while the percentage of Gross Exposure remained relatively unchanged. US Energy as a % of Total US Net Exposure remains in the 89th percentile vs. the past year, and in the 72nd percentile vs. the past five years. At the same time, US Energy as a % of Total US Gross Exposure is in the 86th percentile vs. the past year, and 63rd percentile vs. the past five years.

Why does this matter: considering the outperformance of energy, and the increase in market cap relative to the drop in tech values, net energy exposure as a % of total should be roughly double where it is now.

Finally, all of this is taking place as oil hits lows not seen since Dec 2021; in fact, we can only assume that many hedge funds are erroneously shorting energy as a surrogate to shorting oil itself. Just imagine the squeeze when oil finally catches a bid and pushes the energy sector to new highs.

Full report available to zh pro subs.

https://ift.tt/lDimexw

from ZeroHedge News https://ift.tt/lDimexw

via IFTTT

0 comments

Post a Comment