Americans Are Using Plastic To Make Ends Meet As Prices Continue To Rise

Americans are feeling the pinch of inflation. Wages are up but consumers are worse off. Average hourly earnings have risen by 5.5% over the last year. But factoring in rising costs, real earnings are down 2.6%. So, how are Americans making ends meet?

They’re charging it.

Consumer debt continues to climb at a staggering rate.

Total consumer debt rose by $52.4 billion in March, a 14% increase according to the latest data released by the Federal Reserve. Outstanding consumer debt now stands at $4.54 trillion.

The Federal Reserve consumer debt figures include credit card debt, student loans and auto loans, but do not factor in mortgage debt. When you include mortgages, US consumers are buried under more than $15.8 trillion in debt.

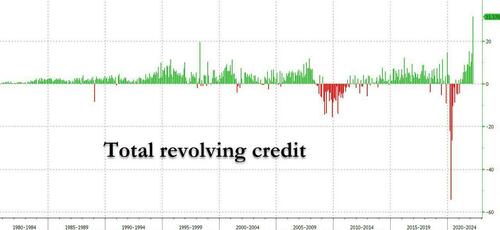

With stimulus money long gone and savings depleted, Americans have clearly turned to credit cards to keep up with rapidly rising prices. Revolving credit, primarily reflecting credit card debt, rose by 35.3% in March. American consumers added $31.4 billion to their credit card bills in a single month. US credit card debt now stands at just under $1.1 trillion and is fast approaching all-time highs.

Not only are credit card balances growing; consumers are trying to find ways to borrow even more. According to Fed data, Americans opened 229 million new credit card accounts in the first quarter. That was higher than prepandemic levels.

With interest rates rising, Americans will soon be paying more in interest charges every month, and many will see minimum payments rise. Average annual percentage rates (APR) currently stand at just over 16%. Analysts say they may well rise above 18% by the end of the year, breaking the record high of 17.87% set in April 2019.

Non-revolving credit including student loans and auto loans also continues to rise steadily. It jumped by $21 billion, a 7.4% year-on-year increase. Americans now owe $3.44 trillion in non-revolving debt.

Americans, by and large, kept their credit cards in their wallets and paid down balances at the height of the pandemic in 2020. This is typical consumer behavior during an economic downturn. Credit card balances were over $1 trillion when the pandemic began. They fell below that level in 2020. We saw small upticks in credit card balances in February and March of last year as the recovery began, with a sharp drop in April as another round of stimulus checks rolled out. But Americans started borrowing in earnest again in May. Since then, we’ve seen a steady increase in consumer debt culminating in March’s decades-high surge.

Officials at the Federal Reserve insist they will be able to raise interest rates and tighten monetary policy because the economy is strong (despite a big contraction in GDP during the first quarter). But the rising levels of debt seem to indicate that apparent economic strength is a smokescreen. Running up credit cards is not a sustainable economic model. Americans can make ends meet by borrowing on plastic for a while, but credit cards have limits. And rising interest rate will push balances toward those limits even faster.

In a nutshell, the Federal Reserve and the US government have built a post-pandemic “economic recovery” on stimulus and debt. It is predicated on consumers spending stimulus money borrowed and handed out by the federal government or running up their own credit cards.

The stimulus is gone. Savings are running out.

https://ift.tt/bBJTinM

from ZeroHedge News https://ift.tt/bBJTinM

via IFTTT

0 comments

Post a Comment