'America, The Beautiful' Is Broken

Authored by David Haggith via The Great Recession blog,

The twaddle that comes out of the White House is deep right now. When our tottering president isn’t out enjoying a bike ride and falling down because Putin put gum in his stirrup so that he couldn’t get his foot out to steady himself, he is assembling a colorful team of Frisco-style professionals highly qualified in the field of transition to guide us through the vicissitudes of war, plague and famine that are swirling around the entire globe right now. (“Frisco” is the name the city loves to hate, so I chose it intentionally for a city I once found beautiful.)

The LGBTQRS+++ hip chick that is the president’s talking mop at the press secretary’s podium spent her morning yesterday assuring us all that we are experiencing a “period of transition” right now — something I am sure she has much experience with — going from times of economic strength in which the vast majority of us are doing great into even better times. Thank goodness for people who can guide us through transition to understand what we are going through and where we will end up, which will be — if we follow MoJoe & Co. — coming out the opposite sex from whatever we we were when we came into this world:

PRESS SEC: "Right now, we don't see a recession right now. We're not in a recession right now. Right now we're in a transition where we are going to go into a place of stable and steady growth." pic.twitter.com/GhSdyUUdE4

— Breaking911 (@Breaking911) June 21, 2022

The primary accomplishment of Team Biden by the end of his one term that has somehow managed to be even more divisive than Trump will be to recolor the flag behind her with prettier inclusive rainbow stripes than the binary red and white that it historically displays. Until then, at least, we now know what “Build Back Better” looks like. According to Jean-Pierre, we are already there and clearly moving into even better times.

It would be my own analysis, on the other hand, that if she and her colleagues don’t see a recession anywhere in sight, I can recommend an eye doctor for all of them. Their own Dr. Powell Fauci Magoo, who, incidentally, was also Trump’s White House physician, doesn’t seem to be serving them well. In the very least, I recommend they step outside the White House for a few moments to escape the curling rings of herb smoke that cloud their vision and take a look around. Perhaps I can provide a guided tour for her, though I am sure she will hallucinate some deep state of Democratic delusions she wants to see so that her trip is not as bad as mine or yours is and is about to be:

What is the true state of the disunion?

While we continue to hear, albeit less confidently now, about the economy being strong, what I see is that the economy has rarely looked worse in numerous ways. Obviously, I am not smoking the right stuff to enjoy the “economy as it ought to be” trip; but here is what I see in black and white when not blinded by so many pretty colors swimming around my head as MoJoe & Co. apparently see in theirs.

First, I note that increasingly a number of voices in the financial press — some mainstream, some not — are starting to hum along to my familiar tune — not very loudly or clearly yet, BUT they are starting to pick it up:

Phoenix Capital now says, “The U.S. is Already In a Recession… Here’s How to Profit From It!“

Everything else is imploding and has been for months.

At least, some people can see the obvious that it does not pay to see when your job (or next term) depends on your convincing everyone they are seeing something else.

Phoenix presents as evidence the rather sharp decent of Walmart and Amazon into the ashes of retail.

Bill “the Dud” Dudley, a former New York Fed chief and one-time vice chair of the Fed’s money-printing FOMC, says with a friendly smile, “Welcome To The Recession.” For a moment there, it almost sounded like he agreed with me that a recession is already here, but in typical bansker safety-net style he adds “in another 12-18 months.” Still, that is better eyesight than can be found in the White House. He, at least, is certain the blurry blob he sees up ahead is a recession, and for a Fed guy he’s speaking rather out of turn:

While the Fed’s forecasts have become more plausible over time, I see several reasons to expect a much harder landing. Much like Wile E. Coyote heading off a cliff, the US economy has plenty of momentum but rapidly disappearing support. Falling back to earth will not be a pleasant experience.

Zero Hedge

That’s hardly anywhere near as comforting as Jean-Pierre. I think I’ll have what she’s having.

