Big Bottle: Breaking Down The Baby Formula Nightmare

Authored by Matt Stoller via BIG,

Big Bottle and the Baby Formula Apocalypse

As anyone with an infant knows, there is a major crisis in the feeding of America’s babies right now, because parents in some areas can’t get baby formula. A few months ago, a major producer of formula - Abbott Labs - shut down its main production facilities in Sturgis, Michigan, which had been contaminated with the bacteria Cronobacter sakazakii, killing two babies and injuring two others. Abbott provides 43% of the baby formula in the United States, under the brand names Similac, Alimentum and EleCare, so removing this amount of supply from the market is the short-term cause of the problem. (Abbott and Mead Johnson produce 80% of the formula in the U.S., and if you add in Nestle, that gets to 98% of the market.) The problem is not, however, that there isn’t enough formula, so much as the consolidated distribution system creates a lot of shortages in specific states.

First, it’s hard to convey what a nightmare this situation is for parents, especially those whose children require special kinds of formula because of gastrointestinal issues or food allergies. “The shortage has led us to decide to put a feeding tube in our child,” said one parent, who simply could not get the specialized formula her daughter needs.

Baby formula is not just food, but the primary or sole nutrition for a vulnerable person in a stage of life in which very specific nutritional requirements are necessary for growth. Baby formula was created during the 19th century as we developed modern food preservation techniques. Before this remarkable innovation, baby starvation was common if a mother couldn’t breastfeed her infant (which happens a lot). The invention of industrialized formula was one of those creations we take for granted, but like antibiotics and other medical and scientific advances, it was one that fundamentally changed parenthood and the family.

This shortage is showing just how reliant we are on industrialized formula. The causal factor behind the crisis is poor regulation and a consolidated and brittle supply chain. Imports from Europe are often prohibited, even if there were excess productive capacity elsewhere. I spent a bit of time calling around to people who work in formula, and the industry is basically on a war footing. Everyone is panicking, because the situation is, in short, a nightmare.

I’m going to try and lay out the situation, and explain the market structure. There are two basic mechanisms that have created a concentrated and brittle market. The first is that regulators are tough on newcomers, but soft on incumbents. And the second is that the Federal government buys more than half of the baby formula in the market, and under the guise of competitive bidding, it in fact hands out monopoly licenses for individual states. That makes it impossible to get newcomers of any scale into the market, along with the more resiliency that such competition brings. It also makes it hard to address shortages in one state with extra formula from elsewhere.

But first, let’s start by following the money.

Financial Returns or Your Baby’s Life

The simplest way to understand why there’s a shortage is to look at the incentives for the CEO of Abbott Labs. Here’s a Reuters report coming out of the company’s investor call in April, after the factory shutdown was underway. Keep in mind, the executives on this call are the people responsible for managing this vital resource, and here’s how seriously they took the problem.

“Abbott called the recall a "short-term hindrance" and said it was working closely with the regulator and has begun implementing corrective actions and enhancements to the facility.

Abbott shares rose 2.4% to $122.90 in morning trade as some analysts said the comments during the conference call allayed worries over the recall.

Despite the recall and supply chain issues, Abbott beat quarterly profit and revenue estimates in the first quarter.”

Not a single Wall Street analyst asked about the recall. Why? In some ways, it’s because it doesn’t matter that much to the bottom line. Abbott Labs is a diversified medical devices and health care company, and its nutritional segment is a relatively small part part of its business. But also, if you need baby formula, which is highly regulated by the Food and Drug Administration, and distributed by a monopoly-friendly system run by the Department of Agriculture, where else are you gonna go?

And that’s the problem. Baby formula is a shared monopoly, and we are at the mercy of Abbott Labs, Read Johnson, and Nestle. And their execs know it. So how does this shared monopoly work? Let’s start with the regulators.

The Failed Priesthood at the FDA

Entering the baby formula market is a difficult process, and takes years of work. For instance, Bobbie, which makes European-style formula with a contract manufacturer, is the first firm to come into the market in five years. Bobbie is also a direct to consumer niche firm, so it doesn’t have the scale to address the market dislocation at hand. It was a rough road getting started; the firm faced a recall and a shut down purely for manufacturing in Germany, and it had to go through millions of dollars of capital and a steep learning curve to get its product accepted by the FDA.

