BofA: We Are "Irrationally" Bullish On 2019, But A Liquidity Crisis Is Coming In 2020

When it comes to the equity market, between the Trump and Powell puts, there appears to be nothing in this world - literally - that can put a dent in stock price. In what Bank of America's CIO Michael Hartnett calls a "Miracle on Wall Street" in his latest Flow Show weekly, he lists a barrage of negative catalysts including: i) yield curve inversion, ii) US-China trade war, iii) recession in Germany, iv) collapse in Chinese industrial production, v) contraction in global profits, vi) oil price spike, vii) BREXIT, viii) Trump impeachment inquiry, ix) Argentine default/Ford downgrade, x) Thomas Cook bankruptcy...and yet risk assets close to all-time highs and US stocks on course for 30% annualized returns, global stocks 24%, commodities 17%, global IG & HY bonds 14%, US Treasuries 10%... or as he concludes laconically, this is "breathtaking stuff."

Betting on a continuation of this "breathtaking" exuberance, Hartnett writes that he remains 2019 irrationally bullish as a result of bearish investor sentiment + desperate central banks/policy-makers + bond 'bubble', culminating in an "overshoot" in credit & equity prices this autumn; even so, Hartnett expects rising bond yields to trigger more frequent episodic violent rotations from deflation assets (e.g. bonds, growth stocks, defensives) to inflation assets (e.g. commodities, value stocks, cyclicals).

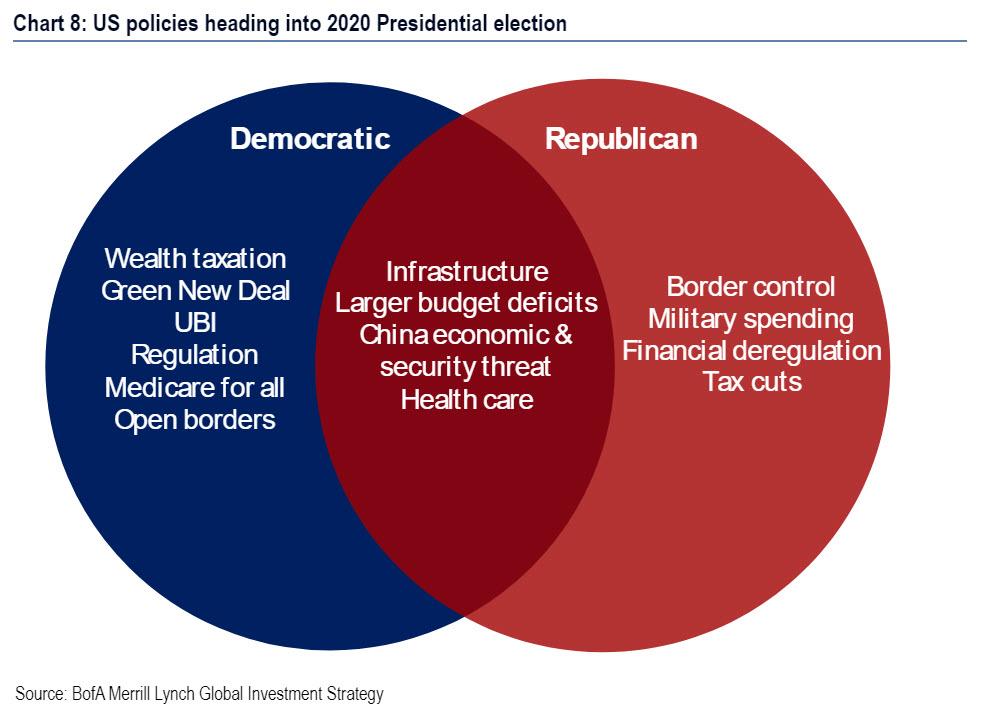

However, the party ends next year (as the presidential election looms) and BofA remains 2020 rationally bearish, when the bank's chief market strategist expects the bond bubble to pop and induce "big top" in credit (spreads trough) & equities (multiples peak), causing a Wall St deleveraging & Main Street recession. Of course, a broad economic recession just months before the presidential election would also have a dramatic impact on the election of the next US president, and may usher in MMT (i.e. helicopter money) far sooner than most had anticipated.

