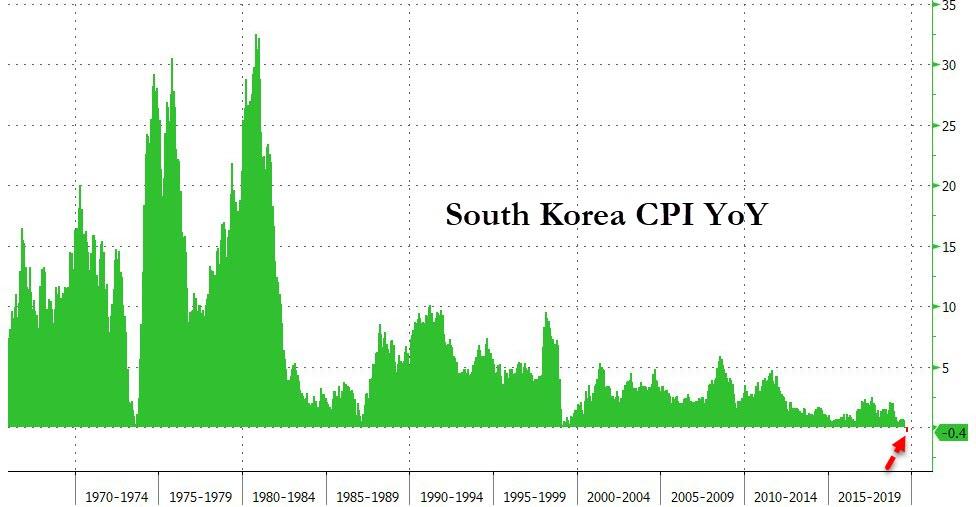

South Korean Consumer Prices Just Did Something They've Never Done Before

Underscoring the hit to domestic demand, as the economy grapples with collapsing exports, for the first time ever (data back to 1966), South Korean consumer prices "fell" year-over-year in September.

The benchmark consumer-price index fell 0.4% in September from a year earlier after being flat in August - already the slowest pace on record in the country. The latest reading missed the median market forecast of a 0.3% decrease.

Source: Bloomberg

Zooming in makes it even clearer that 2019's sudden shift to global easing has not helped... at all!

Source: Bloomberg

Negative inflation is likely to add fuel to a growing debate over whether the risk of deflation is imminent in South Korea and what policy action needs to be taken, which is ironic since BOK Governor Lee last week dismissed concerns of deflation as “excessive.”

Obviously, subdued inflation - alongside declining exports amid continued global trade tensions - has been stoking concerns about a possible recession, adding pressure on the central bank to ease policy further to support growth.

The Bank of Korea in July cut interest rates for the first time in three years, lowering its 2019 growth and inflation forecasts to 2.2% and 0.7%, respectively, from its earlier estimates of 2.5% and 1.1%.

Trade data also notably disappointed tonight with both exports and imports tumbling more than expected...

Source: Bloomberg

The Finance Ministry was quick to dampen any concerns that this price deflation is actually deflation by issuing a statement that confirmed "South Korea is not facing deflation," stealing a page from The Fed's playbook by claiming that the dip in inflation is "temporary," pointing out through their crystal ball that CPI "will likely rise above 1% after next year."

https://ift.tt/2oES2ST

from ZeroHedge News https://ift.tt/2oES2ST

via IFTTT

0 comments

Post a Comment