The reason for regulatory hurdles seems good, on the surface. Manufacturing formula is very specific, it’s not like a snack bar, it fits in somewhere between medication and food in the regulatory spectrum. Congress put extremely detailed instructions in the Infant Formula Act of 1980. To get a product approved, an entrant needs protein efficiency studies, thousands of quality tests from raw ingredients to the end product, nutritional tests to make sure it is suitable for infants, and approvals for new suppliers. There are specialized forms of formula for babies with different conditions. Naturally, starting a new formula firm takes a massive amount of time, patience, and capital.

And that’s if you just want to make a product and can even find a contract manufacturer to produce it for you. There is just one contract manufacturer of baby formula in the U.S. - Perrigo Nutritionals, and it requires a large initial order volume, which adds a hurdle to new potential firms. What about new factories? Earlier this year, a nutrition company ByHeart became just the fourth infant formula brand to have its own factory, something no one else had done in fifteen years. Certifying a factory for infant formula, like making a new product, is difficult and expensive.

Is this expense necessary? Not entirely. The institutional risk tolerance of the FDA is extraordinarily low. FDA officials see themselves as an elite priesthood, pursuing excellence merely by dint of being at the FDA. From this perspective, there is zero incentive to let new players into the baby formula market when, in their view, there are already excellent quality companies serving the market, such as Abbott Labs, Mead Johnson, and Nestle. It’s true that baby formula is overpriced in the U.S., costing about twice as much as it does throughout much of Europe. But to an FDA official, price is incidental.

The thinking goes, who wants to be the official that accidentally lets a reckless entrepreneur poison a bunch of babies, just so that there’s some competition in a market that is already delivering good products? When there is no problem at hand, there is no reason to allow innovation in the industry, or additional capacity.

The problem, of course, is that the FDA is harsh to newcomers, but deferential to incumbents. According to Healthy Babies Bright Futures, baby formula made by the big guys in the U.S. is full of dangerous brain-altering heavy metals. HBBF tested thirteen different baby formulas, and every single one had “detectable levels of arsenic, cadmium, lead and/or mercury,” which are all considered to be neurotoxic, interfering with brain development and “causing permanent IQ reductions in children.”

Moreover, FDA inspections of Abbott plants are obviously a disaster. Abbott had old and dirty equipment making formula, falsified records, deceived regulators, had bad product tracing, and did not fix problems after discovery. FDA inspectors noticed problems with the plant in September, but ignored them. Then, a whistleblower told the FDA of these problems in October, but regulators didn’t even bother to interview him/her until December. Moe Tkacik, in a viral Twitter thread, persuasively laid out parallels to the Boeing/FAA disaster.

So, the origin of the baby formula pocalypse was Abbott management's refusal to repair dilapidated and failure-prone drying machines turning the plant into proverbial petri dishes for cronobacter, because...

— moe tkacik (@moetkacik) May 11, 2022

They needed that $5.73 billion for stock buybacks, obvs pic.twitter.com/GBmn3n4SWn

So that’s the regulatory problem. Then there’s the market structure, which creates a lumpy distribution system when there’s a shortage.

Rebates and Scams

The biggest buyer of infant formula in the U.S. is WIC, or the Special Supplemental Nutrition Program for Women, Infants, and Children, which is run by the Department of Agriculture. Roughly half of women get formula from WIC. Rather than food stamps, which is a set amount of cash that can be used for most products, most states only allow women to buy formula from one company, though each company offers a bunch of different brands.

To save money, the government requires states to hold auctions to get the lowest price for formula. The problem is, state agencies use a complex rebating system to give the contract for the entire state to one manufacturer, and that contract can only be changed once every four years. Here’s the USDA explaining the program.

Typically, WIC State agencies obtain substantial discounts in the form of rebates from infant formula manufacturers for each can of formula purchased through the program. In exchange for rebates, a manufacturer is given the exclusive right to provide its product to WIC participants in the State. These sole-source contracts are awarded on the basis of competitive bids. The brand of formula provided by WIC varies by State depending on which manufacturer holds the contract for that State.

This rebate system distorts the entire market in a state, because it’s just not worth having alternative formulas on a retail shelf if half of the buyers simply cannot purchase those formulas. As a result, the market tips to the WIC supplier, and that supplier raises prices on non-WIC recipients, and does so by between 26-35%.

