Gold Catapulted On Dollar Meltdown, Futures Rise With Focus On Fed Tyler Durden Mon, 07/27/2020 - 08:11

S&P futures rebounded from last week's dump on Monday, ending a two-day slide on Wall Street, as expectations for a more dovish outlook from the U.S. Federal Reserve - due to deteriorating economic conditions - brightened the market mood ahead of the busiest week for quarterly earnings reports which sees updates from companies including Apple, Amazon and Boeing.

Nasdaq 100 futures rose more than 1% as tech companies climbed in pre-market trading along with gold miners. The Stoxx Europe 600 Index struggled for traction as airlines were clobbered after the U.K. ordered quarantines for passengers returning from Spain.

The S&P 500 logged its first weekly decline in four on Friday, following concerns over escalating coronavirus cases in southern and western U.S. states, rising tensions between the U.S. and China, and data that showed a recovery in the U.S. job market unexpectedly stalled. Earnings reports will also be a major focus this week with more than a third, or 189 companies from the S&P 500, expected to report results, including Boeing, Pfizer, Facebook, Apple, Amazon.com and Alphabet.

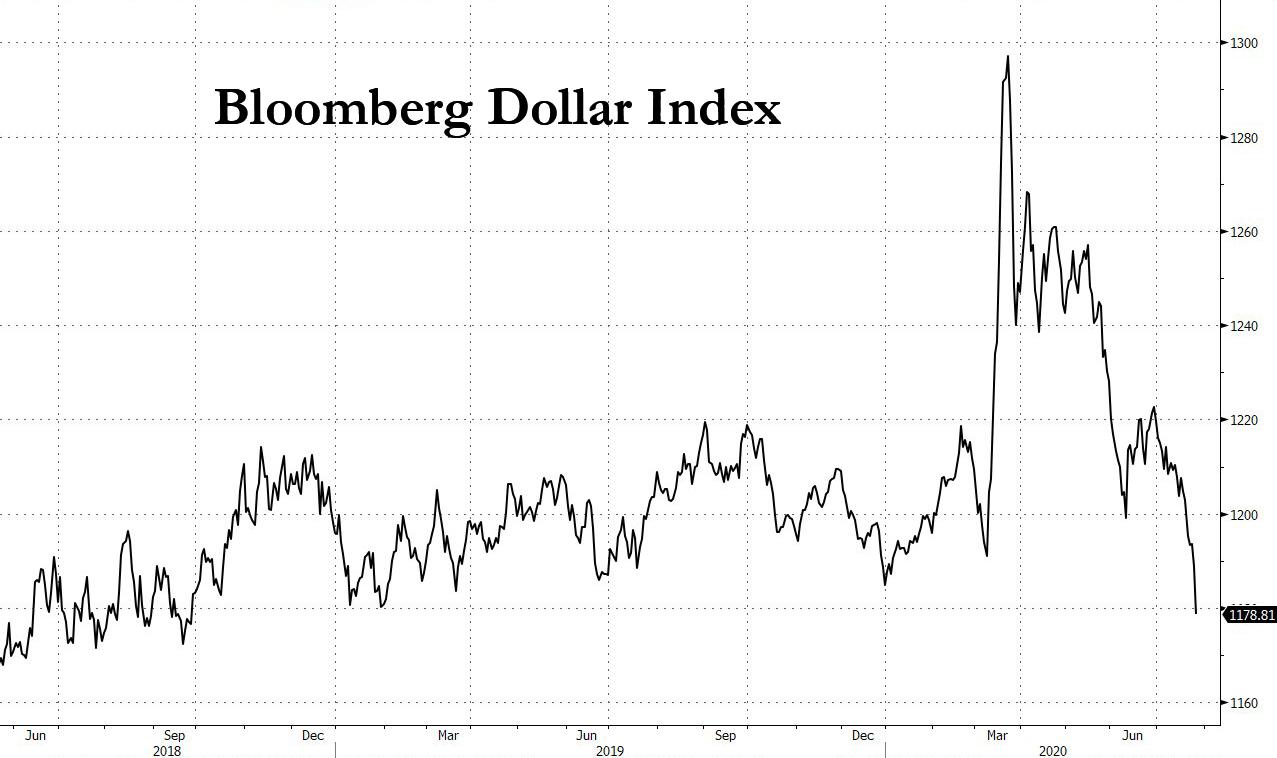

But the top highlights of the overnight session was the continued dollar meltdown which dragged the greenback to the lowest level since February 2019...

