Italian Bonds Rally As League Loses Critical Vote

League Party Leader Matteo Salvini has been stymied in his mission to destabilize and destroy Italy's ruling coalition government.

Yesterday, voters in Emilia-Romagna, a prosperous region in Italy's north that has long been considered part of the country's "red belt," sided with the center-left once again and elected its candidate, Stefano Bonaccini, to serve as governor of the region for five years. Bonaccini won 51.4% of the vote, beating out League senator Lucia Borgonzoni, who won 43.7%. Borgonzoni was the candidate of a center-right coalition. Voters also headed to the polls in Calabria yesterday in an election which the League candidate handily won, as was expected.

While the League remains the most popular political party in Italy, Emilia Romagna is part of the so-called "red belt" - a region of the country that for decades supported the Italian Communist Party (once the largest Communist Party in Europe) before moving to the center-left Democratic Party (or PD) after the fall of communism. Polls ahead of the vote showed that Borgonzoni and Bonaccini were running neck-and-neck, suggesting that the region might be the latest left-wing stalwart to embrace Salvini's tough-on-immigration agenda. The League also triumphed in the region during the EU parliamentary elections in May, becoming the leading party with 34% of the vote to the PD's 31%. And after Salvini led the League to an upset in Umbria three months ago, many observers bet that he would repeat that same feat.

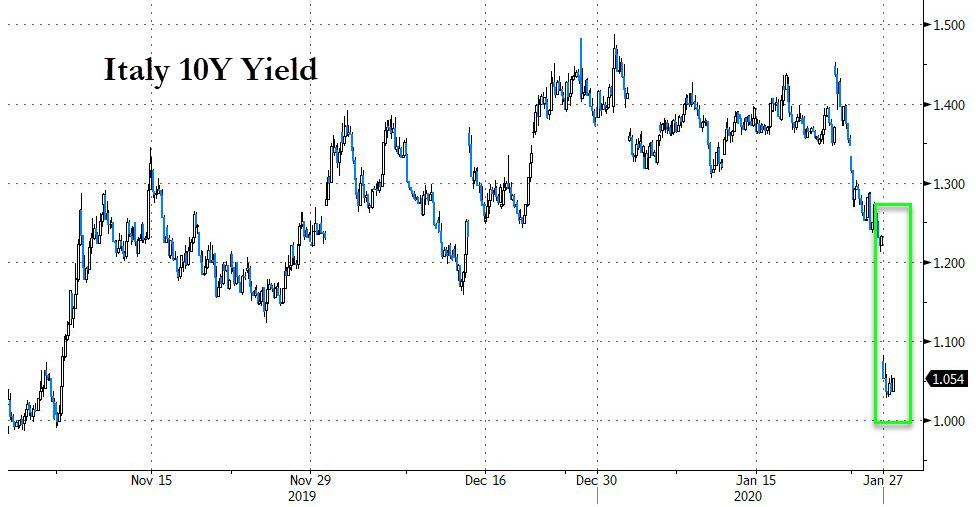

Italian government bonds (known as BTPs) rallied, compressing the spread with German bunds to its tightest level since November. Analysts claimed the risk of imminent collapse for the Italian government had abated - for now, at least.

"With the centre-left win in Emilia-Romagna, the risk of a government crisis in the short term has receded somewhat," said analysts at Barclays in a note to investors. "Yet many hurdles persist: [among them] the future nature of the coalition with a fractured Five Star Movement, the thin majority in the Senate [and] the regional and referendum votes further into 2020."

As one WSJ reporter pointed out, this is hardly the first time that fears of political instability led to a blowout in spreads, only for Italian bonds to rally on the big risk-off headline.

Here's the Italian bond spread after Emilia-Romagna elections. At this point, I'm surprised nobody has set up a "Non-Eurozone Breakup Income Fund" that basically longs any significant widening in euro spreads. Works every time. pic.twitter.com/9oNlUzwosd

— Jon Sindreu (@jonsindreu) January 27, 2020

To be sure, tensions in Italy's ruling coalition - between the center-left PD and anti-establishment Five Star Movement - remain tense, even after longtime M5S leader resigned from the leadership last week in a bid to save the coalition. Despite this, Goldman Sachs said it expects BTPs to outperform, seeing more room for yield compression between bunds and BTPs.

The 10-year BTP yield slid 16 basis points lower to 1.08% bringing the spread to the 10-year bund to 142 bps, the narrowest since Nov. 8 as the ruling coalition looks to stay in power until at least the first half of 2021.

But before you pile in to BTPs, the FT's Tony Barber offers some food for thought: Though this loss was Salvini's second political miscalculation in the last six months, "the overall political momentum" is still behind him. And the ruling coalition of former sworn enemies has been riddled with gridlock. The only thing they seem to agree on is that they don't want Salvini to become prime minister.

https://ift.tt/2GnV03Y

from ZeroHedge News https://ift.tt/2GnV03Y

via IFTTT

0 comments

Post a Comment