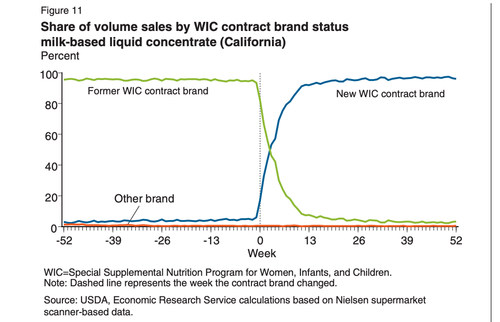

Here’s what happened to the baby formula market in California when the WIC contract changed hands.

This whole scheme, done under the guise of welfare, is essentially a transfer of wealth from the middle class to the poor, done by enriching the baby formula cartel. The monopoly friendly program design was peddled by the anti-poverty group the Center for Budget and Policy Priorities, which is both on the center-left of the political spectrum and aligned with Wall Street.

This brings us back to the shortage. According to Truthout, Abbott is the monopoly provider of formula for 34 states, seven Indian tribal organizations, four territories and Washington, D.C. So that’s where we’d expect the shortages to be focused. Because of the design of the program, it’s not particularly easy to move different kinds of formula to WIC recipients.

And that, perhaps more than any actual national shortage, is the problem. Here’s the Wall Street Journal today. “The FDA said overall the nation’s infant formula manufacturers are making enough to meet demand even w/out Abbott’s main factory online. The industry sold more formula in April than it did the month before the recall, the FDA said." The White House echoed these claims, asserting that “more infant formula has been produced in the last four weeks than in the four weeks preceding the recall.”

There’s a well-known black market in formula, which speaks to the dysfunction of the distribution system. The shortages are concentrated in certain areas even if nationally there might be enough to get by. According to Heather Bottemiller Evich, there are just “6 states that had baby formula out-of-stock rates higher than 50 percent: Iowa, South Dakota, and North Dakota were 50-51%. Missouri was 52%. Texas was 53% and Tennessee was 54%.” But nationally, it’s not so bad.

However, not all data sets suggest outages this high. @iriworldwide, which pulls information directly from retailers, found that the average in-stock rate is currently about 79% across the U.S. — far below the pre-pandemic norms of 95%, but not critically low.

— Helena Bottemiller Evich (@hbottemiller) May 11, 2022

In some ways, the problem is that there’s baby formula, but it’s not in the right place (though the Sturgis factory was a monopoly producer of lots of specialized formulas, so the actual shortage itself is a huge problem). The simplest solution here is to get aggressive and capable leadership around logistics, and then move the formula where it needs to go. We’ll have to open up imports temporarily, and move supply around the country while allowing WIC recipients to buy non-contract brands. I suspect at some point the Biden administration will get their hands on the situation, and fix it. There will be Congressional hearings, and Abbott’s CEO will get yelled at.

Longer-term, I hope there will be consequences. First, we need to explore forcing Abbott to break off its nutritional division from the rest of the firm, since it’s fairly obvious that there’s little corporate focus on making sure the baby formula division is run well. Conglomerates are usually inefficient. Second, Congress should really restructure the WIC program so that the auctions don’t create monopolies, and lumpy distribution patterns that induce regional shortages.

Finally, the FDA needs wholesale reform, since this kind of crisis seems to happen a lot. I mean, the relationship between the FDA and Abbott Labs was also behind the rapid Covid testing scandal, where FDA official Tim Stenzel - who had worked at Abbott - then approved Abbott as one of two firms to make those tests, and blocked all other entrants. That’s why rapid Covid tests were both in shortage and much more expensive in the U.S. than they are in Europe. The FDA needs to be broken up so that its drugs and food divisions are separate, and it needs to take its mandate seriously for a resilient supply chain.

In some ways, this baby formula crisis is the same problem as United having passenger David Dao being beaten up in 2017 and removed from the plane, to public horror and Congressional rage. United’s stock went up after the incident. Or it’s like nurses wearing garbage bags at the beginning of the pandemic because of our dependence on China, and the sad reality that policymakers in the last two years have refused to stop sourcing from China. Hopefully, these kinds of failures, and the public rage, are laying the groundwork for wholesale reform of our government. At every level of policymaking, we have a systemic bias against people who focus on making things, in favor of well-branded monopolists and cloistered regulators who are obsessed with fanciness instead of actual critical thinking.

And that’s no way to run a democracy.

https://ift.tt/J8tneUZ

from ZeroHedge News https://ift.tt/J8tneUZ

via IFTTT

0 comments

Post a Comment