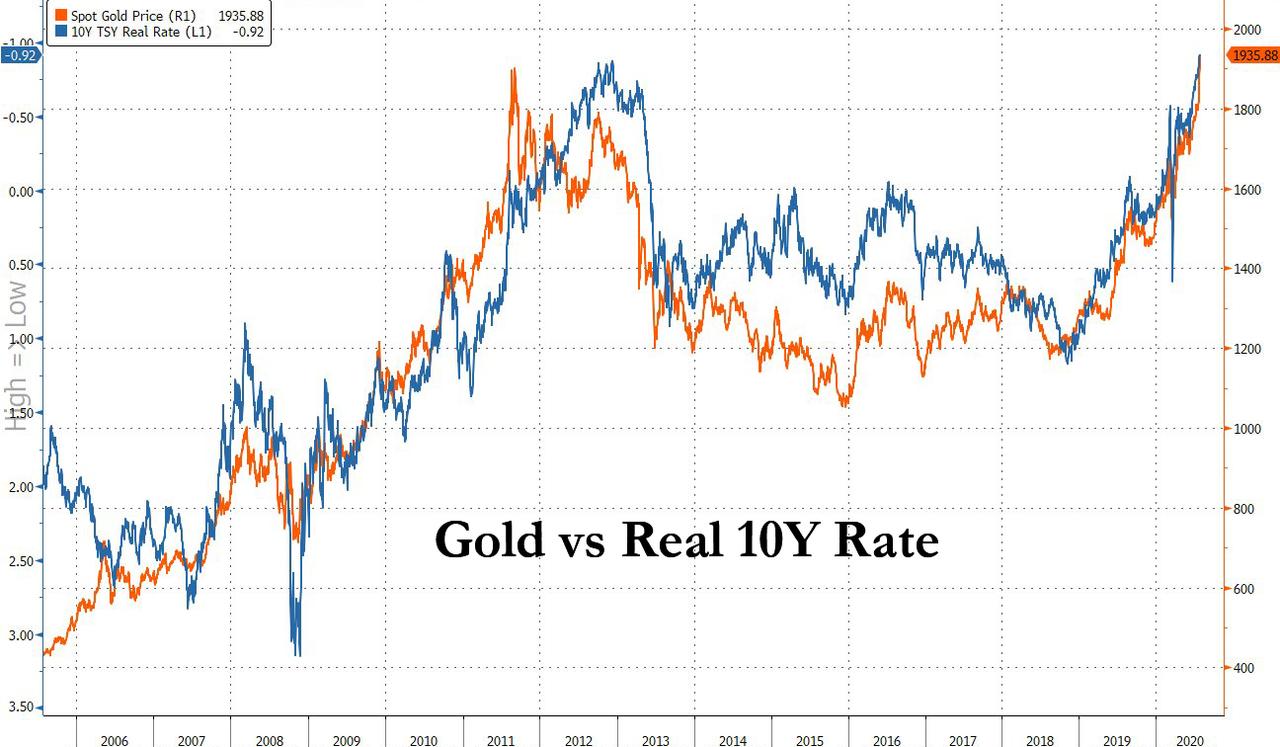

... with investors targeting option barriers and the U.S.-China diplomatic row weighing on the greenback; and the other major move was of course the explosion in gold which was last trading above $1,940 - an all time high - while silver was also sharply higher.

The yellow metal notched its biggest intraday increase since April and pushed toward $2,000 an ounce while Bitcoin rebounded back above $10,000.

“Strong gains are inevitable as we enter a period much like the post-GFC environment, where gold prices soared to record levels as a result of copious amounts of Fed money being pumped into the financial system,” said Gavin Wendt, senior resource analyst at MineLife Pty, echoing what we have been saying for, oh... about 11 years. A weak dollar and negative real rates are providing further impetus. Gold may consolidate before setting its sights on $2,000 and above in coming weeks, he said.