Just to be clear, Dudley states,

If you’re still holding out hope that the Federal Reserve will be able to engineer a soft landing in the US economy, abandon it. A recession is inevitable within the next 12 to 18 months.

So, not only can some people see a recession up ahead, but they are certain that it is “inevitable” and that a soft landing is a dream to be abandoned.

The determining factors for the quality of our landing that Dudley lays out (the reasons we had better hope they line Powell’s runway with lots of bouncy houses and foam to soften the landing) are as follows:

-

First, persistent price increases have forced the Fed to shift its focus from supporting economic activity to pushing inflation back down. (“The central bank’s employment mandate is now subservient to its inflation mandate.”)

-

Second, the new focus on price stability will be relentless. (“Fed officials recognize that failing to bring inflation back down would be disastrous.”)

-

Third, the current economic expansion is uniquely vulnerable to a sudden stop. (“It’ll take time and a considerable monetary policy tightening to reduce demand and for that to translate fully into weaker production of goods and services. But when that time comes, the production adjustment is likely to be abrupt…. As inflation outstrips wage growth, the personal savings rate has plummeted, from 26.6% in March 2021 to 4.4% this April, significantly below its long-run average. No wonder consumer sentiment has fallen to levels last reached in the aftermath of the 2008 financial crisis, and Google searches for the word “recession” are hitting new records.”)

-

Finally, economic history points to a hard landing. (“The Fed has never tightened enough to push up the unemployment rate by 0.5 percentage point or more without triggering a recession.”)

In other words, this:

Biden and his talking mop on the other hand assured us that “recession is not inevitable” and is nowhere in sight. That is because, like the coyote, they forgot to look right beneath themselves. Oops.

Some others also see a recession as “inevitable” and see happening in the near term as “more likely than not”:

Tesla CEO @elonmusk says "a recession is inevitable at some point."

— Bloomberg TV (@BloombergTV) June 21, 2022

He spoke to Bloomberg's Editor-in-Chief John Micklethwait in a wide ranging interview covering crypto, Trump and his aims for Twitter #QatarEconomicForumhttps://t.co/frZzx7EnPa pic.twitter.com/ErJNmspB8R

Since people are not inclined to take my word for it, let my have a Nobel economist (I realize they cannot usually see a recession until it is behind them) reiterate the points for me as he did earlier this week:

"We have a situation similar to the ‘70s: excessive aggregate demand and negative supply shocks," says Roubini Macro Associates CEO @Nouriel https://t.co/WoZPXnbPp1 #QatarEconomicForum #منتدى_قطر_الاقتصادي pic.twitter.com/bDES1U04vl

— Bloomberg Live (@BloombergLive) June 21, 2022

Biden, on the other hand, assured everyone on the same day that another prize of an economist, Larry Summers, assured him “there’s nothing inevitable about a recession.” Never mind that even Summers did say a recession now looks highly likely … but just not … “inevitable.”

Over the weekend, Nomura became the first bank to place the recession squarely within 2022.

The Atlanta Fed, meanwhile, is now prognosticating the 2nd quarter of 2022 closes with precisely zero economic growth, which will still leave us in a trough that began last quarter. If that is the case, then GDP will have continued to scrape along a ceiling that is 1.5% lower than GDP was at the start of the year, now half a year gone by, meaning we entered and remained in a GDP trough since the start of the year.

Nomura believes a mild recession starting in Q4 2022 is now more likely than not (ZH: expect the mood to deteriorate further as “mild” eventually becomes “jarring”)…. Consumers are experiencing a significant negative sentiment shock, energy and food supply disruptions have worsened and the outlook for foreign growth has deteriorated. All these factors will likely contribute to the expected downturn.

Zero Hedge

Amazing. People are starting to look up and see what has been obvious all around them for months now and are finally whipping up the courage to say what they are seeing.

Nomura believes the Fed will skid right on past the QT stopping point as predictably as Wile E. Coyote skids past the cliff edge. Biden believes, if you don”t look down, what’s down there can’t hurt you. Of course that was what he believed when he was out riding his bike, too.

