Futures Jump As Markets Downplay Risk Of US-China Trade War Escalation

Unlike last week, when every day was marked by either full-on trade deal euphoria or, as was the case on Friday afternoon, despair amid speculation of trade war escalation, overnight markets were relatively muted and fluctuated in Europe while US equity futures jumped as the lack of explicitly negative trade war news was interpreted as good news. Indeed, investors generally shrugged off reports that Washington is considering delisting Chinese companies from U.S. stock exchanges, with traders downplaying the likelihood of such radical escalation of the U.S.-China trade war.

Bloomberg reported that President Trump was looking at a broader effort to limit U.S. investment in Chinese companies, although Treasury officials denied that this was being considered "at this time", and it remained unclear how any such delisiting would work. As a result, MSCI’s world equity index, was little changed, down 0.1%. MSCI’s broadest index of Asia-Pacific shares outside Japan also slipped just 0.1%. Some optimism crept into European markets with the Stoxx 600 turning positive, ekeing out a 0.1% gain after opening lower. Markets in Frankfurt, Paris and London were flat.

In the US, futures on all main indexes pointed to a green open, and the dollar spiked higher after the U.S. issued a partial denial that it was discussing new limits on Chinese access to American finance. The concern around the latest Sino-U.S. tensions had caused U.S. stocks to fall on Friday, with the Nasdaq losing 1%. The news also knocked Chinese shares listed on U.S. exchanges on Friday. Alibaba Group and JD.com both lost 5% to 6% on Friday.

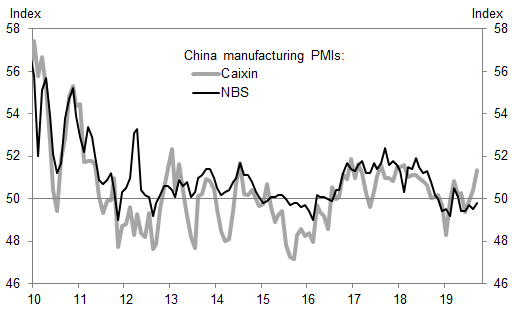

Earlier in the session, Chinese equities slumped almost 1% in the final session before a week-long holiday even though both the official and Caixin manufacturing PMIs beat expectations: the NBS manufacturing PMI increased to 49.8 in September and the Caixin manufacturing PMI rose to 51.4. Financial markets and offices in Taipei closed Monday due to the approach of Typhoon Mitag.

“This is better than what the market was expecting,” said Alessia Berardi, senior economist at Amundi Pioneer, adding that markets were downplaying the likelihood of a major escalation in the trade war by Washington. “The probability of implementing the (delisting) decision for the market is still quite low,” she said.

Overall Asian stocks dropped for a second day, led by utility and health care firms, as Washington’s potential move to restrict U.S. fund flows to Chinese firms dented risk sentiment. Most markets in the region were down, with Japan leading declines and South Korea advancing. The Topix fell 1%, with automakers and pharmaceutical firms among the biggest drags, as Japan’s factory production dropped in August amid a global slowdown. The Shanghai Composite Index retreated 0.9%, driven by Kweichow Moutai and Ping An Insurance Group. Chinese markets will trade only on Monday before a week-long holiday that marks the 70th anniversary of the founding of the People’s Republic of China.

China pledged to continue opening up its financial markets and encourage foreign investment ahead of trade talks with the U.S. India’s Sensex declined 0.5%, as ICICI Bank and Housing Development Finance weighed on the gauge. Indiabulls Housing Finance plunged as much as 38% after the Indian central bank placed curbs on a lender it plans to acquire.

China warned on Monday of instability in international markets from any “decoupling” of China and the United States following the reports, noting a U.S. Treasury response that said there were no immediate plans to block Chinese listings.

Most traders said equity markets thought the threat of delisting was just a tactic before U.S.-China trade talks resume next week. Investors are accustomed to belligerence from Trump before he dials down his rhetoric, said Luca Paolini, chief strategist at Pictet Asset Management.

“It’s a strategy that we have seen in the past - keeping the pressure very high and then settling for whatever deal is possible,” he said. Any progress in talks next month would probably fall short of a comprehensive deal, he added. “It’s more likely than not that there will some kind of agreement that would be more cosmetic in nature.”

