Chinese Exports And Imports Unexpectedly Contract For The First Time Since May 2020

As markets debate whether the Fed will follow other central banks with a (soft) pivot, the global economy is going from bad to worse: overnight, the latest Chinese customs data showed that China exports as well as imports unexpectedly contracted simultaneously for the first time since May 2020 as elevated inflation and rising interest rates hurt global demand.

Chinese exports declined (-0.3% y/y) in October (vs exp +4.5%), the first drop since May 2020 on Covid outbreaks and weak external demand, following a +5.7% increase in September while the implied sequential export growth dropped to -3.8% m/m in October (vs. +0.5% in September).

Imports fell (-0.7% y/y) following a +0.3% gain in the previous month, while sequentially imports fell 3.5% mom sa non-annualized in October (vs. -1.0% in September). Import value declined sequentially on the lower prices of metal ores and weaker imports of tech-related products, such as computers and LCD panels. The trade surplus was well below consensus from weaker exports, though the level was slightly higher than September.

The overall trade surplus slightly widened to a near +$85.15 billion (up from $84.74 billion in September, but below the forecast of $95.97 billion).

According to Goldman, the export weakness broadened across destinations and products. Import of energy goods accelerated somewhat despite a weak import print. Other than weaker DM demand on tighter financial conditions and the ongoing European energy crisis, the contraction of exports partially came from port operation disruptions due to Covid outbreaks.

Some more details on China's trade data from Goldman:

1. By major export destination, exports weakness broadened in October. The year-over-year growth of exports decelerated across most major trading partners. Among major DM countries, growth of exports to the European Union decelerated the most (-9.0% yoy in October vs. 5.6% in September). Growth of exports to United States decelerated to -12.6% yoy in October (vs. -11.6% in September). Among major EM economies, growth of exports to ASEAN decelerated to 20.3% yoy in October (vs. 29.5% in September), and the implied sequential growth turned negative.

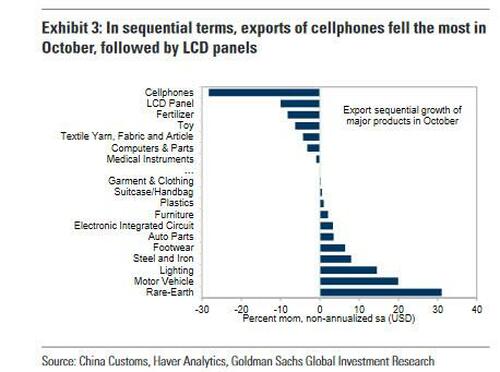

2. By major export category, export growth moderated across most products. The export growth of tech-related products dropped the most (cellphones and LCD panels, see Exhibit 3).

Among tech-related products, exports of LCD panels declined 16.2% yoy in October (vs. -6.6% in September), and export growth of cellphones moderated to 7.0% yoy in October (vs. 23.2% in September). Among housing-related products, exports of home appliances fell 25.0% yoy in October (vs. -19.8% in September). Among Covid-related products, exports of computers declined 16.5% yoy in October (vs. -12.6% in September).

3. Among major import categories, import growth of most energy goods remained solid in October on efforts to ensure energy security, and manufacturing related products rebounded.

Among energy goods, import growth of crude oil picked up to 43.8% yoy in October (vs. +34.2% in September) with import volume up 14.1% yoy (vs. -2.0% yoy in September). Import growth of coal accelerated somewhat to 2.8% yoy in October (vs. +1.5% in September) with volume up 8.3% yoy (vs. 0.5% yoy in September). Among major metal ores, import values declined on lower prices. For instance, iron ore import value fell 26.8% yoy in October (vs. -38.8% in September) with import volume up 3.7% yoy (vs. +4.3% yoy in September). Among manufacturing related products, import growth of machine tools rebounded significantly in sequential terms (+44% mom sa non-annualized in October).

https://ift.tt/l8d2IrS

from ZeroHedge News https://ift.tt/l8d2IrS

via IFTTT

0 comments

Post a Comment