Fed Policy And The Wuhan Coronavirus

Submitted by Nicholas Colas of DataTrek,

When all you have is a hammer, everything looks like a nail. Abe Maslow, the same fellow who developed the “hierarchy of needs” paradigm in human psychology, popularized that phrase to warn scientific researchers about the perils of using tools inappropriate to the task at hand.

It is an especially relevant observation when it comes to Federal Reserve monetary policy, since the hammer of interest rates is the central bank’s chief tool. Balance sheet expansion, such as that used to combat recent repo market tensions, also rattle around in their toolbox, of course. But rate policy is their go-to implement to achieve the goals of stable prices and economic expansion.

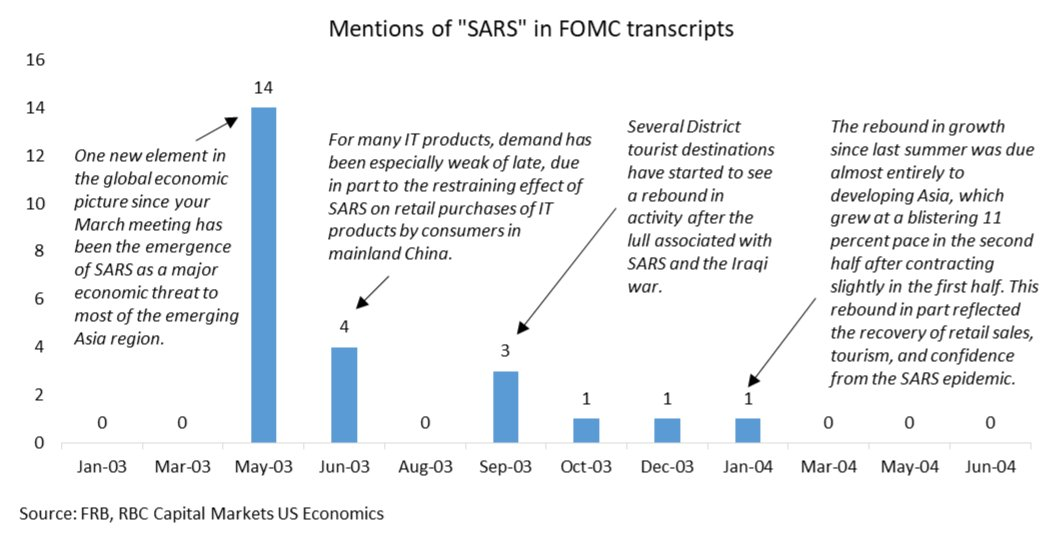

With this week’s FOMC meeting and Chair press conference, the Fed’s hammer will see a fresh test, and one for which it is hardly suitable: addressing the growing global economic uncertainty around the Wuhan coronavirus. As we outlined last week in our review of a Davos panel on the subject, any vaccine is at best months away. In the interim, China is aggressively moving to quarantine entire cities and limiting mass gatherings. Cases are cropping up around the world, and while the illness seems to be less deadly than SARS it is spreading more quickly at present.

Capital markets are beginning to discount the possibility that the Fed will use their interest rate hammer to offset growing economic uncertainty caused by the outbreak:

#1: 2-year Treasury yields broke to below 1.5% on Thursday to 1.486% and closed Friday at 1.495%, which we interpret as a response to concerns about near term global growth. Why that’s an important development.

- 2-years are keenly sensitive to market opinion about future rate policy.

- This is the first time they are below 1.5% since September/October’s global bond rally related to fears over US-China trade talks and recession worries.

- Yields here are now just below the current 1.50% – 1.75% benchmark for Fed Funds, implying that the central bank will cut interest rates.

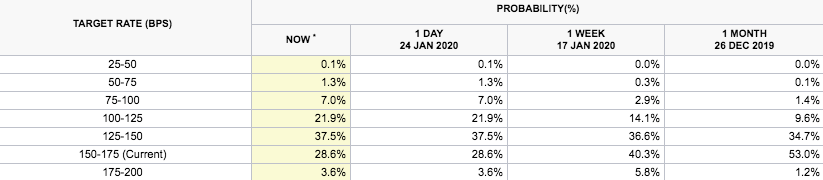

#2: Fed Funds Futures have moved noticeably in the last week, with increasing odds for a 2H 2020 rate cut (or two):

- Futures discount stable Fed Funds through Q1. The odds that rates remain unchanged through the March meeting have not budged in the last week and run 84% – 86%.

- The story changes when you look at the odds around the June 2020 FOMC meeting. A week ago the probability of a rate cut by then was 14%; now it is 25%.

- Last week’s trend to higher expectations for a 2020 rate cut increase as you look at September’s contracts. A week ago, the odds that rates would be lower than today were 37%; now they are 50%.

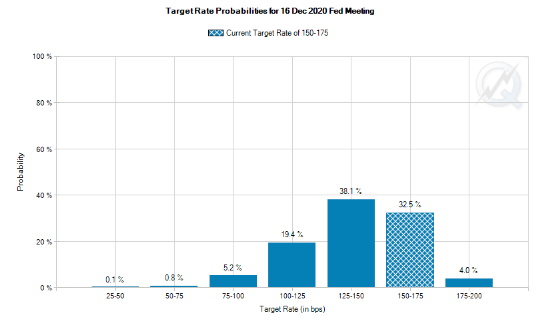

- Fast forward to the December 2020 meeting (chart below, courtesy of the CME FedWatch Tool), and the odds that the Fed cuts rates this year rose last week to 68% from 54%. Moreover, the probability that the Fed cuts by 50 basis points or more rose from 17% to 30% last week.

In summary: it is far too early to tell what effect the coronavirus may have on the global/US economy, but markets are increasingly assuming the economic effects of this public health crisis will inform US central bank policy. While the Fed’s rate tool obviously plays no role in finding a treatment or vaccine for the coronavirus, investors expect the FOMC will do its best to inoculate the US economy against its effects. It is, however, still a hammer…

https://ift.tt/37AgPZZ

from ZeroHedge News https://ift.tt/37AgPZZ

via IFTTT

0 comments

Post a Comment