Stocks Slammed As Rate-Hike Odds Rise, Google Gags

A triple whammy of FedSpeak today (Williams, Kashkari, and Waller) all sung from the same hymn-sheet - 'more work to do', 'higher for longer', 'no rate cuts this year'... and the market is actually starting to get the message.

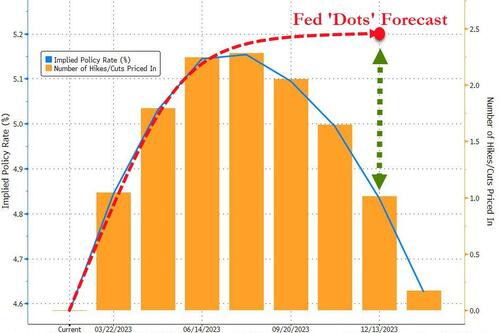

The market's expectations for The Fed's rate-trajectory continued their post-payrolls hawkish trajectory today with the terminal rate reaching a new cycle high of 5.18% and H2 2023 rate-cut expectations now below 30bps...

Source: Bloomberg

That hawkish drift weighed on stocks, most notably big-tech and small-caps...

As the post-FOMC gains are rapidly losing altitude...

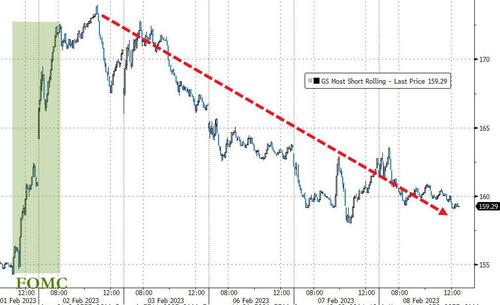

"Most Shorted" stocks are down for the 4th straight day after last week's epic squeeze...

Source: Bloomberg

The Nasdaq pain was exaggerated by GOOGL getting clubbed like a baby seal after its chatbot screwed up a response to a question. That's a $110 billion market cap loss...

Notably, VVIX (the expected vol of VIX) soared today as VIX lifted back up to around 20 (as options traders begin to price in event risk around next week's CPI print)...

Source: Bloomberg

Treasury yields were lower across the curve today fairly uniformly (down 2-3bps), but all remain higher post-FOMC with the short-end still underperforming...

Source: Bloomberg

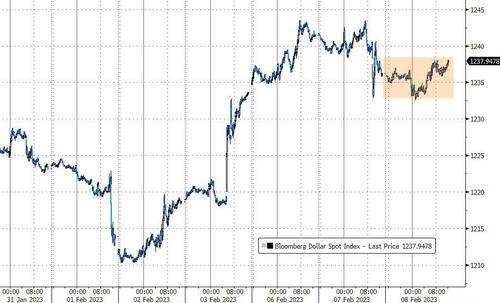

The dollar inched higher on the day after trading in a very narrow range all day...

Source: Bloomberg

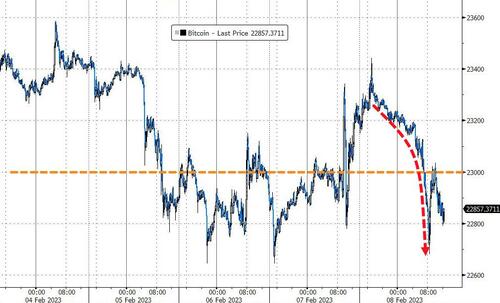

Bitcoin reversed yesterday's gains, back below $23,000....

Source: Bloomberg

Gold briefly touched $1900 overnight but couldn't hold it...

Oil prices extended their recent rebound with WTI topping $78 back at one-week highs...

Finally, the market still appears to be pricing in rate-cuts by the end of the year...

Source: Bloomberg

https://ift.tt/KXAlyRx

from ZeroHedge News https://ift.tt/KXAlyRx

via IFTTT

0 comments

Post a Comment