Separately, Hong Kong protesters clashed with police for a 17th week with further protests planned for China’s 70th anniversary of Communist rule on Tuesday 1st October. Furthermore, Hong Kong police confirmed an officer fired a live round Sunday near Wan Chai MTR station, according to CNN International Correspondent Will Ripley. Subsequently, China Global Times says Police have received information about Hong Kong protest activity on 1 October creating a highly dangerous situation.

In rates, Treasuries were slightly cheaper across the curve, following wider losses across bunds after ECB President Draghi urged greater public spending in a Financial Times interview; Treasuries were choppy in Asia session while yields edged higher in poor volumes after solid China Caixin PMI print. Bond markets captured the early focus as 10y bund and USTs yields rise 3bp with 10y Aussie yields climbing 8bp to 1.02% ahead of the local session close with no fresh news flow cited for the move. Overall, yield curves bear steepened with the German long-end rising ~3.5bps. Core European bond futures remain around session lows after mixed CPIs readings from the German regions and softer peripheral European data although spreads tighten to core. Gilts and short sterling brush off domestic 2Q GDP data.

In geopolitics, Saudi Crown Prince Mohammed Bin Salman said the attacks on the Saudi oil facilities were an act of war by Iran, hopes military response will not be necessary as a political solution is "much better". MBS also called on US President Trump to meet with Iranian President Rouhani to craft a new deal. Iranian Government Spokesman notes that they are prepared for a dialogue with Saudi Arabia if they alter their behavior and stop a war in Yemen; follows news of Iranian President Rouhani receiving a letter from Saudi Arabia.

In FX, the Kiwi was the stark underperformer, tumbling to its weakest level in four years Monday following dismal overnight confidence data, while GBPUSD edged back above 1.2300. The Bloomberg Dollar Spot Index was set to end this quarter stronger than all of its G-10 peers, with the Japanese yen seeing the smallest declines and the New Zealand dollar the largest.

In commodities, crude futures drift lower, Iron ore and nickel lead gains in the metals complex while Palladium rises above a record $1,700 an ounce

Expected data include MNI Chicago Business Barometer. Thor Industries is reporting earnings.

Market Snapshot

- S&P 500 futures up 0.4% to 2,974.25

- STOXX Europe 600 up 0.01% to 391.81

- MXAP down 0.4% to 156.37

- MXAPJ down 0.1% to 501.35

- Nikkei down 0.6% to 21,755.84

- Topix down 1% to 1,587.80

- Hang Seng Index up 0.5% to 26,092.27

- Shanghai Composite down 0.9% to 2,905.19

- Sensex down 0.8% to 38,529.84

- Australia S&P/ASX 200 down 0.4% to 6,688.35

- Kospi up 0.6% to 2,063.05

- German 10Y yield rose 1.7 bps to -0.556%

- Euro down 0.05% to $1.0934

- Italian 10Y yield unchanged at 0.486%

- Spanish 10Y yield rose 1.3 bps to 0.163%

- Brent futures down 1.6% to $60.94/bbl

- Gold spot down 0.6% to $1,487.53

- U.S. Dollar Index up 0.1% to 99.21

Top Overnight News from Bloomberg

- The Trump administration has issued a partial -- and qualified - - denial to the revelation that it is discussing imposing limits on U.S. investments in Chinese companies and financial markets as China vowed to continue opening its markets to foreign investment

- Johnson hoped to use his Conservative Party’s annual convention to launch his campaign to win the next British general election. Instead, he is fighting for his credibility as prime minister as he faces allegations of sexual impropriety and plots to oust him. To add to that the opposition Labour Party has demanded an investigation into alleged potential conflicts of interest

- The U.K. economy experienced major distortions in the second quarter after firms stockpiled goods in the run-up to the original March 29 Brexit deadline, figures published Monday show. The Office for National Statistics confirmed the economy shrank 0.2% between April and June. It was the first quarterly contraction for seven years

- British businesses are getting increasingly gloomy about the economy as Brexit approaches, according to the Lloyds Business Barometer. A measure of optimism in September fell to its lowest since the immediate aftermath of the 2016 referendum, and concerns about Brexit intensified. A negative impact from Brexit is expected by 43% of businesses now, up from 39%

- Germany’s labor market unexpectedly improved this month, easing concerns that the economy is sliding into recession. The number of people out of work decreased by 10,000 to 2.276 million in September, the first drop in five months. The unemployment rate was at 5%, near a record low.

