September Payrolls Preview: Can We Get The First Negative Print In 10 Years?

After the surprisingly poor August payroll report which saw the US economy add only 139K jobs, analysts expect the disappointing trend to continue and forecast a below-trend 145k nonfarm payrolls added to the US economy in September, with earnings growth seen at 0.3% M/M, and the jobless rate seen unchanged at 3.7%.

As RanSquawk cautions, indicators are decidedly mixed with a strong negative bias going into the data: the ADP private payrolls gauge saw a miss against expectations with the prior number revised substantially lower, while initial jobless claims have essentially moved sideways; Challenger’s job cuts data improved, though employers are beginning to see negative effect from trade wars; the employment sub-components within the ISM has pared back in the month; and on wages, consumer wage expectations has become a touch more pessimistic. The data will be released at 8:30 EDT; with the Fed in data-dependent mode, it is also worth noting that Fed chair Powell will deliver remarks at 2:00pm EDT. Today's market response to the dismal non-mfg ISM (whose employment index suggests we may see the first sub-zero payrolls print since September 2009) was telling: the market is now in full blown "bad news is great news for more Fed easing" mode, and the risk tomorrow is clearly to the upside, with a stronger than expected number likely to offset today's surge in rate cut odds for the rest of 2019, leading to a adverse market reaction.

Courtesy of RanSquawk, here is what the street expects:

- Non-farm Payrolls: Exp. 148k, Prev. 130k (whisper is below 100K)

- Private Payrolls: Exp.133k, Prev. 96k.

- Manufacturing Payrolls: Exp. 4k, Prev. 3k.

- Government Payrolls: Prev. 34k.

- Unemployment Rate: Exp. 3.7%, Prev. 3.7%. (FOMC currently projects 3.7% at end-2019, and 4.2% in the longer run).

- U6 Unemployment Rate: Prev. 7.2%.

- Labour Force Participation: Prev. 63.2%.

- Avg. Earnings Y/Y: Exp. 3.2%, Prev. 3.2%.

- Avg. Earnings M/M: Exp. 0.3%, Prev. 0.4%.

- Avg. Work Week Hours: Exp. 34.4hrs, Prev. 34.4hrs.

SUMMARY:

The Street expects to see 148k nonfarm payrolls (whisper expectations are of a sub-100K print) added to the US economy in September. The three-month trend rate of employment growth is 156k, rising from the 133k going into the prior Employment Situation Report; the six-month trend rate is unchanged at 150k, while the 12-month pace has edged lower to 173k from 186k. In its below-trend preview of the payrolls report, Nomura says that it expects a 115k contribution from private firms and a 10k boost from government payrolls, some of which will likely reflect an influx of temporary Census workers for the second consecutive month.

HOUSEHOLD SURVEY:

While the establishment survey results in August were somewhat weaker than expected, household survey data was more positive. As Nomura points out, the prime age (25-54) labor force participation rate (LFPR) rose 0.6pp to 82.6%, matching the recent high from January and marking the largest one-month increase since April 1960, driven by a jump in prime age LFPR for women (Figure 5). That helped push aggregate LFPR up 0.2pp to 63.2%. The increase in LFPR helped put upward pressure on the unemployment rate to keep it unchanged at 3.7% (Figure 6).

In September, much of that large increase in prime age LFPR will revert, putting downward pressure on aggregate LFPR and the unemployment rate. Since 1950, prime age LFPR has increased more than 0.4pp 16 times. In the next month, both the mean and median changes showed a 0.2pp decline. A modest drop in the LFPR would be enough to lower the unemployment rate 0.1pp to 3.6%.

