Futures Tread Water After "Super Thursday's" Amazon Collapse As Traders Look For New Clues

One day after "Super Thursday's" barrage of central bank announcements and avalanche of corporate reports on the busiest day of Q3 earnings season, US equity futures...

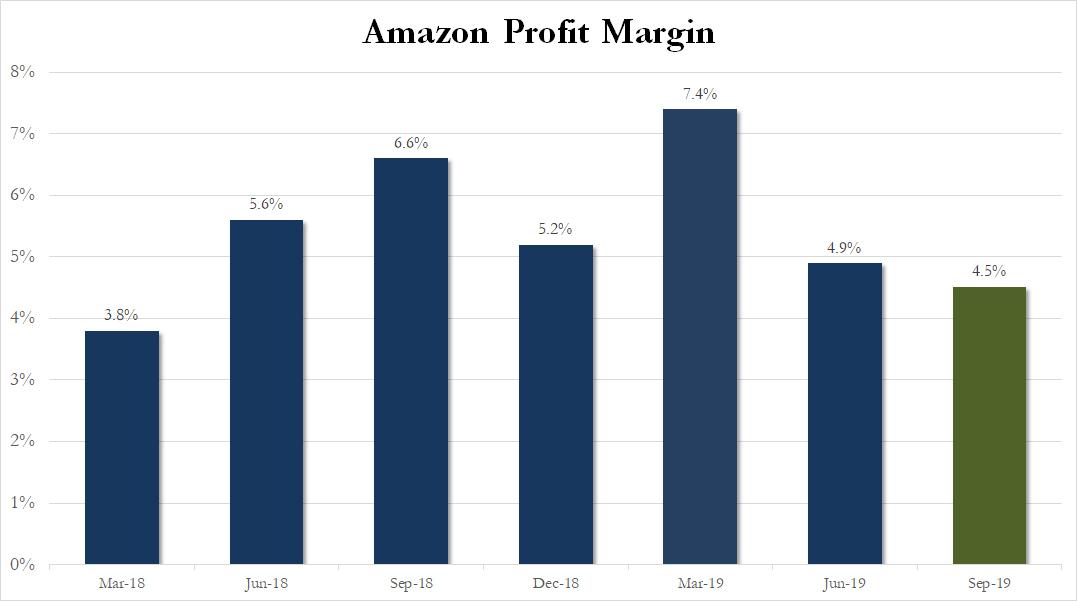

... and world stocks edged higher in a muted session despite ongoing geopolitical tensions, downbeat economic data and mixed earnings which saw Amazon tumble the most in months on poor earnings and worse guidance. The dollar slipped as European and US bonds retreated, crude prices dropped and sterling hovered just above one week lows amid a new bout of Brexit anxiety, while Nasdaq futures held firm even as Amazon shares plunged on a surprise profit warning.

U.S. futures pointed to a slightly positive open on Wall Street following a mixed Thursday, which saw strong quarterly results from Microsoft and PayPal lift the Nasdaq 0.8% while the Dow Jones Industrial Average slipped 0.1% after 3M slashed its full-year earnings outlook. But most attention will be on Amazon.com shares after the company on Thursday forecast revenue and profit for the holiday quarter below expectations on fierce competition and rising costs from its plan to speed up delivery times globally.

European stock markets trader lower with the regional Stoxx 600 slipping 0.3% and Germany's DAX easing 0.1% while Britain's FTSE .FTSE fell 0.4%, with food companies and tech stocks falling after after downbeat earnings in the U.S. including a huge miss by Amazon. Losses were led by the food and beverage sector which weighed after the world’s largest beer maker by Anheuser-Busch InBev tumbled 9% on disappointing quarterly profit and a glum outlook as the earnings season rumbled on.

