Modern Monetary Theory, And The "Economists" Advocating For It, Will Destroy The United States

Submitted by QTR's Fringe Finance

An economist used to mean someone who applied and analyzed the incontrovertible and irrefutable natural laws of economics as they functioned and played out in a free market.

Now, an economist is someone tasked with attempting to engineer enough academic sounding bullshit to convince a growingly skeptical populace that these very same irrefutable natural laws of economics are somehow no longer relevant - that the laws themselves somehow caught a glimpse of the brilliance of academia and, after thousands of years of dictating how free markets work globally, had no choice but to lay down their arms at the majestic aura of Paul Krugman.

This smoke screen is a necessity, of course, for central planners and vote-hungry politicians to feign as though they have “control” over the global economy and can safely promise “free stuff” - college tuition, social benefits, general wealth and prosperity - without ever having to generate the pesky productivity in order to pay for it.

While this is obviously farcical, the truly frightening thing about modern monetary theorists is that, despite being bludgeoned in the face with the negative consequences of their flawed thinking in the form of blistering inflation, it seems like they still won’t admit defeat.

This would be one thing if the year was 2019 and we were still riding out a period of “mysterious” inflation that we apparently, thanks to our magical CPI, couldn’t punch above 2% even when we wanted to.

But that’s not the case: we’ve doled out the largest tranche of quantitative easing in modern monetary history over the last two years, the gap between our country‘s revenue and spending ambitions has never been wider and we’re currently in the midst of an inflationary (and civility) crisis so bad in this country that they’re putting fucking alarm nets on the $20 slabs of meat at Wal-Mart.

And you thought I was being facetious when I wrote, last year, that the U.S. was turning into a third world country. Are you paying attention yet?

Today’s blog post has been published without a paywall because I believe the content to be far too important. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off to become a subscriber in 2022: Get 22% off forever

Days ago, I happened to notice that the New York Times published a profile of Stephanie Kelton, one of the more well-known advocates for modern monetary theory (MMT).

Kelton is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research (whatever that means).

Her “Greatest Hits” of economic nonsense includes this 2019 interview with The Globe Post where she claimed that the U.S. “can never run out of money and can never be forced to default on [its] debt”. Riveting.

In that interview, Kelton also argued points that critics of MMT often use as fodder for hyperbole, like asking why we even pay taxes when the government can just print as much money as it wants:

“So what that means is that a country like the U.S. doesn’t need to tax or borrow in order to get the currency in order to spend. So it’s never about whether you can afford a program in financial terms. You always can. It’s about whether spending to fund your program will cause an inflation problem.”

And, since 2019, Kelton hasn’t stopped with her Time Life-style greatest hits compilation.

Now, at what is arguably one of the most crucial junctures in American history to critically examine Kelton’s dangerously ignorant economic assertions, the New York Times wrote that Kelton:

“…posits that if a government controls its own currency and needs money — to make sure its citizens have food and places to live when, say, a global pandemic pushes many out of work — it can just print it, as long as its economy has the ability to churn out the needed goods and services.”

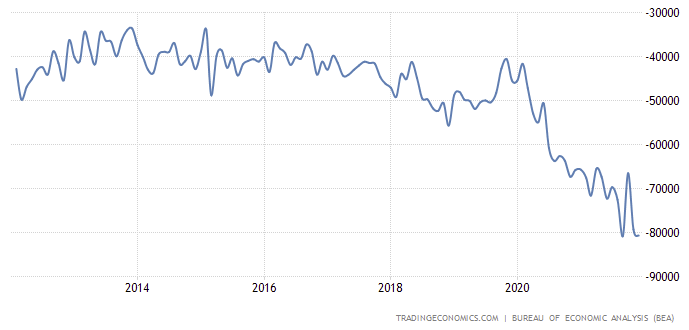

Nevermind the fact that the idea of “just printing it” is a fallacy in and of itself, perhaps Kelton hasn’t seen the country’s worsening trade deficits over the last decade. In other words, our economy doesn’t have the ability to “churn out” anything, especially needed goods and services.

But these deficits weren’t alarming to Kelton in June 2020, after they had almost nearly doubled from the year prior.

Kelton instead took a victory lap in 2020, publishing a book that “shot onto best seller lists” called “The Deficit Myth”. The Times wrote that, at the time of publishing “…inflation had been weak for decades and had dropped below 1 percent as consumers retrenched in the pandemic.”