Asian equities showed a mixed performance after a negative lead from Wall Street in which major bourses fell deeper into the red amid reports which suggested that the White House is mulling limits on portfolio flows into China, albeit a US Treasury official later noted that there are no current plans regarding market access. ASX 200 (-0.4%) turned green as Nufarm shares rose in excess of 25% after the Co. reported an increase in revenue alongside the sale of its South American unit to Sumitomo. Meanwhile, Nikkei 225 (-0.6%) was subdued throughout the session as heavyweight Softbank fell over 2% amid the ongoing concerns surrounding WeWork after CEO Neumann left his position following the failed IPO. Elsewhere, Hang Seng (+0.5%) nursed the initial losses which emanated from continuing disarray in Hong Kong as protesters clash with police for yet another week, with further protests planned for China’s 70th anniversary of Communist rule tomorrow. Losses in Hong Kong later pared amid gains in large-cap energy names and as AB InBev’s Budweiser APAC soared over 5% at its debut today, which was seen as a litmus test for the IPO environment in Hong Kong. Meanwhile, Shanghai Comp (-0.9%) received a short-lived boost after the Chinese Caixin Manufacturing metric beat (see below from RANsquawk analysis). Furthermore, the PBoC skipped open market operations today which resulted in a modest net daily drain of CNY 20bln ahead of the Mainland’s absence for the remainder of the week due to the National Week Holiday.

Top Asian News

- China Factory Outlook Improves in September Ahead of U.S. Talks

- BOJ Paves Way to Buy Fewer Bonds in October to Steepen Curve

- Japan Nuclear Scandal Deepens as Payoff Timelines Widen

- ‘Frightening’ Thai Baht Surge Hurts Tourism, Industry Body Says

Major European bourses (Euro Stoxx 50 +0.3%) are mostly higher, but consolidating within recent ranges ahead of this week’s slate of important macroeconomic data releases, following a mixed AsiaPac session, in which sentiment was initially downbeat on recent negative US/China trade reports that the US was mulling China portfolio flows limits and the delisting of Chinese stocks from US exchanges; although there are no current plans to do so according to a Treasury Official. The sectors are mixed and unreflective of any definitive risk tone. In terms of individual movers; GlaxoSmithKline (+1.0%) are up on the news that the Co’s Phase 3 PRIMA trial for Zejula is the first study which illustrated a significant benefit, which, according to GSK, justifies the earlier acquisition of Tesaro for approximately USD 4.1bln. Saint Gobain (+2.4%) caught a bid on reports that the Co. announced the sale of their construction glass business in Korea. Separately, Ab InBev (-0.2%) are lower, despite the co’s APAC Budweiser unit opening at HKD 27.40/shr, which is above the initial IPO price of HKD 27.0/shr, before extending gains to over 28.0/shr. Elsewhere, BBVA (+1.0%) is higher on the news that the bank may sell EUR 5bln of bad loans to Deutsche Bank (+0.4%). Finally, Whitbread (-5.1%) is under pressure after being downgraded at Barclays.

Top European News

- Funcom Surges as Gaming Giant Tencent Purchases 29% Stake

- KPN Drops After It Cancels Hiring of Proximus’s Leroy as CEO

- Microsoft’s Largest Reseller SoftwareONE Plans Swiss IPO

- Lagarde Inherits ECB Tinged by Bitterness of Draghi Stimulus

In FX, NZD/GBP - Contrasting fortunes for the Kiwi and Pound at the start of the final session of September and Q3, as the former props up the G10 table in wake of a downbeat NBNZ business survey, but the latter shrugs off broadly soft UK data and outperforms in corrective trade following recent weakness. Nzd/Usd is hovering near the base of a 0.6303-0.6250 range, while Cable reclaims 1.2300+ status and Sterling also recoups losses vs the Euro after a test of resistance at 0.8900, but no clean break and a subsequent cross reversal down towards 0.8865. However, the Gbp is on tenterhooks awaiting further political developments and latest moves by opposition party Remainers to request another Brextension rather than risk a no deal departure on October 31.

- NOK/SEK - Marginal divergence between the Scandi Crowns as in line Norwegian retail sales keeps Eur/Nok rooted towards the bottom of 9.9450-9.9180 parameters in contrast to Eur/Sek that is nudging 10.7350 compared to lows of around 10.7060 following recent disappointing Swedish consumption and consumer sentiment reads.