Europe's Stoxx 600 Index erased declines of as much as 0.6% to trade little changed; the basic resources subgroup and chemical companies lead gains with advance of 1.2% and 0.5%, respectively. Earlier, Spain’s IBEX 35 fell the most among western European benchmarks amid fears of a second coronavirus wave and fresh Covid-19 outbreaks that prompted the U.K. to impose a quarantine on travelers returning from the country. The UK move was similar to Norway announcement of a similar quarantine Friday and France issuing new travel warnings for the Catalonia region. Travel and leisure shares were among the worst performers on IBEX, with IAG’s Spain- listed shares dropping as much as 9.2% and Melia Hotels down 7.1%. Cie Automotive declines 9%, extending losses from Friday, when it reported a 50% slide in first-half profit.

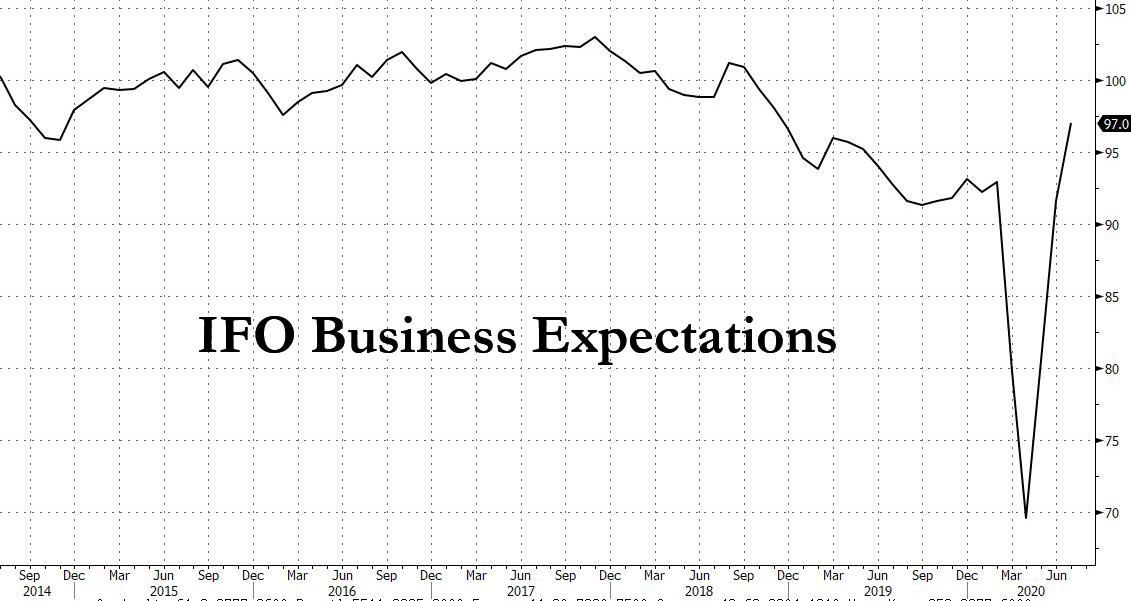

European market also got a boost after Germany's Ifo institute said its business climate index rose to 90.5 in July from an upwardly revised 86.3 in June. It was the third increase in a row and a higher reading than expected, while the Expectations component soared to the highest in two years.

“The German economy is recovering step by step,” Ifo President Clemens Fuest said, adding that companies were notably more satisfied with their current business situation. German business morale continued to recover in July from its biggest decline in decades, with companies expecting Europe’s largest economy to rebound from the coronavirus shock - as long as a second wave of infections is avoided.

Earlier in the session, Asian stocks gained, led by IT and materials, after falling in the last session. Markets in the region were mixed, with Taiwan's Taiex Index and South Korea's Kospi Index rising, and Hong Kong's Hang Seng Index and India's S&P BSE Sensex Index falling. The Topix gained 0.2%, with TerraSky and Sanoyas rising the most. The Shanghai Composite Index rose 0.3%, rebounding from Friday's sharp plunge, with Suzhou Kelida and Baiyin Nonferrous posting the biggest advances.

