Crypto Carnage Contagion Slams Stocks; Bonds & Bullion Surge As Dollar-Bulls Purge

Peace talks between Russia and Ukraine; Gridlock in Washington; Easing COVID restrictions in China... that was a lot of hope to support the early ramp in stocks... but a flury of tweets and headlines from the crypto cagematch between CZ and SBF sparked a bloodbath in bitcoin, altcoins, and everything in the cryptosphere as systemic liquidity fears then spread to stocks.

FTX Token (FTT) briefly bounced but then was crushed as it appeared FTX was being forced to liquidate whatever it had to cover its clients withdrawal needs...

Liquidated long on FTTUSDT: Sell 990,624,000 @ 7.25 🏅🏆💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯

— REKT (@BXRekt) November 8, 2022

FTT crashed to its lowest price since April 2020...

HOOD was hammered, down 20% (an SBF investment)...

Bitcoin plunged most since June, rallying up to pre-FTX plunge levels and then puking hard down to almost a $16k handle...

Source: Bloomberg

...crashing below 2022 lows to Nov 2020 lows...

Source: Bloomberg

And liquidity needs appeared to spread to stocks, which all puked along with crypto. But as crypto bounced so did stocks, because 'FOMO'... and all that hope we mentioned above. Some selling into the close...

The bounce in the S&P 500 hit as it found support at its 50DMA...

VIX opened higher again, then was pushed lower all day until the brown stuff hit the rotating object in FTX and VIX surged above 26...

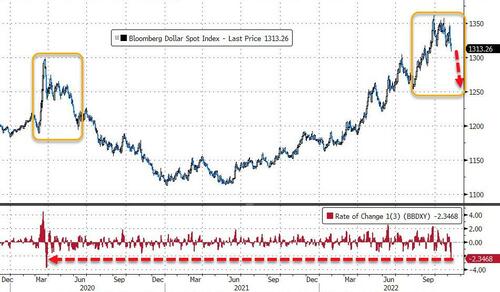

The Dollar index tumbled to 7-week lows today (before a small bounce as equities and crypto puked)...

Source: Bloomberg

...as Dollar bulls monetize longs (almost back to neutrally positioned now)...

Source: Bloomberg

This is the biggest 3-day dive in the USD Index since March 2020...

Source: Bloomberg

As Nomura's Charlie McElligott noted earlier, it's been the dollar's demise that has been driving this bounce in stocks...

For what it’s worth, this violent “Weak Dollar” trade from rush to monetize USD-Longs is not just creating a MASSIVE “impulse easing” in financial conditions... but specifically for US Equities as per Quant Insight, “USD Liquidity” screens as the #1 largest “POSITIVE price-driving” macro factor variable for the S&P 500 and Russell 2000 models... and the 2nd largest positive price driver for the Nasdaq...

And as the dollar dived, gold spiked up to $1720, 5-week highs...

Oil prices plunged along with cryptos (WTI -3% after stalling at $92 October high stops)...

Bonds were bid on the day, with the belly outperforming (7Y -10bps, 2Y & 30Y -5bps). On the week, the belly is now lower in yield while 2Y and 30Y are marginally higher...

Source: Bloomberg

Finally, away from all the crypto-driven excitement, the market's expectations for Fed rate trajectories shifted significantly more dovish today...

Source: Bloomberg

We wonder how much that will change on Thursday morning when CPI prints.

https://ift.tt/2Bk8e4o

from ZeroHedge News https://ift.tt/2Bk8e4o

via IFTTT

0 comments

Post a Comment