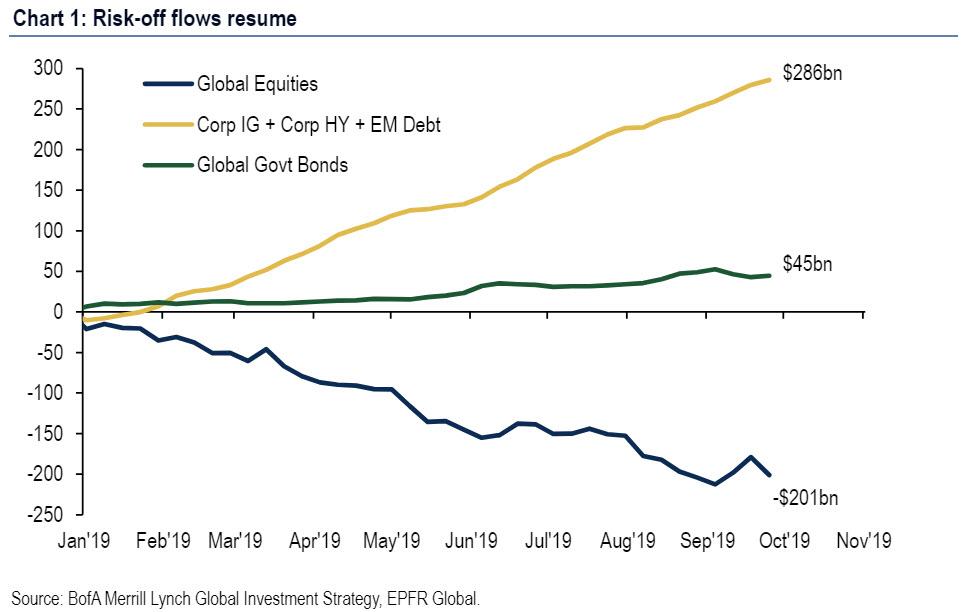

For now, the market isn't buying BofA's thesis, and instead it remains dominated by risk-off weekly flows: $9.2bn into bonds, $2.8bn into gold, $22.0bn out of equities; resulting in risk-off YTD flows…$358bn into bonds, $15bn into gold, $201bn out of stocks (for those asking why stocks remain just 2% below all time highs, we have a one-word answer: stock buybacks).

Here Hartnett makes the following notable flow observations:

Inflows to government bonds ($1.8bn inflows after $10bn outflows past 2 weeks) & 2nd biggest gold inflows ever ($2.8bn); inflows continue across credit markets (IG $5.0bn, HY $0.2bn, EM debt $0.8bn); big redemptions from equities ($22.0bn - reversal of $34bn inflows past 2 weeks); biggest redemptions from tech ($0.3bn) in 6 weeks & US growth funds ($6.1bn) in 3 months.

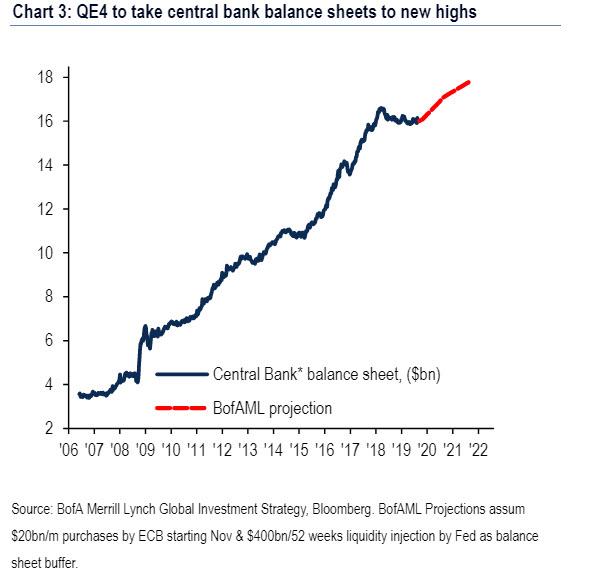

In response to this wholesale risk-off capitulation by traditional investors, central banks have once again gone "all-in", with 43 global rate cuts YTD, 751 rate cuts since Lehman. More importantly, the new ECB QE program, together with the upcoming Fed QE4 to "normalize the money markets", means a new all-time high of $16.6tn central bank balance sheets high by Apr' 20...

... while the stock of negative-yielding bonds will soon resume rising and surpass its prior record of $17 trillion, all of which BofA finds to be maximum bullish for Wall Street... at least until the moment if impotence arrives, at which point it's more or less game over.

Meanwhile, as we near the point of "maximum liquidity", we also hurtle toward the point of "minimum growth", with Hartnett reminding us that the BofA Global EPS Model forecasts -6.8% EPS growth next 12-months vs. consensus -2.8%, with the inflection point higher in global profits the "missing "ingredient to more sustained multi-quarter rotation from deflation to inflation assets.

In short, we are back to square one, as the playbook from the early 2010s - minimum growth & maximum liquidity - is applied all over again:

- own "yield" plays

- own "growth" plays (high beta when PMIs>50, low beta when PMIs<50)

- rent "value" plays.

