Goldman Cuts S&P Target To 4,700 In Second Downgrade In Past Month, Warns Of "Recession Downside" To 3,600

On February 12, when Goldman's permabullish chief equity strategist David Kostin finally capitulated and cut his year-end S&P price target from 5,100 to 4,900, we said that "in addition to his baseline, Kostin considers three alternative scenarios.

- If inflation remains high and prompts continued Fed hiking that lifts the terminal funds rate well beyond the market and our economists’ estimates, we expect thecost of equity would rise on net and the S&P 500 would decline by 12% to 3900.

- Alternatively, if inflation recedes by more than expected this year and results in fewer Fed hikes, we expect the cost of equity would fall and the S&P 500 would riseby 24% to 5500.

- Finally, if the US economy tips into a recession –a question which Goldman's investors have increasingly been asking –the typical 24% recession peak-to-trough price decline would reduce the S&P 500 to 3600.

And gave readers a spoiler alert: "the right scenario will be #3, but before we get there expect another 200 point S&P target in one month, and then another, and then another..."

We were off by a few hours because on March 11, just shy of one month later, Kostin did precisely what we said he would and late on Friday, the bank cut its year-end 2022 S&P 500 target for the second time in a month, from 4900 to 4700, which the bank cheerfully informs its clients is still a 10% upside from current levels.

Why? Because "a surge in commodity prices and a weaker outlook for US and global economic growth lead us to lower our EPS estimates." It is shocking that in early February, weeks after we said that "The Market Is Starting To Think Recession", Goldman had yet to grasp that global economic growth was slowing or that with commodities already soaring there would be stagflationary hell to pay.

Well, better late than never, especially for the market's biggest cheerleaders (behind JPMorgan of course, because to this day, Marko Kolanovic keeps tells his clients to BTFD which they would if they still had any money left to BTFD).

So what is Goldman's new base case? As Kostin explains, "our new 2022 EPS estimate of $221 reflects 5% year/year growth compared with our prior estimate of 8% growth to $226. Our forecast 2023 earnings growth rate remains unchanged at 6% but the EPS level is trimmed to $233 (from $240). A 12% upward revision to Energy sector EPS partially offsets headwinds to profits in other sectors from decelerating consumer spending and increased input cost pressures. Excluding Energy, we expect S&P 500 EPS will grow by just 2% in 2022 vs. 6% for consensus."

And since Goldman will trim its ex-energy EPS forecast in another month or so, we are now officially in an earning recession, aside from the one sector that benefits from commodity hyperinflation which unfortunately also pushes the economy into stagflation.

So if Goldman is taking the axe to its earnings forecast, how does it cut its S&P target by just 200 points? Simple: somehow, Goldman thinks that in a year when the Fed is expected to hike "six or seven" times" in hopes of pushing the economy straight into recession, a view which we first voiced back in January and which has since become consensus...

Goldman: "inflation risks—rather than improving growth expectations—have driven the recent hawkish pivot,"

— zerohedge (@zerohedge) January 15, 2022

Translation: the Fed is i) either hiking into a stagflation or ii) hiking with hopes of creating a recession

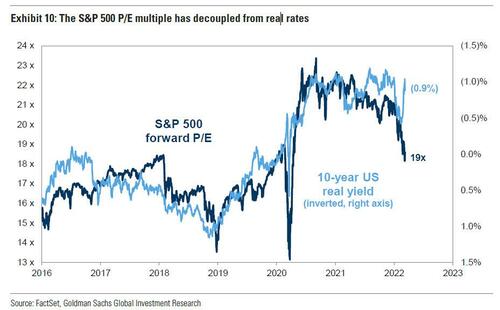

.... that PE multiples will magically rise! To wit: "our 4700 target embeds an expectation that the forward P/E multiple will rebound from 19x today to 20x by year-end as the Equity Risk Premium (ERP) compresses. Our year-end 2022 implied absolute valuation represents a 5% P/E decline from the 21x multiple at the start of 2022. In our base case, real yields climb from recent lows but remain negative through 2022 despite Fed tightening."

At the same time, Kostin believes that decelerating growth and inflation and reduced political uncertainty should compress the ERP from today’s elevated level. According to Goldman, the current 620 bps gap between the S&P 500 earnings yield and the real 10-year US Treasury yield is the widest since March 2020 and matches levels in 4Q 2018, underscoring the potential value opportunity in US stocks if the growth outlook improves. Of course, if it does not improve as the US economy slides into a stagflationary recession as Goldman will admit as its base case in about 3 months, well... oops.

