Mike Wilson: This Slowdown Is Even Worse Than We Expected... Stocks Will Hit 3,000 Late This Year

Morgan Stanley's uberbear Michael Wilson continues to have his cake and eat it too: on one hand the bank refuses to make a recession its base case; on the other Wilson continues to predict increasingly gloomy market outcomes as if he anticipates not a recession but a modest depression.

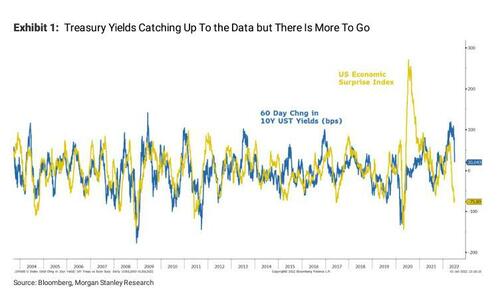

Two weeks after Wilson correctly predicted that the bear market in stocks will end when the recession officially begins (which we know as of this moment, has unofficially started), he looks at rates instead and writes that interest rates continue to fall despite still elevated concerns about inflation, and a Fed that remains committed to doing whatever it takes to squash it.

This is notable because last week, Wilson discussed how the direction of equity markets would be partially decided by their interpretation of this move in rates. In one interpretation, equities might rally as lower rates provide a cushion for valuation and potentially a leading signal that the Fed may ease off its policy stance if inflation pressures slow in 2H '22. In another, stocks could probe new lows as falling yields reflect increasing concerns around growth, a dynamic that would be reflected in higher ERPs. And just so there is no confusion, Wilson reiterated that his intermediate term view is that any fall in rates should be interpreted as more of a growth concern rather than as potential relief from the Fed/inflation pressures.

Fast forward one week, and it looks like the answer is somewhere in between… meaning the equity market may not yet be sure what to make of the fall in rates.

First, rates fell another 20 bps last week after having falling 40bps the prior 2 weeks, leaving 10-year US Treasury yields down 60 bps from their recent high in Mid June. However, as noted last week, yields are still lagging the recent negative data surprises which continued to come in worse than expected last week. In other words, the risk of growth slowing more than expected has only increased.

And speaking of data, last Friday we also got the closely watched Manufacturing ISM survey for June and it was a pre-recessionary doozy. As Wilson notes, this survey is important because it has such a powerful relationship with the S&P 500...

... while providing a great coincident/leading indicator for the economy. The headline index has been falling for over a year. For June, the headline reading came in at 53 which is still in expansionary territory, if badly missing expectations. That said, during a mid/late cycle slowdown, this is about where the index would stop going down, according to Wilson. Furthermore, the S&P 500 is trading right where it should be based on this PMI reading.

The question, as Wilson asks, is whether it's done going down.

For answers, the MS strategist looks to the internals of the survey--orders and inventories. On that score, he is quick to note that the data is not encouraging for those looking for a soft landing. Instead, it's indicating the headline index is likely to fall further.

Based on history, Wilson concludes that "if we are going to end up in a recession (our bear case), it's very likely the PMI would eventually fall to the low 40s." And if one overlays that outcome onto the S&P 500 vs. PMI chart, "it suggests we could reach 3000 late this year—a temporary overshoot of our bear case point in time June '23 price target of 3350" which of course is just Wilson goalseeking his prior conclusions, such as the one from mid-May which we discussed in "Morgan Stanley Sees S&P Tumbling As Low As 3,400: "That's Where Valuation And Technical Support Lie." Incidentally, if Wilson is so confident in the downside case, why doesn't he just make this "bear" case his "base" case. Oh yes, because the Fed could say one word - just one word - and spark a furious rally which will make the bear market a distant memory, crushing Wilson's street cred in a millisecond.

And just to hedging some more, Wilson also notes that given the coincident relationship shown above, and the fact that we won't have additional data points for a while, "equity markets could hang around, and even rally in the absence of a confirmation of a recession." Conversely, in the absence of confirmation a recession will be avoided, it will also be difficult for equity markets to rally too far... unless of course markets price in aggressive rate cuts and QE in the coming weeks.

Fed aside, Wilson again beats the bearish drum, and again warns that earnings remain too high even in the soft landing outcome. Under that scenario, he thinks NTM EPS should fall toward $225-230 over the next few quarters. Using that as his guide, Wilson still get to a fair value tactical target of approximately 3400-3500, or about 300 10% of downside from current prices, which however is just a fraction of the potential upside should the Fed surprise markets and pivot dovishly.

Wilson's bottom line is that we are firmly in the midst of the economic slowdown we expected - i.e., "the Ice." Furthermore, due to the war in Ukraine and China's extended zero covid policy, the MS strategist cautions that :this slowdown is even worse than we expected" and "we believe most investors are also now in our camp and trying to determine how much earnings need to fall. Every investor can decide for themselves what the right earnings multiple should be in the context of the macro economic environment--i.e., what's the right 10-year yield and equity risk premium."

The good news is that Wilson's case for lower multiples earlier this year has played out, and equity risk premiums (the growth component of the P/E) have risen over the last week to more reasonable levels (340bps) as we enter what should be a messy earnings season. In short, going forward stock prices should be determined more by earnings than the macro. The bad news is that what is most difficult about this stage of the cycle is that individual companies will likely see divergent paths, providing conflicting signals to investors. Here, Wilson's experience is that the higher quality companies will admit the problems earlier and set expectations appropriately given the deteriorating macro environment. But this process can take longer than it should, and this time is likely no different.

Much more in the full Michael Wilson note available to pro subscribers in the usual place.

https://ift.tt/8SuaQ7f

from ZeroHedge News https://ift.tt/8SuaQ7f

via IFTTT

0 comments

Post a Comment