Ah, the sweet smell of success, right Ms. Kelton?

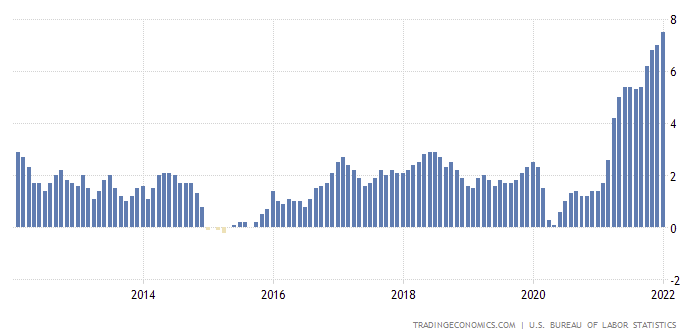

By 2021, when Kelton took a second victory lap on a Bloomberg podcast episode called “How M.M.T. Won the Fiscal Policy Debate,” inflation was already back to 2%.

And just months later, inflation now sits at an out of control 7.5% while our national debt has eclipsed $30 trillion - about triple what it was less than 15 years ago.

The Times named their profile of Kelton: “Is This What Winning Looks Like?”

Not unlike Cathie Wood when her ARK Innovation Fund (ARKK) started plunging 6 months ago, Kelton and her ilk seem sufficiently motivated to try and control the narrative with inflation running out of hand.

For example, only now do we get the admission from Kelton in the Times writeup that MMT “wasn’t assessed carefully for its inflationary effects as it was being drawn up, because it was crisis policy.”

In the words of Adam Sandler in The Wedding Singer:

“Once again, things that could have been brought to my attention yesterday!”

Based on her recent profile, Kelton is holding onto her assumptions and beliefs, lock, stock and barrel, despite the fact that the Fed appears to be in a catch 22 of catastrophic proportions.

Hilariously, Kelton even pushed back on the Times using the same anecdote that former Theranos CEO Elizabeth Holmes used when responding to the Wall Street Journal’s criticisms, while talking to Jim Cramer in 2015.

Modern monetary theorist Stephanie Kelton, 2022:

When she gave presentations on her ideas, Ms. Kelton would occasionally display a quote often attributed to Mahatma Gandhi: “First they ignore you, then they laugh at you, then they fight you. Then you win.”

Elizabeth Holmes to Jim Cramer, 2015:

"This is what happens when you work to change things," Holmes said. "First they think you're crazy, then they fight you, then you change the world."

Even worse, Kelton appears to be clinging to her logical fallacy of an ideology with a resolve that only a self-assured academic could have. The Times wrote that during their interview with Kelton “she never broke her cool when questioned about the inflationary moment and what it says about her theory”, but rather “laid out her response methodically”, placing blame on supply chain constraints and “decades of corporate consolidation”.

About a month before the profile was published, Kelton also wrote a Substack post called: “How Do You Solve A Problem Like Inflation?”

It’s a post that, in a blindingly arrogant way, failed to offer up an apology for how brutal and out of control inflation has gotten in the country, especially for the middle and lower class. Instead, it offered even more reassurance that modern monetary theory is doing its job:

There was, however, a big move up in inflation following the passage of the March 2021 fiscal package. And this has led some people to ask whether the emergence of high inflation means that the MMT experiment has failed. The answer is an unequivocal no.

Today’s blog post has been published without a paywall because I believe the content to be far too important. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off to become a subscriber in 2022: Get 22% off forever

Far be it for me to praise current Fed Chair Jerome Powell. Most of my readers and followers know I have been a strident critic of his for years, but even he understands the obvious fallacy of MMT.

The Times article pointed out that Powell even spoke out against MMT in 2019, stating:

“I have heard pretty extreme claims attributed to that framework and I don’t know whether that’s fair or not. The idea that deficits don’t matter for countries that can borrow in their own currency is just wrong.”

And in my opinion, a large problem with people that want to embrace modern monetary theory is that they have no humility.

The idea that we’re going to be able to print as much money as we would like without suffering any consequences, because we have somehow found a loophole in the basic laws of a free market economic system that we’re gonna be able to exploit in perpetuity, is an arrogant way of thinking.

Realizing that the natural and very basic, elementary laws of economics will eventually have their say in a market, even if only 1% of our micromanaged (interest rates, price controls, regulations) market remains free, is a humble way to look at things.

