Spending On Holiday Items Dropped 3.4% In 2022, Led By Lower-Income Households

With US consumer spending under the microscope now that the US turn into a recession is the most closely watched inflection points, the latest total card spending data (both debit and credit card) tracked by Bank of America had some good and some bad news.

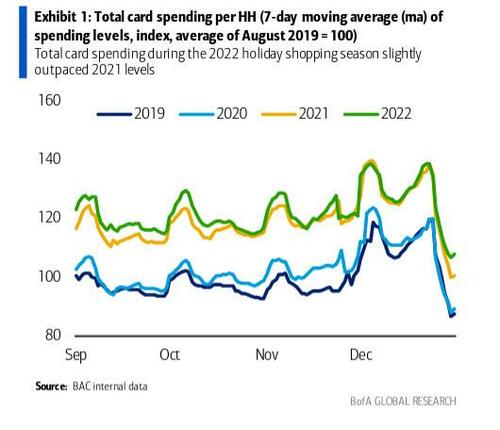

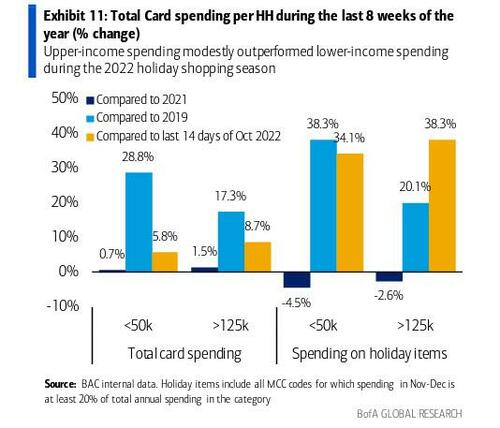

The good news is that total card spending per household (HH), as measured by BAC aggregated credit and debit cards, was up 1.2% year-over-year (y/y) during the 2022 holiday shopping season (which the bank defines as the last eight weeks of the year)

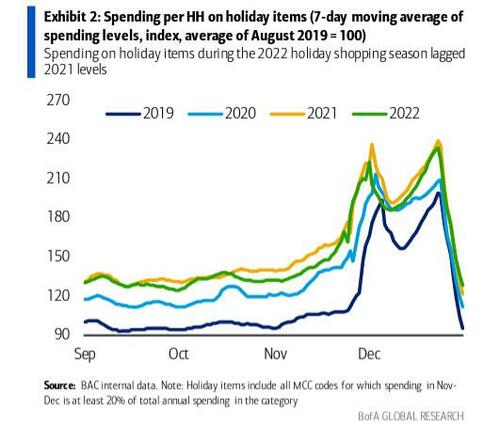

The bad news is that spending per household on holiday items was down 3.4% y/y during the same period

According to BofA economists, the soft y/y growth rates are not a surprise given the outsized surge last year which saw total card spending up 14.6% y/y during the historic 2021 holiday shopping season (i.e., base effect normalization). Additionally, the modest holiday spending data were likely also driven by steeper holiday discounts in 2022, due to significant inventory rebuilding after the 2021 shortages (i.e., liquidations resulting from bullwhip effect). Markets will get a better sense of the extent of discounting in the Consumer Price Index (CPI) report for December, released on Jan 12; it may reveal a much greater than expected drop in various retail items.

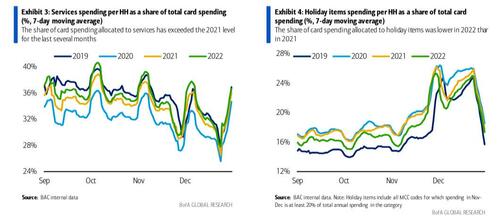

Separately, BofA observes that the "disproportionate weakness of spending on holiday items, compared to total card spending, is consistent with the ongoing rotation of consumer spending back to services." Indeed, the share of services in total card spending has been outpacing 2021 levels for the last several months, and even caught up to 2019 levels in late December.

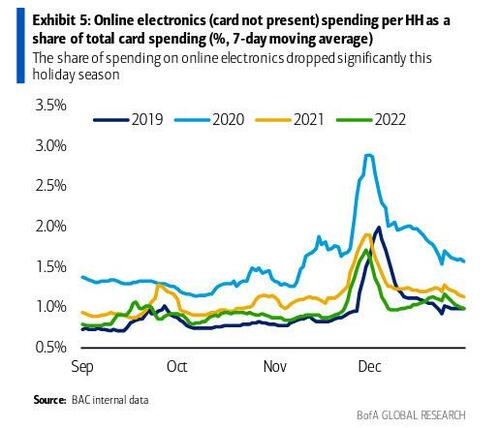

Looking at sector details, BofA finds that consumers appear to have traded their spending on goods such as online electronics...