US ADP NATIONAL EMPLOYMENT:

ADP’s gauge of private payrolls showed 135k additions in September, missing the consensus 140k, while the prior was revised lower from 190k to 157k. The average monthly job growth for the past three months is at 145k, last year the average stood at 214k for the same period, showing signs the job market is slowing, ADP said. Pantheon Macroeconomics stated it is not as soft as it seems, however, as it incorporates official payroll data from the prior month, which only saw a rise of 96K, adding constraint to the September ADP headline print. PM notes the data does not change its forecast for the official BLS data: “The downshift in labour demand in all the surveys we follow suggest job gains will be down to just 50-to-75K by the turn of next year.” It also states that with the lower revisions has no implication for revisions to the official data on Friday. Since 2012, ADP has tended to overestimate private employment growth during August and September on an as-reported basis relative to what the BLS shows the following Friday (Figure 4). Goods and service industries were relatively healthy in the ADP report.

JOBLESS CLAIMS:

In the payrolls survey week, weekly jobless claims data printed 210k versus the 211k going into last month’s payrolls data. The underlying trend remains steady around 215k, Pantheon Macroeconomics suggests, arguing that most of the downward pressure on payroll growth is coming from scaled-back hiring, not lay-offs; “that’s normal in the early stages of a downturn, but if the economy continues to weaken, we would expect claims to begin rising, perhaps by the year-end” Pantheon says.

CHALLENGER JOB CUTS:

This month’s layoffs data declined in September, falling 22.3% M/M and 24.8% Y/Y, making it the lowest monthly total since April. The prior months’ data (Aug) was the fourth highest job cut of 2019, and Challenger notes that employers are beginning to feel effects of the trade war, with trade difficulties being attributed to around 10,000 of the job cuts announced in the last month. Challenger notes that employers held off on making any large-scale employment decisions, as “companies will monitor consumer behaviour, government regulation or deregulation, and market conditions during the final quarter of the year in order to make staffing decisions for next year." The job cuts were led by retail (8132), Industrial Goods (5067), Automotive Companies (4912) with the consultancy noting an expected rise in coming months for this sector if the strikes at General Motors (GM) continues and the fallout impacts suppliers.

BUSINESS SURVEYS:

Within the ISM manufacturing survey, the Employment Index registered 46.3 falling 1.1 points from August, and the lowest since January 2016. ISM noted that comments were generally neutral concerning hiring for attrition, labor force reduction comments were minimal, but it did note that 29% of employment comments were cautious regarding employment expansion. ISM also notes that the manufacturing ISM's employment sub index above 50.8, over time, is generally consistent with an increase in the BLS data on manufacturing employment. In the non-manufacturing ISM report, the employment sub-component fell by 2.7 points to 50.4; respondents noted that the number of new employees was starting to level-off, and a tightening workforce was leading to a more competitive market for qualified potential employees.

Correlating the ISM Employment print with the monthly change in payrolls would suggest a sub-zero payrolls number. If confirmed, this would be the first negative monthly payrolls number in 10 years, since September 2009.

Manufacturing employment indicators in September were mixed. Employment subindices on a number regional Federal Reserve Bank manufacturing surveys improved during the month. Markit’s manufacturing PMI employment series also improved in September. However, ISM’s manufacturing employment subindex declined further below 50, likely as a result of continued weak global growth, suggesting some downside risk for manufacturing hiring.

WAGES:

In the Conference Board’s measure of consumer confidence, the differential between jobs ‘plentiful’ and jobs ‘hard to get’ fell, auguring poorly for the unemployment rate. Analysts look for average hourly earnings to rise by +0.3% M/M, the pace paring a touch versus last month, but would still be encouraging. The Y/Y is seen remaining at 3.2%. The CB’s consumer confidence report stated that, regarding short-term income prospects, the percentage of consumers expecting an improvement decreased from 24.7 to 19.0 percent, but the proportion expecting a decrease also declined, to 5.6 from 6.3.