While no major announcements are expected at the end of the U.S. central bank’s two-day meeting on Wednesday, analysts expect policymakers to lay the groundwork for more action in September or in the fourth quarter. Investors are also keeping a close watch on progress over the next round of government aid with less than a week before enhanced unemployment benefits expire. Top aides to President Donald Trump said they agreed in principle with Senate Republicans on a $1 trillion coronavirus relief package, which will now be negotiated with Democrats.

Investor concern about the global economy and expectations that the Fed’s open market committee meeting will reinforce a dovish outlook are driving the dollar and precious metals in opposite directions and supporting equities. While fresh outbreaks of the virus emerged from China to Spain, cases fell in the populous states of California, Florida and New York.

"The July FOMC meeting should kick off a period from August into mid-September in which markets should price in an increasingly dovish, forward-looking Fed policy via lower real rates," Morgan Stanley strategists including Matthew Hornbach wrote in a report. "This should benefit breakeven inflation rates, support risk assets, and weigh on the U.S. dollar."

In rates, Treasuries bull-flattened with long-end yields lower again by 1bp-2bp, despite the modest E-mini gains. Treasury yields lower by 0.5bp to 2bp across the curve, flattening 2s10s and 5s30s by around 1bp each; 10-year yields ~0.58%, richer by 1.1bp vs Friday’s close. Germany's Bunds outperformed by ~1bp, trading better than Treasuries after Belgium supply events. This week's auction cycle - accelerated and compressed because of FOMC meeting Wednesday and Friday settlement - begins with 2-and 5-year sales, both record size and trading at record-low WI yields. IG credit issuance slate includes Prosus 30Y; dealer calls for next month are in the neighborhood of $50 billion, which would be the slowest August in five years.

In FX, the Bloomberg dollar index fell to near an 18-month low and U.S. Treasuries gained as investors weighed this week’s Federal Reserve meeting and several second-wave outbreaks of Covid-19. The euro advanced due to demand from investors eyeing the 1.1700 option barrier, while interbank desks targeted large USD/JPY barriers at 105.50, according to traders. The dollar’s continued weakness prompted funds to scoop up the Australian and New Zealand currencies, a trader said.

In commodities, besides the massive surge in precious metals, oil fluctuated around unchanged for much of the session, before breaking out modestly in the green.

Expected data include durable-goods orders. Hasbro is among companies reporting earnings. Negotiations on a U.S. stimulus package and a Federal Reserve policy meeting this week are also on the radar, with traders expecting the U.S. central bank to signal more accommodation ahead. Meanwhile, Senate Majority Leader Mitch McConnell is expected to release a $1 trillion pandemic relief proposal on Monday, which will kick off talks with Democrats on further relief measures.

Market Snapshot

- S&P 500 futures up 0.4% to 3,218.00

- STOXX Europe 600 down 0.2% to 366.46

- MXAP up 0.6% to 166.41

- MXAPJ up 0.7% to 545.82

- Nikkei down 0.2% to 22,715.85

- Topix up 0.2% to 1,576.69

- Hang Seng Index down 0.4% to 24,603.26

- Shanghai Composite up 0.3% to 3,205.23

- Sensex down 0.3% to 38,027.82

- Australia S&P/ASX 200 up 0.3% to 6,044.17

- Kospi up 0.8% to 2,217.86

- Brent futures down 0.3% to $43.21/bbl

- Gold spot up 2% to $1,939.94

- U.S. Dollar Index down 0.5% to 93.94

- German 10Y yield fell 0.6 bps to -0.454%

- Euro up 0.5% to $1.1708

- Italian 10Y yield rose 1.4 bps to 0.872%

- Spanish 10Y yield rose 2.1 bps to 0.373%

Top Overnight News

- Spot gold blasted past its longstanding record while silver rode on its coattails as investors seek havens outside the plunging dollar

- China reported the most number of domestic coronavirus infections since the end of the outbreak in Wuhan, raising fears of a serious resurgence

- The lowering of the American flag from the consulate in Chengdu caps a week in which U.S.-China relations spiraled to new lows

