When The Financial System Is Weaponized, Bitcoin Becomes The Peacemaker

Authored by Mark Jeftovic via BombThrower.com,

When the financial system is weaponized, Bitcoin becomes the peacemaker.

When Hobbes wrote Leviathan, he proposed an all powerful government possessing an incontestable monopoly on force that would prevent humanity from descending into a the battle of “all-against-all”.

Today, with government authority and overreach seemingly at its zenith we’re seeing that Hobbes didn’t anticipate what would happen if Leviathan lost the consent of the governed. Thanks to the pandemic and two years of COVID tyranny, that now seems to be happening.

Leviathan used to be the so-called “international rules based order” of globalism, which was an industrial age concoction fuelled by cheap debt and fiat currency. The steering committee behind that paradigm, unelected plutocrats like the World Economic Forum are now frantically trying to pivot globalism into some other set of rules where they still get to call the shots. Call it Stakeholder Capitalism, The Great Reset, or The Great Narrative, the problem is that these are all just industrial age constructs in an emerging decentralized world.

Most people agree that at the very least, we’re heading into a new multi-polar world, but it may not unfold the way PolySci majors characteristically think of it. Not only is the US inexorably relinquishing its role as global hegemon behind Leviathan, but globalism itself is rapidly imploding. Along with it last vestiges of legitimacy and credibility that the institutions and political class who held it together still had.

Globalists: Careful what you wish for

Whether was an all-encompassing conspiracy or not, COVID was gleefully seized upon by the uber-wealthy Davos crowd as an opportunity to “reimagine” this rapidly changing world in their own image. It’s literally in the playbook that the pandemic enabled

“changes that would have seemed inconceivable before the pandemic struck, such as new forms of monetary policy like helicopter money (already a given), the reconsideration/recalibration of some of our social priorities and augmented search for the common good as a policy objective, the notion of fairness acquiring political potency, radical welfare and taxation measures, and drastic geopolitical realignments.

The broader point is this: the possibilities for change and the resulting new order are now unlimited and only bound by our imagination, for better or for worse. Societies could be poised to become either more egalitarian or more authoritarian, or geared towards more solidarity or more individualism, favouring the interests of the few or the many…

you get the point: we should take advantage of this unprecedented opportunity to reimagine our world, in a bid to make it a better and more resilient one as it emerges on the other side of this crisis.”

— Klaus Schwab & Thierry Malleret, COVID-19 & The Great Reset

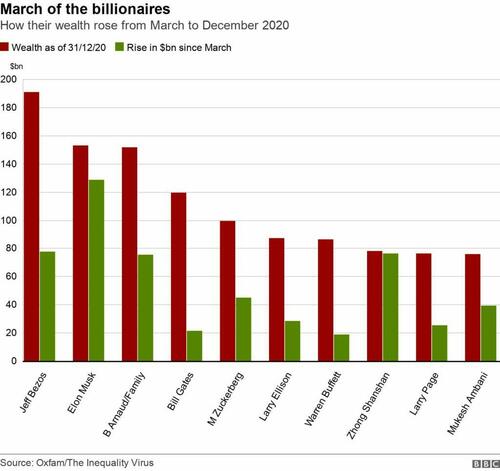

The political and oligarchical class that typifies Davos attendees and WEF membership, had largely driven the agenda and the priorities of the post-Bretton Woods era. Thanks to Cantillon Effect and fiat debasement, these self-appointed elites achieved vast riches and undue influence at the expense of impoverishing the masses through debt and inflation.

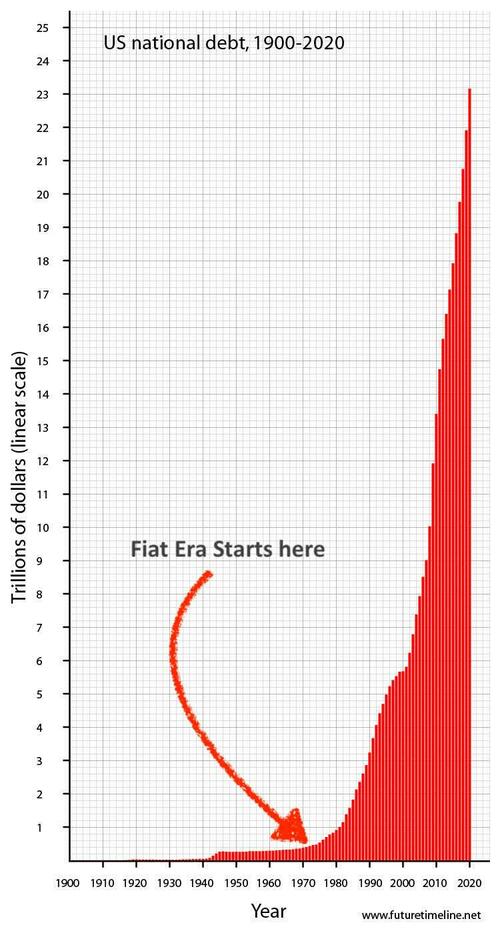

Via https://seekingalpha.com/article/4391707-shocking-growth-in-americas-national-deficit

After 50+ years of the fiat currency standard, the debt side of the equation was hitting the end of the runway, and the pandemic was their chance to impose their Great Reset which would simply wipe the slate clean and re-up their lease on the reigns of power.