REVISIONS:

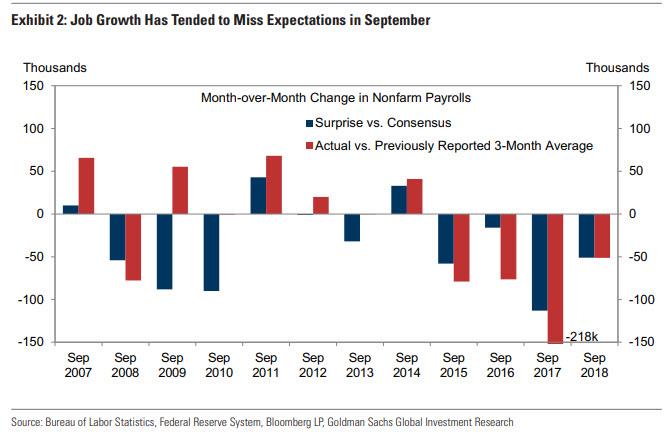

As in August, September payroll growth tends to be weak in the preliminary release. This may reflect a recurring seasonal bias in early vintages, and Goldman is assuming a 20-30k drag for the monthly pace reported tomorrow. As shown in Exhibit 2, first-print September job growth has decelerated in 4 of the last 5 years, and it has missed consensus in 8 of the last 10. At the same time, the 2017 and 2018 observations probably overstate the bias (due to major hurricanes in both months). There is also the possibility of positive revisions in tomorrow’s report that might reverse some of the August bias (the September employment report has included upward revisions in 5 of the last 8 years, including +87k last year). Given these offsetting considerations, the first-print bias as a roughly neutral factor for tomorrow’s report as a whole.

ARGUING FOR A STRONGER REPORT:

- Jobless claims. Initial jobless claims were flat-to-down in the four weeks between the payroll reference periods—averaging 213k—and are consistent with a very low pace of layoffs. Continuing claims declined by 45k from survey week to survey week, the largest sequential improvement since April.

- Labor market slack. With the labor market somewhat beyond full employment, the dwindling availability of workers is one factor weighing on job growth this year. In past tight labor markets however, payroll growth has tended to reaccelerate in September (for example in 2000 and 2007). Some firms likely pulled forward hiring into September, anticipating a shortage of applicants in Q4.

- Census hiring. While temporary employment related to the 2020 Census has significantly lagged that of 1999 and 2009, it picked up meaningfully in the August report (+25k). Address canvassing continued into September, and we expect the level of Census employment to rise further from 27k in August to 40k or somewhat higher, contributing around 15k to monthly job growth in tomorrow’s report.

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas declined by 15k in September to 41k and were 13k below their September 2018 level. The sequential decrease in announced layoffs primarily reflects reversals in the technology (-12k) and government (-4k) sectors, which rose sharply in August.

ARGUING FOR A WEAKER REPORT:

- Employer surveys. September business activity surveys were on net weaker than expected for both the manufacturing and service sectors. The employment components of those surveys rebounded for the manufacturing sector (+1.8 to 51.4) but more importantly, they declined for the services sector (-0.7 to 52.7). As shown in Exhibit 1, the level of these surveys is consistent with an underlying pace of job growth of around 130-160k per month. Service-sector job growth rose 84k in August and averaged 121k over the last six months, while manufacturing payroll employment rose 3k in August, in line with its average over the last six months.

- ADP. The payroll-processing firm ADP reported a 135k increase in September private employment, 5k below consensus and in line with the 136k average pace over the three prior months. While somewhat weaker than our estimates, the report still suggests that the underlying pace of job growth remains firm.

POTENTIAL SOURCES OF NOISE:

- Will Census workers boost topline NFP again? There will likely be another 5-10k temporary Census workers reported in September according to Nomura. The Census Bureau noted in August that up to 40k temporary field staff had started address canvassing as part of the decennial 2020 census. With only 27k temporary Census workers reported by the BLS, 25k of which came in August, there is room for an additional 5-10k in September.

- Will the GM strike affect nonfarm payrolls in September? Probably not. The strike took place after the BLS establishment survey reference period (the pay period containing the 12th of the month). The BLS strike report for September showed no new workers on strike during the CES survey reference pay period. However, if the strike does not end this week, it could show up in the strike report for October, with a reference week of 7 October, and potentially affect October NFP.

Source: RanSquawk, Goldman, Nomura

https://ift.tt/3304GL3

from ZeroHedge News https://ift.tt/3304GL3

via IFTTT

0 comments

Post a Comment