Black Monday: Dow Futures Down 800, Europe Crashes Most In Four Years; Gold, VIX Soars

And just like that the complacency is gone with a bang.

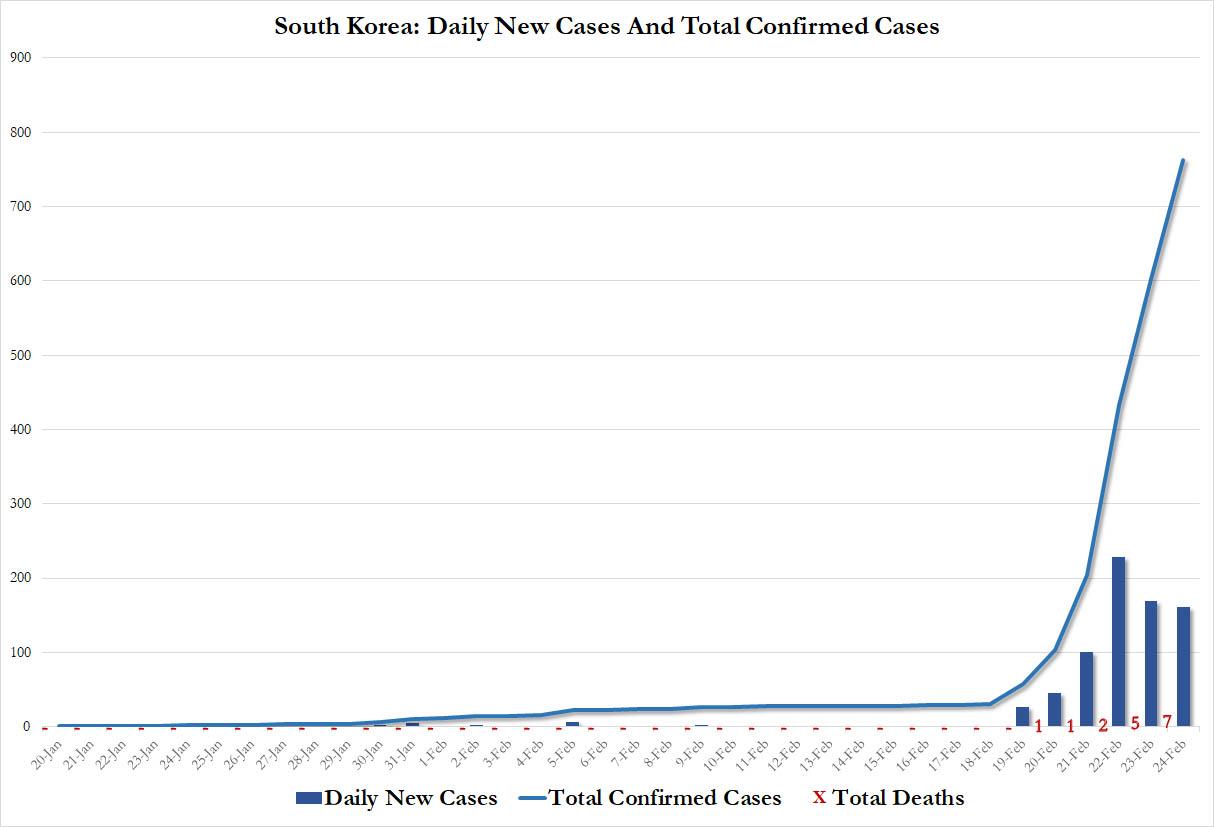

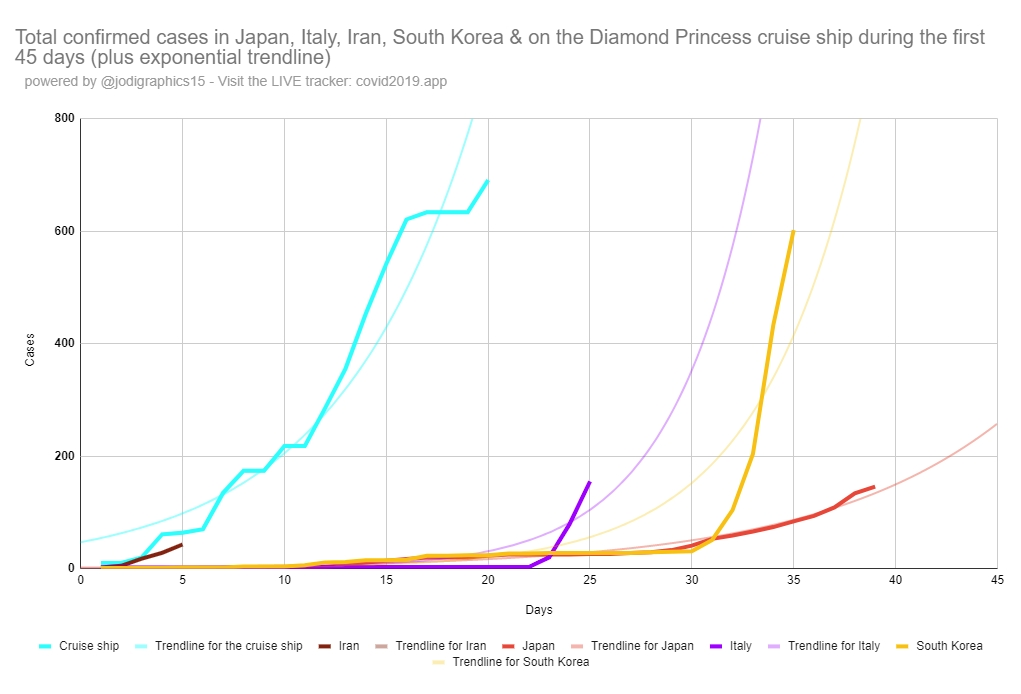

With traders having learned to ignore coronavirus news thanks to manipulated and fabricated new case "data" out of China showing the pandemic was easing, on Monday markets got a very rude wake up call and plunged after South Korea and Italy reported a sudden surge in news cases as two new offshore viral clusters emerged. As Saxo Bank's Eleanor Creagh writes, with South Korea - a key supply chain center and logistics hub - now on high alert level, the latest spike in overnight cases is intensifying the already ongoing regional supply chain disruptions.

The coronavirus has now killed 2,592 people in China (and like orders of magnitude more) which has reported 77,150 cases, and spread to some 28 other countries and territories, with a death toll outside of China around two dozen. And while equities to date had been resilient in ignoring the data, with contagion picking up outside of China, complacent markets have woken up to the realities of what has clearly been a huge mispricing of risk, and the result is nothing short of a global bloodbath in what is shaping up to be "Red Monday":

