The Fed's "Not QE" And How We Are Playing It

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review & Update

“If you are a bull, what is there not to love?”

That was the message from last week, as we discussed the reasoning for our increase of equity exposure in portfolios on an opportunistic basis.

Of course, besides the fact we are moving into the seasonally strong period of the year, the primary reasons for the increase in equity really came down to two simple factors:

-

Trump moving the put the “trade war” to rest (as we previously anticipated.)

-

The Fed moving to increase bond purchases and effectively launch QE4 (more on this in a moment.)

As noted in Tuesday’s discussion:

“Readers are often confused by our more bearish macro views on debt, demographics, and deflation, not to mention valuations, which will impair portfolio returns over the next decade versus our more bullish bias toward equities short-term. That is understandable since the media wants to label everyone either a ‘bull’ or a ‘bear.’

However, markets are not binary. Being a bear on a macro-basis doesn’t mean you are only allowed to hold cash, gold, and stock in ‘beanie-weenies.’ Conversely, being ‘bullish’ on equities doesn’t necessarily mean an exclusion of all other assets other than equities.”

This is an important point.

Our job as investors is to capture gains when the reward outweighs the risk and protect our capital when risk is prevalent.

After a sloppy summer, the markets had gotten oversold to a more extreme level which provided the support, and the “fuel,” required for an advance with the right catalyst. The Fed’s “QE” was the “match that lit the fuse.”

While the bulls were able to string together a decent rally last week, they were unable to capture new highs for the market.

While the markets are “risk-on” at the moment, the oversold condition has now reverted to a more extreme “overbought” condition which limits a further advance from current levels. A correction back to the 50-dma within the next week or so would not be surprising.

However, between now and the end of the year, there is still room for an advance. This is why we are suggesting adding exposure “selectively” and “opportunistically” on pullbacks. As shown below, the market is now trading below its previous bullish trendline advance which provides resistance to a further advance to about 3100-3300 currently.

Given the market is not grossly overbought on an intermediate-term basis, (yellow highlight box), there remains potential upside into the end of the year.

This technical backdrop, combined with the Fed’s QE program (I know, it’s not QE), is why we continue to maintain a long-equity bias in our portfolios currently. We have slightly reduced our hedges, along with some of our more defensive positioning, but remain well aware of the risk currently, which is why we are also maintaining a slightly higher than normal level of cash.

Playing The Fed’s QE (Not QE)

On Thursday, the Fed announced that they will nearly double the daily repo liquidity operations to $120 billion, as well they said the sizing of the 14-day term repo programs would rise from $30 billion to $45 billion. For the most part these daily and term repo operations have been oversubscribed, meaning there is more demand than liquidity being offered by the Fed. This growing problem is a reason for the recent announcement of QE (not QE).

(For more on “Repo” read this.)

As noted by Zerohedge on Thursday morning:

“In a statement published at 1515ET, precisely when the S&P ramp started (on Wednesday), the New York Fed confirmed it would dramatically increase both its overnight and term liquidity provisions beginning tomorrow through November 14th.

‘The Desk has released an update to the schedule of repurchase agreement (repo) operations for the current monthly period. Consistent with the most recent FOMC directive, to ensure that the supply of reserves remains ample even during periods of sharp increases in non-reserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation'”

This is a massive 60% increase in the overnight repo liquidity availability (from $75 billion to $120 billion) and a 28% jump in the term repo provision (from $35 billion to $45 billion).

The Fed continues to insist this is not “Quantitative Easing,” and this is simply short-term funding for short-term cash needs (the original excuse were corporate tax payments which have long since passed.)

However, as we addressed just recently, we suspect it is something significantly different when you consider the most recent Term Repo operation was 1.38x oversubscribed.

“This was not about covering unexpected cash draws to pay quarterly taxes, which was one of the initial excuses for the funding shortfalls.”

So true - remember the whole #REPO crisis started because it was just a demand for cash for #tax #payments. Apparently, companies are paying taxes daily until sometime in 2020.

— Lance Roberts (@LanceRoberts) October 12, 2019

Amazing the #media continually buys into the #narratives as if they were the truth. #ThinkPeople https://t.co/Y3cxdK9AWeNope.

