Worldwide Semiconductor Sales Continue To Plunge

A return to macro is on every money managers' mind this week as global equity futures plunge to a one-month low following US manufacturing activity tumbling to levels not seen since the last financial crisis.

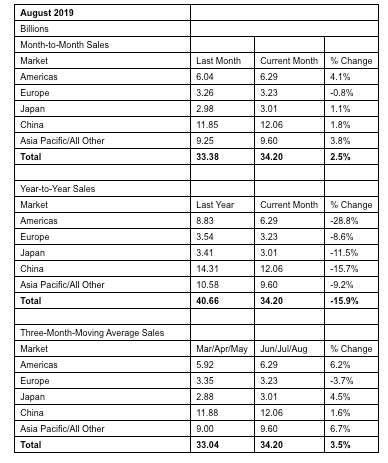

And more evidence of global slowdown was found in the latest report from the Semiconductor Industry Association (SIA) on Tuesday, who warned, semiconductor sales are plunging around the world. SIA said worldwide sales of semiconductors were $34.2 billion in August, a 15.9% drop YoY.

Monthly sales showed the August figure of $34.2 billion, was 2.5% higher than July 2019 total of $33.4 billion, these sales were compiled by the World Semiconductor Trade Statistics (WSTS) organization.

John Neuffer, SIA president and CEO, was rather pessimistic on the global semiconductor industry, indicating YoY changes in sales were disappointing in the Americas.

"While worldwide semiconductor sales remain well behind the totals reached in 2018, month-to-month sales increased in two consecutive months for the first time in nearly a year," said Neuffer. "Sales into the Americas market were mixed, decreasing significantly year-to-year but increasing more than any other region on a month-to-month basis."

On a regional basis, MoM sales increased slightly in late summer. The Americas saw a 4.1% MoM increase from July to August, the Asia Pacific/All Other 3.8%, China 1.8%, Japan 1.1%, but a decline -.8% in Europe.

However, it was the YoY sales that frightened Neuffer, who wasn't completely clear if a bottom would be seen in the global semiconductor industry this year. Semiconductor sales YoY in Europe were -8.6%, the Asia Pacific/All Other -9.2%, Japan -11.5%, China -15.7%, and Americas -28.8% for the August period.

In this cycle, semiconductors are considered an economic bellwether of the global economy, because the chips are central to everything that's modern or electronic, whether it's automobiles, smartphones, robots, airplanes, televisions, computers, and fifth-generation cellular networks. So when demand for, let's say automobiles, severely declines, like Toyota reported a 16.5% YoY drop in September car sales, that would force the car manufacture to slow production, thus delay the need for more semiconductor chips.

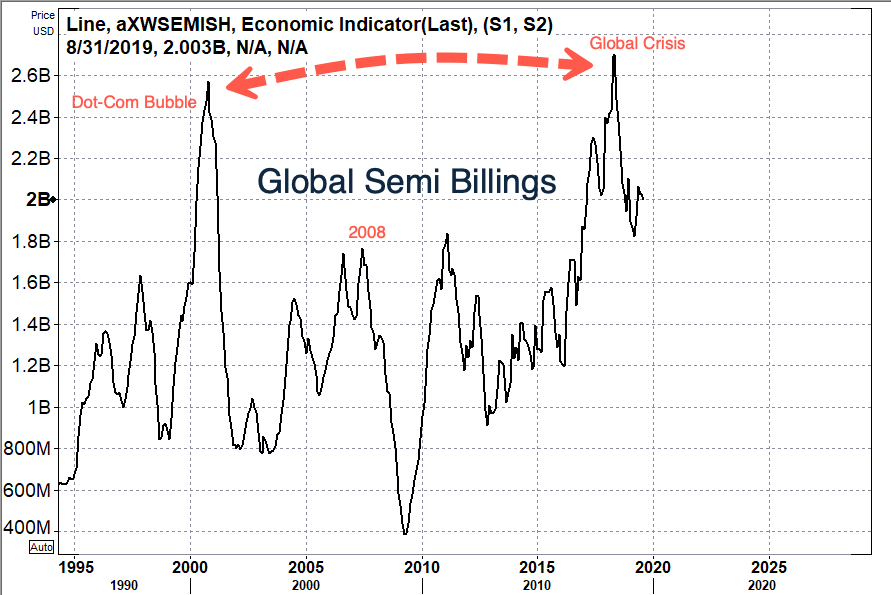

Shown in the chart below, Global semiconductor equipment billings peaked in April 2018.