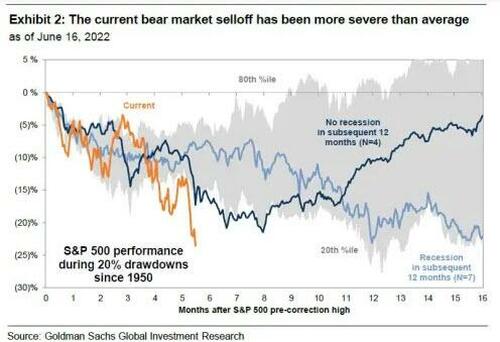

Goldman Sachs is another bank that now joins those who are humming the same tune to say, at least,

We now see recession risk as higher and more front-load…. We are increasingly concerned that the Fed will feel compelled to respond forcefully to high headline inflation and consumer inflation expectations.

Yahoo!

How “front-load[ed]” they don’t say. They, of course, expect it to be shallow and clear up like a short cloudburst.

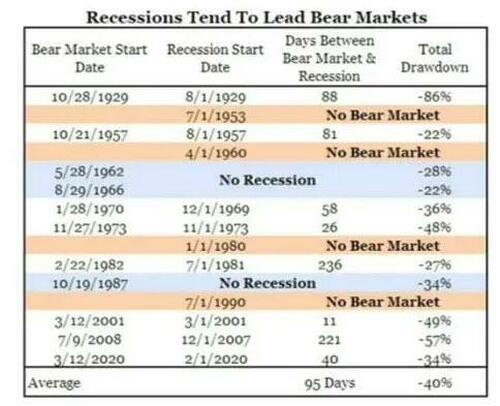

Piper Sandler … shows that the typical bear market follows the start of a recession with a delay of 95 days, and eventually exhaust itself with an average total drawdown of 40% which means that current recession probably already started some time in March:

Zero Hedge

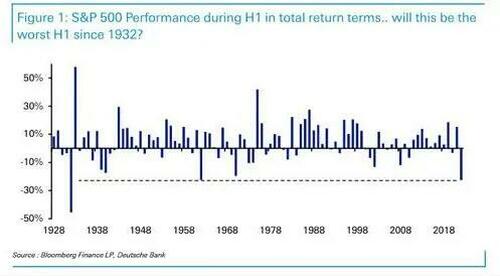

Of course, following the worst start for stocks to a year since the Great Depression…

… and also the worst start since 1932 in total return terms across all asset classes…

… one would be excused to ask if instead of a garden variety recession, the US isn’t rushing straight into a depression.

Summarizes the New York Post,

Wall Street bets are growing that the U.S. economy tumbles into a recession next year as the Federal Reserve raises interest rates at the fastest pace in two decades in order to cool scorching-hot inflation. Bank of America Global Research strategists have ratcheted up the odds of an economic downturn to 40% in 2023…. “Our worst fears around the Fed have been confirmed: They fell way behind the curve and are now playing a dangerous game of catch up.”

OK. Well, none of the banks, except the Atlanta Fed, are quite with me yet, but they are all getting closer and closer by the day.

Now that the experts are lining up on the recession side of the fence, let’s look at a short list of major weaknesses I see in the US economy that are screaming recession is here or near:

The auto industry remains a wreck

In a recent article titled “The Real GDPig was a Whole Lot Uglier than it Looked!” I dug deep beneath the Bureau of Economic Asininity’s surface GDP numbers to reveal how the auto industry has been in a long slouch and was, contrary to overt claims by the BEA, a major factor in pulling the economy down last quarter and the quarter before. There was something I noted, based on loads of evidence from the BEA, that was seriously wrong with the BEAs claims about automobiles driving GDP up in Q4 and then down in Q1, probably because the industry is in such disarray that BEA doesn’t know how to sort out the anomalies in its own numbers.