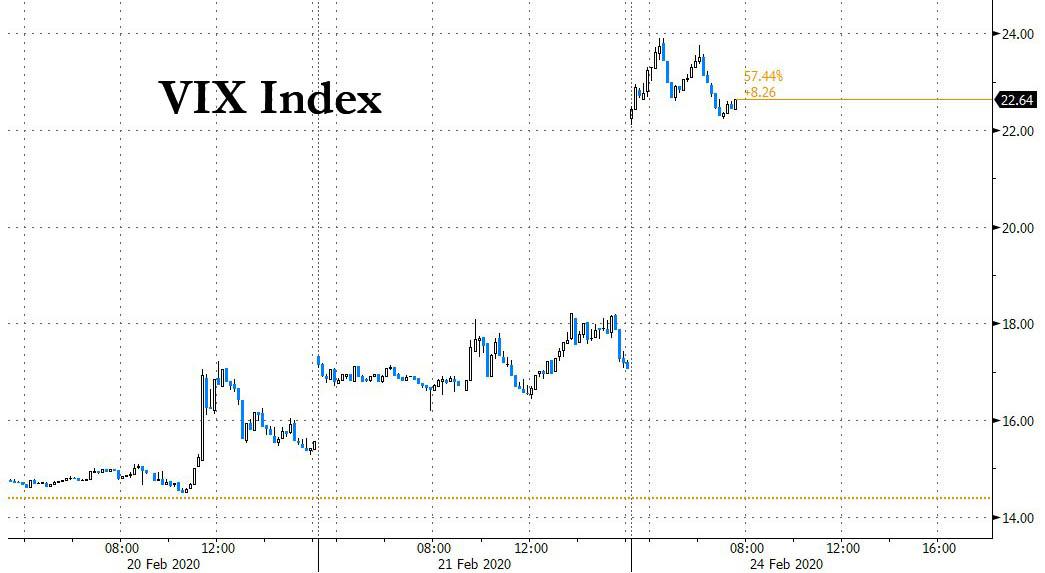

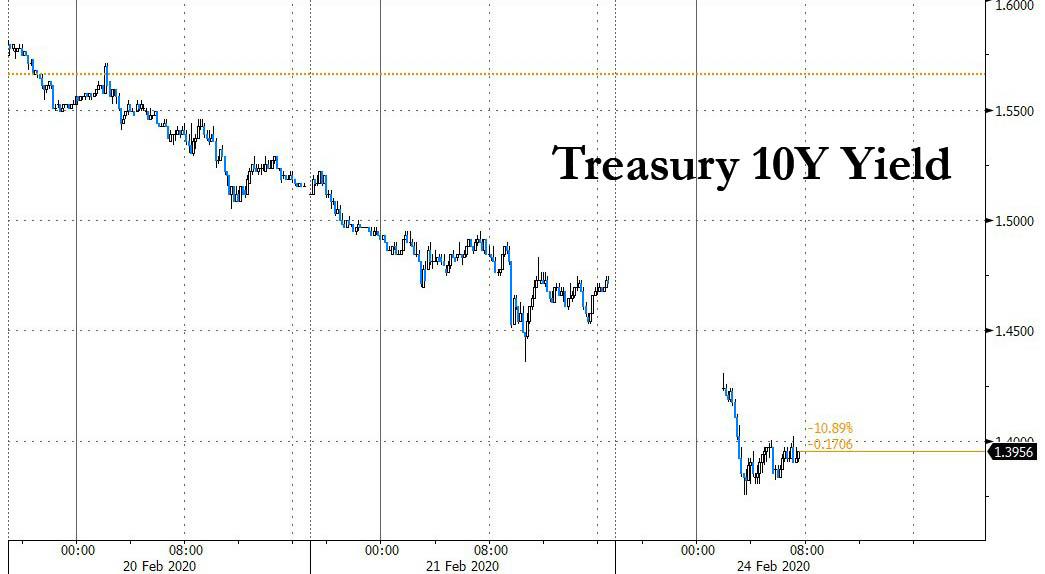

As a result, US index futures tumbled alongside stocks in Europe and Asia on Monday, as authorities struggled to keep the coronavirus from spreading more widely outside China, and to keep investors happy after China failed to impress markets with the raft of stimulus measures announced over the weekend. Safe-havens such as gold surged and U.S. Treasury yields reached their lowest since mid- 2016, as volatility indicators exploded.

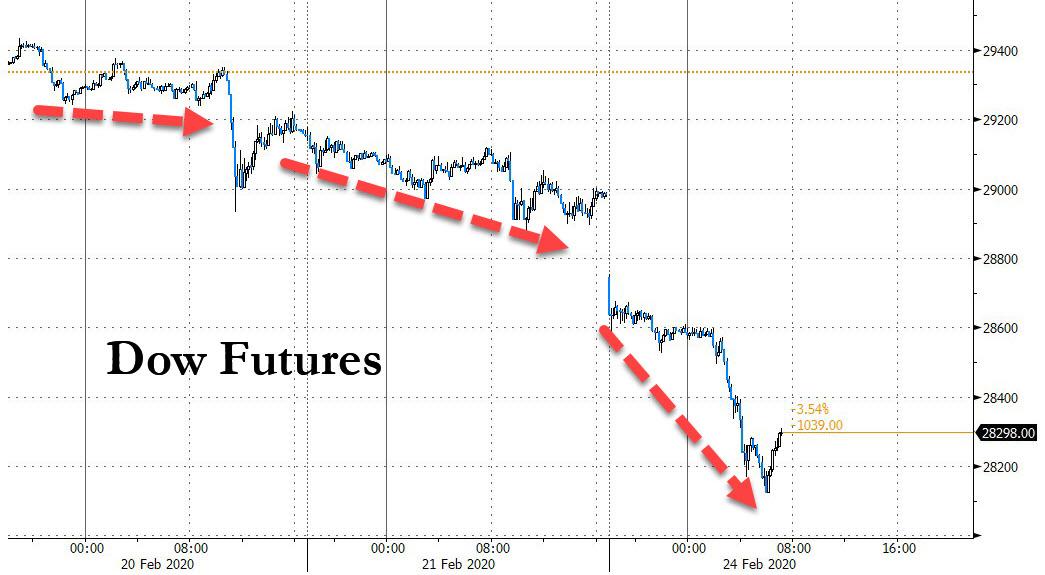

After closing just below 29,000 on Friday, Dow futures plunged over 800 points before stabilizing modestly, and on pace for erasing all 2020 gains.

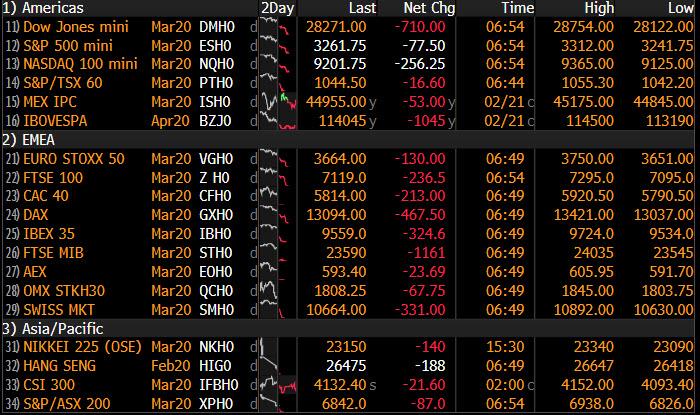

Alongside the crash in the Dow, all three key U.S. index futures were down more than 2%, with S&P 500 Eminis pointing to the biggest drop since August. Nasdaq 100 future contracts tumbled as much as 3.2%, the most among future contracts for major U.S. indexes, crippling the market-leading tech rally, as anxiety about the spread of coronavirus upended bullish sentiment toward tech shares. And as US futures tumbled, the VIX index surged to its highest since August, rising as high as 23.90.

Europe's Stoxx Europe 600 Index took a beating early, dropping as much as 3.6% on twice its average volume - it has only dropped more than 3% on just two other occasions in the past four years - and was heading for the largest drop since Brexit, as investors fled travel and luxury-goods shares, while an index of credit risk on the region’s high-yield companies soared.