- Billionaire investor Ray Dalio said conflict between the U.S. and China could expand into a “capital war” that he suggested would harm the dollar

APAC stocks traded choppy as initial optimism somewhat abated after Wall Street’s decline on Friday amid a struggle in tech shares coupled with rising US-Sino tensions, with the Dow snapping a three-week winning streek as Intel shares slumped over 15% post-earnings. ASX 200 (+0.3%) nursed earlier losses despite the rising case-count in Victoria, with upside led by strength in mining names. Nikkei 225 (-0.3%) lagged as the index played catch-up to the broader losses seen at the back end of last week, whilst JPY strength kept gains limited. Softbank shares cushioned losses for the index as investors had the first chance to react to reports that its chip arm is reportedly attracting interest from Nvidia. KOSPI (+1.1%) remained firm throughout the session as the case-count in South Korea stays on a downward trajectory. Elsewhere, the Hang Seng (+0.1%) saw initial momentum from the euphoria surrounding the debut of its tech index, of which over 40% comprises of shares from Alibaba (8.53% weighing), Tencent (8.52%), Meituan (8.33%), Xiaomi (8.11%) and Sunny Optical (8.02%), whilst Shanghai Comp (+0.1%) traded between gains and losses as industrial profits saw a rebound in June, although price action is upside was hampered amid the rising tensions between US and China. Finally, Taiwan’s TSMC rose over 9% on the back of the broader tech rally coupled with reports that Apple (AAPL) is setting up an R&D area for display tech at TSMC’s plant.

Top Asian News

- TSMC’s $35 Billion Rally Puts Taiwan Stock Index Above 1990 Peak

- Hong Kong to Ban Dining-in, Public Gatherings Of More Than Two

- Nissan Quarterly Loss Said to Be Smaller on Faster Cost Cuts

European indices have kicked the session off relatively indecisively (Eurostoxx 50 U/C) with the exception of the Spanish IBEX (-1.3%) which is the region’s clear underperformer after the UK imposed quarantine measures on those travelling from Spain. Given the measures taken by the UK and concerns that similar action could be taken by the UK on France and Germany, the travel & leisure sector is the clear laggard for the Stoxx 600, facing losses of around 2.5% with Tui (-12%), easyJet (-11%) and IAG (-8%) all lower on the session. Shares in Ryanair (-4.2%) are also seen lower in sympathy and following Q1 earnings with the Co. reporting a EUR 185mln loss and citing fears of a second wave in the autumn. Elsewhere, DAX-heavyweight SAP (+2.9%) has supported the index and the tech sector after confirming Q2 earnings (relative to prelim release) and announcing its intention to IPO its US subsidiary, Qualtrics. HSBC (-2.9%) have acted as a drag on the broader banking sector after reports noted the Co. is facing pressure to look at offloading its US retail bank in order to increase returns and address international tensions with China. Furthermore, the Co. has rejected allegations via Chinese media that they attempted to entrap Huawei in the act of breaking US sanctions and had provided US authorities with misleading information. Mining names are on a firmer footing this morning (Stoxx 600 basic resources +0.9%) with Co.’s in the sector cheering the ongoing rally in precious metals prices with spot gold breaching its all-time high at USD 1921.75/oz and spot silver higher by around 6%. Other notable movers include Atlantia (+4.8%) after source reports noted Italy's CDP is open to acquiring a controlling stake in the Co.'s Autostrade in an attempt to resolve pricing concerns for the unit. To the downside, Rolls Royce (-5.1%) are seen lower this morning after reports in the Telegraph stated the Co. is looking into an emergency sale of its ITP Aero division that builds parts for the Eurofighter Typhoon as it looks to raise billions to deal with the fallout form COVID-19.

Top European News

- Vodafone Extends Losses as Analysts Weigh Tower Unit Update

- Nordea Says Compliance Unit ‘Too Expensive’ as Job Cuts Loom

- German Business Expectations Rise to Highest Level Since 2018

- Italy’s Cassa Depositi Open to Autostrade Stake Deal in IPO

In FX, the Dollar is looking increasingly weak on the bearish combination of US-China angst, 2nd wave coronavirus concerns and delays to more fiscal stimulus after extending losses overnight with the return of Japanese markets from their 4-day long holiday weekend, but GOLD and fellow precious metals continue to lead advances against the Greenback following a breach of the prior record peak and Xau setting a new ATH around Usd 1944/oz. However, the index has pared some declines ahead of sub-94.000 technical support at 93.814 (21 September 2018 low) and another base from 2 years ago at 93.713 (July 9) in the run up to US durable goods and the Dallas Fed manufacturing index.

