Is Bitcoin 'The Real Deal'? - Ukraine Crisis Offers Perfect Opportunity To Find Out

Current political and economic conditions are ideal for bitcoin, but positioning is negative. Which is more important?

There are many attractive features to Bitcoin.

By design Bitcoin has a rising costs basis which helps limit supply (the ever rising difficulty of mining bitcoin), computing power needed to mine is also driven by energy costs, and Bitcoin acts as a store of value outside the control of central authorities.

The Russian invasion of Ukraine, and the subsequent financial retaliation by Western powers has created a perfect environment for Bitcoin to prove it worth as a store of value.

European natural gas prices have risen 16 times from their 2020 lows, and have spiked again in the last week.

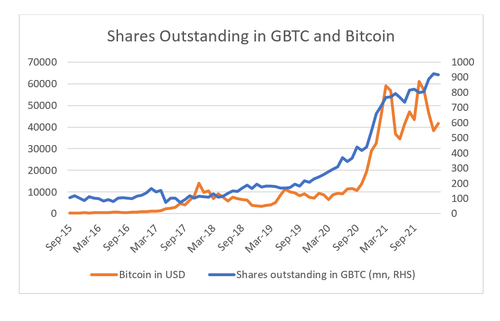

However, from a positioning point of view bitcoin looks more troubled. When I look at the largest Bitcoin “ETF” - the Grayscale Bitcoin Trust (GBTC) - shares outstanding have continued to rise in 2021 and 2022 even as Bitcoin performance has been lacklustre.

Short interest in GBTC remains non-existent.

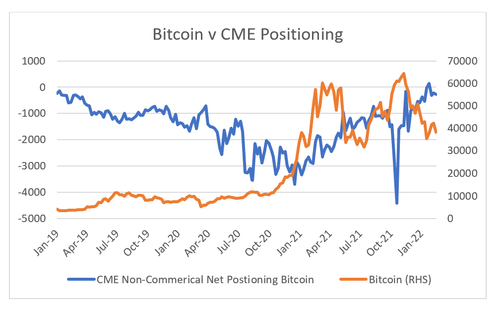

It is possible to argue that GBTC is less representative of the Bitcoin market than it used to be. As alternative we could look at the CME futures market for Bitcoin. Net positioning for Bitcoin was quite negative in late 2020, before it rallied 700%. Currently net short positioning is close to the lowest levels ever, suggesting few bearish bets.

Is Bitcoin the real deal - a digital gold - or is a speculative asset that has benefited from a combination of excessive liquidity and bearish positioning. The Russia/Ukraine crisis offers the perfect opportunity to find out.

* * *

https://ift.tt/gNdGMfz

from ZeroHedge News https://ift.tt/gNdGMfz

via IFTTT

0 comments

Post a Comment