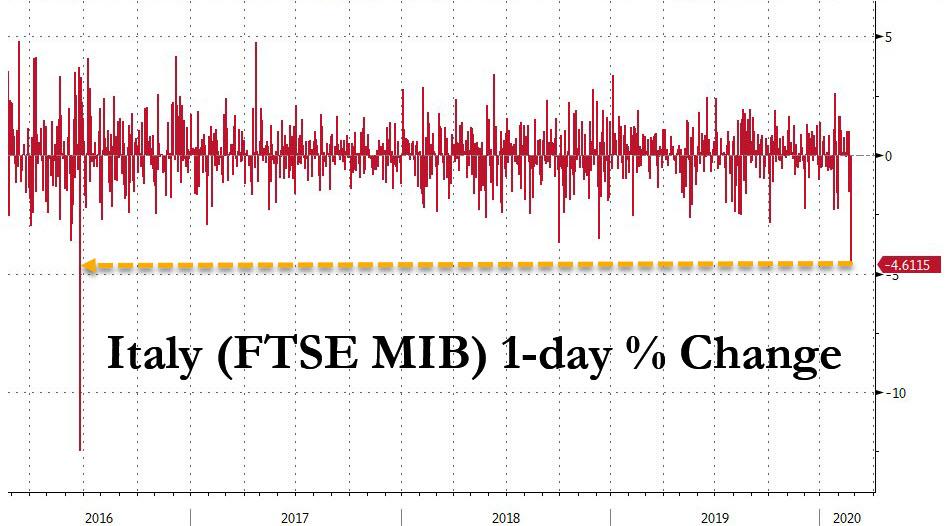

Gripped by a panic that it is emerging as Europe's own coronavirus supercluster, Italian shares crashed almost 5%, also the biggest drop in nearly four years after a spike in cases of the virus left parts of the country’s industrial north in virtual lockdown. Frankfurt and Paris were both down more than 3% and London’s FTSE dropped 2.5%, meaning at least $350 billion had been wiped off the region’ market value.

Italy’s borrowing costs soared after the government imposed a lockdown on an area of 50,000 people near Milan, with infections in the country rising to about 150 from just a handful a week ago.

Over in Asia, "reality bites" as the spread of coronavirus picks up outside China. Reports of 161 new confirmed cases in South Korea has spurred risk aversion even deeper. South Korea's fall to the pandemic is intensifying the already ongoing regional supply chain disruptions. Shutdowns and production delays have the capacity to cause unexpected bottlenecks across many production lines even if the virus spread peaks soon. And it is those non-linear supply side effects like production bottlenecks that are the real wildcard in terms of further downgrades to growth, earnings and longer term disruptions. As a result, South Korea’s benchmark dropped 3.9%, leading declines across Asia, after the government declared a high alert. The number of infections jumped to 763 and deaths rose to seven.

Elsewhere, in Asia, Australia’s benchmark index slid 2.25% and New Zealand fell about 1.8%. China’s blue-chip CSI300 index closed down 0.4%. That left MSCI’s broadest index of Asia-Pacific shares outside Japan at its lowest since early February. Japanese markets were closed for a public holiday.

Iran, which announced its first infections last week, said it had confirmed 43 cases and eight deaths, with most of the infections in the holy city of Qom. Saudi Arabia, Kuwait, Iraq, Turkey and Afghanistan imposed travel and immigration restrictions on the Islamic Republic.

"There is lots of bad news on the coronavirus front with the total number of new cases still rising,” AMP chief economist Shane Oliver wrote in a note. "Of course, there is much uncertainty about the case data. New cases outside China still look to be trending up."

As panicked investors (why were they not selling for the past month one will never know) dumped risk assets, they flooded into safe havens, and as a result the yield on 10-year Treasuries sank to its lowest since 2016, plunging to near all time lows, and sliding below the 1.40% level which according to BofA indicated a recessionary "tipping point." The 30-year Treasury touched a record low at 1.84% and German yields dropped to -0.475%, their lowest in more than four months

"Everybody sees that this could be another leg down for the economy, and we were already in quite a fragile state to begin with,” said Rabobank’s head of macro strategy, Elwin de Groot. "It could be another step toward a recession in more countries."

Meanwhile, that other safe haven, gold, approached $1,700, while Brent crude oil tumbled almost 4%.

As noted over the weekend, the Monday selling panic was triggered by multiple outbreaks of the epidemic that’s now spread to more than 30 countries, with South Korea reporting a jump in infections and Italy locking down an area of 50,000 people near Milan.

Finance chiefs and central bankers from the largest economies warned this weekend that they saw the virus bringing downside risks to global growth; unfortunately there is nothing they can print to stop the virus from spreading, and no tax cuts will prevent the collapse of critical global supply chains.

Meanwhile, as investors bet central banks would step in with policy stimulus to support economic growth, U.S. fed fund futures signaled more rate cuts later this year and a near 20% chance of a cut next month. The yen rallied - regaining its status as a risk-off safe haven - as did the US dollar amid the scramble for safety. Scandinavian currencies and the Australian and New Zealand dollars fell; Norway’s krone dropped against all Group-of-10 peers as oil prices took a new hit, while the Aussie slumped after South Korea raised its infectious-disease alert level to the highest available, and G-20 officials cited downside risks to global growth from the coronavirus. Korea’s won was last down 1% at 1,219.06 after falling to its weakest since August 2019. Emerging-market currencies from Mexico’s peso and Turkey’s lira to Poland’s zloty and Russia’s rouble were in the red.

