Key Events This Week: Data Deluge And Fed Speaker Avalanche

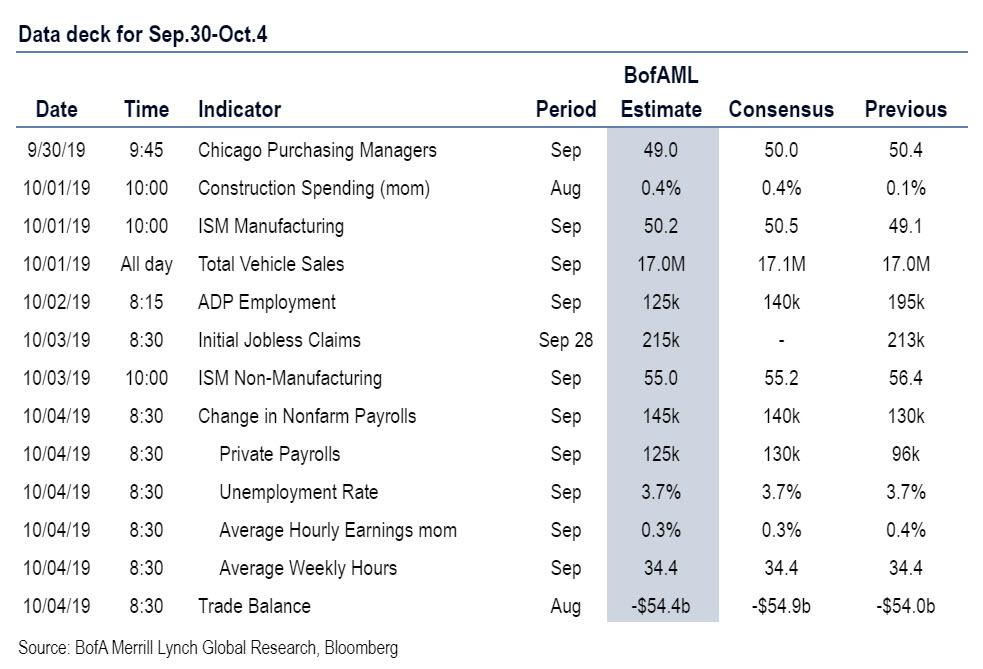

This week’s data docket is packed with important economic releases that according to DB's Brett Ryan will shape investors’ views ahead of the October 30 FOMC meeting—particularly, Friday’s employment report, Tuesday's manufacturing and Thursday's Non-mfg ISMs. Adding to the noise will be almost a dozen Fed speakers, as well as continued political posturing over the US-China trade war, not to mention Trump's impeachment process.

The flash PMI/ISM numbers showed a worrying deterioration in services in Europe after months of holding up well in the face of big declines in manufacturing so the final reading will help show more about this trend. Tomorrow sees China celebrate the 70th anniversary of the People’s Republic of China, which will see financial markets closed until October 7. The start of the event will also see a major speech from President Xi Jinping. It’ll be interesting to hear the tone and the substance. In the UK, the Conservative Party Conference is currently taking place until Wednesday, with PM Johnson giving his first conference speech as party leader on the final day unless it’s brought forward by events overtaking them in Parliament. On Friday the government suggested they would outline firm legal proposals for a Brexit deal in days after the conference. So we could know more about that by the end of the week. The PM may also face a vote of no confidence this week if press stories are to be believed. So a busy week in U.K. politics awaits.

Back to US economics, where according to Deutsche Bank, the headline nonfarm payrolls (+125k forecast vs. 130k previously) could again be boosted by Census workers, which is why it will be critical for market participants to focus on private payrolls (+100k vs. +96k). A payroll print in line with the bank's forecast should have the effect of raising the unemployment rate a tenth to 3.8%. Note that similar to August, the consensus forecast for private payrolls has missed the initial print in four out of the last five Septembers by an average of 44k. The median miss during this period has been an even larger 64k. Indeed, if payrolls miss again, the Fed’s characterization of the labor market as “strong” could be questioned.

There are several important data releases ahead of the September employment report that will also impact the Fed's near-term outlook for the manufacturing sector—a key area of concern Chair Powell highlighted in his post-meeting press conference. Monday's Chicago PMI (49.0 vs. 50.4) is expected to remain depressed amidst ongoing trade uncertainty. Recall that the regional surveys this month have generally softened—the Philadelphia Fed survey slipped 4.8 points to 12, the New York Fed Empire survey fell 2.8 points to 2.0, and the Richmond Fed survey plunged 10 points to -9. All three of these surveys were notably below their 3-month averages.

