Jeff Gundlach Live Webcast: "Convoy"

It's time for DoubleLine's CEO Jeff Gundlach to share his market thoughts with everyone as part of his periodic live webcast, titled this time "Convoy" which can be accessed at the following link:

The last time we heard from Gundlach at the start of the year, as part of his “Just Markets” webcast. Back then, he said he was focusing on signals that show the U.S. economy could be weakening. That was a bit of a contrarian call in January - if one we have been pounding the table on - but it’s now top of mind for investors who are trying to figure out what Russia’s invasion of Ukraine means for global growth.

As Bloomberg reminds us, Gundlach said in his January webcast that he was long-term bearish on the U.S. dollar and bullish on gold. Since the start of the war in Ukraine, both the greenback and gold have rallied in tandem as traders seek havens from risk. It will be interesting to watch whether Gundlach changes his call on the dollar and offers a prediction of where it will be year-end.

Gundlach will also revisit the rebounds in oil and commodities that he discussed back in January. The energy sector has continued to outperform since then, and oil -- which Gundlach called the big winner of last year -- has only added to gains and has hit record highs.

Gundlach also said in January that the Fed was behind the curve. The central bank is getting set to tighten monetary policy -- the FOMC is meeting next week. But since Russia’s invasion of Ukraine, traders have been ratcheting down their expectations for how many hikes we’re going to see this year.

Why the title "Convoy"? As Gundlach explains, “Convoy” refers in part to the truckers’ movement in Canada, which he called “inspiring” (usually Canadians are so “polite" that "it takes a lot to get Canadians going") but also to the relentless movement in the commodity market. Gundlach also said that in recent days we have seen a darker convoy, referring to the line of Russian tanks stuck outside of Kyiv which he calls "Russia’s Convoy of Destruction."

Turning to his actual market commentary, Gundlach says that it's been a “horrific start” to the year in markets, while emerging markets have become a real “debacle” as some mark Russia down to zero. And while the U.K. has been holding up, Gundlach says “there’s almost nowhere to hide" in equities.

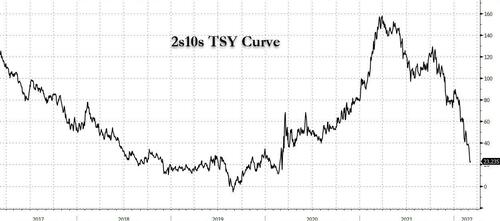

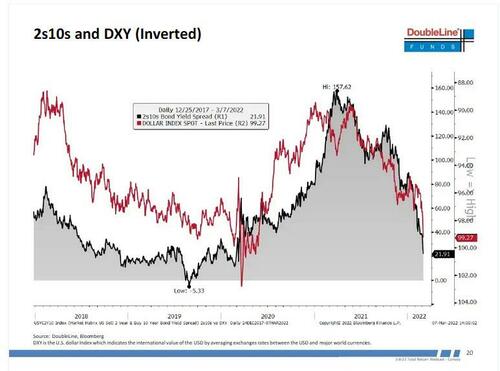

Looking at rates, Gundlach said that the market is predicting a flat yield curve very soon, something we noted in our EOD market wrap when we showed the 2s10s just wide of 20bps.

A quick detour on the markets, Gundlach says that he expected we’d get a better bounce in the S&P 500 today, even though the index closed the day down 0.7%, near session lows as traders sell the rips. Gundlach says the morning recovery in stocks today was likely short covering, and once that wave had passed, equities dropped.

Next, looking abroad, Gundlach notes that Japanese and German bond yields are now in positive territory, amid the global selloff in bonds. “The convoy is running along.”

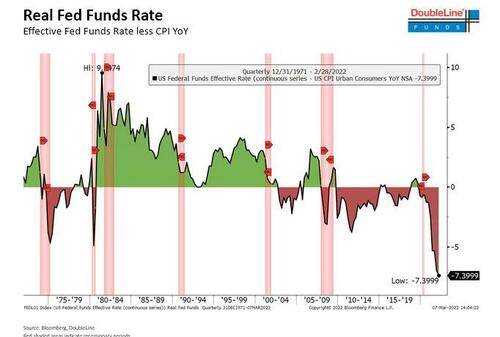

Showing a chart of the record negative real rate of -7.5%, which as he has said in the past "are Jimmy Carter-like” levels, Gundlach says that the Fed’s going to raise rates by 25 basis points, which the Fed has well-telegraphed, and expects a very aggressive hiking trajectory by the Fed.

Curiously, Gundlach says he doesn’t think the Fed will move slower or more cautiously because of the war in Ukraine, in fact he says that while some say that the war will make the Fed less likely to raise rates. “I totally disagree with that." Why?Because he thinks inflation is not going to peak out at 7.5% on the CPI -- we could see a 10% print, he says, and “certainly a 9%” before any relaxation.

“Their job is to fight inflation. They’ve done a terrible job of it so far,” Gundlach says of the Fed. If inflation hits 9%, say, the Fed cannot not tighten.

