US To Hit Debt Ceiling One Week From Today, Starting Countdown To Epic Chaos

In the final days of 2022, Goldman's economists predicted that "the biggest political risk" of 2023 will be the Congressional showdown over America's favorite periodic drama: the debt limit.

This is what the bank's chief economist Jan Hatzius said then: "The debt limit likely poses the greatest political risk next year, and we expect it to rival the 2011 episode in its disruption to financial markets and the economy. That said, we do not expect Congress to enact major fiscal changes. Republicans might press for spending cuts in a debt limit deal, but we do not expect substantial cuts next year. The White House might press for increased fiscal support, but this also looks unlikely as we believe a soft landing is more likely and a divided Congress would have difficulty responding to a recession even if one occurs."

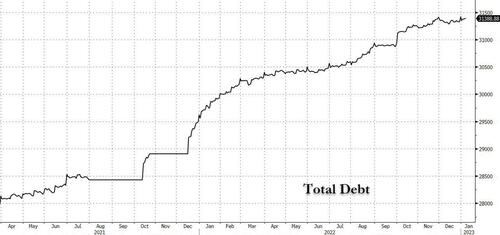

And while the US has about 9 months to go until the mid-September D-Day, or the moment when various emergency measures meant to provide breathing room under the debt ceiling, the existing US cash balance and new tax payments are all exhausted, a new analysis by Wrightson ICAP has calculated that the recent surge in Treasury bill supplies will likely push the outstanding amount of public debt about $10 billion above the debt ceiling after the close of business on Jan. 19, absent the implementation of measures to extend the government’s borrowing authority. Currently, the government is roughly $64 billion away from reaching its $31.4 trillion statutory borrowing limit, a level it will breach in about a week.

More than half of that $64 billion buffer will be chewed up by a swath of benchmark bill, note and bond auctions taking place this week. The net increase to the debt pile from those, after the last of them is settled next Tuesday, will be around $36.6 billion, leaving a little under $27.7 billion of clearance, according to ICAP and Bloomberg.

And that doesn’t even account for the new cash-management bill which settles two days later on Jan. 19. To accommodate that $60 billion security, it’s likely the Treasury will need to implement its extraordinary measures before then. The Treasury plans to sell $36 billion of four-month bills Wednesday, which is $3 billion larger than the previous week’s auction.

Of course, all that hitting the debt threshold level - which is always just a formality for a country that is debt-funded like the US means, is that the Treasury will notify Congress it’s invoking extraordinary accounting measures in the next few days.

“Even if our projections of nonmarketable debt are too high, the Treasury would probably be too close to the ceiling for day- to-day operational comfort,” Wrightson ICAP economist Lou Crandall writes in a note.

Once the Treasury invokes its extraordinary measures, that will give it “ample borrowing capacity” for at least the next few weeks so it could continue increasing the size of the three- and six-month bill sales for the next couple of weeks. Still, Wrightson expects Treasury to keep the sizes steady when it announces the next round Thursday.

Also, the fact that Treasury’s cash management bill offering is only 35 days suggests the department wants to “retain some flexibility” under the debt cap, which argues for relying on boosts to shorter maturities.

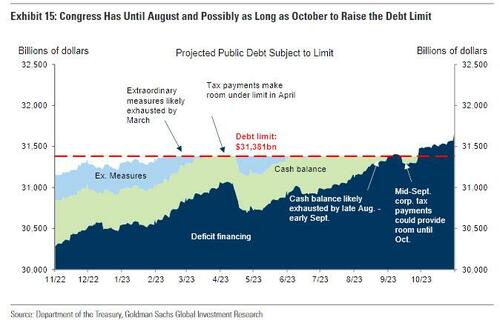

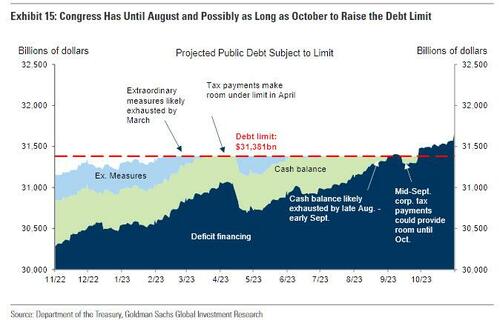

And while the debt ceiling will likely be breached in about a week, as the Goldman chart below shows, analysts doubt the government is actually at risk of defaulting until the second half of 2023 because of the extraordinary measures the Treasury usually uses to avoid exceeding the cap, including using up the existing Treasury cash balance and funding from tax payments.

And so, the question is not if and when the US will breach the debt ceiling and cross the infamous D-Day, but how will broken Congress reach a solution. As we explained one week ago in "Investors Are Already Dreading The Debt Ceiling Chaos In 2023", not even the always cheerful Wall Street expects a smooth and drama-free resolution to a process that will be nothing short of absolutely chaotic and expose the full Congressional dysfunction for the entire world to see.