While Tuesday’s manufacturing ISM (50.8 vs. 49.1) to edge up slightly, the decidedly disappointing PMI figures out of Europe last week provide Fed officials little reason to be optimistic with respect to the global manufacturing outlook. Ongoing weakness in business sentiment and expenditures will continue to spill over into consumer sentiment and spending, the engine of the economy. Given the weakness in August personal consumption expenditures, pay close attention to Tuesday’s September unit motor vehicle sales (16.8 million vs. 17.0 million). A more pronounced drop off in auto sales may presage a more concerning pull back in consumer activity.

Tuesday's August construction (+1.3% vs. +0.1%) figures should point to a rebound in residential investment. According to DB, residential investment should be a relative bright spot in the near term. A positive contribution to growth from housing will be an important reversal of the recent drag on output over the last several quarters and should help put a floor under growth momentum during a period when capex is lagging.

Wednesday’s ADP employment survey (+100k vs. +195k) and Thursday’s nonmanufacturing ISM (54.1 vs. 56.4) will anchor expectations going into Friday’s employment report. Regarding the former, it is worth noting that the initial September ADP survey has overestimated the initial BLS private payrolls print in each of the past two years, and by a wide margin—109k last year and 175k in 2017. With respect to the non-manufacturing ISM, traders will focus closely on the employment component, which last month fell to 53.1, the lowest level since March 2017 (52.1). While this series does not tell us much about the monthly changes in employment, it has historically been a leading indicator of the overall trend in service-sector job growth. Further deterioration would send a more concerning signal to monetary policymakers about the labor market outlook.

While there are no scheduled Fed events today, the same cannot be said for the rest of the week where all but three of the seventeen principals will be speaking, including all five Governors and nine of twelve regional Fed Presidents. Given that Chair Powell will only be making introductory remarks at Friday’s Fed Listens event, focus will be on Vice Chair Clarida’s (neutral) Thursday discussion of the economy and monetary policy. Clarida is likely one of the seven participants that forecasted further cuts in the Fed's September dot plot given his previous focus on low neutral rates both domestically and internationally. His appearance will also feature an audience Q&A, providing an opportunity for the Vice Chair to weigh in on the latest data developments.

With respect to the remaining deluge of Fedspeak, pundits will look for clues as to what particular data policymakers are focused on and where they may lean with respect to further easing. From this perspective, New York Fed President Williams’ (neutral) moderated discussion on Wednesday, Cleveland Fed President Mester’s (hawk/ nonvoter) panel discussion on inflation with former Chair Bernanke on Thursday, and Atlanta Fed President Bostic’s (dove/nonvoter) moderated discussion at a business forum on Friday are the most likely to be informative in this regard.

Several other officials speaking this week have already identified their near-term position on rates in previous comments, namely Chicago’s Evans (dove/voter) appearing at central banking conferences on Tuesday and Thursday, Philadelphia’s Harker (neutral/nonvoter) appearing at a community banking conference on Wednesday, and Dallas’s Kaplan (dove/nonvoter) speaking at a community forum on Thursday. Though we expect little new from her, Kansas City Fed President George (hawk/voter) may provide some additional color on her dissent from the September rate cut in her speech at a conference of business economists on Sunday, October 6. Governor Bowman's (neutral) and Vice Chair Clarida's appearances on Tuesday, Richmond Fed President Barkin's (hawk/nonvoter) on Wednesday, Governor Quarles's (neutral) on Thursday, and Boston Fed President Rosengren's (hawk/voter) on Friday are not expected to yield much new information regarding monetary policy given their respective venues.

In summary, as DB notes, market participants will have much to digest as they gauge how much more monetary stimulus the Fed may need to deliver in the coming months. In our view, mounting downside risks from slowing global growth, depressed business sentiment, trade policy and other geopolitical uncertainties argue for more Fed easing than the policymakers projected in the September dot plot, where even the most dovish participants expected only one more rate cut over the forecast horizon. Indeed, even if some of these downside risks recede, there is still the potential for the Fed to adopt so-called inflation "make-up" strategies at some point next year, whereby they run the economy hot to make up for previous inflation shortfalls. Thus, the bulk of the evidence points towards the Fed having to do more, rather than less easing over the next few quarters.

