Under Armour Shares Tumble After Kevin Plank Received SEC 'Wells Notice' Tyler Durden Mon, 07/27/2020 - 08:10

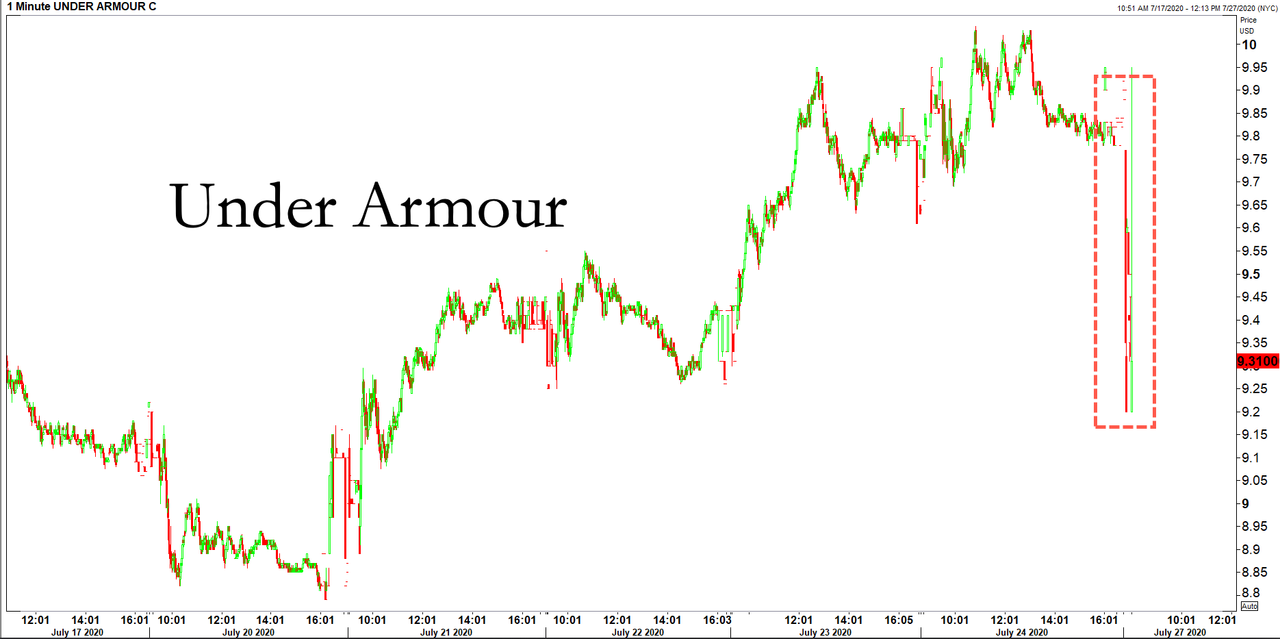

Under Armour shares slid 4.7% Monday morning after the Baltimore-based apparel company released an 8k filing detailing how Kevin Plank, the Executive Chairman & Brand Chief, and David Bergman, the Chief Financial Officer, received a "Wells Notice" from the Securities and Exchange Commission (SEC) about the Company's questionable accounting practices covering 3Q15 to 4Q16.

The Wells Notices relate to the Company's disclosures covering the third quarter of 2015 through the period ending December 31, 2016, regarding the use of "pull forward" sales in connection with revenue during those quarters. A pull forward generally includes a customer sale that is executed earlier than originally planned. Specifically, the SEC Staff is focused on the Company's disclosures regarding the use of pull forward sales in order to meet sales objectives. The SEC Staff has not alleged any revenue recognition or other violations of generally accepted accounting principles relating to that or any other period.

A Wells Notice is neither a formal charge of wrongdoing nor a final determination that the recipient has violated any law. The Wells Notices informed the Company and the Executives that the SEC Staff has made a preliminary determination to recommend that the SEC file an enforcement action against the Company and each of the Executives that would allege certain violations of the federal securities laws.

The Company and the Executives maintain that their actions were appropriate and intend to pursue the Wells Notice process, which will include the opportunity to respond to the SEC Staff's position, and also expect to engage in a dialogue with the SEC Staff to work toward a resolution of this matter. - Under Armour's 8k filing

In response to the Wells Notice announcement, shares of the company have slid 4.7% in pre-market Monday.

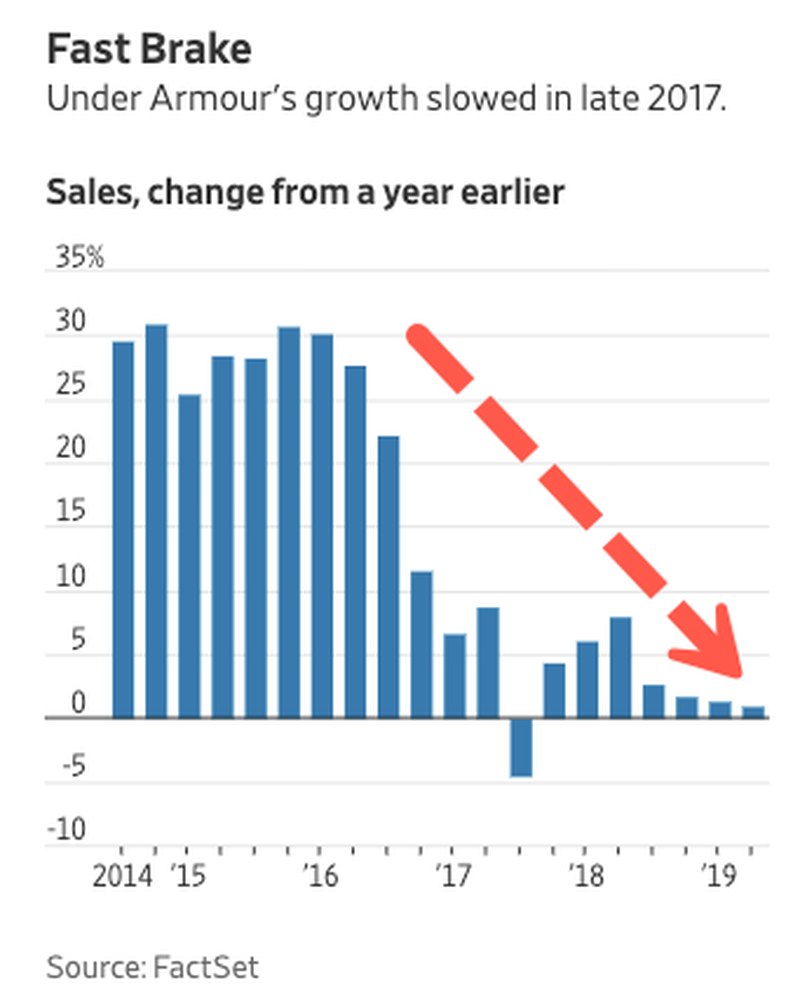

We first told readers in late 2019 the company was at the center of a federal investigation for its "revenue-recognition practices" to inflate sales.

Seems like Plank could be in trouble...

https://ift.tt/2P33Jww

from ZeroHedge News https://ift.tt/2P33Jww

via IFTTT

0 comments

Post a Comment