In commodity markets, Brent crude fell 3.5%, or $2.1, to $56.35 a barrel. U.S. crude dropped 3%, or $1.64, to $51.74 a barrel. Among the main industrial metals, copper fell 1.4% and zinc was down 2.5%.

Expected data include Chicago Fed National Activity Index, and Dallas Fed Manufacturing Outlook. HP Inc, Intuit and Shake Shack are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 2.7% to 3,249.25

- STOXX Europe 600 down 3.5% to 413.20

- MXAP down 1.3% to 164.30

- MXAPJ down 2.2% to 533.03

- Nikkei down 0.4% to 23,386.74

- Topix down 0.03% to 1,674.00

- Hang Seng Index down 1.8% to 26,820.88

- Shanghai Composite down 0.3% to 3,031.23

- Sensex down 1.9% to 40,399.19

- Australia S&P/ASX 200 down 2.3% to 6,978.28

- Kospi down 3.9% to 2,079.04

- German 10Y yield fell 6.6 bps to -0.497%

- Euro down 0.2% to $1.0825

- Italian 10Y yield rose 0.6 bps to 0.746%

- Spanish 10Y yield fell 2.5 bps to 0.201%

- Brent futures down 3.6% to $56.42/bbl

- Gold spot up 2.6% to $1,686.73

- U.S. Dollar Index up 0.3% to 99.54

Top Overnight News from Bloomberg

- Italy, now the virus’s epicenter on the continent, is studying measures to support the local economy

- Infections spiked again in South Korea and Iran, while Afghanistan, Bahrain and Kuwait all reported their first cases

- President Xi Jinping urged China to “spare no effort” to contain the coronavirus outbreak in Beijing, as the nation’s top legislature postponed its annual legislative session in the capital to help check the disease’s spread

- The U.S. will sign military deals worth more than $3 billion with India on Tuesday, President Donald Trump said at the start of a two-day state visit to the South Asian nation

- The victory by hard-liners in Iran’s election puts parliament back in the hands of people determined to turn the clock back on reconciliation with the West

- Chancellor Angela Merkel’s Christian Democratic Union is trying to pick up the pieces after a state election defeat in Hamburg drove home public alarm over divisions in Germany’s leading party

Asian equities traded with steep losses across the board following Wall Street’s decline on Friday, amid the rapid rise in the number of coronavirus cases outside China - which prompted the Dow to post its worst daily performance since February 7th, S&P recorded its largest one-day loss since late-January, whilst the Nasdaq notched its worst session since January 27th. Furthermore, weekend development caused US equity futures to open the week with notable downside, with S&P Mar’20 dipping below 3300, Nasdaq Mar’20 declining over 1.5% and DJ Mar’20 slumping over 300 points. ASX 200 (-2.3%) was pressured by its large-cap financial stocks and some mining stocks as yields and base metal prices fell, instigating a breach below the key 7000 mark in the index. South Korea’s KOSPI (-3.8%) opened with detrimental losses following the spike in the number of cases in the country alongside seven confirmed deaths and the country’s alert level raised to the “highest” over the weekend, resulting in the index dipping below the 2100 psychological level. Furthermore, Samsung Electronics’ shares slid over 3% after the Co. shut its operations plant in Gumi City in South Korea after an employee was reported to be infected with the COVID-19 virus. As a reminder, Japanese markets were shut as participants observe Emperor’s Birthday holiday. Elsewhere, Hang Seng (-1.8%) and Shanghai Comp. (-0.3%) joined the stock rout, with the former heavily pressured by its large-cap energy names as prices in the complex plumb the depths. Meanwhile, Mainland was initially resilient in comparison amid further pledges by China to support impacts of the virus, with President Xi over the weekend stating that the government will step up policy support to help achieve economic and social development targets for 2020. Conversely, Shenzhen Comp. (+1.3%) fared better after Guangdong, the province in which the tech hub resides in, lowered its coronavirus response level from the first level to the second level, subsequently, Shenzhen traffic saw an uptick today. Finally, UST Mar’20 futures and Bund Mar’20 futures retained an underlying bid overnight amid the risk aversion in the market.