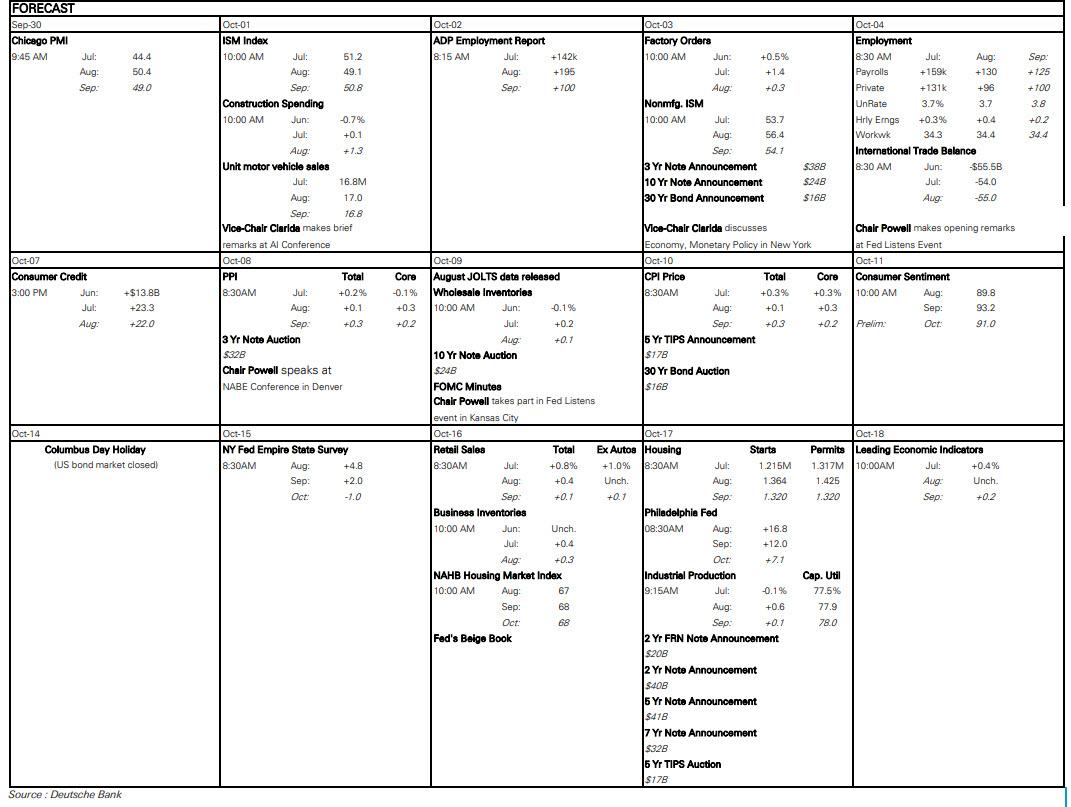

Courtesy of Deutsche Bank, here is a day-by-day calendar of coming events:

Monday

- Data: Germany September unemployment change, preliminary September CPI; Italy August preliminary unemployment rate, preliminary September CPI; UK final Q2 GDP, August consumer credit, mortgage approvals; Euro Area August unemployment rate; US September MNI Chicago PMI, Dallas Fed Manufacturing Activity.

- Central Banks: Bank of Japan's Summary of Opinions released.

Tuesday

- Data: South Korea September CPI; Japan August jobless rate, September vehicle sales; September manufacturing PMIs for Australia, South Korea, Indonesia, Japan, India, Russia, Turkey, Italy, France, Germany, Euro Area, UK, South Africa, Brazil, Canada, US and Mexico; Euro Area September CPI estimate; advance September core CPI; US September ISM manufacturing, August construction spending.

- Central Banks: Reserve Bank of Australia policy decision; remarks from ECB's Lane and Weidmann, Fed's Evans, Clarida and Bowman.

- Politics: Speech from President Xi Jinping on 70th anniversary of the People's Republic of China.

Wednesday

- Data: Japan September monetary base; UK September construction PMI; US weekly MBA mortgage applications; US September ADP employment change.

