The Turn?

Authored by Sven Henrich via NorthmanTrader.com,

Did markets just hit a key wall and are ready for a much overdue turn? That’s the question we want to explore from a technical perspective following the sudden reversal action on Thursday and Friday as action at a key technical juncture may suggest a shift in character.

Let me make perhaps a bit of a controversial statement: It’s not the coronavirus that’s the biggest threat to the global economy, it’s the potential of a massive market selloff that would shake confidence at a critical juncture in the business cycle while the reflation trade everybody was positioning for looks increasingly fragile. Yes, the virus, hopefully ultimately temporary, clearly has a short term effect, but rather the broader risk is the excess created by ultra-loose monetary policies that has pushed investors recklessly into asset prices at high valuations while leaving central bankers short of ammunition to deal with a real crisis. There was no real crisis last year, a slowdown yes, but central bankers weren’t even willing to risk that, instead they went all in on the slowdown. It is this lack of backbone and co-dependency on markets that has left the world with less stimulus options for when they may be really needed. Reckless.

I repeat what I’ve said before: I hope the coronavirus is not the trigger that gets associated with an eventual end to this bull market. For one, it’s the worst reason as people are dying from it, and second, it would be paraded as an excuse for the proponents of cheap money and debt spending to not learn their lesson again. They’ll just blame the virus and not the monetary monstrosity that has been created and then proceed to do it all over again, or even more so than before.

It’s already heading in that direction anyways as central bankers across the globe are already in full denial mode. This week US central bankers either wouldn’t answer key questions or kept pretending this market is not in a bubble and valuations are justified due to low interest rates and kept insisting their policies such as repo or treasury bill buying have no impact in asset prices.

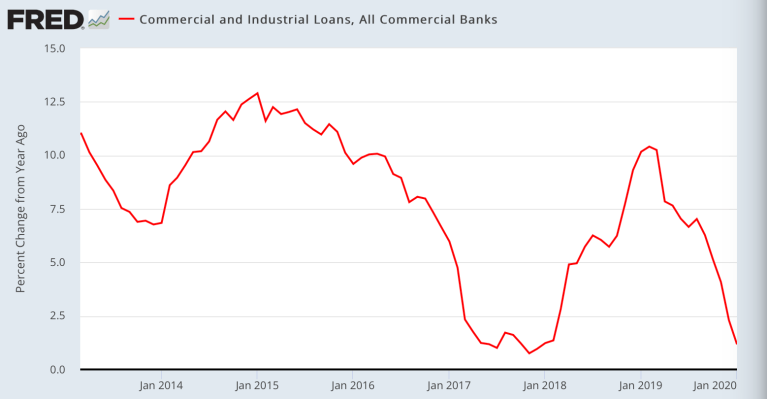

Kudlow is out there pretending collapsing yields are not a sign of a weakening US economy while loan growth is cliff-diving along with yields:

And we see the BOJ’s cheerleading despite Japan looking to be in a recession:

“I don't think Japan's moderate economic recovery is derailing."

— Sven Henrich (@NorthmanTrader) February 22, 2020

Japan is hitting a recession and he’s out cheerleading.

They all are. It’s quite the scene.

They will not warn investors because they’re trying to keep them from selling. For if they sold it’d all fall apart. https://t.co/LMOSHCSaXs

All obvious attempts at cheerleading to keep confidence up. I suspect the truth is much crueler than that: They are deeply concerned about markets selling off because a massive market correction now would be enough to push the fragile global economy into a recession.

They’ve so hyped these markets up to ignore all negatives that they’ve created this vast valuation excess that any rebalancing would wreak havoc on not only markets, but by extension, the economy.

Hence the prime mission is to keep confidence up and sweet talk everything to keep people from selling. I’ve said this before and I’ll say again: Central bankers will not warn you of a coming recession or turn. Their job is to keep investors in and they use capital markets to manage the economy.

This all works well as long as they remain in control. But this is what it takes these days:

As of this week the Fed’s holdings of treasuries is now a mere $14B from all time highs and looks to reach a new record high in March.

— Sven Henrich (@NorthmanTrader) February 21, 2020

But it's not QE and we're not in a crisis. They say.

Note the Fed piled back in faster then they tried to get out. pic.twitter.com/mtaLMBLLOd

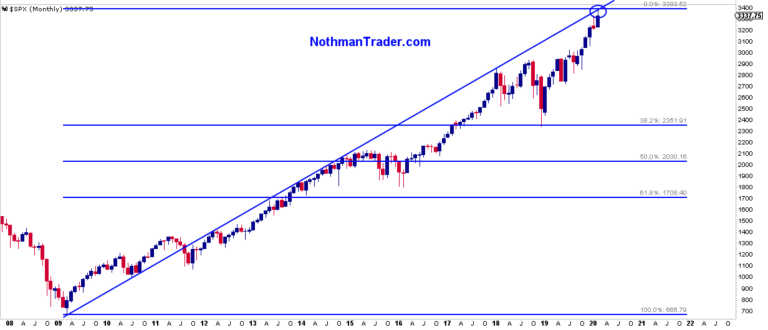

And congratulations: The Fed has just managed to push $SPX directly into a trend line that has held as technical resistance for the better part of a decade:

And ironically Friday’s sell off coincided with the Fed’s smallest liquidity injection in 2020 perhaps a mistake they won’t make again 😉

Only $25B in repo today and everything turns to shit.

— Sven Henrich (@NorthmanTrader) February 21, 2020

Go figure. pic.twitter.com/NeGSI8homi

Was last week the beginning of a turn? Are there signs of loss of control? It’s too early to tell, but there were some specific technical developments that are well worth watching.

For that discussion please see the video below:

Please be sure to watch it in HD for clarity. To get notified of future videos feel free to subscribe to our YouTube Channel.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

https://ift.tt/37W5AKB

from ZeroHedge News https://ift.tt/37W5AKB

via IFTTT

0 comments

Post a Comment