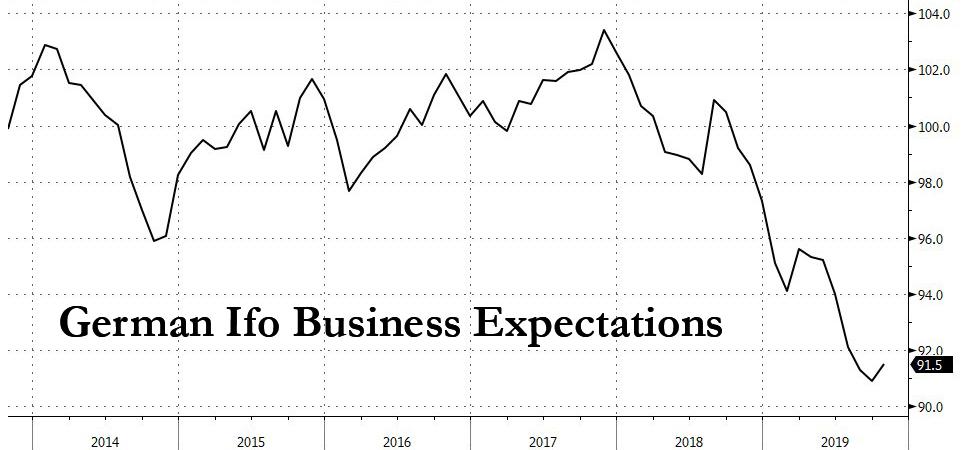

Lackluster European data did little to quell underlying concerns over the health of the global economy. Germany’s Ifo business climate came in broadly unchanged while the mood among consumers in the block’s largest economy fell to its lowest in three years heading into November...

... as job losses in the auto and financial sector made shoppers more pessimistic about the outlook for Europe’s biggest economy. Still, the euro strengthened slightly after German business expectations improved in October from a decade low, a glimmer of hope for the economy following a series of weak data points.

“We may have reached the bottom in the euro zone, but there is still uncertainty that is troublesome in the U.S. Many accounts will be waiting for the Fed,” said Natixis fixed income strategist Cyril Regnat referring to next week’s meeting of the U.S. central bank with markets pricing a 90% chance of a rate cut.

The losses in Europe followed mixed performance in Asia where Japan's Nikkei finished up 0.2% and Chinese blue-chips gained 0.6% while Hong Kong's Hang Seng fell 0.28%. Most Asian markets edged higher, led by health care firms, as investors awaited more quarterly earnings to gauge the health of the global economy; Australia advanced and India retreating as the MSCI Asia Pacific Index headed for a third straight week of gains. The Topix added 0.3%, as Eisai surged for a third day on hopes that its Alzheimer’s drug will get approval, while Daiichi Sankyo also provided strong support. Japan’s recent equity rebound is dividing Wall Street views on where it will go next. The Shanghai Composite Index closed 0.5% higher after reversing earlier losses, with Kweichow Moutai and Jiangsu Hengrui Medicine among the biggest boosts. U.S. Vice President Mike Pence criticized China’s actions against protesters in Hong Kong while calling for greater trade engagement. India’s Sensex dropped 0.3%, heading for a second day of declines, as Housing Development Finance and HDFC Bank weighed on the gauge.

And just to keep things interesting, trade talks are also back in focus with U.S. and Chinese trade officials due to discuss plans for China to buy more U.S. farm products while Beijing in return will request cancellation of some planned and existing U.S. tariffs on Chinese imports. The two sides are working to try to agree on a text for a “Phase 1” trade agreement announced by U.S. President Donald Trump on Oct. 11, in time for him to sign it with China’s President Xi Jinping next month at a summit in Chile. Though there are still large gaps to bridge. However, a speech by U.S. Vice President Mike Pence on Thursday, which criticized China’s handling of the Hong Kong protests and its treatment of Muslim Uighurs in the Xinjiang region, did jangle nerves.

“Geopolitical concerns such as the global trade war are keeping investor optimism in check,” said Paula Polito, client strategy officer at UBS Global Wealth Management, adding the firm’s latest survey had found that investors had opted to raise their holdings of cash well above usual levels. A Reuters poll of economists showed that most think a steeper decline in global growth is more likely than a synchronised recovery, despite central bank easing.

Elsewhere, in his last meeting as president of the European Central Bank, Mario Draghi left ECB policy and guidance unchanged, but advised his successor to “never give up” on propping up the eurozone economy in the face of a worsening outlook.