- JPY/NZD/EUR/AUD/GBP – The Yen has strengthened further vs the Buck and through 106.00 to test half round number resistance at 105.50, while the Kiwi pivots 0.6650 and Euro is straddling 1.1700 with some underlying traction from a broadly better than expected Ifo survey. Similarly, the Aussie is rotating around 0.7100 as US Dollar weakness more than offsets the ongoing COVID-19 spread in Victoria and RBA’s Kent underlines little concern about the current Aud/Usd level. Elsewhere, Sterling has also traversed another big figure largely at the Greenback’s expense, but faces a key chart obstacle in the form of a 1.2842 Fib retracement to compound no deal Brexit risk.

- CAD/CHF/SEK/NOK – Soft oil prices and flaky risk sentiment are hampering the Loonie to a degree as it rotates either side of 1.3400, while the Franc seems reluctant to rally too far above 0.9200 given the latest jump in Swiss sight deposit balances alluding to more official intervention. However, the Scandinavian Crowns have both regained momentum vs the Euro within 10.3030-10.2665 and 10.6930-6325 parameters on solid fundamental and technical impulses (like Swedish household lending staying firm in June).

- EM –The Rand is a regional outperformer and eyeing 16.5100 against the Dollar awaiting news from the IMF about SA’s request for a Usd 4.2 bn credit line to help fund anti-virus measures, but the Lira is still struggling to break free from 6.8500 even though Turkish manufacturing confidence improved to 100+ in July

In commodities, WTI and Brent crude futures have begun the week on the backfoot, following the relatively indecisive performance in European equity bourses. For the complex itself, attention remains on what is now Tropical Storm Hanna after being downgraded from a Hurricane once it made landfall in the Southern Texas Coast, a downgrade which place crude prices under mild pressure at the time. Elsewhere, the complex has seen a few refinery updates notably the Marathon Galveston Bay, Texas (585k BPD) facility is said to be restarting units following on from a two-month overhaul while Total are selling their Lindsey (200k BPD) refinery to the Prax group. Looking ahead for the complex it’s a similar story to last week with little on the scheduling front aside from the usual weekly updates. As such, and given overnight price action, precious metals may once again hold the commodity markets gaze as spot gold has set a record high at USD 1944.45/oz and silver prices are bolstered by some 6% given USD weakness and the continuing decline for real yields. Elsewhere, base metals came under pressure during APAC hours given ongoing US-China tensions, but downside is limited by dollar downside.

US Event Calendar

- 8:30am: Durable Goods Orders, est. 7.0%, prior 15.7%; Durables Ex Transportation, est. 3.5%, prior 3.7%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 2.4%, prior 1.6%; Cap Goods Ship Nondef Ex Air, est. 2.8%, prior 1.5%

- 10:30am: Dallas Fed Manf. Activity, est. -4.9, prior -6.1

DB's Jim Reid concludes the overnight wrap

I’ve lost a bit of weight since lockdown started even though I think I’ve eaten slightly more at home. To be honest I’ve been a bit puzzled by this. However yesterday I started to work out how as we went round another person’s house for the first time since March. 3 pieces of cake later and then home for a normal dinner was a little more like the old days. Also not doing a couple of days a week travelling for work also probably stops me comfort eating as much. So as life slowly returns to normal I may have to go back to my old belt buckle hole again. That brief relationship with the last hole on the belt will likely be a fleeting Q2/early Q3 2020 thing.

