Market Correction Goes Viral, Is It Time To Buy?

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Correction Goes Viral

Over the last few weeks, the message from the newsletter has been repetitive:

“The markets are overbought, overextended, overly complacent. A correction is coming so reduce and rebalance portfolio risks.”

Despite those issues, the markets continued to push higher leaving readers with the assumption the “warnings” were wrong.

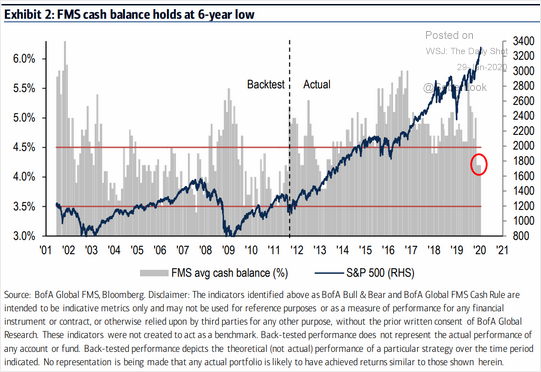

As noted last week, there have only been a few points over the previous 25-years where investors were so extremely lopsided in their positioning. We have shown many charts of investors being “all in” to equities over the last three weeks, but here is the latest Fund Manager’s Survey, which shows cash balances at 6-year lows.

The importance of these measures is not meant to be a “timing” signal to buy or sell positions. These measures are more valuable when thought about as an “accelerator” in a car. When markets are rising, investors press down on the accelerator, taking on more equity risk. As long as the road is straight, and visibility is good, it seems there are no consequences for driving at high speeds. However, if the road suddenly turns, or a hazard presents itself, bad outcomes happen very quickly.

The same is true for the markets. As markets are rising, investors ignore the warning signs, and the flashing yellow lights, under the assumption, there is no risk ahead. This is why we discussed taking profits a couple of weeks ago, which was simply how we “eased our foot off the gas” as signs were warning of a “sharp curve ahead.”

I apologize for the analogy, but the message is important. The reason that investors do so poorly over time is the inability to manage risk. Risk is never a function of how much money you make when markets are rising; it is a measure of “your ability to survive the crash.”

This past week, the road took a sharp right as the “Coronavirus” begin to impact overly optimistic views of a global reflation. While media headlines have run rampant with commentary suggesting investors shouldn’t worry about the virus, we wrote on Thursday, this time is different than 2003. To wit:

“Following a nearly 50% decline in asset prices, a mean-reversion in valuations, and an economic recession ending, the impact of the SARS virus was negligible given the bulk of the ‘risk’ was already removed from asset prices and economic growth. Today’s economic environment could not be more opposed.”

With global growth already slow, and the U.S. dragging its feet along at roughly 2% annual growth, there isn’t much room to absorb the impact of an event that potentially curtails consumption. Here was the important point in our recent article:

“China itself is a much more crucial player in the global economy than it was at the time of SARS, or severe acute respiratory syndrome, in 2003. It occupies a central place in many supply chains used by other manufacturing countries—including pharmaceuticals, with China home to 13 percent of facilities that make ingredients for U.S. drugs—and is a voracious buyer of raw materials and other commodities, including oil, natural gas, and soybeans. That means that any economic hiccups for China this year—coming on the heels of its worst economic performance in 30 years—will have a bigger impact on the rest of the world than during past crises.

That is particularly true given the epicenter of the outbreak: Wuhan, which is now under effective quarantine, is a riverine and rail transportation hub that is a key node in shipping bulky commodities between China’s coast and its interior.”

Importantly, as percentage of global GDP, China is 4x the size it was in 2003.

Don’t dismiss the risk of a viral contagion on an already weak global economy, at a time when asset prices are grossly deviated from actual profits, and GAAP earnings.

Is The Correction Over?

Since taking profits out of our portfolios, this leads us to the obvious question of whether or not the “Coronavirus Correction” is over?

From an investment standpoint, this is a fairly tricky question which brings up what we term in our practice as an “equity risk duration match.”

On a very short-term basis, there is a potential for a reflexive bounce. If your “investment duration,” or rather your “investment holding period” is very short, there may be a “trading” opportunity for you. However, if your “duration” is a longer time-frame, like ours, then the short-term oversold bounce is likely an opportunity to “reduce risk” further into.

As they say, “a picture is worth a thousand words.”

https://ift.tt/2uYvgsg

from ZeroHedge News https://ift.tt/2uYvgsg

via IFTTT

0 comments

Post a Comment