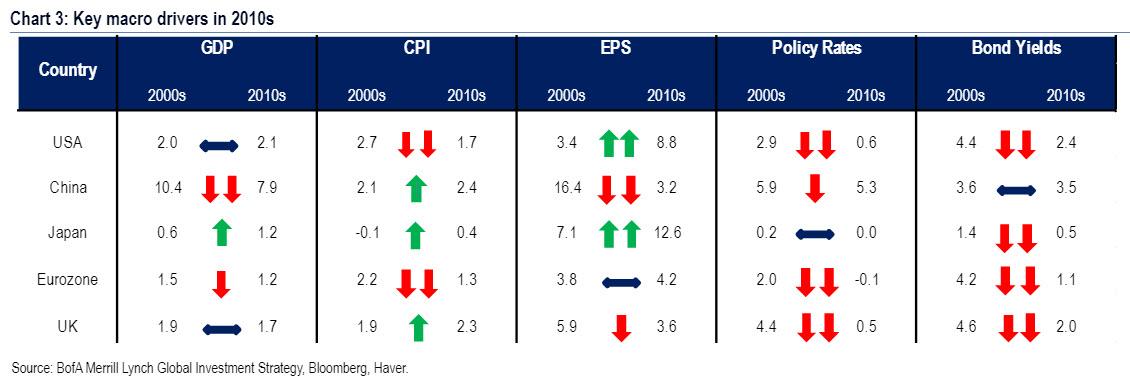

It's not just the market that is experiencing a 2010s deja vu: the next chart shows key macro drivers of 2010s - steady GDP in US, accelerating EPS in US, weaker GDP in China, stagnation in Japan & Eurozone, lower CPI, collapsing rates & yields.

That said, three catalysts can change this in the 2020s, and break the cycle:

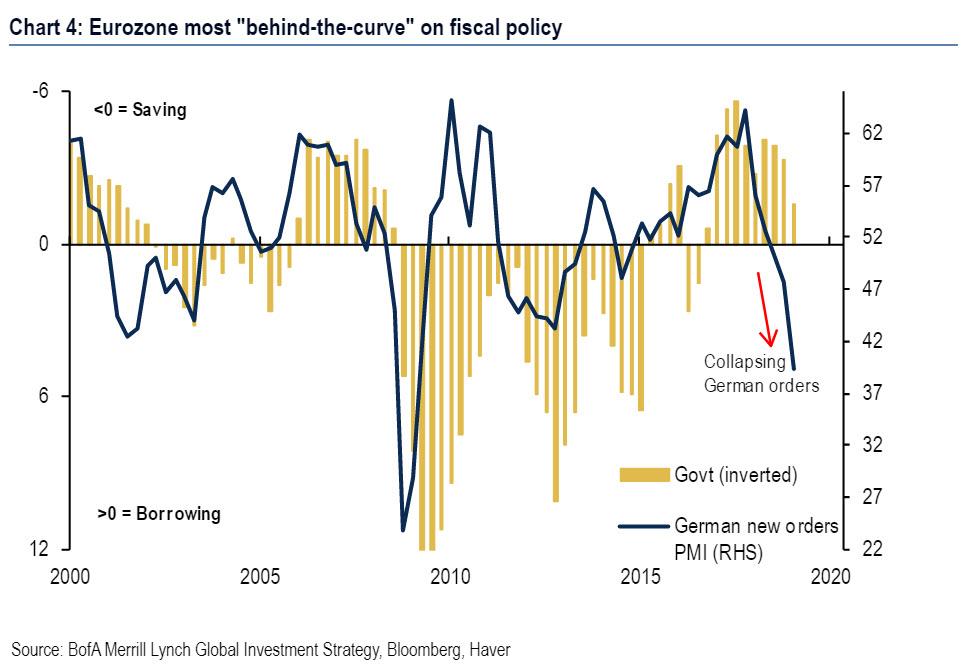

- Catalyst 1 = higher growth & higher yields: This would require PE (Populist Easing), a shift to MMT, fiscal stimulus as cheap financing incites large government spending addressing wealth inequality, student debt, housing affordability and climate change boosting global animal spirits; but fiscal policy-makers remain timid, e.g. Eurozone most "behind-the-curve"…Germany in recession yet Eurozone governments remain net savers not borrowers in 2019 (much to Mario Draghi's disgust).