Life might not get fully back to normal for some time though or at least be in fits and starts as this weekend we perhaps got a glimpse of how challenging life will be this winter without a vaccine. Spain which had seen new cases rise to around a thousand per day at various points over the last week (c.10,000 / day at the peak, below 300 most of June) is starting to attract fresh attention and travel advisory warnings including a 14-day quarantine order for those returning from there to the U.K. France also saw cases edge back up above a thousand at the end of last week and is one to watch as the public health agency said “we’ve thus erased a good part of the progress that we had accomplished in the weeks after the lockdown was lifted”. I don’t think this is of immediate major economic consequence (relative to what we already have) but if this is happening at the height of summer it begs the question of where we’ll be in say November.

For now new cases in Europe continue to be well behind that across many US states but there have been signs of this plateauing in recent days but we need to get past weekend lulls in reporting for confirmation. Meanwhile, over the weekend Florida (423,855) overtook New York (411,736) to become the second most infectious state in the US in terms of total cases recorded. That said the average per day weekend case growth was well below the last 5 weekend average (2.64% vs. 5.13%). The same was true for the Texas (2% vs. 3.07%), California (1.44% vs 2.32%) and Arizona (1.81% vs. 3.74%). Fatalities, which clearly lag, climbed with Texas (3.34% vs. 1.37%), Florida (1.76% vs. 1.17%) and Arizona (2.56% vs. 2.15%) all showing rises.

Asia is another region of concern with India (32,063) leap frogging France (30,195) over the weekend to become sixth highest in the global fatalities list. Australia’s Victoria state also reported a new daily record of 532 infections over the past 24 hours while China reported the most domestic cases (61) since it brought the initial outbreak in Wuhan under control. Vietnam also saw its first cases in more than three months, Tokyo found 239 new cases yesterday, marking the sixth straight day in which the number topped 200 while Hong Kong has reported more than 100 cases for 4 days running.

Markets in Asia are mixed against this backdrop with the Nikkei (-0.29%) trading down as it catches up with last week’s moves after a 4-day holiday. Elsewhere the Hang Seng (-0.09%), Shanghai Comp (+0.09%) and Asx (+0.09%) are trading flattish while the Kospi (+1.05%) is up. In FX, the US dollar index is down -0.49%, marking 6 days of continuous declines and at the lowest level since September 2018, while all the G-10 currencies are trading up with Euro at 1.1702 and breaking through another big figure. Meanwhile, futures on the S&P 500 are up +0.47% and spot gold prices are up to a record $1,931.51/oz (+1.55%) this morning with silver trading up +5.92%.

Looking forward now, and after the biggest two week fall in the Nasdaq (-2.39%) since the turmoil in mid March, one of the most interesting things this week will be earnings releases from Amazon, Apple, Alphabet (all Thursday) and Facebook (Wednesday). This could have a big impact on sentiment. Intel falling -16.24% on Friday after results the previous night helped tech sentiment dip a little on Friday.

Elsewhere one of the key macro highlights this week will be the Federal Reserve’s latest monetary policy decision, along with Chair Powell’s subsequent press conference. Recent communications from the Fed have made it clear that the FOMC will soon pivot away from stabilisation towards accommodation, and in a piece earlier this week, our US economists released the first of a two part series looking at how much accommodation will be needed and how it will be provided (link here). On Friday we published a CoTD that used our economist work to suggest that if balance sheet was the only tool used, to keep policy neutral an extra 12 trillion of QE could be required. We are currently at $7tn. See it here and email Jim-Reid.ThematicResearch@db.com to get added to the direct daily distribution.

Data releases will also get a decent amount of attention, particularly given the Q2 GDP releases out in the US (Thursday) and the Euro Area (Thursday/Friday) that are likely to show some of the largest quarterly contractions in history. They will also help calibrate forecasts for economists going forward. The other main data release will be the release of PMIs from China on Friday. All the other data releases will be in the day by day calendar at the end.