For those who missed it, here are our thoughts from last week:

With the House paralyzed indefinitely after Kevin McCarthy just lost his 10th House Speaker vote (the longest such stretch since before the civil war) as a group of Republican holdouts refuses to side the GOP establishment, Bloomberg rates strategist Alexandra Harris writes that the debt ceiling is already top of mind for investors even though the US isn’t likely to face the threat of a technical default until the second half of 2023 and Treasury bills aren’t yet pricing such concerns. That’s because the Republican standstill surrounding the House speak vote foreshadows the chaos that could unfold when must-pass bills, like government funding legislation and an increase or suspension of the debt ceiling, have to be addressed.

clip and save for fights over government funding and the debt ceiling https://t.co/HQaF98JcRs

— Grace Segers (@Grace_Segers) January 5, 2023

“Although the markets did not react on Tuesday to the political chaos in the House, the dysfunction is a clear signal that House Republicans will struggle to raise the debt ceiling when the time comes in 3Q23,” Stifel Financial’s chief Washington policy strategist Brian Gardner says in a note.

“Investors should be on guard as the summer approaches as to the possibility that the brinksmanship over the debt ceiling could lead to market volatility and a risk-off trade." Well at least the Fed will be happy.

The good news is that the debt ceiling crisis isn't due for a while: the government is roughly $102 billion away from reaching the $31.4 trillion statutory limit, although analysts doubt the government is actually at risk of defaulting until the second half of 2023 because of the extraordinary measures it usually uses to avoid exceeding the cap.

Treasury has been reducing its cache of bills in order to give itself more breathing room under the cap before invoking their accounting tricks. And speaking of tricks, California Democrat Brad Sherman floated a potential deal that would trade Democratic votes to make McCarthy the speaker of the House in return for rules aimed at preventing a US government shutdown or a debt limit crisis.

According to Harris, from a money-market standpoint, a dragged-out fight over the debt ceiling will likely result in less T-bill supply at a time when there’s still a glut of cash in the overnight funding, pushing rates even lower and motivating eligible counterparties to keep parking cash at the Fed. Yes: that means the Overnight Reverse Repo balance will balloon even more.

This comes at a time when Federal Reserve policy makers are expecting balances at the overnight reverse repo facility to drop from its current levels above $2 trillion. It rose by another $41 billion on Wednesday to $2.23 trillion. In the minutes of the December gathering, Patricia Zobel, manager pro tem of the New York Fed’s system open market account, noted that greater competition among banks for funding could contribute to drawdowns in the RRP, but clearly that has not been the case since most banks still refuse to raise rates on their deposits.

All of which brings us to what Goldman predicted in its "10 questions for 2023", would be the biggest political risk of this year. Not surprisingly, it was another debt ceiling crisis. For those who missed it, here is what Goldman said:

Will the debt limit have as negative an impact on financial markets in 2023 as it in 2011?

Yes. The political and fiscal conditions next year will be similar to the last two extremely disruptive debt limit increases, in 1995 and 2011. Like next year, in those periods a Democratic President in his third year faced a Republican House after losing the majority in the midterm election. Those episodes also followed a run-up in public debt as a share of GDP and/or a rise in federal interest expense, similar to the experience over the last few years. However, midterm gains of 54 seats in 1994 and 63 in 2010 gave Republicans a clearer political mandate and the votes to carry it out, at least in the House. By contrast, Republicans netted only 9 seats in the 2022 midterms and enter 2023 with a very thin House majority. Public focus on the public debt is also much lower compared to those prior periods, and Republicans have not emphasized fiscal restraint nearly as much recently as they had in the mid-1990s or early part of the Obama Administration.

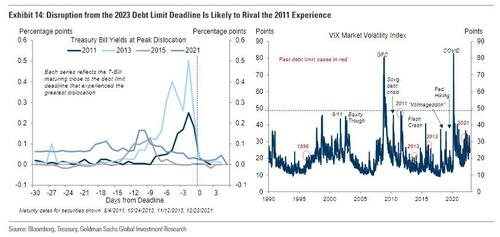

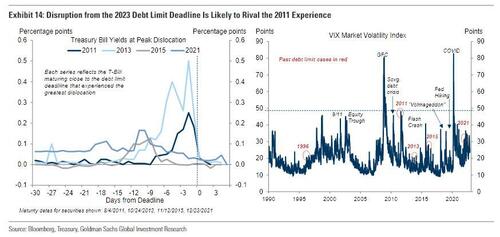

Prior disruptive debt limit standoffs led to increased market volatility and a sell-off in Treasury securities maturing around the debt limit deadline, and we would expect this to occur next year. In 2023, we would expect yields on bills maturing around the deadline to rise by at least as much as they did in 2011 and 2013, and for volatility in financial markets to rise similar to those periods (Exhibit 14).

There is also a real chance that Congress fails to raise the debt limit in time next year, forcing Treasury to reduce daily payments to the level of receipts (i.e., immediately eliminating the budget deficit), resulting in a spending cut of around 10% of GDP at an annualized rate. While we think it is more likely that Congress manages to avoid this and raise the debt limit before it constrains Treasury’s ability to pay its obligations, the risk appears higher than at any point since 2011.

The deadline for Congress to raise the debt limit before Treasury must cut back net borrowing will likely be sometime in August but could be as late as October depending on Treasury cash flows. An early signal of the risk the debt limit poses will come at the start of 2023, when the new House of Representatives is seated. If Republicans reinstate the “motion to vacate” that allows any member of the House to call for a vote for a new speaker of the House—several Republican House members have recently called for this in return for their vote for speaker—it could be difficult for the next speaker to put a clean debt limit increase to a vote until forced by financial markets.

For more detailed on these, and other questions and predictions, read the full note available to pro subs.

https://ift.tt/GNaTxOk

from ZeroHedge News https://ift.tt/GNaTxOk

via IFTTT

0 comments

Post a Comment