But modern monetary theorists don’t know anything about being humble. Commensurate with their monetary ideology, for them it’s about gaming the system and pulling together whatever half-assed monetary “tools” we can, combined with a word salad of financial jargon, to, very simply, worry only about the making the present as comfortable as possible - no matter what the cost to the future.

A couple weeks ago I wrote an article talking about how every move the Fed makes is going to be scrutinized because of the inescapable quagmire that our central bankers have gotten themselves into. They must decide right now: crash the markets or stop inflation.

But, after the Fed, second on the pecking order of people whose actions we should be carefully watching should be people like Stephanie Kelton, advocating for theories that are far to the left of what our current Fed Chair believes. Her ideas - and the notion of only focusing on comfort in the present - will prove to be dangerously costly. Yet, they’re seductive in a way: we won’t realize we’ve overstepped our boundaries in applying them until the destruction is already in the rearview mirror.

It also probably wouldn’t hurt to keep an eye on “deep thinkers” like Alexandria Ocasio-Cortez, whose economic aspirations appear to be include printing and spending as many trillions of dollars as an Excel cell will physically allow us to manufacture.

While that’s a bit of hyperbole, the importance of keeping an eye on this developing niche in economics can’t be understated.

Years ago, when I was still introducing myself to economics in the early 2000s - and back when I was a bone fide Democrat - I would have never fathomed that an idea as idiotic as a trillion dollar coin or the Green New Deal would come close to becoming reality. I’ve been horrified over the last couple of years on how these ideas have even been put up for discussion, let alone written into law.

When I was younger, I used to think only the smartest people in the world were members of Congress. Now that I know the truth - that Congress is replete with lobotomized automatons pushing legislation with the sole motivation of trying to appease lobbyists and constituents with “free shit” - I’m far more worried.

In the words of the late, great former Senator Mike Gravel:

“It’s like going into the Senate. You know, the first time you get there, you’re all excited: ‘My god, how did I ever get here?’. Then about six months later you say: ‘How the hell did the rest of them get here?’ Some of these people frighten me.”

On a serious note, in the balance hangs the world reserve currency: the U.S. dollar.

The U.S. dollar is literally all we have to cling to in our country. We don’t have production, we don’t have trade surpluses, and we sure aren’t a creditor nation.

The dollar is the only thing that has allowed us to run our backwards monetary policy in this country and get away with it. While I’m not sure that the dollar is going to last as reserve currency for much longer anyways, implementing and clinging to modern monetary theory - while countries like Russia and China are stockpiling gold - is a surefire way to accelerate our country’s economic demise and put us in potentially our most precarious position in recent history.

The best part is: you don’t even need to be an economist - you don’t even need to know where the hole is in modern monetary theory to know that it doesn’t work.

It can be simply boiled down to: something about it just doesn’t feel right. Or, in other words, it doesn’t pass the smell test.

When people investigating financial malfeasance look for the hallmark clues of Ponzi schemes and other types of fraud, one of the red flags they always hone in on are promises that sound “too good to be true”.

In the case of Stephanie Kelton, not unlike many postmodernists, we have a woman who has amplified and magnified otherwise simple, steadfast economic rules into a confusing and complex web of jargon that fails to render the rules ineffective, but instead delays their consequences into the future and creates so much confusion that the layperson is tricked into assuming that she knows what she’s talking about.

Kelton thinks she has found some type of hidden esoteric code - the Game Genie for the economy - that’s going to allow us to cheat and re-write very clear, time-tested economic laws that have been in place for thousands of years.

Anyone seeing any red flags yet?

Now read:

-

Inflation Is The Kryptonite That Will End Our Decades-Long Monetary Policy Ponzi Scheme

-

Cancel Culture Is Now Officially A Snake Eating Its Own Tail

-

It’s Still Starting To Feel Like Time For A “Limit Down” Morning

-

One Unloved Retail Stock That Could Be Perfect For Both The Short And Long Term

-

When The Global Monetary Reset Happens, Don't You Dare Forget Why

-

The Fed Is Fucked And So Are The Lobotomized "Genius" Fund Managers It Has Created

This post is public so feel free to share it: Share

https://ift.tt/rnMhjlk

from ZeroHedge News https://ift.tt/rnMhjlk

via IFTTT

0 comments

Post a Comment