But that isn’t what’s happening. Covid looked like it set the table for yet an another unprecedented power grab and wealth transfer from the masses, but this time it all happened too fast, too soon. Twenty-years of future creeping totalitarianism and plunder was crammed into 18 months.

So yes, there will be some sort of Great Reset, but it won’t be what the globalists hoped for, which was a linear extrapolation of the industrial age kleptocracy into a digitized Technocracy with themselves firmly ensconced at the helm.

Decentralization, network computing and cryptography has changed all that. With it, the very architecture of power, finance and civil society. Because of that, no amount of industrialized authoritarianism will succeed at anything other than catalyzing the demise of the outgoing system. All you have to do is look at the top graph of the debt and realize that propagandized narratives are no substitute for reality.

The Band-Aid moment

A major inflection point has occurred with the breathtaking incompetence of the Trudeau Regime’s abject mishandling of the #FreedomConvoy movement.

After cowering for weeks, the PM came out and did more for the cause of decentralization and Bitcoin in a few days than any of us writing about it could accomplish in a decade. As Frank Holmes, Hive Blockchain’s Executive Chair described it “Justin Trudeau is the Greatest Salesman for Bitcoin in Canada”.

Everybody involved in the fumbling of the trucker’s revolt completely discredited themselves, from Trudeau to Freeland to the NDPs to the corporate, state-funded media, all of it.

Canada, a G7 nation and ostensible pillar of democracy had weaponized the financial system against its own citizens. Abandoning any pretence of due process or civil rights, they nearly blew up the banks in the process, expended all of their political capital to ram it through Parliament, and then after all that they had to ignominiously back down.

The world can never unsee what happened in Canada.

Without saying so explicitly, those events hammered home what we should all expect from the relentless push toward Central Bank Digital Currencies (CBDCs). If the government of a G7 nation like Canada can simply freeze bank accounts based on unvetted, illegally obtained data, with no due process and no recourse, how will life be when these very same capabilities are baked-in to a CBDC?

The intent is clear. They spell it out in their white papers. We’ve already looked at the Bank of Canada’s white paper on CBDCs in the September issue (of The Crypto Capitalist Letter). The salient quote is:

“Although still early in their development, smart contracts could enable entirely new digital economy applications with many potential benefits. To start, smart contracts could enable programmable money by adding certain attributes to it. For example, money could be programmed to gain or lose value over time, or it could be programmed to be used in transactions for only specific goods or services. Furthermore, smart contracts can enable programmable payments—automated payments that are executed after certain conditions are met. These can range from simple push payments to more complex ones. For instance, smart contracts could enable automatic routing of tax payments to authorities at the point of sale, pay-as-you-go insurance or payments that can support IoT applications.”

And as I mentioned previously,

this all sounds generic and non-biased enough. However take a look around. Those “certain attributes” and “certain conditions” may well end up being things like what Justin Trudeau, or whomever replaces zim thinks about your activities (or “unacceptable opinions”).

Donating to #FreedomConvoy? Listening to Joe Rogan Experience? Those aren’t approved activities. That’ll cost you some demerits.

So too does the importance of un-censorable access to the financial system come into focus on another front as the world reacts to Russia’s military invasion of Ukraine.

Cancel-culture goes Full Hobbesian

People may be predisposed to view what happened in Canada and the Russian invasion of Ukraine as separate incidents with their own unique inciting incidents and ramifications. I think they are related, but not in the context of a “shadowy global conspiracy” where this is all part of an over-arching plan to impose a New World Örder (yes, I think a lot of globalist elites pine for that, but that’s not what I’m talking about here).

They are related in two other key ways:

First: we’re seeing time and again that technocrats have over-played their hands and leaders are over-estimating their own power. Trudeau’s humiliation has faded to the background for now, but mark my words: his career is all but finished. Whatever WEF-inspired agenda there actually was in play, Trudeau may have single-handedly derailed it.

Over in the Ukraine, Putin almost certainly thought he would have steamrolled the country in under 48 hours and that hasn’t happened. He may now be in a very precarious position because of it.

