Ukraine Invasion Scrambles Hedge Funds' Outlook For Oil: Kemp

By John Kemp, Senior Market Analyst at Reuters

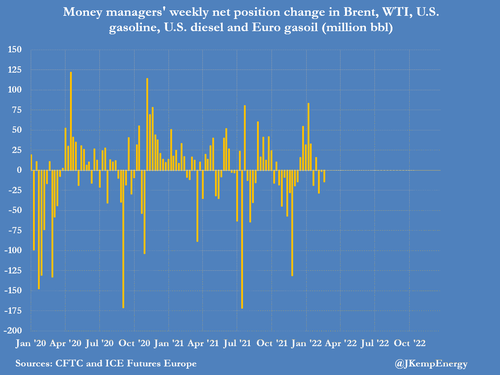

Prior to Russia’s invasion of Ukraine, investors were reducing their bullish position in crude oil and refined products, which likely explains the extreme volatility once the military operation started. Hedge funds and other money managers sold the equivalent of 14 million barrels in the six most important petroleum-related futures and options contracts in the week to Feb. 22, according to regulatory data.

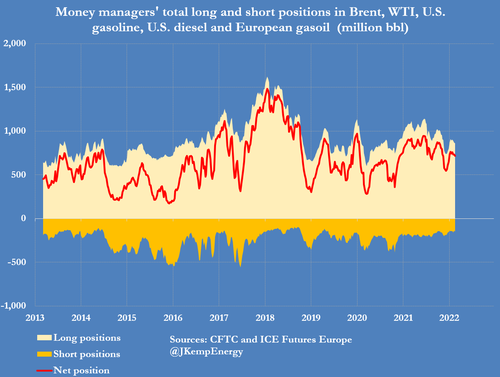

Portfolio managers have been net sellers in four of the five most recent weeks...

... reducing their combined position to 714 million barrels from a recent peak of 761 million on Jan. 18.

Before the invasion, the hedge fund community was still bullish about the outlook for prices, with the combined position in the 63rd percentile for all weeks since 2013. But funds were a little less bullish than they had been in the middle of January, when the combined position was in the 70th percentile.

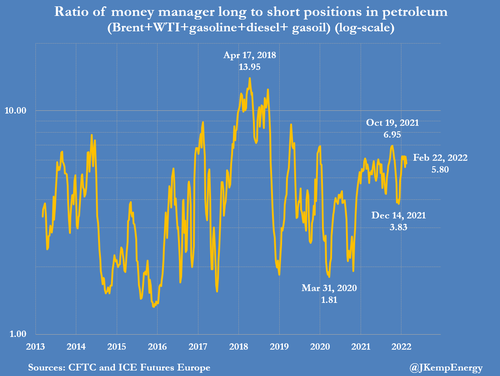

Bullish long positions outnumbered bearish short ones by a ratio of 5.80:1 (77th percentile), but the position was slightly less lopsided than the ratio of 6.24:1 (80th percentile) five weeks earlier.

Until the invasion began, investors seemed confident the intensifying conflict and sanctions would not disrupt oil exports from Russia.

Fears about inflation, the prospect of rising interest rates, and the likelihood of a nuclear deal between the United States and Iran resulting in more oil exports dominated concerns about the diplomatic situation in Ukraine.

Most fund managers were content to leave their bullish positions unchanged, but among the few who made adjustments, most were motivated by profit-taking after a months’ long rally, or anticipated a reversal in the trend.

In the most recent week, funds were sellers of NYMEX and ICE WTI (-21 million barrels), U.S. diesel (-2 million) and European gas oil (-5 million), but left U.S. gasoline unchanged, and purchased Brent (+13 million).

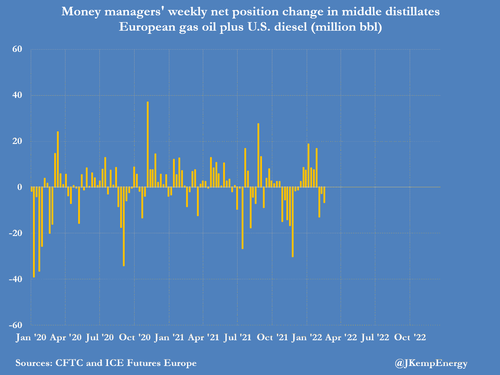

Funds have been net sellers of U.S. diesel and European gas oil combined for the last three weeks, after being buyers for the previous seven, reflecting growing unease about the sustainability of the economic recovery.

However, since then, the focus has shifted from the economy to the intensifying diplomatic and financial conflict between Russia on the one hand and the United States and the EU on the other.

The escalating conflict has gradually taken on the characteristics of unrestricted economic warfare, with the number of trading bans, asset freezes, confiscations and forced disposals multiplying rapidly.

Oil and gas prices have started to climb as traders anticipate economic warfare will eventually disrupt energy exports from Russia, even though both the U.S. and Russian governments insist this is not their intention.

https://ift.tt/vpJ9KQa

from ZeroHedge News https://ift.tt/vpJ9KQa

via IFTTT

0 comments

Post a Comment