- JPY/CAD/EUR/AUD/CHF - All weaker against a generally firm Greenback, as the DXY holds above 99.000 in a relatively narrow 99.047-216 range, with the Yen paring gains between 107.75-108.00 and flanked by decent option expiries at 107.50 (1.5 bn) and 108.00-05 (1.2 bn), while the Loonie meanders from 1.3225-47 ahead of Canadian PPI data. Elsewhere, the single currency has faded into 1.0950 amidst soft Eurozone inflation updates from Germany’s states and Spain, but Eur/Usd may derive underlying support from a hefty expiry at the 1.0900 strike (2.3 bn) and the fact that the big figure fended off several attempts to the downside last week. Similarly, the Aussie is keeping afloat around 0.6750 and within 1.0740-1.0800 extremes vs its Antipodean rival on the back of a better than expected Caixin Chinese manufacturing PMI and with the jury out on tomorrow’s RBA policy verdict (full preview available in the Research Suite), but the Franc is lagging across the board after a marked decline in the Swiss KOF indicator and downward revision to the previous print. Usd/Chf currently just shy of 0.9950 and Eur/Chf is straddling 1.0850 with latest weekly sight deposits suggesting more intervention.

- EM - Bucking the broad trend of losses vs the Dollar, Turkey’s Lira has climbed over 5.6500 after trade data showing a smaller deficit and typically upbeat comments/forecasts from the Finance Minister, bar a sharp downgrade to 2019 GDP.

In commodities, crude futures are lower, but well within recent ranges, as the market mostly shrugs off recent news flow; Russian oil output for the month of September is lower than in August, according to sources, at 11.24mln BDP (vs 11.29mln BDP). Additionally, following last Friday’s reports of Saudi Arabia agreeing to a partial ceasefire in Yemen, the Iran backed Yemeni Houthis reportedly offered to release 350 prisoners, 3 of whom are Saudis. Separately, an Iranian Government Spokesman said that they are prepared for a dialogue with Saudi Arabia if they alter their behaviour and stop the war in Yemen, following reports that Iranian President Rouhani had received a letter from Saudi Arabia. Spot Gold is lower, in line with the modestly better risk tone, and is back below the USD 1500/oz mark, an area which has been a solid base since mid-August. Separately, Copper prices are higher, after Chinese Caixin Manufacturing surprised to the upside, easing demand concerns in the red metals biggest market, although some of the forward-looking sub-components were more disappointing

US Event Calendar

- 9:45am: MNI Chicago PMI, est. 50, prior 50.4

- 10:30am: Dallas Fed Manf. Activity, est. 1, prior 2.7

DB's Jim Reid concludes the overnight wrap

A happy wet Monday to you all. Last week we briefly mentioned how the Opposition party here in the U.K. outlined plans for a 4-day work week within a decade. To be honest after the weekend I’ve had ferrying children to parties and having to endure rolling crying tantrums between them, at the moment I would happily vote for a party who suggested a 7-day working week.

The first day of this working week, and the last of Q3, sees us go straight to Asia where Chinese markets have only today (due to holidays for the rest of the week) to digest Friday’s news that the US are considering limiting portfolio flows into China and their companies. The Bloomberg story suggested the options Mr Trump’s team are considering include delisting Chinese companies on US exchanges, limiting US government pension fund exposure to China and even limiting private US investment firm’s access. On Friday the US shares of Alibaba lost -5.2%, JD.com fell c.6% and Baidu down -3.7%. So a big story but the article didn’t suggest that the debate is particularly advanced so a difficult one to price at the moment. If you took it to it’s most negative you’d have to point out the amount of US Treasuries that China hold and the impact that any retaliation might have. A fair amount of water will need to flow under the bridge before we get there though.

Maybe conscious of the impact on the Asian open and follow through to the rest of global markets, a US Treasury spokesman made an emailed statement on Saturday that read that “The administration is not contemplating blocking Chinese companies from listing shares on US stock exchanges at this time”.

This statement has probably calmed the Asian session with bourses trading a lot better than feared on Friday night. The Nikkei (-0.55%) and Shanghai Comp (-0.40%) are still lower but the Hang Seng (+0.52%) and Kospi (+0.38) are up. Elsewhere futures on the S&P 500 are up +0.37% and 10y JGB yields are up +1.8bps to -0.230%.

