Inflation Stretching Budgets Thin For Americans As They Rethink Holiday Buying

What looked like a win for workers earlier in the year, as wages increased, has turned out to be another blow after accounting for inflation. Real wages are negative on the year, and that is impacting how consumers spend this holiday season. \

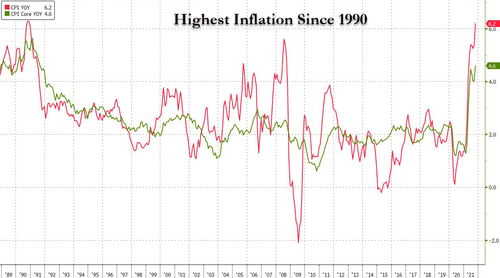

Consumer confidence has been sliding as real wages are negative on the year as consumer prices in October spiked 6.2% YoY, far higher than the +5.9% YoY expected and accelerating from September's 5.4% YoY; that was the highest print since 1990...

Inflation this holiday season will undoubtedly be a topic at the dinner table. Retailers are pushing costs onto consumers as they attempt to preserve margins. Soaring commodity costs (including decade high in food prices), snarled supply chains, higher transportation costs, labor shortages have allowed shallower discounts.

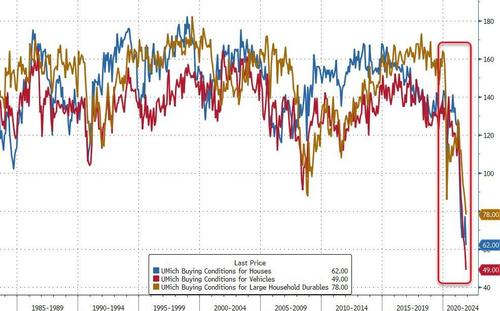

Buying attitudes for big purchases has utterly collapsed (due to price concerns)

Despite consumer sentiment waterfalling to COVID lows, a new Deloitte survey shows holiday shoppers are now planning to spend more than they anticipated in September.

Deloitte projects holiday sales could increase by 7% to 9% this year.

We do note that Deloitte's projection is nominal and so may simply reflect higher prices of the same goods, as opposed to a more positive sentiment reflective of confidence driving Americans to 'buy more'.

Sure enough:

Of the 1,200 respondents (polled between Oct. 21 to Oct. 25), 41% said the reason for expanding their holiday budgets was higher prices. That's up from 27% who said the same last year.

So far, consumers are stomaching price increases as BofA forecast a bigger-than-consensus jump in spending in October.

The survey showed about 63% of consumers experienced a stockout situation, meaning that particular gifts they were looking to buy were not in stock due to supply chain woes.

How will Americans afford this increase in buying? Simple - the way they always have - credit cards. And that spending is already ramping up as inflation eats away at actual incomes and savings. And sure enough, after shrinking for 2 consecutive months, credit card debt soared by just shy of $10 billion - the second highest this year- and pushed the total revolving credit outstanding back over $1 trillion for the first time since April 2020.

So the Federal Reserve finds itself in a situation where it must stomp out soaring inflation by adjusting monetary policy accordingly (but is deathly afraid of the economic and market consequences of such an action). Failure to taper and lift interest rates to combat inflation will cause even more discontent among consumers who may go on a buying strike because they can barely afford shelter, food, and energy.

https://ift.tt/3E0Zmu6

from ZeroHedge News https://ift.tt/3E0Zmu6

via IFTTT

0 comments

Post a Comment