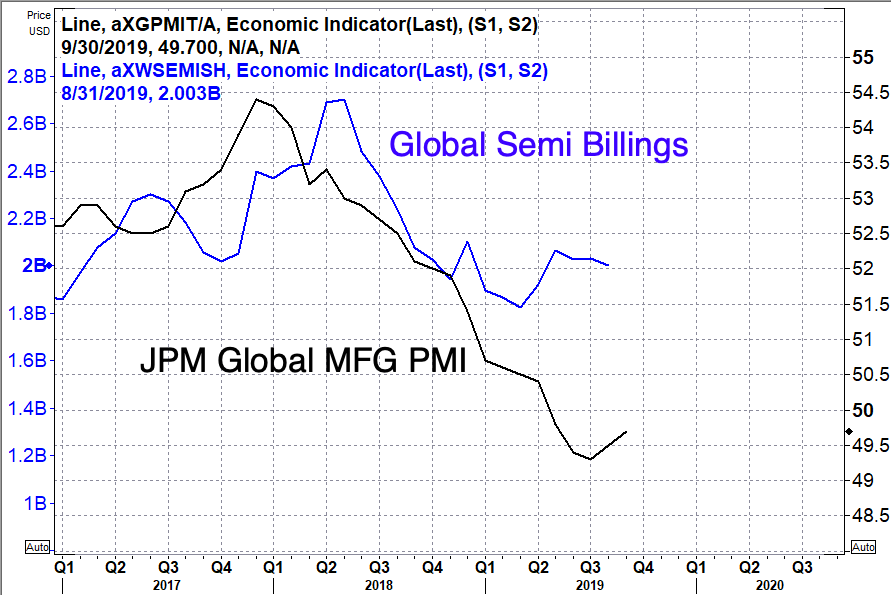

J.P.Morgan Global Manufacturing PMI peaked in December 2017, then shortly after, Global semiconductor equipment billings moved sharply lower in 2H18.

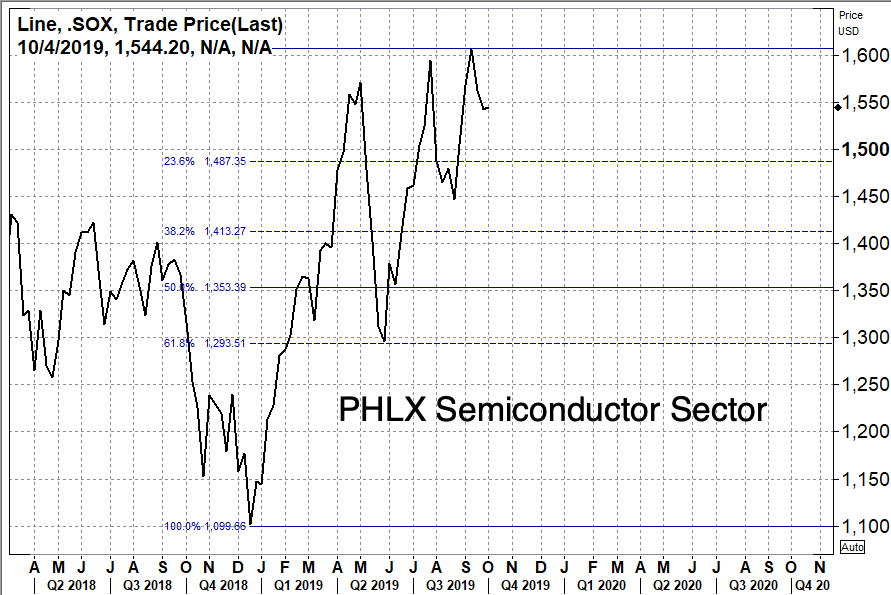

PHLX Semiconductor Sector has nearly doubled in the last 38 weeks, moved up 46%. If a return to macro event is underway, and risk assets are repriced into fall/winter, this would mean semiconductors stocks are headed for catastrophe.

https://ift.tt/335JXFF

from ZeroHedge News https://ift.tt/335JXFF

via IFTTT

0 comments

Post a Comment