Japan Hikes National Sales Tax Despite Recession Fears

Japan has increased its national sales tax to 10% from 8% on Tuesday, a significant policy change that could tilt the world's third-largest economy into recession by depressing consumer sentiment, reported Market Watch.

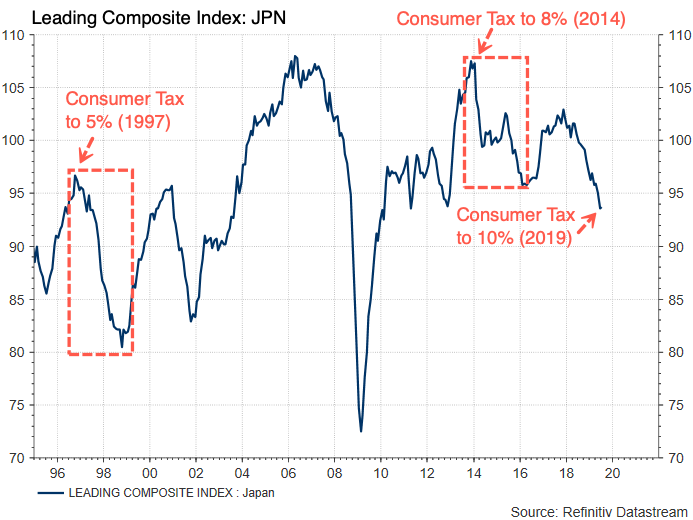

The last two times policymakers increased the sales tax, 2-point rise to 5% in 1997 and another to 8% in 2014, an economic contraction shortly followed.

Prime Minister Shinzo Abe twice delayed the tax hike in recent years.

Abe has indicated the tax is now unavoidable given the demographic challenges in the aging country. He said the tax would help pay down the enormous national debt, and position the country towards more financial responsibility in balancing the budget by 2025. But taxing the consumer as the economy is deteriorating could be a recipe for economic disaster in 2020.

Japan's GDP expanded at an annual pace of 1.8% over the summer. The economy is quickly slowing into fall, thanks to the trade war between the US and China. Global trade volumes are plummeting through 2H19, has taken a toll on Japan's exports. The tax will likely sideline the consumer in 2020, force them into a savings pattern that could tilt the economy into a recession next year, similar to the tax increase in 2014.

"The economy is already in a bad state," said Toshihiro Nagahama, executive chief economist at Dai-ichi Life Research Institute.

"To put it in terms of the human body," Nagahama added, "exercising when you're not in good health is probably unwise."

The tax goes into effect Tuesday, includes clothes, electronics, transportation, and medical services, but policymakers are allowing tax breaks for real estate and automobile purchases. Low-income households will see insignificant tax hikes, along with no tax hikes for groceries.

Policymakers set aside $18.49 billion in tax breaks for consumers. Another $2.77 billion will be for real estate and automobile purchases, but it's likely that any tax breaks will have little effect in boosting animal spirits.

"The reduced tax rate and reward points system may limit the pain to shoppers," said Koya Miyamae, a senior economist at SMBC Nikko Securities. "Still, consumer sentiment tends to deteriorate before and after a tax hike, which will, in turn, dampen economic activity."

Abe's timing of the consumer tax hike poses a deflationary risk at a time when the global economy is stumbling.

"Considering the current economic conditions, the timing is bad," said Toshihiro Nagahama, chief economist at Dai-ichi Life Research Institute.

Worsening economic conditions in Japan underlines the darkening outlook for the Japanese economy even before the tax hike was implemented. Though service-sector activity remains steady, the tax hike will likely slow domestic consumption in the quarters ahead, eventually tipping the economy into recession.

During the last two consumer hikes (1997, 2014), the country's leading economic index topped out and slid. This time around, the tax was pushed out when the index has been declining for at least 1.5-years, a policy error by the government that could prolong the next downturn.

https://ift.tt/2nu6ZqY

from ZeroHedge News https://ift.tt/2nu6ZqY

via IFTTT

0 comments

Post a Comment