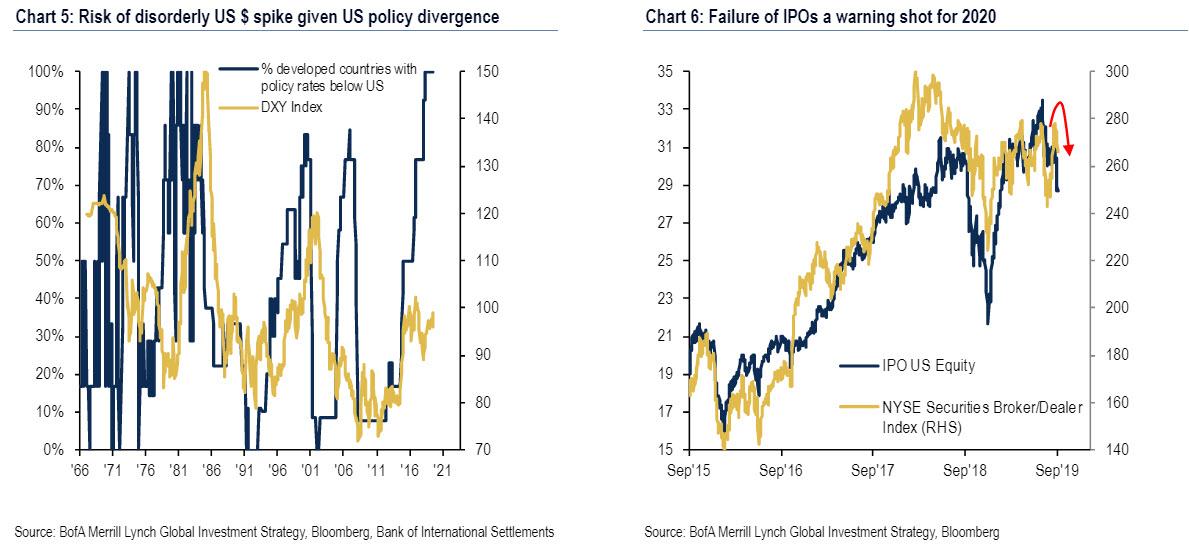

- Catalyst 2 = higher rates & lower growth: BofA's bearish narrative for 2020 is via policy impotence & pop in bond 'bubble'; for the moment credit spreads remain very low but IPO underperformance (chart below), spike in repo rates, credit tremors (Argentina, Ford, Thomas Cook) and growing risk of disorderly rise in US dollar given US policy divergence, all hint at "potential liquidity crisis in 2020" according to BofA, an outcome that would be music to the ears of Donald Trump's opponents in the 2020 elections.

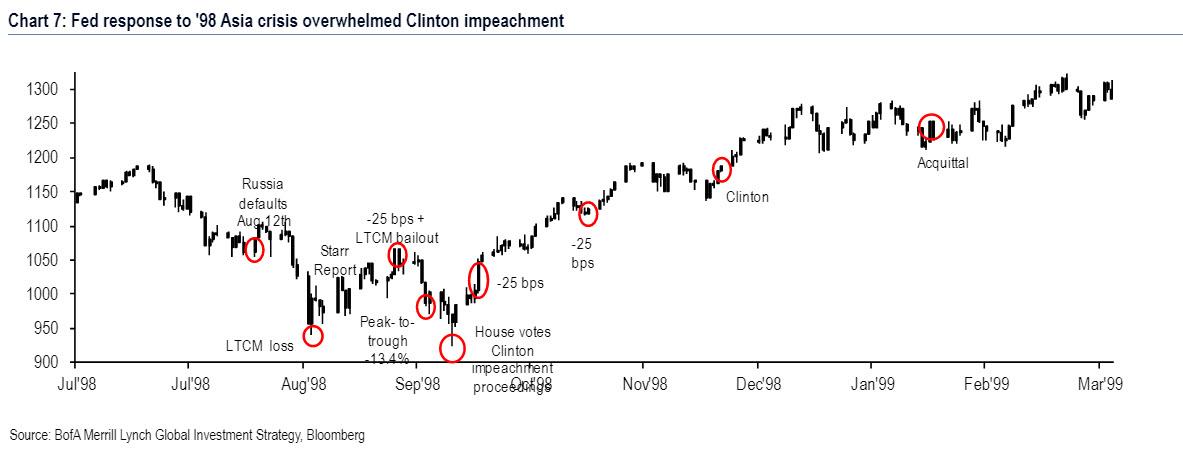

- Catalyst 3 = lower EPS & lower yields: note Fed response to '98 Asia crisis overwhelmed Clinton impeachment (Chart 7); a potential Trump impeachment in 2020...

... could herald shift to left towards redistributive policies of higher regulation & higher taxation harming US EPS.

That means that if the Clinton impeachment a harbinger of what comes next, expect an even more pressing and dramatic financial or geopolitical crisis to be unleashed somewhere in the world, which will force even more easing by the Fed, and in turn send stocks to even recorder highs, before the next and perhaps final bubble bursts, send stocks crashing to new generational lows. The only question is whether Trump will successfully delay this day of reckoning to beyond November 2020. And once we cross that point, the collapse will be just a matter of time, as will be the launch of MMT under president AOC/Warren in 2024 and the end of the US Dollar as a reserve currency.

https://ift.tt/2m2c7l8

from ZeroHedge News https://ift.tt/2m2c7l8

via IFTTT

0 comments

Post a Comment