A Return To 'Head-Smacking Craziness'? Hedge Fund Billionaire Singer Warns 'Bear Market Is Not Over Yet'

"Central bankers think they are the masters of the universe because the world is looking to them (and only them) to deliver continuous stability and prosperity. There is no reason to suppose that they understand the modern financial system and economy to any greater extent than they did in 2007 (that is to say, not at all). Nevertheless, they plow ahead, expressing total confidence that what they are saying and doing is wise and not dangerous drivel..."

That's how billionaire hedge fund manager Paul Singer described the elites' arrogance in the past, that, we believe, we are seeing once again as Fed Chair Powell - whether under political pressure or his own hubris - practically declares 'mission accomplished' over inflation.

Singer had something to say about the threat of inflation too, forecasting years ago - as The Fed unleashed wave after wave of QE - what we have seen in the last two years...

"We believe that if and when inflation goes from being something that affects only a particular list of assets (a growing list, presently a combination of things owned by the well-off plus a number of things that are basic necessities) to a widespread “in-your-face” phenomenon affecting the cost of living of almost the entire population, then the normal yardsticks of risk, return and profit may be thrown into the garbage can.

These measures may be replaced by a scramble by citizens and investors to preserve value on a foundation of shifting sand, together with societal unrest that may make the current politically-useful “inequality” riffs, blaming the “1%” and attacking those “millionaires and billionaires” who refuse to “pay their fair share,” look like mere warm-ups for real class warfare."

Since the start of the Biden administration, inflation has soared and all those threats have come to pass...

And while inflation looks to be slowing, the billionaire founder of Elliott Investment Management, warned a room of hedge fund managers and large investors this week that there's likely to be a disorderly unraveling of markets.

Bloomberg reports that, according to people familiar with the discussion at the Managed Funds Association conference this week in Miami, Singer said the bear market isn't over and that a drop of 20% is likely not enough.

More than a decade of aggressive monetary and fiscal policies can't be unwound in a year, he explained, drawing parallels to ballooning debts as potentially wreaking havoc rivaling The Great Depression, despite growing hope for a 'soft landing'.

Singer, 78, added that many valuation metrics in the market remain higher than in 1929 or the dot-com era bubble...

As we noted above this is not the firs time Singer has sounded the alarm bells, citing the Fed's years of easy money policies.

In 2021, he said he couldn't wait to say "I told you so" to the people who participated in the "head-smacking craziness."

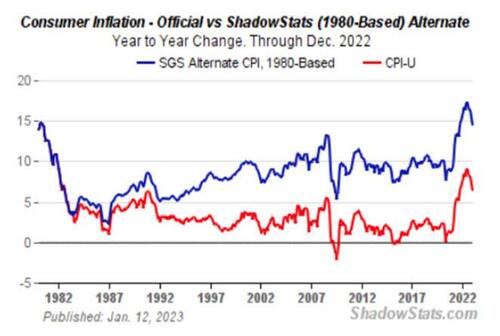

Singer also told the crowd this week that inflation is higher than what's reported and that focusing on core metrics — which exclude food and energy prices — is unrealistic...

Finally, we return to Singer of the past, who offered this reality-check on the market's apparent belief in central planners' omnipotence...

"It is important to note that mass human behavior cannot be modeled or predicted with any degree of precision. When forces are brought to bear that suggest a possible shift in direction of mass human behavior (examples include oppression, tyranny, economic underperformance, inflation, incentives and disincentives), there is no way of telling if, how or when such forces will actually result in a change of vector."

In the past, Singer has had a clarifying investment thesis:

"Although the levitation of financial assets has yet to levitate gold, we will grit our collective teeth on that score and await either 'asset price justice' or the 'end times,' whichever comes first."

The recent gains in the precious metal - as the market prices in a pivoting Powell - may just be the sign of the 'end times' Singer has warned of.

https://ift.tt/yOHhc78

from ZeroHedge News https://ift.tt/yOHhc78

via IFTTT

0 comments

Post a Comment