The auto industry has also been a major factor in the superheated CPI reports because scarcity due to lack of production has been driving up prices. Many tried to claim the auto industry was turning around, using it as a sign that the negative GDP print in Q1 was a one-off. I did not believe evidence bore that out, and that has turned out now to be the case:

The S&P Global Sector PMI™ revealed that Automobiles & Auto Parts sector output contracted worldwide for a second successive month amid the sharpest reduction in new orders since the COVID-19 pandemic and renewed supply disruptions linked to the pandemic and Russia-Ukraine war.

Seeking Alpha

While that is a global production situation, it doesn’t look any better in the US:

The U.S. light-vehicle market doesn’t appear to be in the best health. While many automakers now opt against issuing monthly sales reports, those that still do are posting some pretty brutal numbers. This does not bode well for an industry that seemed pretty certain that 2022 would be its recovery year.

The Truth about Cars

Manufacturers are still warning about supply constraints and an inability to manufacture at full scale. The auto industry has always been a major component in GDP and is continuing to pull it down. Some economists thought the industry would start getting back up to cruising speed this quarter. That does not appear to have been the case.

As for sales volume, most automakers were posting double-digit declines for the month of May. Overall, the seasonally adjusted, annualized rate of sales (SAAR) for May fell dropped to a crippling low of 12.81 million, according to Motor Intelligence. That’s to be contrasted against April’s 14.6 million units and over 17 million average from May of 2021…. “The market faces a real risk of turning negative from 2021.”

Well, that just doesn’t sound good at all, and that was the area where the optimists were most expecting some reprieve after the negative Q1 GDP print, which they chose to believe was the anomaly, rather than accept the idea that the high GDP increase in the quarter before was the clear outlier from the trend.

Retail remains a mixed bag

In another recent article titled “The Retail Apocalypse was Bloodier than it Looked,” I similarly described how the retail industry was a much bloodier picture than what many economists were making of it. It seemed like major retailers got ready to throw a party and one one came. Last quarter they stocked up all they could and remained laden with inventory from imports that are mistakenly thought to subtract from GDP, but that is a misunderstanding of how they are merely reconciled back out of other GDP inputs in which they are embedded.

This quarter major retailers are threatening to unload, and that is seen by some as possible hope for a boom in retail; but at what price?

America’s top retailers messed up – particularly the ones that focus on durable goods rather than groceries. Most of them released their earnings reports last month, saw shares take a beating and moved on….

Then, the mega-retailer [Target] did something no one was expecting. On Tuesday, Target told investors it anticipated a profit margin more around 2%. It would slash prices on certain goods and cancel incoming orders. It’s highly unusual for a company to slash its profit expectations within weeks of its earnings report.

Target said in its Tuesday press release that the profit slash comes from a need to “right-size” inventories. People aren’t buying items like televisions, outdoor furniture and kitchen appliances like they were last year….

It’s all leading to what Forbes’ Madeline Halpert called “markdown mania,” and not just at Target. Gap is hawking $60 leggings for just $12. Target is selling televisions for 25% off and patio sets at a 52% markdown….

The demand for random crap suddenly vanished, taking everyone by surprise.

Freightwaves

It is hard to imagine how massive price slashing to near-zero profit margins to unload inventory no one wants to buy is going to prove to be a positive for GDP! As reported in the headlines, GDP is measured in inflation-adjusted dollars, so I suppose the impact of the mess in retail inventories and sales will depend on how much prices are slashed and how successfully that gets consumers to pick up the unwanted merchandise. Regardless of how it impacts the GDP number, this extreme dislocation clearly speaks of a badly broken economy, not one humming along like a new car … or like new cars used to hum along. Sounds more like one that’s humming my tune.

[ZH: An example of this is the fact that while we started the year with relatively 'low' inventory-to-sales, that has since exploded higher amid the 'bullwhip' effect...

Why does this matter? Well, for a simple but critical reason: if one year ago we saw the hyperinflationary start of the bullwhip effect, we have entered the terminal phase of the "bullwhip effect", where plunging inventory-to-sales ratios reverse violently higher, where supply chains unclog suddenly and rapidly amid a sudden chill in the economy, and where prices for so-called "core" goods collapse almost overnight, even as non-core prices (food and energy) explode even higher.]