This was bailing out a bank that is in serious financial trouble. It started with the ECB a month ago loosening requirements on banks, then proceeded to the Fed reducing capital reserve requirements and flooding the system with reserves.

Who was the biggest beneficiary of all of these actions? Deutsche Bank.

Deutsche is about 4x as large as Lehman was in 2008 and is currently following the same price path as well. Let me repeat, the Fed is terrified of another “Lehman Crisis” as they do not have the tools to deal with it this time.

(Courtesy of ZeroHedge)

Clearly, the Fed is concerned about something other than the impact of “Trump’s Trade War” on the economy.

As noted by Zerohedge:

“Needless to say, if the funding shortage was getting better, none of this would be happening; instead it appears that with every passing day the liquidity shortage is getting worse, even as the Fed’s balance sheet is surging.

The only possible explanation, is someone really needed to lock in cash for month end (the maturity of the op is on Nov 7) which is when a ‘No Deal’ Brexit may go live, and as a result one or more banks are bracing for the worst.

The question, as before, remains why? Just what is the source of this unprecedented spike in liquidity needs in a system which already has $1.5 trillion in excess reserves?”

That is the correct question.

But in the meantime, the injection of liquidity continues to support asset prices as the litany of “algo’s” which drive -80% of the trading on Wall Street, respond in “Pavlovian” fashion to more liquidity.

Funding The Deficit

Every morning, at RIAPro.net, we post commentary as to what is moving the markets. On Thursday we pointed out a dynamic in the funding of the U.S. Treasury that few are following despite the implications it has on monetary policy.

On Thursday, we posted the following:

“Today’s Chart of the Day is probably one of the most important macro charts to understand, yet is so underappreciated. The chart highlights that net purchases of U.S. Treasury debt by foreign investors (central banks, governments, corporations, and citizens) have been negative over the last two years. This is occurring as deficits topple the $1 trillion mark. In other words, not only are trillion dollar deficits being entirely funded with domestic funds, but domestic funds must also absorb the foreign net selling. To better understand the implications of this new dynamic, we suggest reading an article we wrote in June titled Who is Funding Uncle Sam?“

The problem is something we have discussed previously, which is a “dollar funding shortage.” In other words, the Treasury needs to sell bonds to cover deficit spending. If there is a “shortage” of buyers, then the Treasury can’t “raise the money” it needs to meet spending demands.

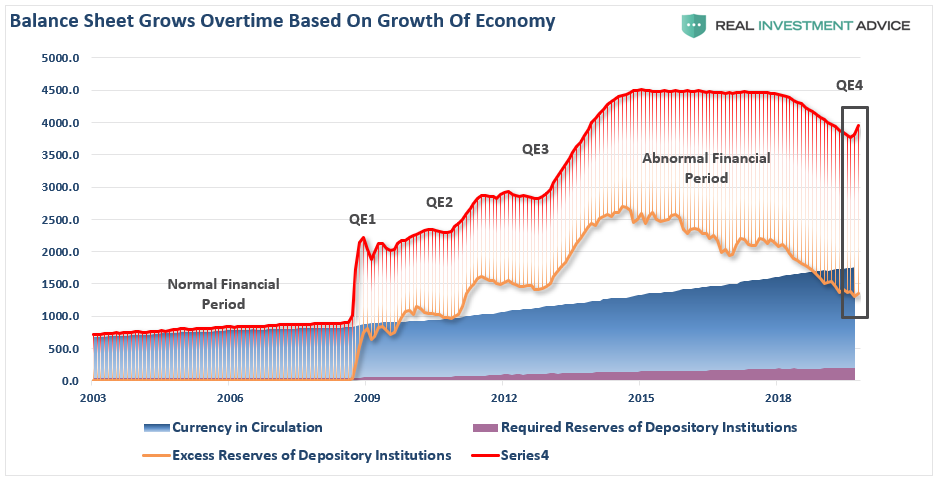

Hence the need for the Fed to step into to monetize existing debt so domestic issuers can take up new issues. We believe the funding situation is one causes of the overnight funding issues, and the sudden introduction of QE. As shown, despite deficits not being as large as in the last recession, the amount of domestic funds required to fund the Treasury deficit is now larger.

