"Prices Start To Sink At Record Paces" - Manhattan Luxury Home Prices Plunge To 2013 Levels

Luxury home prices in Manhattan continue to decline, pressured by Bill de Blasio's "Mansion Tax" and the capping of SALT deductions included in President Trump's tax deal. Prices of these luxury homes, which constitute the top 20% of the market, fell to their lowest levels since 2013, according to a new report via StreetEasy.

Luxury homes, priced at or above $3,816,835, dropped 6.1% in the fourth quarter over the previous year. Sellers are beginning to accept a declining market that has shifted to buyers -- where prices are being negotiated to the low end – in return, this has created downward momentum in prices.

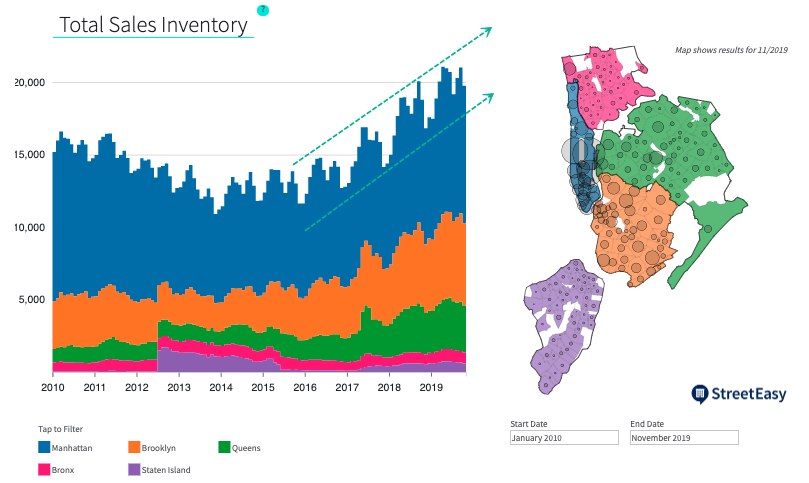

StreetEasy said inventory soared last quarter by 12.2% over the previous year, with at least 4,354 luxury homes sitting on the market.

"With so much new construction saturating the Manhattan real estate market, we were bound to see prices start to sink at record paces," said StreetEasy Economist Nancy Wu.

"This is happening across all price points and boroughs, as prospective buyers wait out the market from the comfort of their rentals. Market dynamics in 2020 will continue to favor the buyer across all price tiers, and many sellers will have to face the fact that if they want to sell, it may very well be for less than their initial asking price," Wu said.

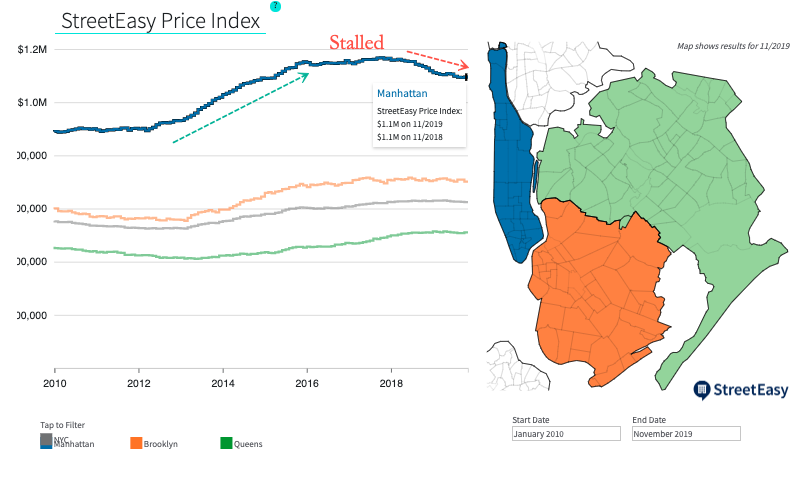

For all homes in the borough, the StreetEasy Manhattan Price Index fell 3.7% last quarter over the prior year, to $1,086,217. Inventory for homes in the district rose 3%, with homes staying on the market for at least 96 days, ten more than the prior year. The report notes that it's a buyer's market as inventory continues to build.

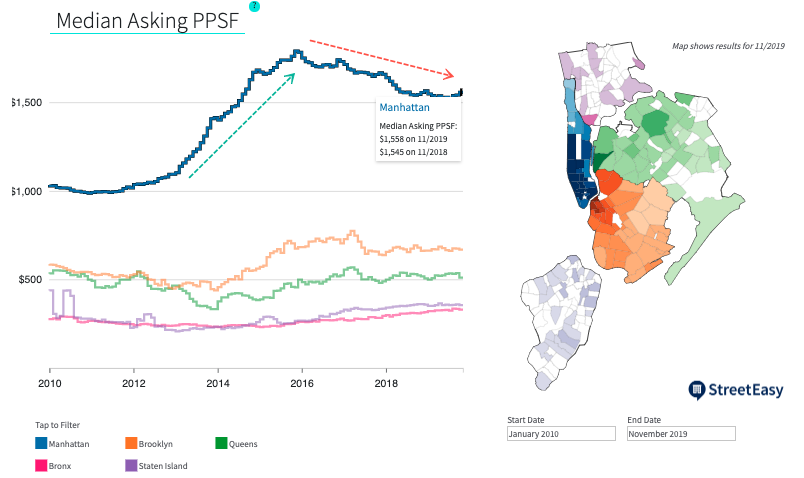

The Median Asking Price Per Square Footage (PPSF) for Manhattan homes jumped 80% from $1,000 in 2010 to $1,800 in 2015 – has since declined 14% to $1,550.

Total Sales Inventory for Manhattan homes has been surging in the last five years.

With a decade-long economic boom starting to wane as the Federal Reserve cuts rates three times and injects hundreds of billions of dollars in emergency funds into REPO markets, sparking potential blow-off tops in stocks-- everybody's anxieties about a persistent slowdown could continue to weigh on luxury real estate in New York and elsewhere.

https://ift.tt/2t4ll43

from ZeroHedge News https://ift.tt/2t4ll43

via IFTTT

0 comments

Post a Comment