Something is broken. Likely it means that backlogged inventory arrived all at once a day late and many dollars short for the retailer. Lest you think I’m the only one who is struggling to rightly understand the peculiarities here, let me quote the expert in the article:

To end, I’d like to emphasize that the vibes are abruptly off and no one really knows what’s happening.

That’s a mess, not strength. That is log jams clearing through the ports then jamming up in warehouses, causing aberrations in how things are reported. Dysfunctional is not strong. Even executives at the…

Gartner supply chain conference in Florida this week … were confused and not feeling very zesty…. Transportation managers canceled orders in early 2020 predicting a recession, then found their hastiness left shelves empty and consumers furious. Now that they’ve built back up, customers aren’t buying anymore and their balance sheets are destroyed. The whiplash is baffling.

The truth is retail sucks so bad right now that even the retailers have no idea what to make of it, neither do the shippers. It’s just baffling whiplash. “Destroyed balance sheets” are not the stuff of strong economies. What we have is a trainwreck or a shipwreck, and retailers and shippers alike are struggling to figure out what to do with it and what it really means.

Housing slides

Housing prices and housing sales are already falling as mortgage interest has more than doubled. Consumer sentiment is already at an all-time low. (Hence the need for Jean-Pierre to tell us things are not as bad as they feel right now, and we are transitioning from great economic strength to strength that is even built back better.)

The housing market isn’t at a level that will by itself put us into recession just yet, but it is certainly sliding rapidly that way … and rather all of a sudden, given that Fed interest rates are still on the hot stimulus end of the Fed’s normal scale. That is because mortgage rates our outpacing the Fed’s tweaks, anticipating where things are headed:

The highest share of sellers on record dropped their list price during the four weeks ending June 12 as mortgage rates shot up to levels not seen since 2008….

Redfin

“The housing market isn’t crashing, but it is experiencing a hangover as it comes down from an unsustainable high,” said Redfin deputy chief economist Taylor Marr. “Housing demand has already cooled significantly to the point that the industry has begun facing layoffs.

“Demand from homebuyers was still extremely high as recently as February, but rates are making it really tough. Going from 3% to nearly 6% almost instantly has scared a lot of people out of the market.”

Prices have stalled and have begun to follow sales down in some areas. Employment in the industry definitely has started to fall. What housing moves now foretell is that, as all the other forces mentioned above drive us quickly into recession, housing will be bringing up the rear to stomp us down deeper, given that housing the biggest GDP drivers in the US economy, being a major factor even in retail sales of all the items that get built into a house, plus all the new furniture that fills the new homes.

So, while the Biden-Powell team are calling all of this a strong and resilient economy, you had better think twice if they try to sell you choice waterfront real estate in Florida. It’s probably not in Miami or on the Gold Coast.

The golden oldie of America’s pride

If America’s economy is looking strong, why is America’s most golden of all cities now referred to in The Atlantic as a “failed city?” Herb Caen, San Francisco’s “beloved old chronicler,” once said that, If he ever got to heaven, he’d look around and say, “It ain’t bad, but it ain’t San Francisco.” To read The Atlantic’s description today and many others I’ve read over the past two years, he might say today upon opening his eyes in San Francisco, “I knew I’d wind up in hell.” It’s such pretty beaten up version of the city he once loved that he would only recognize it as some upside down version of the old San Fran.

Says a modern-day liberal chronicler,

Progressive leaders here have been LARPing left-wing values instead of working to create a livable city. And many San Franciscans have had enough.