- Central Banks: Remarks from Fed's Barkin, Harker and Williams.

Thursday

- Data: September services and composite PMIs for Australia, Japan, Russia, Italy, France, Germany, Euro Area, UK, Brazil and US; Euro area August PPI, retail sales; US weekly initial jobless claims, August factory orders; September ISM non-manufacturing index; final August durable goods orders.

- Central Banks: Remarks from BoJ's Funo, Fed's Evans, Quarles, Mester, Kaplan, Clarida, ECB's de Guindos, Rehn, BoE's Tenreyro.

Friday

- Data: September Germany construction PMI; US September nonfarm payrolls, unemployment rate, average hourly earnings, labour force participation rate, August trade balance.

- Central Banks: Reserve Bank of India policy decision; remarks from Fed's Rosengren, Bostic, Powell.

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing report on Tuesday, the ISM non-manufacturing report on Thursday, and the employment report on Friday. There are several scheduled speaking engagements from Fed officials this week, including New York Fed President Williams on Wednesday, Vice Chair Clarida on Thursday, and Chair Powell on Friday.

Monday, September 30

- 09:45 AM Chicago PMI, September (GS 49.0, consensus 50.0, last 50.4); We estimate that the Chicago PMI declined by 1.4pt to 49.0 in September, following a 6.0pt increase in August. Some industrial commentary from the region indicates that their business outlook has dimmed somewhat in recent months.

- 10:30 AM Dallas Fed manufacturing index, September (consensus +1.0, last +2.7)

Tuesday, October 1

- 03:15 AM Chicago Fed President Charles Evans (FOMC voter) speaks; Chicago Fed President Charles Evans will speak at a monetary policy conference hosted by the Bundesbank. Prepared text and audience and media Q&A are expected.

- 08:15 AM Fed Vice Chair Clarida (FOMC voter) speaks; Fed Vice Chair Richard Clarida will give introductory remarks at a conference on machine learning in Washington. Prepared text is expected.

- 09:30 AM Fed Governor Bowman (FOMC voter) speaks; Fed Governor Michelle Bowman will speak at the annual St. Louis Fed community banking conference.

- 09:45 AM Markit US manufacturing PMI, September final (consensus 51.0, last 51.0)

- 10:00 AM ISM manufacturing index, September (GS 49.1, consensus 50.1, last 49.1); Our manufacturing survey tracker declined by 0.7pt to 50.8 in September, following slightly softer regional manufacturing surveys on net. After five straight declines, we expect the ISM manufacturing index to remain unchanged at 49.1 in September.

- 10:00 AM Construction spending, August (GS +0.4%, consensus +0.4%, last +0.1%); We estimate a 0.4% increase in construction spending in August, with scope for a rebound in private nonresidential construction and further modest gains in private residential as well as public construction.

- 5:00 PM Lightweight Motor Vehicle Sales, September (GS 16.9m, consensus 17.0m, last 17.0m)

Wednesday, October 2

- 08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will make opening remarks at a conference on investing in rural America hosted by the Richmond Fed in Harrisonburg, Virginia.

- 08:15 AM ADP employment report, September (GS +155k, consensus +140k, last +195k); We expect a 155k gain in ADP payroll employment, reflecting low jobless claims and higher oil prices which should somewhat offset the impact of a decline in the summer job growth trend. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 09:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks; Philadelphia Fed President Patrick Harker will speak at the annual St. Louis Fed community banking conference. Prepared text and audience Q&A are expected.

- 10:50 AM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will take part in a moderated discussion at the University of California, San Diego.

Thursday, October 3

- 02:45 AM Chicago Fed President Charles Evans (FOMC voter) speaks; Chicago Fed President Charles Evans will speak at a central banking conference in Madrid. Audience and media Q&A are expected.

- 08:30 AM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks; Fed Vice Chair for Supervision Randal Quarles will discuss the Financial Stability Board at a conference in Brussels. Prepared text and audience Q&A are expected.

- 08:30 AM Initial jobless claims, week ended September 28 (GS 210k, consensus 215k, last 213k); Continuing jobless claims, week ended September 21 (consensus 1,654k, last 1,650k): We estimate jobless claims decreased 3k to 210k in the week ended September 28, following a 3k increase in the prior week.

