As 'Hard Landing' Looms, Why Isn't VIX Exploding Higher?

Despite all the 'tools', "hard landing"-recession fears are rising once again as this week's hotter-than-expected CPI and PPI suggest The Fed is once again "behind the curve" on what looks set to be 'sticky' inflation.

And this trend is only then made worse by legacy crowding in "bearish/hawkish" positioning now being covered/monetized/unwound.

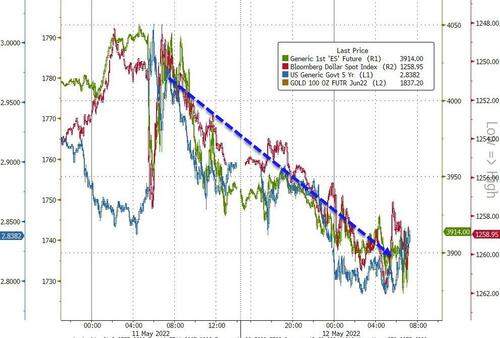

And as Nomura's Charlie McElligott notes that despite such a robust Fed rate hiking path being anticipated in order to “tighten” financial conditions to help kill-off “demand” side of their inflation inflation problem, Treasury Futs and ED$’s are seeing extension of the recent sharp rally (with Nominal- and Real- Yields plummeting further), as it is the implications of that impulse policy- & FCI- tightening on the economy that is driving an actual risk-off “Growth-Scare” dynamic (boosted too by overnight speculation of a Beijing lockdown).

As such, this Fed “hike until it breaks” theme continues to trade as they need to crunch demand. However, as that theme continues to drive stock prices down (the ultimate deflationary impulse), many are asking, why VIX is not higher...

The answer is threefold:

-

pre-positioning (over-hedged already),

-

velocity of decline (not crashy enough for equity dip-buyers and vol spike-sellers), and

-

short-termist dissonance (historically VIX is not low).

As McElligott notes, the world generally remains “over-hedged” (either via options or grossed-up shorts futs / ETFs and presses those “dynamically” into down-moves, or covers into rallies).

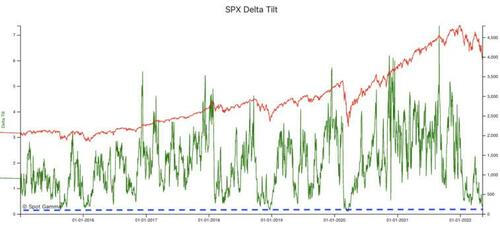

As SpotGamma notes, the Delta Tilt reading now matches that of previous major lows, suggesting again that we are at “peak puts”, and (barring a massive rally) there is little to change this signal before 5/20 wherein we’ll lose about 25% of total S&P500 gamma.

Additionally, this “slow moving car wreck” Equities selloff has been so frustrating: the grinding de-allocation / de-leveraging unwind has not been “crashy” enough to see “Long Gamma” really do much to hedge bleeding Longs...so you just gotta “Net Down”.

Goldman's Rocky Fishman confirms that the rare sequential in stocks sell-off has left hedging with options challenging.