Today’s scene looks so bad it may finally liberate liberals from their own liberalism. Here, too, the smoke of herb has long circled the heads of those that lead, and look at how colorfully banal it has all become:

On a cold, sunny day not too long ago, I went to see the city’s new Tenderloin Center for drug addicts on Market Street. It’s downtown, an open-air chain-link enclosure in what used to be a public plaza. On the sidewalks all around it, people are lying on the ground, twitching. There’s a free mobile shower, laundry, and bathroom station emblazoned with the words dignity on wheels. A young man is lying next to it, stoned, his shirt riding up, his face puffy and sunburned. Inside the enclosure, services are doled out: food, medical care, clean syringes, referrals for housing. It’s basically a safe space to shoot up. The city government says it’s trying to help. But from the outside, what it looks like is young people being eased into death on the sidewalk, surrounded by half-eaten boxed lunches.

The Atlantic

I used to think San Francisco was America’s most beautiful major city — the golden lady in my opinion — even if too liberal for my taste. Not now. Even the people who used to feel privileged to live there want to get out of town and head for the hills … forever. As they do, Californians are taking the values that destroyed their great cities and transporting them like transplanted cancer cells to Idaho, Montana, Colorado and Wyoming so they can wreck all that is beautiful about those places, too, replacing farmlands and ranches with MacMansions and shopping centers in order to do it all over again.

But I digress. Let it suffice for now to say, the picture of San Francisco as it has become is a pretty good metaphor for the US economy as it has become. I’ll leave you, then, with words of the modern-day chronicler above:

During the first part of the pandemic, San Francisco County lost more than one in 20 residents—myself among them. Signs of the city’s pandemic decline are everywhere—the boarded-up stores, the ghostly downtown, the encampments. But walking these streets awakens me to how bad San Francisco had gotten even before the coronavirus hit—to how much suffering and squalor I’d come to think was normal.

Stepping over people’s bodies, blurring my eyes to not see a dull needle jabbing and jabbing again between toes—it coarsened me. I’d gotten used to the idea that some people just want to live like that. I was even a little defensive of it: Hey, it’s America. It’s your choice….

I’d gotten used to the crime, rarely violent but often brazen; to leaving the car empty and the doors unlocked so thieves would at least quit breaking my windows. A lot of people leave notes on the glass stating some variation of Nothing’s in the car. Don’t smash the windows….

A couple of years ago, one of my friends saw a man staggering down the street, bleeding. She recognized him as someone who regularly slept outside in the neighborhood, and called 911. Paramedics and police arrived and began treating him, but members of a homeless advocacy group noticed and intervened. They told the man that he didn’t have to get into the ambulance, that he had the right to refuse treatment. So that’s what he did. The paramedics left; the activists left. The man sat on the sidewalk alone, still bleeding. A few months later, he died about a block away…

In lockdown the beauty became obscene. The city couldn’t get kids back into the classroom; so many people were living on the streets; petty crime was rampant. I used to tell myself that San Francisco’s politics were wacky but the city was trying—really trying—to be good. But the reality is that with the smartest minds and so much money and the very best of intentions, San Francisco became a cruel city. It became so dogmatically progressive that maintaining the purity of the politics required accepting—or at least ignoring—devastating results….If you’re going to die on the street, San Francisco is not a bad place to do it. The fog keeps things temperate. There’s nowhere in the world with more beautiful views. City workers and volunteers bring you food and blankets, needles and tents. Doctors come to see how the fentanyl is progressing, and to make sure the rest of you is all right as you go.

It’ll all get so much better when the water from the parched Colorado River is completely shut off later this summer, driving LA water-mob slobs to storm SF to get their hand’s on some liquid that may soon sell for more than the city’s old gold. The old lady, drowning in wokeness and tears and suffocating in the worn-out wraps of her own regulations and process has been laid to rest in a graveyard of intentional squalor for the sake of the impoverished at a cost of $60,000 per tent space born by the SF taxpayers. I’m sure the tolerance of criminal decline seen in the “smash and grabs” I wrote about at the start of the year for RT.com didn’t help. May she Rest In Rainbows as a testament to all that is dying in liberal, woke Amerika.

https://ift.tt/o9eMbhp

from ZeroHedge News https://ift.tt/o9eMbhp

via IFTTT

0 comments

Post a Comment