- 09:45 AM Markit US services PMI, September final (consensus 50.9, last 50.9)

- 10:00 AM Factory Orders, August (GS flat, consensus -0.4%, last +1.4%); Durable goods orders, August final (last +0.2%); Durable goods orders ex-transportation, August final (last +0.5%); Core capital goods orders, August final (last -0.2%); Core capital goods shipments, August final (last +0.4%): We estimate factory orders were flat in August following a 1.4% increase in July. Durable goods orders moved up in the August advance report.

- 10:00 AM ISM non-manufacturing index, September (GS 55.5, consensus 55.0, last 56.4); Our non-manufacturing survey tracker declined by 0.4pt to 54.0 in September, following mixed regional service sector surveys. We expect the ISM non-manufacturing index to decline by 0.9pt to 55.5 in the September report.

- 12:10 PM Cleveland Fed President Mester (FOMC non-voter) speaks; Cleveland Fed President Loretta Mester will take part in a panel discussion on inflation with Ben Bernanke at the Brooking Institution in Washington. Audience Q&A is expected.

- 1:00 PM Dallas Fed President Robert Kaplan (FOMC non-voter) speaks; Dallas Fed President Robert Kaplan will speak at a community forum hosted at the Dallas Fed’s Houston branch. Audience and media Q&A are expected.

- 6:35 PM Fed Vice Chair Clarida (FOMC voter) speaks; Fed Vice Chair Richard Clarida will discuss the economic outlook and monetary policy at a Wall Street Journal event in New York. Audience Q&A is expected.

Friday, October 4

- 08:30 AM Nonfarm payroll employment, September (GS +165k, consensus +145k, last +130k); Private payroll employment, September (GS +150k, consensus +128k, last +96k); Average hourly earnings (mom), September (GS +0.2%, consensus +0.3%, last +0.4%); Average hourly earnings (yoy), September (GS +3.2%, consensus +3.2%, last +3.2%); Unemployment rate, September (GS 3.6%, consensus 3.7%, last 3.7%): We estimate nonfarm payrolls increased 165k in September. Our forecast reflects very low jobless claims, a further boost from Census canvassing activities (worth +15k mom sa), and the tendency for September job growth to pick up when the labor market is tight. We also note that employment surveys appear to have stabilized at a level consistent with above-potential job gains. On the negative side, we expect September first-print seasonality to reduce payroll growth in the month by 20-30k. We also note the possibility that recent tariff escalation could weigh on hiring in the manufacturing, retail, and transportation sectors. Importantly, we are not assuming a meaningful drag from Hurricane Dorian, which had moved north into Canada by the beginning of the payroll survey week. We estimate a one tenth decline in the unemployment rate to 3.6%. Continuing claims have edged lower and the jobless rate typically declines following sharp increases in labor force participation (+0.4pp to 63.2% over the last three months). Finally, we estimate average hourly earnings increased 0.2% month-over-month and 3.2% year-over-year, reflecting unfavorable calendar effects.

- 08:30 AM Trade balance, August (GS -$54.4bn, consensus -$54.5bn, last -$54.0bn); We estimate the trade deficit rose by $0.4bn in August, reflecting an increase in the goods trade deficit.

- 8:30 AM Boston Fed President Rosengren (FOMC voter) speaks; Boston Fed President Eric Rosengren will deliver opening remarks at an annual conference hosted by the Boston Fed which this year focuses on geographic disparities in 21st century America.

- 10:25 AM Atlanta Fed President Bostic (FOMC non-voter) speaks; Atlanta Fed President Raphael Bostic will take part in a moderated discussion at the Tulane Business Forum.

- 2:00 PM Fed Chair Powell (FOMC voter) speaks; Fed Chair Jerome Powell will deliver opening remarks at a Fed Listens event hosted by the Fed Board. The event will also feature Fed Vice Chair for Supervision Randal Quarles moderating a panel on the importance of price stability and low inflation, and Fed Governor Lael Brainard moderating a panel on employment in a changing labor market.

- 6:45 PM Kansas City Fed President Esther George (FOMC voter) speaks; Kansas City Fed President Esther George will speak at the annual meeting of the National Association for Business Economics in Denver. Audience Q&A is expected.

Source: Deutsche Bank, BofA, Goldman

https://ift.tt/2nUmLuK

from ZeroHedge News https://ift.tt/2nUmLuK

via IFTTT

0 comments

Post a Comment