WTI Holds Losses After API Reports Crude Build

Oil’s losses deepened, with thin liquidity exacerbating sharp swings, as China’s mounting death toll overshadowed the country’s resolve to boost its economy and US manufacturing data disappointed this morning.

“The disconnect between how forward-looking assets like energy equities anticipated a China recovery does not translate to immediate crude strength as there is a lot near-term risk to demand before we see recovery take hold,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management.

With winter storm impacts likely hitting as well as holiday disruptions, this last week's inventory data is perhaps more noise than signal.

API

-

Crude +3.298mm

-

Cushing

-

Gasoline

-

Distillates

Crude stocks rose for the second straight week...

Source: Bloomberg

WTI hovered just above $73 ahead of the API data and did not change on the print.

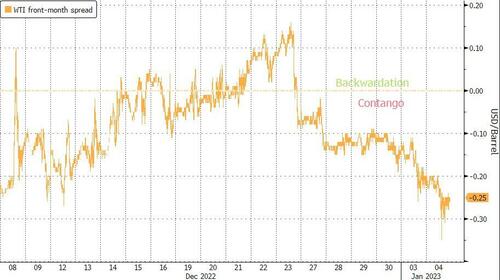

Deepening contango in front-month oil spreads reflects the dour near-term view...

Finally, we note that Saudi Arabia kept oil exports steady last month as it continued to implement an OPEC+ agreement aimed at stabilizing world crude markets, according to an official from the kingdom.

https://ift.tt/kuQsl2p

from ZeroHedge News https://ift.tt/kuQsl2p

via IFTTT

0 comments

Post a Comment