Regardless of the reason, the Fed is injecting liquidity into the market at the highest pace since the Financial Crisis.

This certainly doesn’t suggest that “All is well in Denmark.”

So, how do we “play it?”

Playing QE4

Tuesday’s article, “It’s Crazy, But We Are Adding Equity Risk,” was based on research we did for our portfolio allocation models.

“While it may seem ‘crazy,’ it is for these reasons, despite the longer-term bearish backdrop, that we need to ‘gradually’ and ‘incrementally’ increase exposure for the next couple of months. Importantly, I did not say leverage up and buy speculative investments. I am suggesting a slight increase in exposure toward equity risk, as opportunity presents itself, until we have an allocation model that both hedges longer-term risks, but can take advantage of shorter-term bullish cycles.”

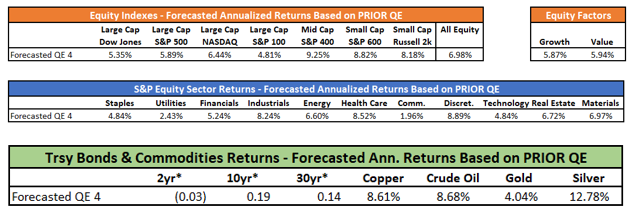

That research was just published for our RIAPro subscribers (Click here for a 30-day FREE Trial to read the entire report) which revealed the performance of equities, commodities, and bonds during periods of QE.

Here is an excerpt:

“If we assume that assets will perform similarly under QE 4, we can easily forecast returns using the normalized data from above. The following three tables show these forecasts. Below the tables are rankings by asset class as well as in aggregate. For purposes of this exercise, we assume, based on the Fed’s guidance, that they will purchase $60 billion a month for six months ($360 billion) of U.S. Treasury Bills.”

Not surprisingly, during periods of QE we find that:

-

Markets exhibit higher volatility.

-

Defensive positioning underperforms relative to the S&P 500.

-

Growth stocks outperform (on a relative basis.)

-

Longer-term bond yields rise while shorter-term yields were flat, resulting in steeper yield curves in all three instances.

-

Copper, crude oil, and silver outperformed the S&P 500.

This data supports our recent changes in positioning where we have taken profits in our defensive positions like utilities and staples, and are increasing exposure to cyclical and growth sectors.

“This is why we continue to maintain a long-equity bias in our portfolios currently. We also recently slightly reduced our hedges, along with some of our more defensive positioning. We are still maintaining slightly higher than normal levels of cash.”

In our equity portfolio we have also added positions to take advantage of the steeper yield curve, while shortening duration and increasing credit quality in our bond portfolios to hedge against higher rates.

(Our portfolios are displayed “real time” at RIAPro.)

While we believe that QE4 will likely provide some upside bias (Our target expectation is 3300) there are significant differences between QE4 and QE1, namely the entire economic and financial backdrop are entirely reversed.

“The critical point is that QE and rate reductions have the MOST effect when the economy, markets, and investors have been ‘blown out,’ deviations from the ‘norm’ are negatively extended, confidence is hugely negative. In other words, there is nowhere to go but up.

The extremely negative environment that existed in 2009, particularly in the asset markets, provided a fertile starting point for monetary interventions. Today, the economic and fundamental backdrop could not be more diametrically opposed.”

While another $2-4 Trillion in QE might indeed be successful in further inflating the third bubble in asset prices since the turn of the century, there is a finite ability to continue to pull forward future consumption to stimulate economic activity. In other words, there are only so many autos, houses, etc., which can be purchased within a given cycle. There is evidence the cycle peak has been reached.

If we are correct, and the effectiveness of rate reductions and QE are more diminished that many expect. There is a limit to just how many bonds the Federal Reserve can buy, and a deep recession will likely find the Fed powerless to offset much of the negative effects.

If more “QE” works, great. We are positioning for it.

But, as portfolio managers taking care of our clients retirement savings, we are maintaining hedges and plenty of “risk controls” just in case things don’t work out as planned.

https://ift.tt/32Nifhk

from ZeroHedge News https://ift.tt/32Nifhk

via IFTTT

0 comments

Post a Comment