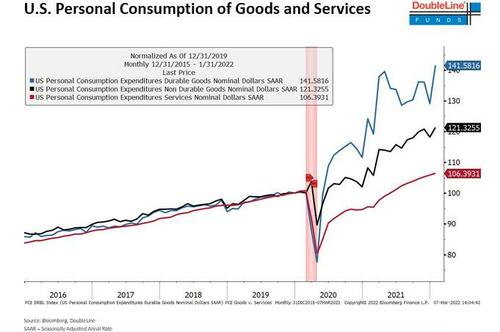

Shifting to the economy, Gundlach shows the surge in durable goods consumption offset by modest services spending, and says that the economy “is really screwed up,” and it’s hard to make historical comparisons.

Echoing the latest Michael Wilson notes, Gundlach says that we’re going to have a lot of "demand destruction" because a lot of money goes to food and energy.

Going back to the chart above, Gundlach says that durable goods consumption was way out of whack during the pandemic, and “rather a lot” of that spending might simply have been brought forward from the future as consumers anticipate future inflation. Sure enough, he says that we’re starting to see consumer sentiment lagging, he says, referring to a USA Today survey, which polled readers about the economy. About 51% of respondents said we’re in a recession or depression presently.

Then Gundlach again points to the deterioration in the University of Michigan consumer sentiment readings, whose main index is now the weakest since 2011.

Meanwhile, as noted earlier, the US trade deficit has exploded since stimulus was handed out in the U.S. It looks high, he says, showing the effect of the money printing: "trade deficit has increased mightily -- it’s up 80% “since the money started to be thrown around."

And speaking of the presentation title, Gundlach thinks there will be problems with hiring truckers. Specifically, Gundlach points out that a 25-year-old may not want to become a trucker, since self-driving trucks mean that the job won’t exist by the time they reach retirement age. He predicts this will cause problems recruiting truckers for the time being, adding to supply-chain troubles.

In retrospect, Gundlach says that things are “substantially worse” now with regard to the economic outlook than they looked back in September, he says, and points to three dynamics which will hurt spending:

- Payback for the surge in durable-goods consumption during the pandemic

- The drag from fiscal policy, which is switching from stimulus to contraction

- The “demand destruction” thanks to inflation, with food and energy soaking up more of the household budget

Gundlach next turns to the job market, and referring to the labor-force participation rate, says that’s still below pre-pandemic levels. That’s in part due to federal transfers from pandemic-relief spending. Also, “the crime-force participation rate has taken away some of those workers.”

Expanding on this, Gundlach says if you can steal $900 without prosecution, that encourages crime and, effectively, reduces the incentive to take a job.

Gundlach next turns to currencies, and says he’s been bullish on the dollar for about a year, against his long-term bearish perspective on the U.S. currency. Gundlach next shows the 2s10s yield spread vs the inverted DXY Index which he notes is very highly correlated.

He then warns that when the dollar finally buckles under weight of the twin deficits, that’ll be the next big recession.

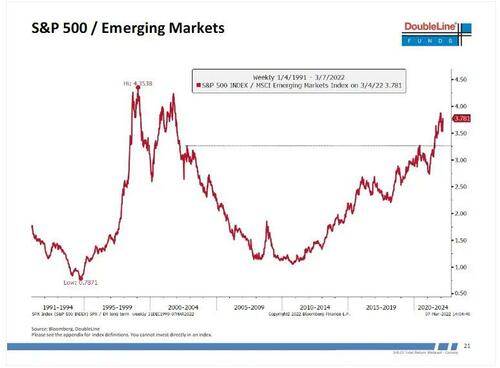

Next, Gundlach shows a chart which correlates emerging markets versus the S&P 500. He says EM is very cheap, citing the CAPE ratio. We’ve had a huge run of about 10 years of U.S. stock-market outperformance. His conclusion: emerging markets are “very cheap,” although as the recent fiasco with Russia shows, maybe there's a reason for that...

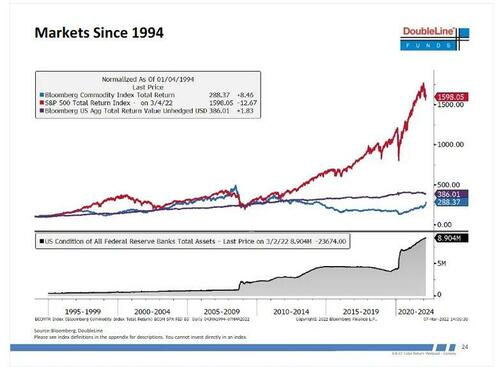

Gundlach next shows what he says is one of his favorite slides, which shows the past 26 years of the Bloomberg Commodity Index’s total return, compared with the S&P 500 Index and the Bloomberg Agg Index. Indeed, as shown below, on a total return basis commodities don’t look like they’ve done much against the S&P 500 or against bonds.

Gundlach says that it’s “incredible” to see the government’s involvement in deficits and money printing. It all led to big outperformance of US stocks versus everything else. But now "commodities are on fire" and "it reminds him of the 1970s." Incidentally it has been reminding us as well since last October ...

* * *

His full presentation is below:

https://ift.tt/qeE5X4B

from ZeroHedge News https://ift.tt/qeE5X4B

via IFTTT

0 comments

Post a Comment