Overnight, we’ve seen China’s official September PMIs with manufacturing PMI coming in at 49.8 (vs. 49.6 expected), marking the fifth continuous month of contraction while the services PMI came in at 53.7 (vs. 53.9 expected) bringing the composite PMI to 53.1 (vs. 53.0 last month). In terms of underlying details, the new orders component of the manufacturing reading printed at 50.5 (vs. 49.7 last month), marking the first above 50 reading since April while the new export orders component also improved to 48.2 from 47.2 last month. Separately, China’s September Caixin manufacturing PMI stood at 51.4 (vs. 50.2 expected), the highest reading since February 2018. In terms of other overnight data releases, Japan’s August retail sales came in at +2.0% yoy (vs. +0.7% yoy expected) and the preliminary August industrial production stood at -1.2% mom (vs. -0.5% mom expected).

Elsewhere the FT has an an exclusive interview with Mr Draghi this morning as he nears the end of his tenure. The key section is a direct quote where he says that “I (have) talked about fiscal policy as a necessary complement to monetary policy since 2014. Now the need is more urgent than before. Monetary policy will continue to do its job but the negative side effects as you move forward are more and more visible.” He then added, “Have we done enough? Yes, we have done enough — and we can do more. But more to the point what is missing? The answer is fiscal policy, that’s the big difference between Europe and the US.” He also said a long term commitment to a fiscal union was essential for Europe to compete.

Talking of fiscal, new Italian Finance Minister Roberto Gualtieri said that the government will use “all the flexibility available” with the country’s finances and plans “a slight expansion in order to reconcile the balance of public finances and the credibility of our commitment to cut debt,” while adding that any tightening “would have a negative effect on the economy.” On the deficit target, Gualtieri hinted that the number for 2020 would be between this year’s original goal of 2.4% and the revised target of 2.04%. Elsewhere, Ansa reported that the cabinet will present a framework for the budget after a meeting scheduled at 6:30 pm local time today. The deadline for submitting the draft budget to Brussels is October 15. So one to watch.

Market action on Friday was dominated by the US-China capital controls story. The negative impact of that news offset the earlier, positive impact of optimistic comments from President Trump and other officials on the scope for a near-term trade deal. The S&P 500 ultimately closed -1.01% lower on the week (-0.52% on Friday), while the DOW fell only -0.43% (-0.26% Friday) and the NASDAQ dropped -2.19% (-1.13% Friday). The former outperformed due to its greater exposure to bank stocks, which ended +0.26% higher on the week (+1.03% Friday), while the latter was dragged down by its exposure to China trade. Despite the seesawing moves, the VIX only rose +1.9pts on the week (+1.2pts Friday) to 17.3.

In Europe, the STOXX 600 fell a more modest -0.30% (+0.47% Friday), though it had already closed before the selloff in the US session. Bonds rallied across Europe, with the biggest driver being the poor PMI data last Monday which showed the German manufacturing sector reading falling to 41.4, its worst reading in around a decade. Bund yields fell -5.2bps (+0.9bps Friday), while OATs and BTPs rallied -5.9bps (+0.7bps Friday) and -9.8bps (flat on Friday), respectively. The five year-five year inflation swap rate fell below its pre-ECB level at 1.18%, down -6.7bps on the week (-1.2bps Friday) and is now just 5bps away from its all-time low just after Draghi’s Sintra speech in June. In the US, the curve steepened slightly as the front-end rallied more than the long-end, with 2- and 10-year yields down -5.4bps and -4.3bps (-2.6bps and -1.4bps Friday) respectively.

There’s plenty to look forward to this week with the rest of the global PMIs/ISM (manufacturing tomorrow, services Thursday) pretty important before US payrolls at the end of the week. The flash numbers showed a worrying deterioration in services in Europe after months of holding up well in the face of big declines in manufacturing so the final reading will help show more about this trend. Tomorrow sees China celebrate the 70th anniversary of the People’s Republic of China, which will see financial markets closed until October 7. The start of the event will also see a major speech from President Xi Jinping. It’ll be interesting to hear the tone and the substance. In the UK, the Conservative Party Conference is currently taking place until Wednesday, with PM Johnson giving his first conference speech as party leader on the final day unless it’s brought forward by events overtaking them in Parliament. On Friday the government suggested they would outline firm legal proposals for a Brexit deal in days after the conference. So we could know more about that by the end of the week. The PM may also face a vote of no confidence this week if press stories are to be believed. So a busy week in U.K. politics awaits.

Finally it’s a busy week for Fed-speak with all but three of the seventeen principals speaking, including all five Governors and nine of twelve regional Fed Presidents. For more on these see DB’s Brett Ryan’s preview of the US week ahead here.

https://ift.tt/2n39ct2

from ZeroHedge News https://ift.tt/2n39ct2

via IFTTT

0 comments

Post a Comment