So while Goldman's traditional optimism has been dramatically neutered in the past month, it is still present although not even Goldman can see itself predicting an imminent bounce in stocks, and as Kostin notes, "because we expect the various sources of current investor uncertainty will take time to be resolved, most of the equity upside should come later in 2022. Our 3- and 6-month S&P 500 targets are 4300 and 4400, respectively."

But what if they don't get resolved. Well, one day after Goldman said recession odds for the next year have risen to 20-35% (we, on the other hand, believe that they remain at 100% for the current year), Kostin grudgingly raises the odds of a recession even higher and writes that "the current S&P 500 index level of 4260 suggests roughly a 40% likelihood of a downside recessionary case" adding that "investors have recently expressed concerns that the US economy might tip into recession, leading to much lower EPS and valuations."

In such a "recession" scenario, which Goldman does not anticipate yet diligently models out for right after it hits, the bank expects reduced earnings and valuation multiples would cause the S&P 500 to decline by 15% to 3600, in line with the median historical peak-to-trough price decline of 24% around past recessions. Here, unlike above, Goldman is less excited to note that this represent a 15% drop from current levels and is probably sufficient to trigger the Fed's put.

However, were the US economy to avoid recession, Goldman is quick to note that 10%+ S&P 500 corrections such as this one typically represent good buying opportunities, with a median subsequent 12-month return of 15% (if the recession is confirmed however, it's an entirely different matter .

Alas, the market does not see things quite as cheerfully as Goldman, and as stocks continue to slide, so does liquidity and positioning: as we have repeatedly noted in past weeks...

Checking in on liquidity: <4MM to move ES 1 tick pic.twitter.com/rBtoteblXP

— zerohedge (@zerohedge) February 28, 2022

... extremely low levels of equity market liquidity have amplified the impact of widespread investor selling, and Goldman's US Equity Sentiment Indicator, which combines nine measures of positioning across institutional and retail investors, has fallen into negative territory "but remains above levels that have generally marked the bottoms of large market drawdowns during the past several years." In other words, there is more selling to come.

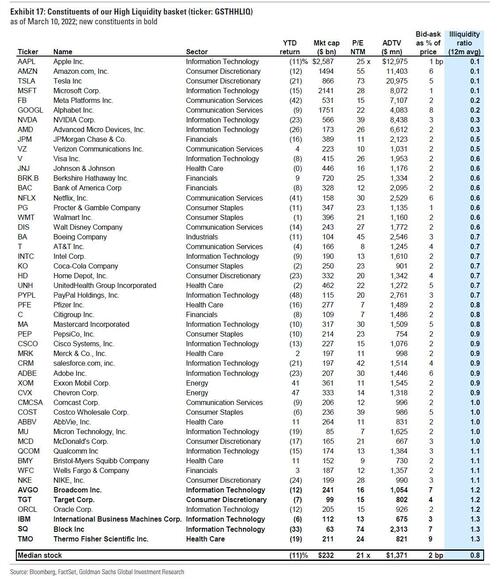

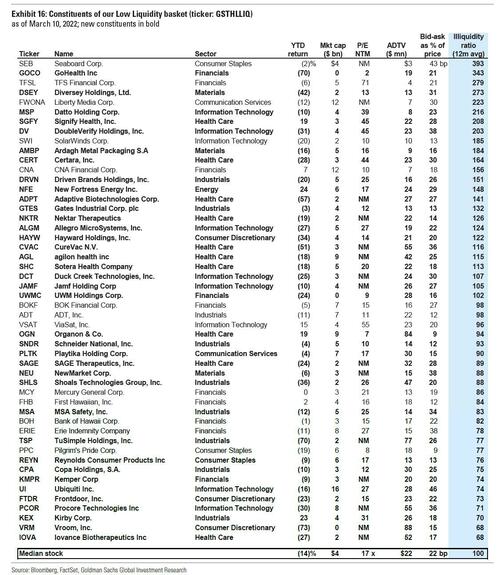

Amid poor market liquidity, highly liquid stocks have underperformed less liquid peers, as is typically the case during market sell-offs and periods of tightening financial conditions, as investors dump what they can - something they will continue doing for a while.

Finally, in addition to turning more bearish, Goldman is also rebalancing its liquidity baskets, to help those who wish to trade out of most liquid stocks, which just happen to be the most popular ones...

... and into the least liquid ones.

The full Goldman report is available to pro subs in the usual place.

https://ift.tt/wKz1v4T

from ZeroHedge News https://ift.tt/wKz1v4T

via IFTTT

0 comments

Post a Comment