Spoos Shake Off Rollercoaster Session, "Article 5" Panic, To Close Above 4000

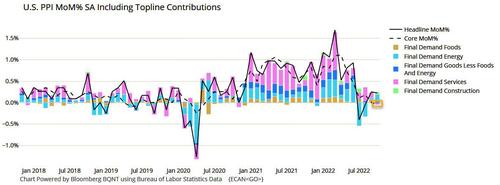

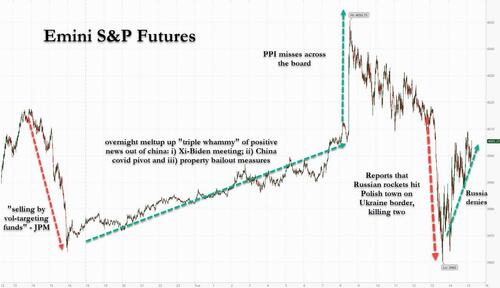

The past 24 hours have bee a rollercoaster session of sheer chaos and illiquidity. It all started one hour before the close on Monday when futures unexpectedly tumbled, wiping out all of the session's gains as a result of what JPM said was "selling by vol-targeting funds", before an overnight meltup driven by a triple whammy of good news out of China (reportedly positive read on the Xi-Biden meeting, China's covid pivot and property bailout measures) culminated with an explosion higher thanks to a PPI number which missed across the board, and where the service PPI print came in negative for the first time since 2020...

... although all of this was wiped out in seconds following reports that two Russian missiles had hit a Polish town near the Ukraine border sparking speculation of an "Article 5" response (i.e., NATO vs Russia all out war). In the end however, we closed more or less where we started, just around 4000, after Russia denied that it was behind the rocket and blamed Ukraine and the west for another provocation.

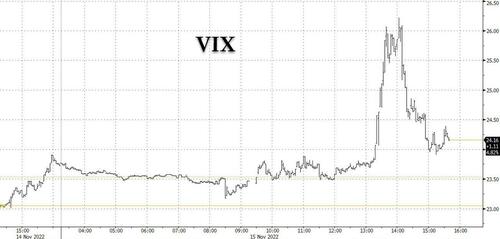

Was it all just an attempt to shake out weak hands? It remains to be seen if we are headed for another world war, but judging by the pump and dump in the VIX, the market has already moved on.

Despite the rollercoaster action at the index level, all sectors were in the green with just banks briefly dipping in the red before bouncing.

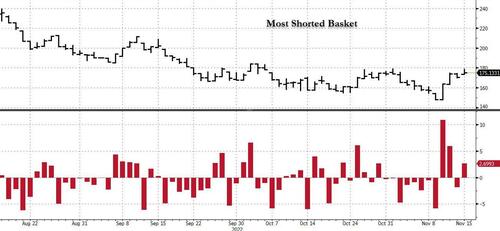

Meanwhile, the most shorted names continued their ascent, rising 2.7% on Tuesday and bringing the 4-day gain to a stunning 18%.

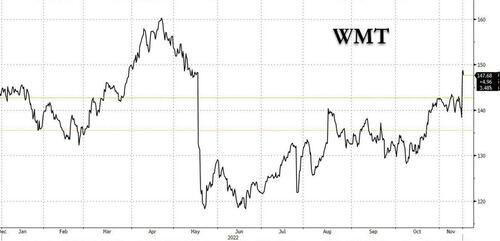

There was some fireworks in single names: after reporting blowout earnings, solid guidance and a new $20BN buyback, WMT soared 6.5%, its best day since July 2020, and erasing its entire YTD loss.

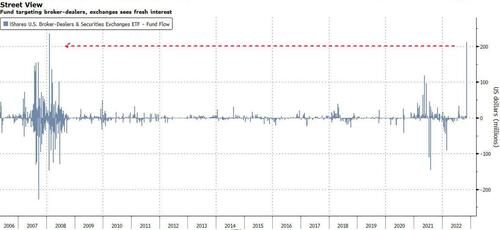

While attention was focused on every market twist and turn, Bloomberg pointed out something new: after months with barely any capital moving in or out, the Broker-Dealers & Securities Exchanges ETF (ticker IAI) added $211 million on Monday, the second-best influx since the product launched in 2006, and one of only two inflows of more than $100 million in well over a decade.

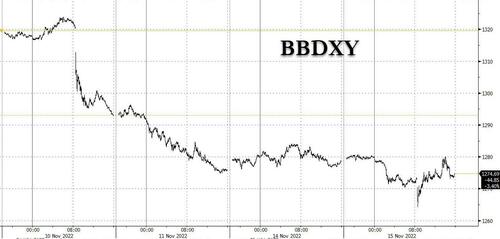

Away from stocks, the dollar descent continued, and not even the modest bounce on the back of the Russian missiles news was able to dent the market's conviction that the Fed's peak tightening is now behind us.

Likewise in bonds, yields drifted all day, and after a modest shakeout around the time of the Polish news, closed near session lows.

Cryptos tried to extend their modest rebound from Monday's collapse, with Bitcoin briefly rising above $17K before the Poland news sent them tumbling. While one can debate if cryptos are a store of value, it is quite clear that any news - both positive and negative - sends digital tokens tumbling as the shakeout of weak hands refuses to go away.

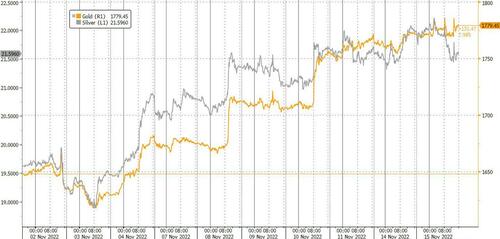

Finally, bitcoin's loss is gold's win, and as cryptos are unable to find a footing, it is gold that has rediscovered its role as the other sound money, and after trading in the mid-1600s as recently as a weeks ago is this close from rising above $1800

https://ift.tt/Hij9oR7

from ZeroHedge News https://ift.tt/Hij9oR7

via IFTTT

0 comments

Post a Comment