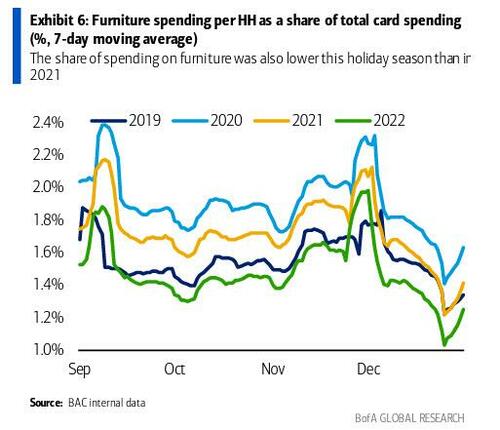

... furniture ...

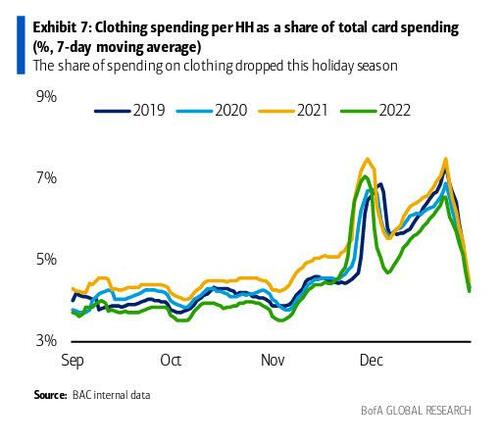

... and clothing ...

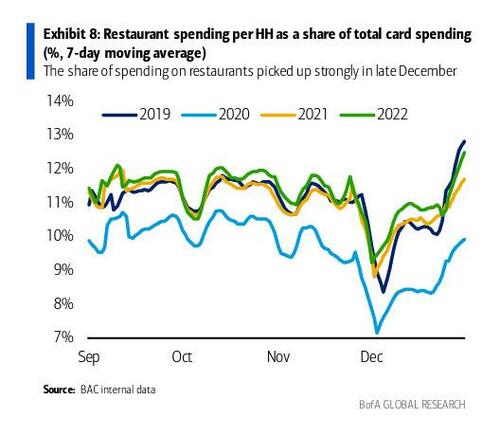

... for “experiences” that they missed out on during the pandemic, such as restaurants...

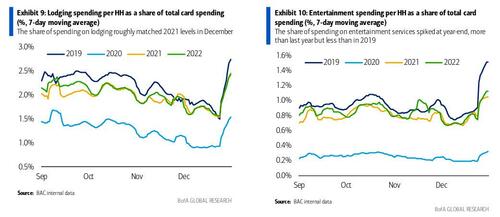

... lodging, and entertainment.

Indeed, the 2022 end-of-year spike in spending on these services looks more like the 2019 pattern than it did in 2020 or 2021. This again suggests that the economic effects of the pandemic continue to slowly fade.

Next, looking at household income distributions, the income trends noted a month ago in the Black Friday special report continued throughout the holiday season; no surprise here, lower-income households (income <50k) saw softer y/y growth in total card spending and spending on holiday items than upper-income households (>125k).

While this was partially due to base effects as lower-income households were the biggest beneficiaries of fiscal stimulus in 2020 and 2021, it is also the case that lower-income households also experienced a smaller “holiday bump” in spending, defined as the increase in spending relative to the last two weeks of October. Still, compared to 2019, however, lower-income households are still seeing much faster spending growth.

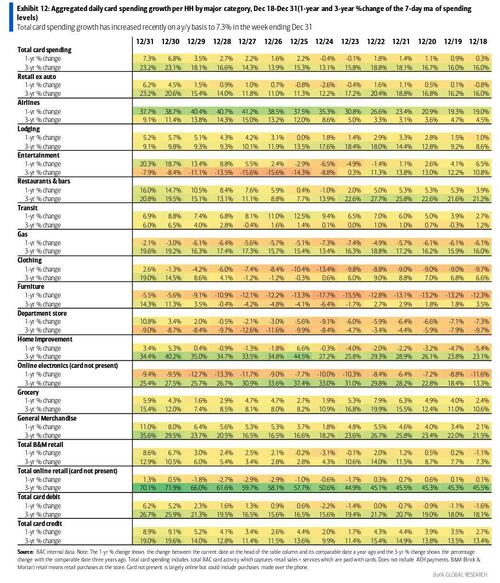

Finally, and signaling that US consumers are still spending aggressively, total card spending per household accelerated to 7.3% y/y in the week ending Dec 31, and the chart below shows that spending also accelerated on a 3-year basis, suggesting the pickup is not just an artifact of the base effect from last year’s Omicron outbreak.

According to BofA, the acceleration was in no small part due to a calendar distortion: Dec 31 fell on a Saturday in 2022 but was earlier in the week in the previous three years. Since many people return to work on the first Monday/Tuesday of the new year, there were additional days of holiday-related spending in 2019-21 that we did not have in 2022. If this proves correct, we will see much weaker y/y and 3-year spending growth in the first week of January.

https://ift.tt/90Dk3AY

from ZeroHedge News https://ift.tt/90Dk3AY

via IFTTT

0 comments

Post a Comment