Top Asian News

- S.Korea Moon Calls for Extra Budget Review Amid Virus Spread

- Trump Says U.S. To Sign $3 Billion in Defense Deals With India

- China Asks Residents Not to Travel to U.S., Ministry Says

- Goldman Among Dissenters on Israeli Rates as Price Declines Near

European equities (Eurostoxx 50 -3.7%) have kicked the week off with substantial losses as the lack of containment of the coronavirus grips investor sentiment. Over the weekend, despite efforts by Chinese authorities to assuage concerns over the domestic fallout of the virus, focus instead has been on the pick-up in reported cases external to China. The case count in South Korea has continued to rise with Yonhap’s latest tally amounting to 833 infected, whilst closer to home, fears in Europe have been elevated by Italy reporting 152 cases and a third death from COVID-19; FTSE MIB (-4.7%). Momentum for selling has continued since the cash open with the DAX cash moving ever closer to 13,000 to the downside, whilst futures Stateside paint an equally sobering picture with the e-mini S&P lower by 94 points thus far. From a sectoral basis, airline names stand out as a notable laggard given the travel implications from the increasing case count with easyJet (-12.5%), RyanAir (-10.6%), Tui (-8.8%), Air France (-10%), Deutsche Lufthansa (-6.7%) all showing heavy losses. Elsewhere, the luxury space continues to be a prime target for sellers with Swatch (-5.3%), Richemont (-5.9%), LVMH (-5.3%) all suffering, whilst ongoing concerns over car production has weighed on auto/autoparts manufacturers (BMW -4.7%, Daimler -5.4%, Continental -4.6%, Volkswagen -4.9%) and exacerbated selling pressure for the DAX (-3.8%). In-fitting with price action in the respective complexes, energy and material names are also feeling the squeeze in early European trade, whilst chip manufacturers/IT names are also getting sold aggressively as the e-mini NASDAQ (-3.3%), lags its peers ahead of the Wall Street open.

Top European News

- European Stocks Fall Most Since 2016 After Luxury Sinks on Virus

- Merkel’s Party Seeks Way Out of Crisis After Hamburg Failure

- German Business Sentiment Holds Up Against Virus Concerns

- Barclays CEO Staley Expects to Leave by End of 2021, FT Says

In FX, although Japan’s market holiday may be crimping volumes and supply, heightened concerns about the spread and impact of China’s coronavirus are helping the Yen forge gains vs an otherwise broadly bid Dollar around 111.50 compared to recent lows below 112.00. However, Gold is really shining as a safe-haven beacon and outperforming after accelerating towards Usd1700/oz and setting a fresh multi-year peak around Usd1689.30, with technicians now eyeing a Usd1715 Fib if the psychological barrier is breached.

- USD - As noted above, the Greenback is also benefiting from risk-off flows and the DXY has bounced further from Friday’s post-US preliminary PMI base to reclaim 99.500+ status as a result, even though Treasury yields are collapsing and the curve is significantly flatter. Nevertheless, the index remains some distance from last week’s 2020 best and the elusive 100.00 mark within a 99.405-657 range.

- NOK/CAD/NZD/AUD - The clear G10 laggards, as sharp declines in crude prices compound Chinese nCoV losses for the Norwegian Crown and Loonie, while the Kiwi and Aussie are undermined by their closer geographical location and economic ties to China. Eur/Nok is hovering near 10.1500, Usd/Cad is a whisker shy of 1.3300, with Nzd/Usd struggling to keep hold of 0.6300 and Aud/Usd unable to retain 0.6600 as the YUAN remains sub-7.0000.

- SEK/GBP/EUR/CHF - Also suffering from the China health outbreak, Eur/Sek trades north of 10.5500 and Cable is struggling to stay in touch with 1.2900 ahead of UK-EU trade talks, while Eur/Gbp is at the upper end of 0.8345-93 parameters after a better than expected German Ifo survey that has helped the single currency stave off attempts to test support/underlying bids at 1.0800. Meanwhile, the Franc is still somewhat betwixt and between, with Usd/Chf straddling 0.9800 and Eur/Chf dangling just above 1.0600 after another blow for Germany’s CDU party at the Hamburg election.

- EM - Widespread and steep declines in many cases vs the Usd, with the Krw extending losses for obvious reasons and Rub also feeling the heat as Brent drops over Usd2/brl, while the Try hardly derived any traction from an improvement in Turkish manufacturing confidence given the spread of COVID-19 and ongoing geopolitical issues. Last but not least, the Zar is on the defensive ahead of Wednesday’s SA budget and Mexican Peso even more cautious before mid-February inflation metrics.

In commodities, WTI and Brent front-month futures are posting significant losses at present, in-line with the general risk sentiment as they are both down by circa USD 2.0/bbl. Focus for the crude market is firmly fixated on the demand-side, as the coronavirus’ spread, particularly its marked jump in Italy over the weekend, is heavily impacting sentiment in the auto and travel sector; and as such is increasing concerns of a marked demand impact outside of China as well. Moving to the supply side, where Friday’s reports of Saudi and others looking for a circa 300k BPD addition to production cuts if Russia does not come on-board, which would be instead of the 600k BPD cut the JTC has recommended, did add to the downward price pressures; subsequently, these remarks have been denied by Saudi. Looking ahead, the OPEC+ meeting is now in theory just a matter of days away and focus remains heavily on the official stance from Russia as to whether they will support additional cuts at all, if so to what extent. Turning to metals, where spot gold has galloped ahead overnight with a new YTD high at USD 1689.29/oz on the mass FTQ we are experiencing today – technically, resistance inevitably lies at the psychological USD 1700/oz mark before a fib at USD 1715/oz. Elsewhere, basemetals are firmly in negative territory on the aforementioned sell off and departure from risky-assets; particularly as the virus’ spread outside of China is exacerbating demand concerns for such commodities.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. -0.2, prior -0.4