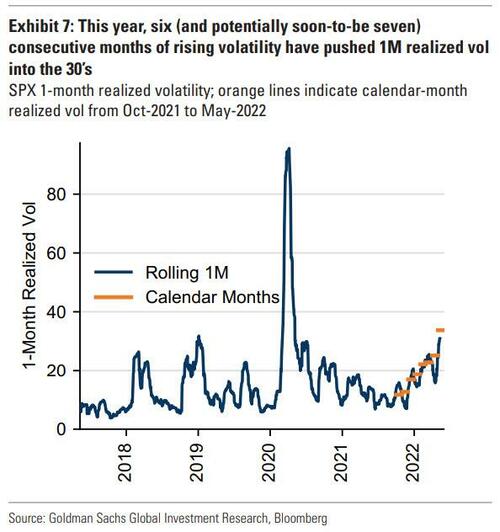

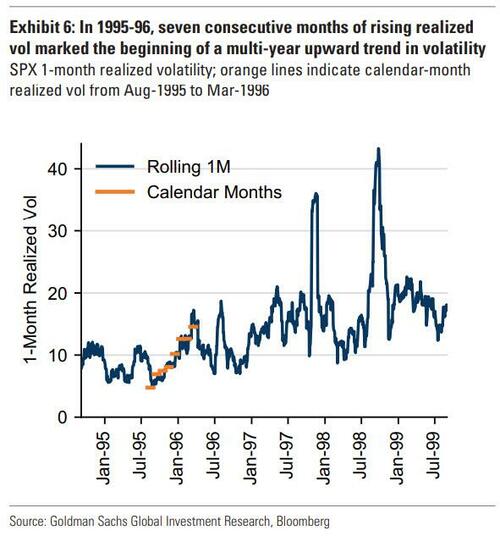

The SPX hit a 3-month low in May for the 5th calendar month in a row, the first time it has done that since 1974. May is also on track to be the 7th consecutive month SPX realized vol has increased - only the second such streak in the index’s 90-year history.

The sequential sell-off presents a challenge to investors’ play books that are driven by the sharp sell-offs of the GFC and COVID eras that see markets bottom quickly and rebound strongly. Despite one of the larger sell-offs on record, the PPUT hedged equity strategy is down almost as much as the S&P this year, and the rolled 25-delta put strategy we have been tracking has fallen more than an 80/20 portfolio it should have been protecting.

Notably however, following the previous streak, volatility trended upward for several more years...

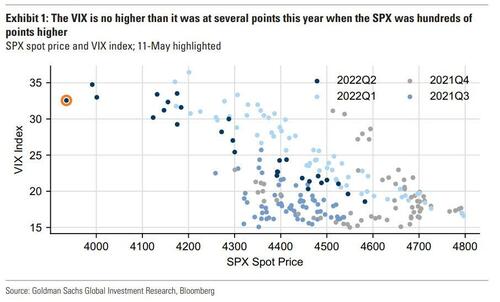

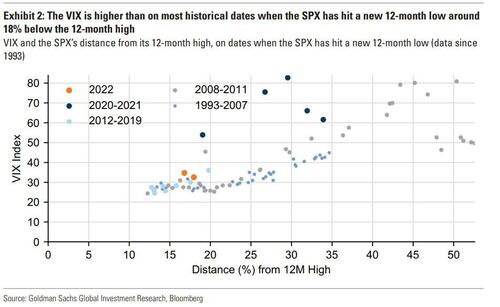

And finally, as Fishman explains, when only viewed in the backdrop of COVID and the GFC, which drove 80+ VIX peaks, it is easy to think the VIX should be higher, but we believe that a broader context points toward implied vol already being quite high in the low 30’s.

Even though the VIX’s reaction to recent spot downside has been mild, its high starting point leaves vol high overall.

Volatility typically rises quickly when markets sell off, but compared with previous periods when the SPX is at an all-time low and high-teens percent below its high, both the VIX and realized volatility look elevated.

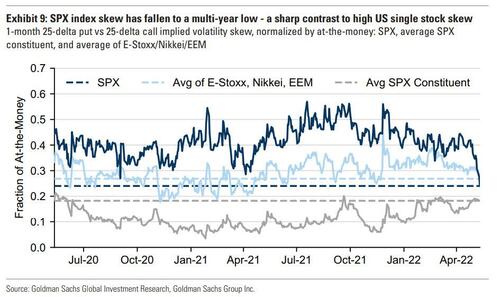

Finally, Fishman warns that a low skew points toward further vol underperformance ahead. SPX index skew has fallen sharply during the last month - more aggressively than other global indices’ skew has, and in sharp contrast to rising single stock skew.

Lower skew implies that market participants do not see implied vol rising quickly should the sell-off continue, and also likely results from investors buying calls as a right-tail hedge for under-allocated portfolios.

https://ift.tt/s7cfu4x

from ZeroHedge News https://ift.tt/s7cfu4x

via IFTTT

0 comments

Post a Comment