In rates, Treasuries were marginally cheaper across the curve led by front-end and following wider losses across bunds after Germany’s Ifo business expectations gauge exceeded estimates. Gilts fell amid Brexit uncertainty and potential for a general election in December. Yields rose less than 1bp, with 10-year hovering near highest levels of the overnight session around 1.77% and little changed on the week. Bunds were cheaper vs. Treasuries by 1.5bp , gilts by 3.7bp; EU agreed to grant a Brexit extension but defers decision on the length, expects announcement on new deadline by Tuesday

In currency markets, the dollar traded flat against a basket of six major currencies while the euro steadied after falling to a one-week low against the U.S. dollar in the previous session on the ECB leaving the door open for more monetary policy easing, but keeping interest rates unchanged. The British pound edged down to $1.2820, extending a 0.5% drop on Thursday, as investors waited for a European Union decision on a Brexit extension after British Prime Minister Boris Johnson called for a December general election. Johnson conceded on Thursday for the first time that he would not meet his “do or die” deadline to leave the European Union next week. EU envoys will discuss the length of another delay to Brexit at a meeting on Friday. An EU official said the choice was between three months and a “two-tier” lag but warned that a decision might not come just yet. Swedish krona was steady as producer prices hold steady.

In commodities, oil prices fell on the day but were on track for strong weekly gains as support from a surprise draw in U.S. inventories and possible action from OPEC and its allies to trim production further outweighed broader economic concerns. West Texas Intermediate crude CLc1 was down 0.4% to $55.99 a barrel, and global benchmark Brent crude dipped 0.3% to $61.45 per barrel.

Looking to the day ahead now, and earnings releases continue today with Verizon Communications, Anheuser-Busch InBev, Charter Communications and Barclays. In terms of data, there’ll be the Ifo business climate index from Germany, as well as GfK’s consumer confidence reading. From France, we’ll get September’s PPI, while in the US there’s the final University of Michigan sentiment reading for October. Finally from central banks, the ECB’s Villeroy will be speaking while the Russian central bank will be deciding on rates.

Market Snapshot

- S&P 500 futures little changed at 3,004.75

- STOXX Europe 600 down 0.3% to 396.25

- MXAP up 0.04% to 161.10

- MXAPJ down 0.03% to 516.59

- Nikkei up 0.2% to 22,799.81

- Topix up 0.3% to 1,648.44

- Hang Seng Index down 0.5% to 26,667.39

- Shanghai Composite up 0.5% to 2,954.93

- Sensex down 0.5% to 38,843.03

- Australia S&P/ASX 200 up 0.7% to 6,739.22

- Kospi up 0.1% to 2,087.89

- German 10Y yield rose 1.9 bps to -0.385%

- Euro up 0.1% to $1.1120

- Italian 10Y yield fell 2.9 bps to 0.566%

- Spanish 10Y yield rose 1.0 bps to 0.248%

- Brent futures down 0.1% at $61.62/bbl

- Gold spot up 0.8% to $1,503.98

- U.S. Dollar Index little changed at 97.58

Top Overnight News from Bloomberg

- U.S. Vice President Mike Pence criticized China’s actions against protesters in Hong Kong while calling for greater engagement between the world’s two biggest economies, delivering a long-anticipated critique of Beijing’s human rights record as the two nations try to resolve their trade war

- German business confidence stabilized in October and expectations unexpectedly improved from a decade low, suggesting that Europe’s largest economy may have stopped deteriorating at the start of the fourth quarter

- China fired back at Vice President Mike Pence’s criticism on human rights, calling his speech “lies” and chiding him for ignoring U.S. problems like racism and wealth disparity

- Boris Johnson’s efforts to break three years of gridlock in the U.K. Parliament with another election were thrown into doubt, after his main opponent demanded he rule out a no-deal Brexit first. Labour Party Leader Jeremy Corbyn said Thursday that his decision on backing the prime minister’s bid for an election depends on the length of a Brexit extension granted by the European Union

- Oil is set for the biggest weekly gain in more than a month as tightening crude supplies tempered further signs of a slowing global economy. A temporary halt to the North Sea Forties oil pipeline system added to a surprise decline in U.S. crude stockpiles last week

- South Korea is abandoning its developing- nation privileges at the World Trade Organization following allegations by the Trump administration that some countries were taking advantage of the status

- S&P Global Ratings is set to issue its first major statement on Italy’s finances since the country’s fledgling coalition government took power, in what could provide a further boon to its sovereign debt

