After Today's "Crazy" Meltdown, What Is Oil's Fair Value? Goldman Has The Answer

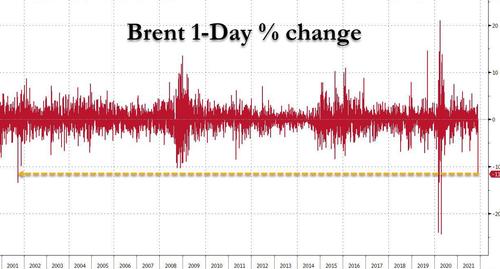

Black gold suffered a very red day today: the fall in Brent prices to below $74/bbl (-10%) - fears that a new Covid variant would lead to a freeze in oil demand - was the largest daily decline since oil prices collapsed to negative levels last April, exacerbated by usually low trading activity on Black Friday (with similar moves in 2014, 2016 and 2018), the breach of key support levels (50, 100 and 200-day moving averages) as well as likely negative gamma effects.

At the worst point of the crash, WTI futures slumped 14% from their pre-Thanksgiving close and Brent collapsed more than 12%. By the close they’d both recovered slightly, but for Brent futures it was still the seventh worst one-day drop in history!

"It’s been a crazy day in the markets that feels very reminiscent of last March,” said Craig Erlam, senior market analyst at Oanda Europe.

While the initial overnight plunge was driven by revived fears of widespread lockdowns and travel bans, a host of technical factors, including muted post-holiday volumes and (downward) momentum-chasing algos exacerbated the sell-off. The panic spread to every corner of the market from European diesel trades and time-spreads, the relative value of oil today to oil tomorrow, through to opaque options markets.

“Factors such as the break of technical support levels and an environment with lower liquidity post the Thanksgiving holiday have intensified the price drop,” said UBS commodity analyst Giovanni Staunovo.

While one can blame algos, trendlines and the lack of carbon-based traders for today's plunge, one thing is certain: there was nothing fundamental about today's move.

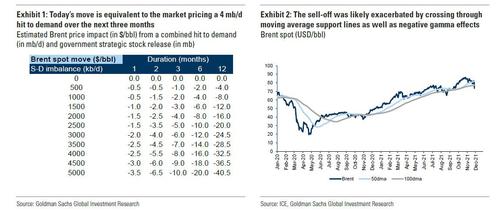

As Goldman's commodity strategist Damien Courvalin, who has emerged as Goldman's designated oil cheerleader and who in the past 4 months has been quite vocal about his $90+ oil price target in the coming months, writes today at $74/bbl Brent, the market is pricing a roughly 4 million b/d negative demand hit over the next three months, with no offsetting OPEC+ response.

To put this into its stunning context, global oil demand fell "only" 2 million b/d peak to trough during last winter’s Covid wave, meaning that today the market priced in a twice as severe wave as last winter!

The parallel nature of the sell-off, with back-end prices down $5/bbl could also be interpreted as the market pricing in a shallower but longer demand hit. Specifically, the change in the entire curve is pricing in a 2.5 mb/d hit over 3 months with a more permanent impact on demand of c. 1.5 mb/d.

Needless to say, in Goldman's view both seem an excessive repricing: current jet demand levels are just 1 mb/d above last winter, when cases and hospitalizations were far higher and before any widespread vaccinations. While a worst case outcome could be a return to last winter’s levels, 0.5 mb/d downside to Goldman's current base-case until 2Q 22 would be a conservative assumption given what we know at present.

Separately, some limited mobility restrictions could feasibly be expected to subtract an additional 0.5 mb/d from global demand outside of jet on the return of mobility restriction. This would be a similar impact to half of last winter’s wave in Europe given the ever weakening link between restrictions and economic activity/oil demand.

In such a scenario, Goldman agrees with what we said earlier today, that should demand collapse OPEC+ would pause its ramp-up at least for one month vs. consensus estimates of increase through April 2022.

In other words, adding all of the above, the impact of a new large Covid wave would be c.0.7 mb/d over 3 months, and up to at most $2 downside versus Goldman's current modal price forecast path. Instead Brent collapsed to $12 below it, an arb of some $10/barrel.

