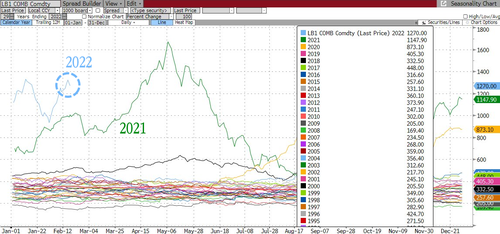

Lumber Prices Have Never Been This High Ahead Of Spring Building Season

The spring construction season is about to begin as homeowners face some of the highest lumber prices ever for this time of year.

March lumber futures in Chicago closed at $1,270 per 1,000 board ft. in Chicago on Friday, up more than 36% since the beginning of the month due to tighter Canadian supplies ahead of the spring building season.

Bloomberg reports the increase in lumber prices comes as Canfor Corporation, the world's third-largest integrated forest products company based in Vancouver, British Columbia, announced a supply cut of 150 million board feet of production due to mountain pine beetle infestation that has devastated trees. Simultaneously, West Fraser Timber Co, the world's largest timber company, reported port congestion and truck and rail car shortage make it challenging to transport lumber to buyers.

"In Western Canada, these transportation challenges are really unprecedented in both scale and duration," West Fraser Chief Executive Officer Ray Ferris told investors on an earnings call last Wednesday.

Over three decades, lumber prices have never been higher for this time of year as the first and third-largest timber companies report supply woes.

Ferris said lumber and plywood shipments fell 20% year-over-year, and pulp shipments plunged 30% in January. He also said shipping "products in a timely manner remains challenged," warning the company might be forced to take "unscheduled downtime" due to the transportation problems.

Tight lumber supplies ahead of the spring construction season in North America are likely to add more housing inflation to not just prospective homebuyers but also homeowners who want to remodel their kitchens or bathrooms.

Add lumber to the list of the "shortage of everything," as Goldman Sachs' head commodity strategist and one of the closest-followed analysts on Wall Street, Jeffery Currie told Bloomberg TV last week, "We're out of everything, I don't care if it's oil, gas, coal, copper, aluminum, you name it we're out of it."

https://ift.tt/2DT0YPs

from ZeroHedge News https://ift.tt/2DT0YPs

via IFTTT

0 comments

Post a Comment