Asian equities traded mixed with a lack of conviction amid the absence of any firm macro drivers and as earnings releases remained centre stage. ASX 200 (+0.7%) outperformed led by gold miners after the precious metal reclaimed the psychological USD 1500/oz level and with broad gains seen across sectors amid recent currency weakness, while Nikkei 225 (+0.1%) was choppy and stalled after reaching its highest level in over a year with continued losses in SoftBank amid speculation of a USD 5bln write down to its Vision Fund. Hang Seng (-0.4%) and Shanghai Comp. (+0.4%) were subdued despite the PBoC’s liquidity efforts that resulted to a net injection of CNY 560bln this week, with weakness seen in financials and participants cautious as earnings season in the region began to pick up. There were also recent mixed comments from US Vice President Pence who suggested the US will continue to seek better relations with China and that if the sides can get an economic relationship right, they can make progress on other issues, although he noted the curtailing of rights and liberties in Hong Kong and criticized US businesses for kowtowing to Beijing. Finally, 10yr JGBs were choppy as they mirrored the indecisiveness in Japan and with demand subdued by a lack of BoJ buying in the market today.

Top Asian News

- Asia’s Richest Man Gets Win as Rivals Face $7 Billion Bill

- Piramal Plunges After Announcing $770 Million Capital Raising

Major European Bourses (Euro Stoxx 50 -0.3%) are mostly lower amid a lack of fresh drivers, with most indices well within yesterday’s ranges. Dax and Euro Stoxx 50 (cash) both made fresh YTD highs this week; fears of a no deal Brexit have faded substantially and earnings, by and large, have not been as bad as feared. Sectors are mixed, with some divergence seen in the consumer sectors; Consumer Discretionary (+0.9%) outperforms after luxury apparel maker Kering’s (+9.9%) earnings topped expectations, while Consumer Staples (-1.0%) lags, with poor AB InBev () earnings weighing on beverage makers. In terms of other individual movers; Michelin (+3.5%), WPP (+5.8%), LafargeHolcim (+2.0%) and Moncler (+8.5%) were all buoyed by strong earnings. Moreover, Barclays (+0.9%) results were firm; the bank beat on top line expectations, including healthy CIB revenue, and adjusted pretax posted firm Q/Q gains. Despite a GBP 1.4bln provision for compensating customers caught up in the PPI mis-selling scandal, Barclay shares rose to the highest since November 2018. Conversely, Capgemini (-6.7%), Eni (-1.0%) and MTU Aero Engines (-1.5%) earnings were poor, seeing their stocks come under pressure.

Top European News

- U.K.’s Javid Concedes Split Will Be After Oct. 31: Brexit Update

- United Internet Drops After Cutting Forecast on Lost Fee Dispute

- SoftwareONE Gains After Raising $699 Million in Swiss IPO

- Ad Giant WPP Posts Surprise Sales Rise in Boost to CEO Read

In FX, the Euro has extended its recovery from sub-1.1100 lows vs the Dollar in wake of October’s German Ifo readings that were broadly better anticipated and prompted the institute to conclude that the economy may be finding a base, with modest growth likely in Q4. However, Eur/Usd still looks leggy between decent option expiries (1.5 bn from 1.1090 to 1.1100 and 1 bn at 1.1150-55) and a broadly firm Greenback, as the DXY holds above 97.500 within a 97.573-712 range following Thursday’s encouraging US Markit PMIs.

- AUD/NZD/NOK/SEK - The G10 outliers, with the Aussie outperforming vs US and NZ counterparts after holding above 0.6800 and reclaiming 1.0700+ status respectively, while the Kiwi has lost more momentum below 0.6400. Similarly, the Scandi Crowns are retreating further from best levels seen in the immediate aftermath of yesterday’s Riksbank policy declaration about a probable rate hike in December on the assumption that it will be one more and done akin to the Norges Bank after September’s 25 bp tightening. Eur/Nok is nudging 10.1900 and also being driven by the aforementioned incremental Euro incline, while Eur/Sek has been back above 10.7500 compared to just under 10.6500 at one stage on Thursday.

- CHF/CAD/JPY/GBP - All narrowly mixed against the Buck, as the Franc pares some losses from 0.9930, but remains below 0.9900 and the Loonie meanders between 1.3060-75 ahead of Canadian budget balance updates for August due later. Meanwhile, the Yen is holding within 108.70-57 parameters and even the Pound is relatively restrained due to less Brexit buffeting (for now), as Cable pivots 1.2850 and Eur/Gbp straddles 0.8650.