On earnings we have many of the world’s biggest companies reporting this week. In total, releases include 190 from the S&P 500 and a further 169 from the STOXX 600. Among the releases include SAP, Ryanair and LVMH today. Then tomorrow we’ll hear from Starbucks, Visa, McDonald’s, Pfizer, Peugeot and Nissan. Wednesday will see Facebook, Sanofi, Rio Tinto, GlaxoSmithKline, Qualcomm, PayPal, Boeing, Santander, General Electric, General Motors, Barclays and Nomura release earnings. After that, Thursday’s releases include Alphabet, Amazon, Apple, Samsung, Nestle, Procter & Gamble, Comcast, L’Oreal, Stanley Black & Decker, AstraZeneca, Linde, Mastercard, American Tower, AB InBev, Total, Volkswagen, Ford, Royal Dutch Shell, Lloyds Banking Group and Credit Suisse. Finally on Friday, there’s Chevron, Charter Communications, Merck, AbbVie, Phillips 66, ExxonMobil, BNP Paribas, Caterpillar, Nokia, NatWest Group and Fiat Chrysler Automobiles.

Looking back to last week now, one of the bigger stories was gold breaching the $1900/oz level on Friday (overnight gold surged to an all-time high of c. $1,932/0z). The metal rallied +5.06% to an 8 year high of $1902/oz, which was the biggest one week gain since late March. The 2011 high of $1921/oz is clearly in view, just 1% away. Other precious metals also had big weeks as the dollar sold off (-1.57%) and real rates moved lower. Silver was up +17.79% to a 6 year high, the largest 1 week move since 1980. Elsewhere, platinum (+9.36%) and palladium (+10.23%) also rose the most since the last week of March. Other, more industrial-focused commodities underperformed precious metals on the week as risk sentiment waned. Oil gained slightly through, with WTI (+1.85%) and Crude (+0.46%) up just ahead of the largest oil companies releasing earnings this upcoming week. Copper fell -0.19%, dropping for the first time in 10 weeks.

Global equity markets fell as economic uncertainties mixed with more tense US/China relations to create mild risk off. In particular, US tech stocks were given more scrutiny towards the end of the week on added concerns surrounding their valuations, even in the midst of decent earnings results. The S&P 500 dropped -0.28% (-0.62% Friday) on the week, ending a streak of three straight weekly gains, which is tied for the longest of this year so far. The tech-focused Nasdaq underperformed as the index reacted to US/China news in a similar fashion to its action during the trade war, falling -1.33% (-0.94% Friday). Including the Nasdaq’s -1.08% loss the prior week, it was the biggest 2-week fall in the index since the height of the market turmoil in mid-March. European equities underperformed the S&P with the Stoxx 600 retreating -1.45% (-1.70% Friday) over the five days, also breaking a 3-week streak of gains. The DAX outperformed the STOXX 600, only down (-0.63%), but other major European bourses were all weaker with the CAC (-2.23%), FTSE 100 (-2.65%) and FTSE MIB (-1.69%) losing ground.

Core sovereign bonds were mixed on the week as risk sentiment diverged slightly. US 10yr Treasury yields fell -3.8bps (+1.1bps Friday) to finish at 0.589%, while 10yr Bund yields were unchanged (+3.3bps Friday) at -0.45%. Even as equities dropped on the week, HY cash spreads continued tightening on both sides of the Atlantic. US HY cash spreads tightened -45bps (+3bps Friday) and Europeans ones tightened -23bps (-2bps Friday). As stated above, the dollar fell over -1.5% on the week to its lowest level since September 2018, while the Euro rose +2.00% in the currency’s fifth straight weekly gain.

On Friday, preliminary European and US PMIs were released showing that the recovery has more momentum in Europe than in the US. The Euro-area composite PMI was the strongest (54.8 vs. 51.1 exp.) since June 2018, led by services (55.1 vs. 51.0). Germany’s composite PMI (55.5 vs. 50.2 exp.) rose to the highest level since August 2018. However, there was one note of caution even with the index improving as employment was down for the fifth straight month. In France, the composite PMI rose to 57.6 (vs. 53.5 exp.), the highest since January 2018. In the UK, a high services beat (56.6 vs. 51.5 exp.) pulled the composite to 57.1 (vs. 53.5 exp.). Numbers out of the US showed the composite at 50.0, as both manufacturing (51.3 vs 52.0 exp.) and services (49.6 vs 51.0 exp.) failed to meet market expectations.

https://ift.tt/2WUHE7Z

from ZeroHedge News https://ift.tt/2WUHE7Z

via IFTTT

0 comments

Post a Comment