What Joe Biden's Executive Order On Digital Assets Really Means

One River Asset Management's Head of Research, Marcel Kasumovich, wrote about the improtant of Biden’s Executive Order on the future of digital asset infrastructure and innovation. His note is reproduced below.

This week, your inbox is likely overflowing with two observations – President Biden’s Executive Order on digital assets and the positive price response to what was supposed to be old news. It was as though digital assets exhaled a sigh of relief with the release of the Order. And it went further than expected. The Order is the first-ever ‘whole-of-government approach,’ with broad goals of supporting digital asset innovation, guarding consumer protections, ensuring financial stability, and playing a leading role in international finance. It resets the tone around digital assets – agencies will work together to integrate new technologies into the mainstream. We see four key points of emphasis.

First, the US wants to be the global leader in digital asset innovation. This is similar to the embrace of the internet in the 1990s, where US technologies eventually proliferated throughout the global economy. Yes, it happened more slowly than technologists would have liked back then too. Congress first started working with an electronic mail system in 1993, and internet laws only began in 1996 (here). For those working on the technology, the years of wait surely felt like a lifetime. Yet, arguments of bad operators dominating the internet seem like a lifetime ago. Digital assets are at a similar policy inflection point to the 1990s internet.

Like the internet back then, policy is now focused on the benefits of new technologies with a watchful eye on risks. Access to affordable financial services featured prominently in the Executive Order. It is important not to minimize the scale of the opportunity. Think global. Billions of people around the world are unbanked or underbanked. India is an extreme example. Two-thirds of India’s population is rural and only 31% have internet access (here). That’s 649 million people who will be brought on-line. That’s 649 million people whose first formal banking experience will almost surely be digital. The reach of US technology leadership, as with the internet, is global. It can unlock a revolution in digital banking.

Second, digital currencies are being driven by US national interests. The potential for a US central bank digital currency (CBDC) is deemed urgent by the Order. However, the focus is a bit more subtle, attentive to assessing “the technology infrastructure and capacity needs for a potential US CBDC,” (emphasis added). Our judgment here is simple – US national interests are tied to both the infrastructure used to operate digital assets and the US dollar as a reserve currency in the global financial system

What does this mean in practical terms? Well, the Order sounds the starting gun of an infrastructure footrace. The Federal Reserve entered the 24x7x365 settlement competition in 2019 when it started the development of FedNow (here). But the digital asset ecosystem has a huge lead that it is unlikely to relinquish. For one, protocols such as Ethereum are inherently interoperable around the world, unlike FedNow. Further, decentralized protocols are attracting development talent with a record 4,000+ Ethereum developers in December 2021 (here). Finally, the US dollar is already in a digital leadership position with two of the top five digital assets by market capitalization being US dollar stablecoin. The digital infrastructure “rails” are built, Ethereum and Bitcoin are in a leadership position, and policy will embrace them (eventually).

Third, the focus on strategic financial stability is telling of the desire to integrate digital into the mainstream. The Financial Stability Oversight Council, the highest body on stability matters, is charged with the task of mitigating systemic risk. This will be critically important in the context of the banking system. Instantaneous and final settlement is foreign to current financial intermediation that is built to accommodate error. “Fat finger” trades are final in digital. Consequently, native digital asset operators have designed technology systems that focus on pre-trade risk management. And those accustomed to operating in the digital arena have internalized the importance of precision.

Of course, the underlying technologies demonstrate remarkable resilience. Bitcoin has been functional 99.99% of the time since January 3, 2009, with 3,285 consecutive days of operating without interruption. Newer decentralized financial protocol, using assets like bitcoin and ether as collateral have guarded against financial stability risks via overcollateralization and ruthless mathematical formulas, and thereby ensuring any investor taking leverage solely bears the risk. This will require a huge shift in the mindset of traditional markets, where investors connect negative price performance to systemic risk. The digital financial system will greatly enhance stability and resiliency of the ecosystem.

Finally, the devil is always in the details – we are now closer to a single digital regulator. Even if there were not a single regulator formally recognized, the whole-government approach makes it clear that regulatory entities will be cooperative in their approach. The Order provides political cover for entities to reframe and rethink their positions. Again, it is useful to put this in the historical context of the internet. The first “internet law” passed was the Telecommunications Act in 1996 (here). It was the first major change in telecommunications law since 1962. We are at a similar stage with digital assets. The Automated Clearing House (ACH) was the last major innovation in payments in the 1970s (here). It’s time for digital.

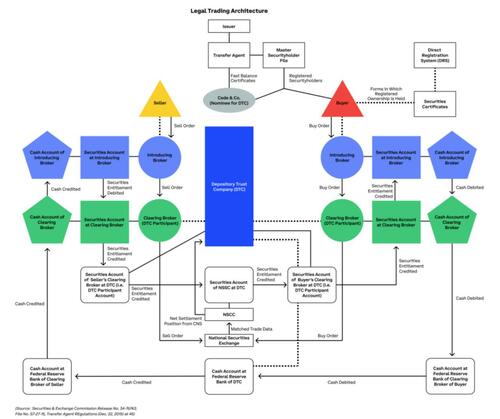

Make no mistake, the regulatory environment will change with the legal structure of trading activity in the digital era. Great efforts are being made to provide lawmakers with clear frameworks on these issues. Testimony from Alesia Haas to the US House Committee on Financial Services is notable (here). Figure 1 illustrates the current, cumbersome legal web involved in a trading transaction that requires the current layers of regulation.

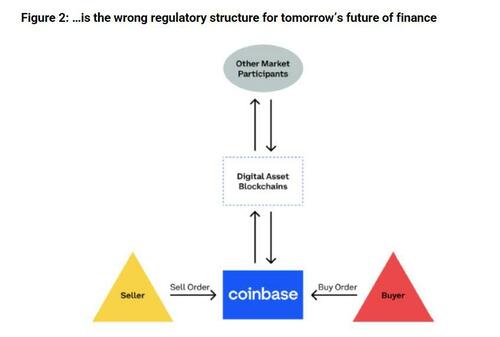

Figure 2 shows the future of finance – minimalist by comparison with only five simple nodes. The regulatory boxes required in Figure 1 are just not applicable to Figure 2; the efficiency gains of embracing digital will be tremendous.

The Order puts to rest the debate about whether and where digital will fit into the future of finance. Digital technologies are set to play a leading role. The mandate is unequivocal. It is not to say that everyone and everything in digital will win. To the contrary, the message is more about embracing the technologies for the strategic betterment of America than accepting the current state of play in areas like decentralized finance. Digital asset technologies are transformative in how we transfer value. It has the potential to level the playing field in all markets as the lines between traditional and native-digital assets become blurred alongside a broadening of tokenization. We welcome the strategic initiatives.

https://ift.tt/9j4VbE6

from ZeroHedge News https://ift.tt/9j4VbE6

via IFTTT

0 comments

Post a Comment