What? Me worried?

In the US the government, the establishment and the clerisy are all embattled by scandal, incompetence and the perception of weakness and hypocrisy.

Absolutely nobody in the world thinks any government has handled the pandemic well (other than a sliver of Zoom-class apparatchiks who were largely unaffected by two years of lockdowns) and corporate media is fast becoming universally reviled.

Secondly, against this backdrop of wholesale loss of credibility and institutional bankruptcy, those in power are getting desperate and increasingly resort to weaponizing the rails of society itself against normal citizens, everywhere:

-

Canada’s weaponization of the banking system against citizens for thought crimes.

-

The use of the SWIFT system against Russia (albeit with exemptions for energy purchases from Europe, meaning that the bulk of those most penalized in Russia will be, as always, powerless citizens who have no say in government)

-

Russia instituting capital controls on their own people as they try to evacuate out of a plunging ruble.

-

The Ukraine foreign minister demanded ICANN remove the .ru top level domain from the internet root (this raises the prospect of “a splinternet” which was the very thing I said we were headed for as far back as 2016).

-

Hapless Russian citizens being frozen out of the Moscow subway system after Apple and Google turned off their payment systems in Russia.

-

Russian teenagers being barred from the CHL hockey draft, Western bars and liquors stores pulling vodka from the shelves

These are just a few samplings of an accelerating dynamic. It’s a Hobbesian war of everybody canceling everybody else.

The only thing everybody has in common is that nobody doing the canceling can possibly fathom that someday, they’ll be on the receiving end of it and it won’t feel very good when it happens.

The rationale doesn’t matter. At some point for some reason Big Tech will pull the plug on *you*. https://t.co/ww1hcAhQLc

— Mark Jeftovic: Freedom should not be in "quotes" (@StuntPope) March 1, 2022

The Geopolitical Minsky Moment has arrived

Whether it’s the innocent civilians of Ukraine fighting for their lives against invading Russian troops (of mainly conscripts), or if it is people coming to realize that none of us had informed consent when it came to taking the jab, or if it’s citizens of a G7 nation being de-personed by their own government for doing something that was legal the day before an emergency decree, there is one common factor across all of it:

It’s that the political class has lost control, their own policies have led to disaster. Possibly even a new world war, and instead of admitting their own errors, they will, everywhere and always, double down on failure and impose the costs on the populace.

What all this does is create a new incentive structure – a new dynamic. One where people begin to act unilaterally in ways that the government can’t impede. This dynamic is one of decentralization, peer-to-peer networks, and public-key cryptography. This is the game-changer that restructured the terrain so that no matter how hard the current ruling class tries to impose their model of society on the rest of us, it won’t fit.

Bitcoin is now part of the game theory and the incentive structure everywhere. The Ukrainian government is using it to crowdfund donations to repel the invasion, the Russian citizens are using it to protect their savings from the havoc their leaders have brought upon them.

But the transition period will take years to play out and it will be very turbulent. It will be a Fourth Turning-style dynamic, of which the defining characteristic will be, I think, the people everywhere, turning against their own oligarchs.

Living in the Jackpot

In the summer of 2020 I started writing a series on Bombthrower called The Jackpot Chronicles, cribbing the term from a recurring theme in William Gibson’s near future cyberpunk novels. Those books described a world careening from crisis to crisis in the wake of a fictional pandemic that set off a never-ending series of rolling catastrophes (one of which was a limited thermonuclear exchange with Russia).

The Jackpot is what we have to go through as we transition to a decentralized, network-based society. We’re living in The Jackpot now. The most precious commodity in The Jackpot is optionality.

Things that are long optionality are: cryptos, precious metals, real estate, income producing businesses, second passports, second homes outside of major cities and in other countries.

Things that are short optionality include: money in bank accounts, relying on credit cards, unproductive debt, living pay check to pay check, having a single source of income, being in poor health, having zero critical thinking skills, being addicted to anything, believing your TV or being reliant on government programs in any fashion.

From here on in folks, if it wasn’t already, the core focus now and evermore should be optionality, Plan B, bug-out plans, resiliency, local communities, family and anti-fragility.

* * *

Today’s post contained excerpts from the most recent letter to my premium list: The Crypto Capitalist Letter.

The world is undergoing a monetary regime change. Get the Crypto Capitalist Manifesto investment thesis free when you join the Bombthrower mailing list. Follow me on Gettr, join my Telegram, or if you’re still on Twitter.

https://ift.tt/QFnC5qd

from ZeroHedge News https://ift.tt/QFnC5qd

via IFTTT

0 comments

Post a Comment