- EM - Central Bank vibes in play, as the Lira concedes more ground after the CBRT’s 250 bp rate cut and Turkish President Erdogan piles on the pressure for further aggressive easing via a single digit call for the benchmark 1 week repo vs 14% at present. Usd/Try has touched 5.7900 before paring back, but the Rouble seems to be taking a widely expected CBR cut in stride ahead of the 11.30BST decision even though weaker than forecast inflation opens the door to -1/2 point after 3 cuts of 25 bp in a row. Usd/Rub sub-64.0000.

In commodities, Crude futures are marginally lower in uninspired trade amid a lack of fresh fundamental developments and look set to end the week on a firmer footing; the key driver of Crude’s strong performance this week was a surprise draw in EIA inventories on Wednesday, slightly over 10mln bbls in total. Additionally, further disruptions to the North Sea Buzzard Oil field and a temporary shutdown to the Forties Pipeline System also lent support. WTI futures have made substantial strides from early October lows, with the Dec’ 19 future currently residing just shy of the USD 56.00/bbl mark, while Brent sits at the USD 61.50/bbl mark. The USD 50.50/bbl – USD 51.00/bbl region for WTI, a quadruple bottom for June, August and early October, remains impenetrable for now. Though demand side concerns continue to cap gains, as evidenced by crude’s inability to hold on to last month’s post Aramco attack related gains, geopolitical risk premia remains ever present, as does the prospect for further OPEC+ cuts (sources hinted at the latter earlier in the week, although Russia’s Novack played things down). Metals are similarly lacklustre; Gold yesterday reclaimed the USD 1500/oz mark and sits below USD 1510/oz. Copper, meanwhile, hold on to decent gains for the week, supported by unrest and strikers in Chile that has affected supply of the red metal.

US Event Calendar

- 10am: U. of Mich. Sentiment, est. 96, prior 96; Current Conditions, prior 113.4; Expectations, prior 84.8

- U. of Mich. 1 Yr Inflation, prior 2.5%

- U. of Mich. 5-10 Yr Inflation, prior 2.2%

- 2pm: Monthly Budget Statement, est. $83.0b, prior $119.1b

DB's Jim Reid concludes the overnight wrap

An interesting past 24 hours where flash PMIs were slightly on the disappointing side, Draghi said goodbye in a classic Game of Thrones manner (see explanation below), Pence finally gave his hawkish China speech and a crafty plan from U.K. PM Johnson was unleashed to give Parliament more time to scrutinise his bill but only in return for a pre-Xmas election. Oh and Amazon fell -6.81% in after hours trading after soft earnings guidance. Given my weekly recycling bin is always full of Amazon boxes after deliveries of essentials for the children then I’m a little surprised at this!

Anyway, apologies for this but let’s get Brexit out the way first. You’re welcome to skip the next three short paras if you’re fed up with it. As looked likely as soon as he suspended the Brexit bill on Tuesday, last night PM Johnson tabled a Parliamentary vote for Monday for an election on December 12th and will offer Parliament more time to debate his Brexit bill if they agree to it. Parliament would now have until November 6th to scrutinise his bill under his plan (assuming the election date is approved).

The biggest issue for the government is that under The Fixed-Term Parliaments Act 2011 he’ll need a two-thirds majority. Labour are in a very difficult position as they have been first demanding an election and then shifting to demanding one after a no-deal Brexit has been taken off the table. Assuming the EU agree an expected length extension today or by Monday at the latest it will be very difficult to credibly vote against it. Confusion reigned afterwards though as Labour whips were initially told to abstain before leader Jeremy Corbyn said that he is awaiting the EU’s response before deciding whether to back an election, but if no-deal is taken off the table, then “we will absolutely support an election.” The Liberal Democrats took a similar position, refusing to commit until after the EU responds, while the SNP said that they would support an early election but possibly not under Johnson’s timetable whereby the Brexit legislation would be tabled again before the vote takes place. Unless Labour make a proper about-turn, Monday could be yet another damp squib of a vote.