- 10:30am: Dallas Fed Manf. Activity, est. 0, prior -0.2

DB's Jim Reid concludes the overnight wrap

The news-flow on the COVID-19 Coronavirus has taken a decidedly more negative tone over the last two to three days and we are starting the week with a sizeable risk-off move. The accumulation of reported cases and fatalities in China continue to grew at a slower pace but it’s the spread elsewhere that’s becoming a major worry. Italy has effectively put 50,000 citizens on lockdown with people in several towns in Lombardy and Veneto not able to travel without special permission. Italy now has 157 confirmed cases and 3 deaths and is now the 4th worst country in terms of infections. On Friday morning Italy only had 3 confirmed cases so you can see why concerns are dramatically rising. Last night Austria stopped all trains in and out of Italy and the Italian government has also canceled the Venice Carnival and other mass gathering events. With these sort of headlines markets are going to be very wary today and the next few days are going to be crucial for Italy and Europe to see whether the number of cases continues to rise at a growing rate. Elsewhere, South Korea now has 763 confirmed cases which is up dramatically from 30 a week ago. South Korea is ramping up its virus screening efforts in the city of Daegu, where the majority of cases are located, as it has identified 37,000 people in the city with symptoms of the virus. South Korea also announced yesterday that it is postponing the re-opening of schools after a winter break, scheduled for next Monday, and are restricting military personnel from leaving their base or facility. However, on a slightly better note China’s state run CCTV reported that Guangdong, which has the most confirmed infections after Hubei, has become the 6th Chinese province to lower its coronavirus emergency response level from the highest level. Other provinces are Gansu, Liaoning, Guizhou, Shanxi and Yunnan. Currently, there are 77,150 confirmed cases in China with the death toll at 2,592.

The flip side to the raised concerns is that stimulus talk will grow. The Seoul Shinmun newspaper is reporting that the Democratic Party of Korea has assessed that the nation will need more than KRW 10tn ($8.3bn) in extra budget funding to support the economy and provide aid for losses related to the outbreak. Meanwhile, Chinese President Xi Jinping reiterated that the Chinese authorities will step up policy adjustments to achieve the nation's economic and social goals while fighting the virus outbreak. Bloomberg has also reported overnight that China’s central and local governments are loosening the criteria for factories to resume operations. So it will be crucial to look at the virus spread data as China returns to work. Our Chinese economists have published their latest real-time series of economic indicators overnight (including our latest shipping data). Activity has started to recover but clearly risks remain. See the report here.

Risk off has taken hold in Asia this morning with the Hang Seng (-1.36%), Shanghai Comp (-0.37%) and Kospi (-3.23%) all down alongside most indices in the region. Japanese markets are closed for a holiday. As for fx, the Bloomberg dollar index is up +0.30% this morning. Elsewhere, futures on the S&P 500 are down -1.39% while yields on 10y USTs are down -4.4bps to 1.472%. Spot gold prices are up +1.15% and crude oil prices are down -2.46% overnight.

Coronavirus concerns also dominated the G-20 weekend meeting. Interestingly France’s Francois Villeroy de Galhau and Italy’s Ignazio Visco both said on the sidelines that the euro area governments must shoulder most of the burden for rebooting economies if the coronavirus has a deeper impact on growth. Mr. Visco added that the world economy has two quarters to bounce back from the coronavirus hit before policy makers should unleash coordinated fiscal stimulus.

The other major news over the weekend was from Nevada where Bernie Sanders is on course to comprehensively win the latest Democratic primary. The Senator from Vermont has now won the popular vote in each of the first three states - the first candidate to ever do so for either major party - and now looks to be in a very strong position as the race accelerates into Super Tuesday next week. Former Vice President Biden, rebounded from his first two disappointing finishes, and is currently 2nd at 21.0%. The leader in delegates coming into the night, Mayor Pete Buttigieg, is on track for 3rd place at 13.7%. As the other 12% of the vote comes in, he needs to climb over the 15% threshold to be eligible to receive any proportional delegates from the state. Senator Elizabeth Warren is currently 4th with 9.6%, however neither she nor any other major candidates have indicated they are going to drop out of the race so far. With a debate tomorrow ahead of the South Carolina primary, watch for the more moderate-left candidates to attack Sanders and try and stall his momentum, something that did not happen last week as most of the focus of the last debate was on newcomer Mayor Bloomberg, who was not on the ballot in Nevada. The odds on a comeback by the field might be slimming though. Since 1972, only one candidate - President Bill Clinton - has received the Democratic nomination after failing to secure a primary victory in one of the first 3 states. It still feels the market is way too relaxed about the US election later this year.

Staying with politics, in Germany we had elections in the state of Hamburg yesterday where Merkel’s CDU posted its worst result post WWII (with 11.2% of the vote) while the Greens (24.8%) almost doubled their support. The city-state’s governing Social Democratic Party secured a clear victory with about 38.6%, even as its support eroded from 45.6% five years ago. Overall the CDU’s weak performance is likely to have bearing on the leadership crisis in the party. So watch this space.

Moving on now to look at the week ahead before we review last week in markets. In this final week of February, the virus development outside of China will take center stage and will drive markets. Outside of this, politics will be a big focus after Sanders emphatic victory in Nevada. We have the final Democratic presidential debate in South Carolina tomorrow before the primary there on Saturday and Super Tuesday a week after the debate. As for data, a second look at Q4 GDP in the US as well as PCE inflation, regional manufacturing reports and sentiment indicators are all due, while in Europe Germany’s IFO survey is expected.

