McDonald's Goes "Big Tech" While Franchisees And Money Losing Delivery Companies Bear The Costs

McDonald's is trying to turn around its business, like many other companies, by moving to a more "futuristic" business model. And by "futuristic", of course, we mean benefiting from increased costs it is lopping onto its franchisees and taking advantage of ubiquitous money-losing delivery services.

A week before Steve Easterbrook was named McDonald's CEO, the company had suffered one of its worst years in decades. Customers were ditching McDonald's for Chipotle burritos and Chik-fil-A sandwiches en masse, according to a new Bloomberg Businessweek profile.

To add insult to injury, the company lost hundreds of thousands of customers to Burger King during the week of Spain's Real Madrid vs. Barcelona match - one of the most important fixtures in all of soccer. Customers were choosing Burger King's delivery option, which McDonald's didn't have. Hundreds of other burger competitors were popping up on food delivery apps across the U.K., as well, pushing Easterbrook to address the weakness.

Lucy Brady, who oversees McDonald’s global strategy and business development teams said: "He looked at me and said, 'We’re not going to go through the traditional market pilot and study delivery for six months. We’re just going to do it'.”

Easterbrook then commanded each country's manager to nominate their best executive to build out an online delivery business that would be operational in just two week's time. Brady suggested a target of having 3,000 delivery restaurants online by July 1. Easterbook came back by saying he wanted to get 18,000 locations online - about half of the company's locations around the globe.

Easterbrook made it so that management's compensation was tied to the speed of the roll out and McDonald’s quickly teamed with Uber Eats for the widest possible deployment. The partnership was so meaningful to Uber, that it devoted two pages to its delivery agreement with McDonald’s in a roadshow prospectus ahead of Uber's IPO.

Easterbrook, who let go 11 of the 14 most senior executives he inherited, now says he uses the service when he travels to get a gauge of its quality. McDonald's expects the delivery business to account for about $4 billion in sales by the end of this year.

But catching up to Burger King on delivery wasn’t the only goal Easterbrook had. Easterbrook seeks to reconfigure all of his restaurants into data processors, utilizing things like machine learning and mobile technology.

It's a great vision for McDonald's, but it hits the wallets of franchisees hard. Franchisees have mostly balked at the costs that it would require to equip their stores with things like license plate scanners and touchscreen kiosks.

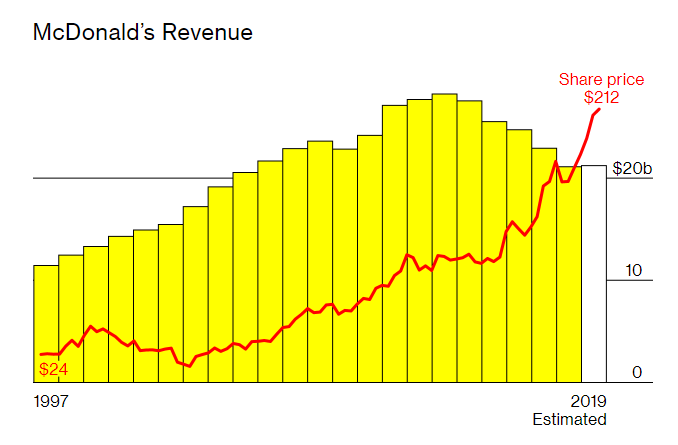

And what would futuristic sounding bullshit be if Wall Street didn't eat it up? For McDonald's stock, the strategy is working. As the article notes, only a couple of companies in the S&P 500 have outperformed McDonald’s since 2015. Easterbrook has said he seeks to reclaim the company’s image as a "beacon of innovation".

Currently, the company has a market cap of $159 billion and feeds about 1% of the human population daily. But its share of the US market has shrunk to 13.7% from 15.6% in 2013, ceding ground to casual dining chains like Panera and burger joints like Shake Shack and Five Guys.

The company's earnings started to stagnate in 2013 and fell by almost 20% to $4.7 billion the following year. The company’s former CEO, Dan Thompson, said upon leaving that the company had "failed to evolve at the same rate as our customers' eating out expectations".

Easterbrook became the company's global chief brand officer in 2013 and sat down with Apple CEO Tim Cook to become a partner for the Apple Pay launch system. This resulted in a digital add-on installed on every machine at McDonald’s 14,000 locations in the US.

In 2014, the company launched the "experience of the future" concept which was an initiative that Easterbrook had worked on.

It reimagined the entire store from the ground up: from how orders were placed, to what services were offered. Some franchisees have benefited so much from the ideas that restaurant sales are growing at double digit rates.

But other franchisees have banded together to try and force the company to slow the program's roll out two years past its original target. These franchisees are objecting to the massive cost of the project, which can run into the tens of millions of dollars for owners of select locations – even after McDonald’s pays for 55% of the remodels.

Adding an Uber Eats counter for delivery, touchscreen kiosks, modern furniture and power outlets means that franchisees can incur costs up to $750,000 per restaurant, according to McDonald’s.

But the enhancements are achieving what they set out to do. Annual profits are inching higher again and McDonald’s posted its fastest global sales gain in seven years last quarter. Changes like including all day breakfast have also brought customers back and the company has introduced a curbside pick up system that allows customers to order through the app and notify the store when they are within 300 feet of the property.

But the company's workers and franchisees who have long complained about low hourly wages and poor conditions have taken a dim view of the overhaul. Workers claim that new items, self order kiosks and app orders have them "riddled with anxiety", even causing some workers to flee to competing fast food restaurants.

Eli Asfaw, who operates seven franchises in the Denver area said: “I would like to make the kitchen as stress-free as it possibly can be. For a start, scaling back rollouts mandated by the company, such as all-day breakfast, would make it easier for us to keep people and make our people happy.”

Staff welfare continues to be a major issue for the company in the United States, where the median pay for food workers is $10.45 an hour. Complaints of endemic sexual-harassment and poor working conditions have been a national conversation and part of the political fabric, with 2020 Democratic presidential candidates sending a letter to Easterbrook about his "unsafe and intolerable" work conditions and "unacceptable" behavior at the chain's restaurants.

One franchisee, who owns 21 stores near Washington DC, says the modernization has succeeded in attracting new customers, but the revamp was a burden: “There’s training that’s involved. We have to get the employees ready for it—mobile order and pay and Uber Eats and kiosks. All these different things are happening at the same time, and it really took a toll on us.”

Meanwhile, McDonald's shows no signs of slowing down, acquiring AI startup Dynamic Yield for $300 million in March and Silicon Valley startup Apprente Inc. in September. The acquisitions will help add learning software to drive-thrus and use voice recognition software to hopefully cut down on lines in restaurants.

“We were just going so hard at it, it proved to be a bit of a handful,” Easterbrook concedes of the roll out.

You can read Bloomberg's full writeup on Steve Easterbrook here.

https://ift.tt/2LL3OUW

from ZeroHedge News https://ift.tt/2LL3OUW

via IFTTT

0 comments

Post a Comment