House Weaponization Panel Gets IRS To End 'Abusive' Surprise Visits; Taibbi Thanks Jim Jordan

House Republicans on the GOP's "weaponization" subcommittee said in a Friday report that the IRS has agreed to end its "abusive" policy of surprise visits to taxpayers' homes following pressure from the panel.

"The Committee’s and Select Subcommittee’s oversight revealed, and led to the swift end of, the IRS’s weaponization of unannounced field visits to harass, intimidate, and target taxpayers," reads the report. "Taxpayers can now rest assured the IRS will not come knocking without providing prior notice—something that should have been the IRS’s practice all along."

The IRS announced in July that it would end most unannounced agent visits to the homes of Americans, citing security concerns.

But it also came after the agency engaged in what appeared to be witness intimidation, after visiting the New Jersey home of journalist Matt Taibbi on the same day he appeared before Congress to testify on government abuse.

Following the incident, Chairman Jim Jordan (R-OH) demanded answers from the IRS, writing "In light of the hostile reaction to Mr. Taibbi’s reporting among left-wing activists, and the IRS’s history as a tool of government abuse, the IRS’s action could be interpreted as an attempt to intimidate a witness before Congress."

Taibbi thanked Jordan on Saturday, writing in response to the report:

One of the cases outlined is my own. My home was visited by the IRS while I was testifying before Jordan’s Committee about the Twitter Files on March 9th. Sincere thanks are due to Chairman Jordan, whose staff not only demanded and got answers in my case, but achieved a concrete policy change, as IRS Commissioner Daniel Werfel announced in July new procedures that would “end most” home visits.

Anticipating criticism for expressing public thanks to a Republican congressman, I’d like to ask Democratic Party partisans: to which elected Democrat should I have appealed for help in this matter? The one who called me a “so-called journalist” on the House floor? The one who told me to take off my “tinfoil hat” and put greater trust in intelligence services? The ones in leadership who threatened me with jail time? I gave votes to the party for thirty years. Which elected Democrat would have performed basic constituent services in my case? Feel free to raise a hand.

If silence is the answer, why should I ever vote for a Democrat again? -Racket News

Taibbi had opined earlier in the day on the disturbing IRS home visits, writing in Racket that: perhaps the most 'unsettling revelations' happened after his case - when on April 25, 2023 a woman was visited by an IRS agent using a fake name.

On that date, a woman was visited at her home by a man identifying himself as “Bill Haus” from the IRS’s Criminal Division. He then “informed the taxpayer he was at her home to discuss issues concerning an estate for which the taxpayer was the fiduciary,” and after sharing “details about the estate that only the IRS would know,” the taxpayer “let him into her home.”

The woman informed “Haus” that the estate issues had been resolved, and furnished documents to prove it. At this point, he informed her of his real purpose, claiming she was delinquent on several tax filings and provided “several documents to the taxpayer for her to complete.”

Hesitating, the woman offered to put him on the phone with her accountant, but when he didn’t answer the phone, she contacted an attorney, who “repeatedly told Agent ‘Haus’ to leave the taxpayer’s home since the taxpayer had not received any prior notice from the IRS of any issue.” The agent reportedly replied that he was with the IRS and could go into anyone’s house at any time, and before leaving told the taxpayer she had “exactly one week to satisfy the remaining balance or he would freeze all her assets and put a lien on her house,” as the Committee report put it.

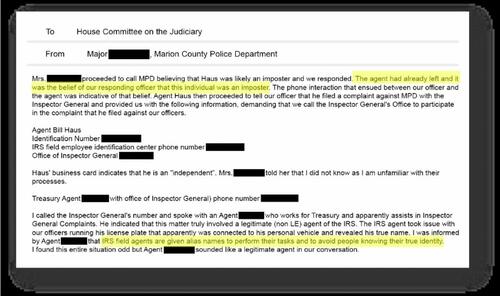

Once “Haus” left, the taxpayer feared a scam and had the good sense to immediately contact the Marion, Ohio Police Department (MPD), upon whose reports this story ends up being based. (Emails published below.) The MPD ran the plate of “Bill Haus” and found it came back to a car owned by someone with a different name. The police contacted the car owner, who “attested that he was an IRS agent but admitted Bill Haus was not his real name; he was using an alias.”

* * *

Taibbi also notes that "Agent Haus" was pissed after his identity was discovered, and then filed a complaint with the Treasury Department's Inspector General against the MPD for outing him. It was only after a senior MPD offer called the Inspector General (TIGTA) that they were able to confirm that Haus was an actual IRS agent.

As Taibbi further considers:

Pause here to consider the numerous problems already confirmed, to police, by the IRS:

IRS agents make field visits using aliases;

IRS agents make “pretext” visits, i.e. they announce they’re asking about one thing, when really by their own admission, they might be investigating something else;

The IRS makes local, covert home visits without informing local authorities.

Think of the problems that could arise from the last issue alone. According to the exchanges, the IRS isn’t required to inform local officials of investigative activity, but as noted by the TIGTA official in communications with the MPD, this is something they should do, to avoid mixups. Here for instance, even after a lengthy inquiry, local police were unsure “Agent Haus” really worked for the Treasury. Imagine if the taxpayer called police to come over during her visit, and think of the things could go wrong. It’s insanity that the Treasury would have investigators using aliases making Clockwork Orange-style “surprise visits” without informing local officials.

Amazing.

https://ift.tt/MSWTRPt

from ZeroHedge News https://ift.tt/MSWTRPt

via IFTTT

0 comments

Post a Comment