Admittedly, to this negative Covid impact, one could also add the added bearish element of this week's bearish SPR announcement which Goldman calculates is worth a net 47 million barrels to its 1H 2022 balances, and an additional $2/bbl downside to our forecasts. Taken together, these represent at most $5/bbl downside to Goldman's $85/bbl 4Q21-1Q22 oil price forecasts.

Said otherwise, a worst-case outcome means oil is fairly priced at $80. At its closing price below $73 it's a steal.

On the other hand, there is substantial potential for offsetting bullish developments via the lack of progress in Iranian negotiations (where things are going nowhere fast and where Goldman had expected a supply ramp up beginning in 2Q 22), as well as OPEC+ freezing its production hike for three months (instead of one) which would completely offset the combined negative hits of both another large Covid wave and SPR releases.

Alas, none of this mattered to the algos, robots and CTAs who led the charge of today's meltdown: as Bloomberg notes, the market spiraled ever lower as oil broke through key technical levels, with futures dropping 100-day and 200-day moving averages. That gave algorithmic computer-driven trades the upper hand on a day when many participants were away from the market.

“The sell-off has no doubt been driven exacerbated by algo-driven trading as key technical levels broke down,” said Fawad Razaqzada, an analyst at ThinkMarkets.

Then we got the added kicker of negative gamma once the options market kicked in. When prices fall heavily, banks often sell futures contracts in order to hedge themselves against losses from put options. Banks often sell puts to producers who want to protect against a bear market. This feedback loop, known as negative gamma to options traders, was seen as a factor on Friday.

“Dealers just took down hedges and they are shorter put options than normal, so must sell futures to hedge,” said Ilia Bouchouev, a partner at Pentathlon Investments and former head of oil derivatives at Koch Supply and Trading.

Of course, for banks like Goldman, what happens next is clear: once the humans return, there will be an epic buying frenzy as today's drop was at least twice as big as it should have been. Others agree: even if the Omicron variant is as scary as described - and that is by no means decided - they expect prices to recover quickly when the U.S. market returns fully after the holiday and volumes return to normal. The longer-term outlook remains robust.

“This is a huge overreaction in terms of the market,” Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd., said in a Bloomberg Television interview. “This is the market pricing in the worst possible scenarios.”

Of course, it would be most ironic if in a week or two, once the Omicron panic has subsided, oil trades well above Wednesday's closing price and is approaching triple digits. In fact, the wheels on such an outcome are already in motion and as Bloomberg confirms our earlier speculation, OPEC+ is "increasingly inclined to ditch their plan to raise output next week", as a new virus variant triggered oil’s worst crash in over a year.

The 23-nation alliance led by Saudi Arabia is leaning toward abandoning a plan for a modest production hike scheduled for January when it meets on Dec. 1 to 2, according to delegates who declined to be identified. The group was already considering a pause after the U.S. and other consumers announced the release of emergency oil stockpiles on Monday.

“The emergence of a new Covid variant that could spawn renewed shutdowns and travel restrictions is precisely the type of change in market conditions that could cause ministers to deviate from their plan” to add barrels, said Bob McNally, president of consultant Rapidan Energy Group and a former White House official.

Saudi Energy Minister Prince Abdulaziz bin Salman has warned that global crude markets are poised to return to surplus next month, and that demand is at risk from new infections. OPEC’s internal research shows a substantial excess forming early next year, that will only balloon if the U.S. and its associates tap their strategic reserves.

It appears the Saudis were correct.

But while until now, withholding additional barrels while the U.S. and others called out for them would have been a politically fraught move, fraying an already-fragile relationship between Riyadh and Washington the emergence of the new virus off-shoot, with its obvious risks to fuel consumption, makes an output freeze much easier to defend. UBS even joined this website in suggesting that the group could consider an output cut.

As such, today's stunning kneejerk crash in oil, which priced in a horrifying pandemic outcome twice as bad as that of last winter when the world was blanketed in covid and nobody had vaccines, will prove to be a career-making buying opportunity for a commodity which one way or another is headed far, far higher.

https://ift.tt/3DWB3NN

from ZeroHedge News https://ift.tt/3DWB3NN

via IFTTT

0 comments

Post a Comment