Another Big CBDC Flop... Here's What Really Comes Next (And It's Not What The Elites Hoped For)

Authored by Nick Giambruno via InternationalMan.com,

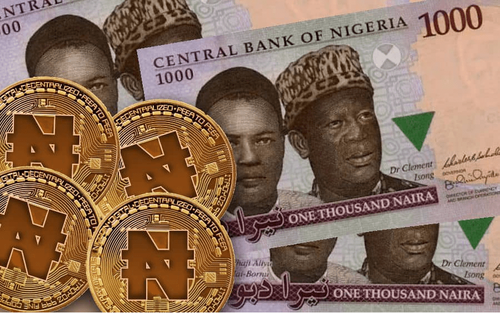

Last year, Nigeria launched its much-ballyhooed eNaira, Africa’s first central bank digital currency (CBDC).

Central bankers, academics, politicians, and an assortment of elites from over 100 countries hoping to launch their own CBDCs have closely followed the eNaira.

They used Nigeria—Africa’s largest country by population and size of its economy—as a Petri dish to test their nefarious plans to use CBDCs to enslave the people of North America, Europe, and beyond.

The jury is now in.

The eNaira has been a massive failure.

According to Bloomberg, only 1 in 200 Nigerians use the eNaira. That’s even after the government implemented discounts and other incentives as desperate measures to increase adoption.

This came as a surprise to the elites.

Nigeria has one of the highest Bitcoin adoption rates in the world—ranking #11 among all countries.

Bitcoin’s ability to bypass the government’s capital controls—which restrict the use of foreign currencies and sending and receiving money from abroad—was a big draw for Nigerians, as it is in other countries with these repressive policies.

A long history of rampant currency debasement in Nigeria—including six devaluations in recent years—also helped spur the adoption of Bitcoin, which is totally resistant to inflation.

In short, the elites have miscalculated. They figured Nigerians wouldn’t be able to differentiate between Bitcoin and the eNaira—they are both digital currencies, after all.

The Bloomberg article admitted, “Nigerians’ passion for cryptocurrencies doesn’t extend to the central bank offering.”

It also said Nigerians view the eNaira as “a symbol of distrust in the ruling elite” and that the people view the government as “hostile to them and therefore have no interest in anything it introduces.”

To all the Nigerians rejecting the eNaira, I say bravo!

The failure of CBDCs in Nigeria could throw sand in the gears of the elites’ plan to implement them worldwide. That would be a big positive for human freedom.

The flop of CBDCs in Nigeria is an encouraging development.

It also reveals an outcome that was probably the opposite of what the elites desired—increased Bitcoin adoption.

CBDCs and Bitcoin

Despite all the hype, CBDCs are nothing but the same fiat currency scam on steroids.

It’s doubtful CBDCs can save otherwise fundamentally unsound currencies—as I believe all fiat currencies are.

If the current fiat system is not viable, then CBDCs are even less viable as they enable the government to engage in even more currency debasement.

Would a CBDC have saved the Zimbabwe dollar, the Venezuelan bolivar, the Argentine peso, or the Lebanese lira?

I don’t think so.

The eNaira did not save the Nigerian fiat currency. And a CBDC won’t save the US dollar or the euro from their fates either.

There are a lot of bad things that come with CBDCs.

But there’s a silver lining…

CBDCs are going to introduce and familiarize people with using digital currencies. It’s then only then a matter of time before they discover Bitcoin.

CBDCs and Bitcoin share some characteristics. For example, they are both digital and facilitate fast payments from a mobile phone. But that is where the similarities end.

The reality is that CBDCs and Bitcoin are entirely different in the most fundamental ways.

You need the government’s permission and blessing to use a CBDC, whereas Bitcoin is permissionless.

Governments can (and will) create as many CBDC currency units as they want. With Bitcoin, there can never be more than 21 million, and there is nothing anyone can do to inflate the supply more than the predetermined amount in the protocol.

CBDCs are centralized. Bitcoin is decentralized.

Governments can censor transactions and freeze, sanction, and confiscate CBDC units whenever they want. Bitcoin is censorship-resistant. No country’s sanctions or laws can affect the protocol.

There is no privacy with CBDCs. However, with Bitcoin, if you take specific steps, it is possible to maintain reasonable privacy.

CBDCs are government money that are easy to produce and give politicians a terrifying amount of control over people’s lives. On the other hand, Bitcoin is non-state hard money that helps liberate individuals from government control.

In short, CBDCs are a pathetic attempt to compete with Bitcoin.

CBDCs make an inferior form of money even worse, but at the same time, it’s an excellent Trojan Horse for Bitcoin.

It doesn’t take much imagination to see that once governments inevitably inflate their CBDC units, censor transactions, freeze people’s accounts, and confiscates funds, it will push people to look for better digital alternatives, first and foremost Bitcoin.

That’s how, contrary to conventional wisdom, CBDCs could be an enormous catalyst for Bitcoin adoption. The failure of the eNaira in Nigeria is proof of this dynamic.

* * *

If you want to navigate the complicated economic and political situation that is unfolding, then you need to see this newly released video from Doug Casey and his team. In it, Doug reveals what you need to know, and how these dangerous times could impact your wealth. Click here to watch it now.

https://ift.tt/udHhUYo

from ZeroHedge News https://ift.tt/udHhUYo

via IFTTT

0 comments

Post a Comment