EU ambassadors will be meeting today to decide the length of an extension with some talk of a two tiered extension - first to get the current deal through and if that fails, one out to end of January. This is all speculation though. I wonder whether Mr Johnson has consulted with Mr Macron about his plan and whether that will influence his thinking. Speculation continued yesterday that the French leader was still hawkish about an extension but most expect him to reluctantly agree to the Benn Act’s request. So all eyes on the EU and then all eyes on the Labour Party. One curveball would be that the EU wait until after the vote on Monday. Another curveball would be the government going on strike if they don’t get their motion passed. On the former, overnight news reports from Bloomberg suggest that the EU might now hold off on its extension decision today as it seeks more clarity from the UK itself before making a decision. They are not to get any clarity until after the vote on Monday. So a game of chicken and the egg awaits. A fun few days ahead... yet again.

Another highlight yesterday was the hawkish speech vis-à-vis China from Vice President Pence. He had been expected to use confrontational rhetoric regarding China’s human and civil rights record, including the situation in Hong Kong. He did talk about those issues, but he also linked them with an eventual trade deal, saying that it would be harder to cooperate on trade if the authorities resort to violence against the protesters in Hong Kong. Previously, senior administration officials had barely spoken about Hong Kong, let alone link it directly to trade talks. At the margin, such rhetoric is likely to make a deal more difficult to achieve, though Pence did also insist that the US does not want a confrontation and that he wants the relationship to be based on "candor, fairness, and mutual respect.” Earlier, Bloomberg had reported that China aims to buy at least $20bn of agricultural products in a year if it signs a partial trade deal with the US and this will take China’s imports of US farm goods back to around 2017 levels, before the impositions of tariffs started. The report further added that in the second year of a potential final deal, purchases could rise to $40 bn to $50 bn but that would depend on Trump removing remaining punitive tariffs. As we go to print, Reuters is reporting that China is likely to ask the US to cancel some of planned and existing tariffs on Chinese imports in exchange for buying more US farm products. The report further added that China is likely to ask the US to drop the proposed plan of imposing tariffs on the additional $156bn of Chinese imports on December 15 along with the removal of 15% tariffs imposed on Sept. 1 on about $125 billion of Chinese goods. The USTR Robert Lighthizer and US Treasury Secretary Steven Mnuchin are scheduled to speak to Chinese Vice Premier Liu He today over telephone.

Back in Europe, the ECB left policy unchanged at Mario Draghi’s swansong as ECB President yesterday, in a move that had been expected after September’s policy package. Draghi said the decision was unanimous, which makes a contrast from last month’s meeting. It actually reminded me of Game of Thrones where all the action usually came to a climatic conclusion in the penultimate episode of a series before the tidying up of loose ends in the final one. Draghi fought his last major battle in September and this was his epilogue. Indeed Draghi justified the moves last month, saying that “Everything that has happened since September has showed that the Governing Council’s determination to act in a substantive manner was justified.” Striking a negative tone on the growth outlook, Draghi’s statement said the risks to the growth outlook “remain on the downside”, in stronger language than his previous press statement where he said they “remain tilted to the downside”. However, Draghi did say that the reduced chance of a hard Brexit was a positive development.

After the press conference, the Euro weakened against the dollar, ending the day -0.23 %, while bond markets rallied after a bit of a see-saw day. 10yr bunds (-1.2bps), OATs (-1.4bps) and OATs (-3.0bps) all pared back earlier losses to end the day higher, with 10yr bunds closing below -0.40% for the first time in a week. Meanwhile Greek ten-year yields fell for the 9th time in the last 10 sessions to a fresh record low of 1.218%. European banks gave up their gains however, with the STOXX Banks index ending the session -0.59%, while inflation expectations were unmoved after Draghi, with five-year forward five-year inflation swaps remaining at 1.203 %. In the US, Treasuries rallied a bit with 10yr yields -0.3 bps and the 2s10s curve +0.3bps. Gold rallied as the press conference was taking place, ending the day up +0.75% and at a two-week high.

