Unsold Class 8 Inventories Balloon To Second Highest In Industry History

The Class 8 market, which experienced a slowdown for almost all of 2019, still looks to be in trouble.

The ratio of retail sales to inventories in January for the heavy duty trucks remains elevated at the second highest in industry history. This makes production cuts the next obvious move for the industry. The inventory-to-sales numbers help present a picture of the health of the heavy-truck industry.

Sales of Class 8 trucks are expected to drop 33% this year compared to last year. Inventories remain high due to sluggish retail sales, despite "analysts" perpetually claiming that the industry is in good shape, just as they did throughout 2019 as orders fell all year long compared to 2018's robust order numbers.

Kenny Vieth, ACT president and senior analyst, told FreightWaves that the number of trucks being built per day compared to the industry's order backlog continues to paint the picture of an industry in "good shape".

Inventory of Class 8 trucks was up 3,400 units in January over December 2019, as production outpaced sales. The inventory-to-sales ratio in January was 3.9 months, second only to the 4.4 month print from April 2009. An ideal ratio is between 2 to 2.5 months.

Companies like PACCAR Inc., who owns Peterbilt Motors and Kenworth Truck Co., are trying to address this issue. CEO Preston Feight said on the company's January 28th conference call: “We make sure that what we’re building has a customer name on it, so we’ve been able to adjust our build rates to align with our orders.”

Vieth continued: “There comes a time in every cycle when the industry needs to start shedding inventory. High inventories were a positive contributor through most of 2018 and 2019. The total amount of inventory is going to be a headwind for production in 2020.”

The U.S. tractor market, which accounts for 60% of heavy-duty truck sales, saw its inventory-to-sales ratio spike to 3.1 months from 2.5 months.

Yet Vieth wants to continue focusing on the industry's backlog whittling away. The backlog in the industry, caused by robust ordering in 2018, was blamed for dismal Class 8 numbers throughout 2019.

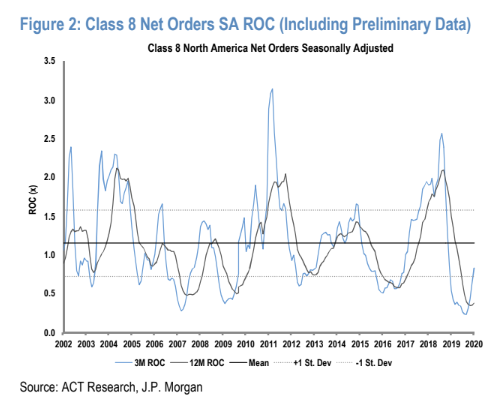

Recall, about a week ago, we noted that Class 8 truck orders had a "dead cat bounce" of 10% in January, which marked their first rise in 15 months.

While analysts pontificated about brighter days for the heavy duty truck market during almost every single data report throughout 2019, we remained skeptical. But it looks as though there will be at least one month of reprieve for the market, with January heavy duty truck orders rising 10% according to preliminary ACT research data and JP Morgan. Class 8 orders were up 17,700 units for the month.

It marked the first YoY increase for the heavy duty truck market in an astonishing 15 months. The data was down 12% sequentially, however. Seasonally adjusted orders were 15,900 units (190,800 SAAR), which were up 3% on a month to month basis.

At the time, we noted that ACT Research had estimated that the backlog will continue to wear away, falling 7,200 units to 116,300 units at the end of January. JP Morgan noted in a research piece last week that "truck and truck components group outperformed the broader

Vieth concluded: “Where the backlog rates are compared with the build rate, we’re golden. This is very sustainable and very good for the industry.”

We'll see about that, Kenny.

https://ift.tt/2w45FPq

from ZeroHedge News https://ift.tt/2w45FPq

via IFTTT

0 comments

Post a Comment