Given the virus influenced the weak flash US PMI on Friday, albeit surprisingly in the services not the manufacturing component, a lot of attention will be on the various regional surveys due out this week including the Dallas Fed today, Richmond Fed on Tuesday, Kansas Fed on Thursday before the Chicago PMI on Friday. Sentiment indicators in the form of February consumer confidence on tomorrow and the University of Michigan survey on Friday will also be closely followed, as will the hard data in the form of preliminary January durable and capital goods orders on Thursday.

Here in Europe we have the February IFO survey out of Germany today. It’s one of the best measures of contemporaneous growth and will be closely watched in light of the mixed message given out by the European PMIs on Friday. The current forecast is for a slight decline in both the expectations and current assessment components. Germany’s final Q4 GDP revisions (0.0% expected) are then due tomorrow with the economy likely to flirt with a technical recession over the winter. We’ll also get a first look at inflation for February across Europe with preliminary readings due in Spain on Thursday and France, Germany, Italy and the Euro Area on Friday. Confidence indicators for the Euro Area are also due out on Thursday. Elsewhere, it’s a quiet week ahead for data out of the UK.

Meanwhile it’s worth keeping an eye on some of the data out of Asia this week. While they won’t reveal the full impact of the slowing in Chinese growth due to the coronavirus, it may reveal the early effects. Of note is January trade data out of Hong Kong tomorrow, January industrial production in Japan on Thursday and Australian private capex and Thailand trade data.

Finally earnings take a back seat with just 44 S&P 500 companies due to report including Berkshire Hathaway and Macy’s. Our equity strategists last week published a scorecard on the global earnings season last week which you can view here.

Recapping last week now. It ended with markets once again gripped by fears surrounding the coronavirus’s effect on the global economy, as data started to show some adverse effects. The S&P 500 finished the week -1.25% lower (-1.05% Friday), and ended with only the second back to back daily loss of the year.

Semiconductors (-2.99% Friday) and technology (-2.24% Friday) stocks were the largest decliners in the US with the Nasdaq declining -1.59% on the week (-1.79% Friday). The STOXX 600 followed suit, falling -0.57% on the week (-0.49% Friday), even as PMI data on Friday was better than expected across the Eurozone. The Nikkei fell -1.27% over the week (-0.39% Friday), the Hang Seng was down -1.82% (-1.09% Friday) and the KOSPI fell -3.60% (-1.49% Friday) as the spread of coronavirus and deaths rose in the nations neighboring China. Chinese equities themselves were up over +4% on the week, as the promise of fiscal and monetary stimulus supported stocks.

Gold continued to rise, being +1.48% higher on Friday and up +3.75% over the week, as havens were chased in the risk off mood. Gold had the best week since August, as it finished at over $1643/oz. US 30-year Treasury yields fell to a record low at 1.914% and ten-year treasuries fell -4.7bps to 1.468%, just off the September lows, but not quite down to the 2016 all time lows of c.1.35%. 10 year bund yields rose +1.3 bps on Friday (but -3bps on the week) to -0.43% as top-line PMI data was better than expected. The euro fell to near 3 year lows mid-week before bouncing slightly higher on Friday.

Last Friday’s flash European and US PMI data releases were highly anticipated with one consistent theme being weakness linked to the coronavirus outbreak coming through in lesser demand across travel and tourism, as well as falling exports, and supply chain disruptions.

In Europe, Flash Eurozone PMIs showed an expansion at 51.6, 0.3 better than last month. This was the fastest growth in 6 months. However across the Eurozone, suppliers expressed that delays for inputs was the most widespread since December 2018 - in many cases blaming supply chain issues on the coronavirus outbreak.

PMIs looked good on the surface as the German index showed business activity contracting less than feared, 47.8 compared to the estimated 44.8. However, expectations for output over the next 12 months fell, manufacturers are still cutting jobs, and hiring in services slowed. There was also indications that a distortion caused largely by supply chain disruptions, may have positively skewed the final reading.

The UK’s PMI reading showed manufacturing production growth rising to its strongest since April, helping to offset a slight loss of momentum in the service economy, the composite showed an expanding 53.3 reading matching last month’s release. Survey respondents noted that the clarity surrounding politics since the general election has manifested into higher business activity and greater willingness to spend among clients. However, service providers also reported that the coronavirus outbreak weighed on overseas bookings and resulted in the cancellation of some orders from clients in Asia.

The US flash PMI readings showed business activity contracting for the first time since 2013, printing at 49.6, falling from 53.3. This drop increased worries that the coronavirus outbreak was affecting supply chains and the economy more broadly than originally thought. Service providers (49.4 vs 53.4 expected) were among the most responsible for the low print, with new orders registering the first contraction in the data going back to 2009. Manufacturing (50.8 vs 51.5 expected) held up better than services which is surprising if Coronavirus supply chain hits were the main cause of weakness. Overall the flash numbers created as many questions as they did answers.

https://ift.tt/2SVEwqA

from ZeroHedge News https://ift.tt/2SVEwqA

via IFTTT

0 comments

Post a Comment