With Draghi speaking of a worsening outlook, the preliminary PMIs out yesterday painted a mixed picture on that front. The Euro strengthened to its high for the day of $1.1163 along with bond yields after the better-than-expected French releases, where both services (52.6 vs. 51.0 expected) and manufacturing (50.5 vs. 50.2 expected) came in ahead of expectations. However, the currency and yields gave up their gains after the German reading underwhelmed and the Eurozone reading was basically as expected. In Germany, services fell to a 37-month low of 51.2 (vs. 52.0 expected), while manufacturing saw a modest recovery from its 10-year low to reach 41.9 (vs. 42.0 expected). The overall picture for the Eurozone was basically one of stagnation, with the Eurozone composite PMI at 50.2 (vs. 50.3 expected). In contrast to the last couple of months, we also saw the gap between the manufacturing (45.7) and services (51.8) PMIs widen once more, up by 0.2pts to 6.1pts. That said this gap is still below the peak in July of 6.7pts. And in the US, although the market is more attuned to the ISM readings, the manufacturing PMI unexpectedly rose to 51.5 (vs. 50.9 expected), while the services reading saw in line with expectations at 51.0 (from 50.9 last month), both remaining near their cyclical lows.

Turning to equities now, US markets made modest gains yesterday as they reacted to a stream of earnings releases, though technology stocks outperformed with the NASDAQ +0.81%. Semiconductors (+2.47%) in particular outperformed, boosted by a positive report from Lam Research (+13.90%) which alleviated concerns around the sector which surfaced after Texas Instruments’ poor guidance earlier this week. The S&P 500 was up +0.19%, and both of the major indexes have traded in tight ranges of just 2% over the last 10 trading sessions. Twitter was the biggest faller on the index yesterday, down -20.83% after the company saw revenue miss expectations in Q3 with guidance for Q4 lower. Meanwhile, a poor result from MMM (-4.06%) dragged on the DOW, which ended -0.11%. After markets closed, Amazon (-6.81% after hours) dropped on surprisingly low revenue guidance for the fourth quarter, on lower expected holiday volumes as well as reduced activity from the profitable cloud computing business line. On a positive note, Intel (+4.10% after hours) increased their full-year revenue guidance.

In Europe the session ended in positive territory, with the STOXX 600 up +0.59% to a fresh one-year high, while the DAX (+0.58%), the CAC 40 (+0.55%) and the FTSE MIB (+0.79%) all rose on the day.

Asian markets are largely trading flat this morning with the Nikkei (+0.01%), Shanghai Comp (-0.01%) and Kospi (-0.03%) making very modest moves while the Hang Seng is down (-0.44%). Elsewhere, futures on the S&P 500 are trading unchanged while the US dollar index is up +0.06% this morning after advancing +0.14% yesterday. Yields on 10y USTs are down -1.4bps and oil prices are c. -0.50% lower.

Moving back to Europe, tomorrow sees the first-round results announced for the SPD leadership race in Germany, who are currently in coalition with Angela Merkel’s CDU. Our FX strategists have written about why this result will matter for the Euro, as depending on the result this could have big implications for the fiscal stance of the country’s grand coalition, and even its survival. If finance minister Scholz were to fail to reach the run-off, that would favour more left-wing candidates who want to end the balanced-budget commitment and question the debt brake. Victory for a more left-wing candidate also raise the tail risks around the planned SPD mid-term review of the coalition planned for December, potentially leading to the SPD pulling out. See Robin Winkler’s blog here .

Before we look at the day ahead let’s tidy up other data releases from the US. Core durable goods orders fell -0.5% (vs. -0.1% expected), while core shipments fell -0.7% (vs. -0.2% expected). So a bit weak. US initial jobless claims fell to 212k (vs. 215k expected), although the previous week’s reading was revised up by +4k. New home sales were at 701k in September (vs. 702k expected), although last month saw a small -6k downward revision. And finally the Kansas City Fed manufacturing index fell to -3 as expected, which was its second lowest reading since President Trump’s election.

Looking to the day ahead now, and earnings releases continue today with Verizon Communications, Anheuser-Busch InBev, Charter Communications and Barclays. In terms of data, there’ll be the Ifo business climate index from Germany, as well as GfK’s consumer confidence reading. From France, we’ll get September’s PPI, while in the US there’s the final University of Michigan sentiment reading for October. Finally from central banks, the ECB’s Villeroy will be speaking while the Russian central bank will be deciding on rates.

https://ift.tt/2MLdMWP

from ZeroHedge News https://ift.tt/2MLdMWP

via IFTTT

0 comments

Post a Comment